August 2, 2012 09:39 AM | Permalink |

(Read the PDF Version)

Don’t extend the “active financing exception” and the “CFC look-thru rules”

Two temporary rules in the tax code that allow U.S. multinational corporations to park their earnings offshore and avoid paying tax on them expired at the end of 2011. If Congress refuses to extend these expired provisions, many U.S. companies will have much less incentive to send their profits (and possibly jobs) offshore.

The active financing exception and the CFC look-thru rules make it easy for U.S. multinational companies to move income to offshore tax havens and avoid paying U.S. tax.

Income shifting by multinational corporations using offshore tax havens, including transactions facilitated by these two rules, cost the U.S. Treasury an estimated $90 billion per year in lost tax revenue.[1]

The Extenders

Congress enacted both of these offshore measures on a “temporary” basis (sometimes noting the need for “more study”) and both have been extended numerous times. These two offshore provisions are part of the perpetual tax “extenders,” a package of more than 50 temporary tax breaks that, as their name suggests, need to be extended every 1-2 years to prevent their expiration.

Many of the extenders are of dubious merit and the provisions are generally extended without being paid for and without any meaningful discussion of whether they are achieving their intended purposes. But steady streams of corporate lobbying[2] and campaign contributions[3] continue to flow to keep the provisions from expiring. These two offshore rules, like most of the other extenders, expired on December 31, 2011 and are included in the extenders bill currently before Congress.[4]

How We Tax U.S. Multinational Corporations

A U.S. multinational corporation is taxed on its worldwide earnings. If the income is also taxed by a foreign jurisdiction, the company receives a credit against its U.S. tax for any foreign taxes paid. Tax on “active” income from a U.S. corporation’s foreign subsidiaries is not imposed until those earnings are brought back (“repatriated”) to the United States.

A U.S. multinational corporation generally cannot defer paying tax on the income of its foreign subsidiaries that is considered “passive,” such as interest, dividends, rents, and royalties. A section of the tax code, known as “Subpart F,” requires multinational corporations to include this type of income in their taxable income each year even if the income is not repatriated.[5] Congress has determined that deferral is not appropriate for this type of income because it is highly fungible and the entities that earn it are very mobile.

Subpart F was designed to prevent companies from manipulating their U.S. tax obligation by the simple act of moving intangible assets that earn this type of passive income offshore. The two exceptions to Subpart F (the offshore extenders) that are discussed in this report render Subpart F practically meaningless.

The Active Financing Exception

The “active financing exception” is an exception to the general rule that passive income earned by a foreign subsidiary must be recognized for tax purposes when earned.[6]

The active financing exception was repealed in the loophole-closing1986 Tax Reform Act, but was reinstated in 1997 as a “temporary” measure after fierce lobbying by multinational corporations. President Clinton tried to kill the provision with a line-item veto; however, the Supreme Court ruled the line-item veto unconstitutional and reinstated the exception. In 1998 it was expanded to include foreign captive insurance subsidiaries.[7] These provisions have been extended numerous times since 1998, usually for only one or two years at a time, as part of the tax extenders.

-

The active financing exception makes it easier for multinationals to expand overseas, making investments and creating jobs in foreign countries rather than here in the U.S., by reducing the related tax costs.

-

The active financing exception allows multinationals to avoid tax on their worldwide income by creating “captive” foreign financing and insurance subsidiaries. The financial products of these subsidiaries, in addition to being highly fungible and highly mobile, are also highly susceptible to manipulation or “financial engineering,” allowing companies to manipulate their tax bill as well.[8]

-

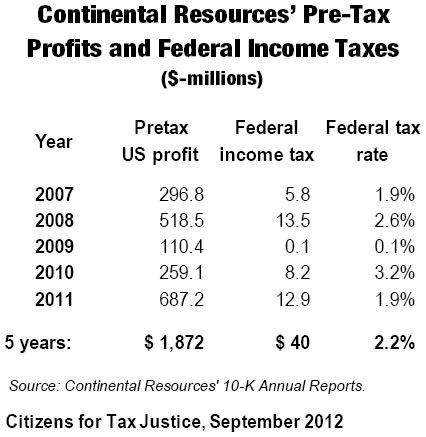

The exception is one of the primary reasons General Electric has paid, on average, only a 1.8% effective U.S. federal income tax rate over the past ten years.[9] G.E.’s federal tax bill is lowered dramatically with the use of the active financing exception provision by its subsidiary, G.E. Capital, which Forbes noted has an “uncanny ability to lose lots of money in the U.S. and make lots of money overseas.”[10] In its SEC filings, the company notes that

GE’s effective tax rate is reduced because active business income earned and indefinitely reinvested outside the United States is taxed at less than the U.S. rate. A significant portion of this reduction depends upon a provision of U.S. tax law that defers the imposition of U.S. tax on certain active financial services income until that income is repatriated to the United States as a dividend….This provision, which expires at the end of 2011, has been scheduled to expire and has been extended by Congress on six previous occasions, including in December of 2010, but there can be no assurance that it will continue to be extended. In the event the provision is not extended after 2011…we expect our effective rate to increase significantly.”

