October 4, 2016 12:01 AM | Permalink |

T he Use of Offshore Tax Havens by Fortune 500 Companies

he Use of Offshore Tax Havens by Fortune 500 Companies

Read this report in PDF.

Download Dataset/Appendix (XLS)

Table of Contents

Executive Summary

Introduction

Most of America’s Largest Corporations Maintain Subsidiaries in Offshore Tax Havens

Earnings Booked Offshore for Tax Purposes by U.S. Multinationals Doubled between 2009 and 2015

Evidence Indicates Much of Offshore Profits are Booked to Tax Havens

Companies are Hiding Tax Haven Subsidiaries from Public View

Measures to Stop Abuse of Offshore Tax Havens

Methodology

End Notes

Executive Summary:

Back to Contents

U.S.-based multinational corporations are allowed to play by a different set of rules than small and domestic businesses or individuals when it comes to paying taxes. Corporate lobbyists and their congressional allies have riddled the U.S. tax code with loopholes and exceptions that enable tax attorneys and corporate accountants to book U.S. earned profits to subsidiaries located in offshore tax haven countries with minimal or no taxes. The most transparent and galling aspect of this is that often, a company’s operational presence in a tax haven may be nothing more than a mailbox. Overall, multinational corporations use tax havens