-

The active financing exception also plays a significant role in the ability of large U.S.-based financial institutions to pay low effective rates. As a group, the financial industry has one of the lowest effective rates of all corporations, averaging only 15.5% for the years 2008-2010.[11]

-

One of the proffered rationales for the rule is, of course, to enhance the competitiveness of big U.S. banks. What that really means is that U.S. taxpayers are subsidizing these banks, allowing even more outsized profits compared to other institutions, thus encouraging the financialization of the economy.

-

The exception encourages U.S.-based financial institutions to prefer lending to foreign customers over U.S. customers because they can pay a lower (or zero) tax rate on the related earnings.

-

The Joint Committee on Taxation estimates the 2-year cost of extending this provision to be $11.2 billion.[12]

The CFC Look-Thru Rules

Another exception to the general Subpart F rules requiring current taxation of passive income, the “CFC look-thru rules” allow a U.S. multinational corporation to defer tax on passive income, such as royalties, earned by a foreign subsidiary (a “controlled foreign corporation” or “CFC”) if the royalties are paid to that subsidiary by a related CFC and can be traced to the active income of the payer CFC.[13]

|

The current extremely generous CFC look-thru rules were enacted in 2006 after intense corporate lobbying. The resulting loophole “looks like a narrow technical rule…[but] it has, without fanfare, effectively repealed antideferral rules for much of what subpart F of the Internal Revenue Code was originally intended to prevent.”[14] The purpose of the provisions is unclear because the legislative history is contradictory, but the result is a rule that “says that most tax haven deferral relating to intercompany payments is just fine.”[15]

|

Rules known as the “check-the-box” regulations allow similar tax planning with non-corporate entities. In his first budget President Obama proposed to reform the check-the-box rules, but that provision didn’t appear in later budget proposals.

|

-

The CFC look-thru rules allow multinationals to create transactions purely for “earnings stripping” – to create dividends, interest, rents, and royalties to strip active income out of high-tax countries and move it into low-tax or no-tax countries without incurring any U.S. tax liability (or any tax liability anywhere).[16]

-

The CFC look-thru rules allow U.S. multinationals to create “stateless income”: [17] income that is treated, for tax purposes, as earned in a low-tax (or no-tax) country, where the company’s operations may consist only of renting a mailbox, instead of in the countries where the employees and assets are located.[18]

-

Transactions enabled by these (and the check-the-box) rules are the primary reason for the low effective tax rates of companies with highly-valued intangibles. High-tech companies like Apple[19] and Google[20] and pharmaceutical companies like Pfizer[21] and Forest Laboratories[22] are easily able to shift income from the U.S. (or other countries with a meaningful corporate income tax) to low- or no-tax countries.

-

The Joint Committee on Taxation estimates the cost of extending the CFC look-thru rules for two years to be $1.5 billion.[23] Based on previous Treasury estimates, reforming the check-the-box regulations would raise roughly $100 billion over ten years.[24]

|

CFC Look-Thru Rule Example: An Irish subsidiary of a U.S. multinational corporation pays royalties for the use of a trademark to a related subsidiary in Bermuda. Under the general rules, this would be passive income subject to immediate tax in the U.S. But if the royalties paid are related to the active business of the Irish subsidiary, the CFC look-thru rules allow continued deferral. So the payment is not currently subject to U.S. tax.

The payment is deductible by the Irish subsidiary and reduces its Irish income tax. The payment is income to the Bermuda subsidiary but Bermuda has no corporate income tax.

So now that income isn’t taxed anywhere!

In 2008 alone, Google used its now infamous “Double Irish Dutch Sandwich” technique to move $5.4 billion[25] in royalties from its 2,000-employee Irish subsidiary to a Bermuda subsidiary through a zero-employee Dutch subsidiary (to avoid withholding taxes in Ireland). Google used the CFC look-thru rules or the check-the-box rules (or both) to achieve this result.

|

Good Tax Policy

Tax reform seems to be on everyone’s agenda these days, but fundamental tax reform is an enormous undertaking that will take months, if not years, to achieve. Without waiting for that magical tax-reform day to come, Congress can make meaningful changes to the current rules that will reduce the ability of U.S. multinational corporations to send their profits offshore. In fact, Congress doesn’t have to do anything – these two offshore provisions have already expired.[26] Tax reform is hard, but this is easy.

[1] Kimberly A. Clausing, “The Revenue Effects of Multinational Firm Income Shifting,” Tax Notes, March 28, 2011.

[2] U.S. Public Interest Research Group Education Fund and Citizens for Tax Justice, “Representation Without Taxation, Fortune 500 Companies that Spend Big on Lobbying and Avoid Taxes,” January 18, 2012, available at http://www.uspirg.org/reports/usp/representation-without-taxation.

[3] U.S. Public Interest Research Group Education Fund and Citizens for Tax Justice, “Loopholes for Sale, Campaign Contributions by Corporate Tax Dodgers,” March 21, 2012, available at http://www.uspirg.org/reports/usp/loopholes-sale.

[4] Joint Committee on Taxation, “Description of the ‘Family and Business Tax Cut Certainty Act of 2012’,” JCX-67-12, August 1, 2012 available at www.jct.gov.

[5] Subpart F is comprised of Sections 951 – 965 of the Internal Revenue Code.

[6] Internal Revenue Code Section 954(h).

[7] Internal Revenue Code Section 954(i).

[8] Linda M. Beale, “More on the FY2011 budget—the active financing exception,” A Taxing Matter, February 2, 2010, available at http://ataxingmatter.blogs.com/tax/2010/02/more-on-the-fy2011-budgetthe-active-financing-exception.html.

[9] Citizens for Tax Justice, “Press Release: GE’s Ten Year Tax Rate Only Two Percent,” February 27, 2012, available at http://www.ctj.org/taxjusticedigest/archive/2012/02/press_release_general_electric.php.

[10] Christopher Helman, “What the Top U.S. Companies Pay in Taxes,” Forbes, April 1, 2010, available at http://www.forbes.com/2010/04/01/ge-exxon-walmart-business-washington-corporate-taxes.html.

[11] Citizens for Tax Justice, “Corporate Taxpayers and Corporate Tax Dodgers, 2008 – 2010,” November 3, 2011, available at www.ctg.org/corporatetaxdodgers.

[12] Joint Committee on Taxation, “Estimated Revenue Effects of the ‘Family and Business Tax Cut Certainty Act of 2012’,” JCX-68-12, July 31, 2012 available at www.jct.gov.

[13] Internal Revenue Code Section 954(c)(6).

[14] David R. Sicular, “The New Look-Through Rule: W(h)ither Subpart F?” Tax Notes, April 23, 2007.

[15] Id. “There was no allusion this time around to the fact that U.S. companies were already able to circumvent subpart F in many cases and should be allowed to do so explicitly and with improved efficiency.”

[16] Lee A. Sheppard, “Looking Through the New Look-Thru Rule,” Tax Notes, October 23, 2006.

[17] Edward D. Kleinbard, “Stateless Income,” Florida Tax Review, Vol. 11, p. 699, 2011, and “The Lessons of Stateless Income,” Tax Law Review, Vol. 65, p. 99, 2011.

[18] Martin A. Sullivan, “‘Stateless Income’ is Key to International Tax Reform,” Tax.com, June 27, 2011, available at http://www.tax.com/taxcom/taxblog.nsf/Permalink/UBEN-8J8MGL?OpenDocument.

[19] Charles Duhigg and David Kocieniewski, “How Apple Sidesteps Billions in Taxes,” The New York Times, April 28, 2012, available at http://www.nytimes.com/2012/04/29/business/apples-tax-strategy-aims-at-low-tax-states-and-nations.html.

[20] Jesse Drucker, “Google 2.4% Rate Shows How $60 Billion Lost to Tax Loopholes,” Bloomberg, October 21, 2010, available at http://www.bloomberg.com/news/2010-10-21/google-2-4-rate-shows-how-60-billion-u-s-revenue-lost-to-tax-loopholes.html.

[21] David Cay Johnston, “Tax repatriation,” Reuters.com, October 19, 2011, available at http://blogs.reuters.com/david-cay-johnston/tag/offshore-profits.

[22] Jesse Drucker, “Forest Laboratories’ Globe-trotting Profits,” Bloomberg BusinessWeek Magazine, May 13, 2010, available at http://www.businessweek.com/magazine/content/10_21/b4179062992003.htm.

[23] JCX-68-12.

[24] Department of the Treasury, “General Explanations of the Administration’s Fiscal Year 2010 Revenue Proposals,” May 2009, p. 128, available at http://www.treasury.gov/resource-center/tax-policy/Documents/General-Explanations-FY2010.pdf.

[25] Jesse Drucker, “Google 2.4% Rate,” note 20.

[26] Because the check-the-box rules were regulations and not a result of statutory changes, it appears that the administration could reform the check-the-box rules also without any Congressional action.

![]()

from the company’s public filings with the Securities and Exchange Commission (SEC).

from the company’s public filings with the Securities and Exchange Commission (SEC).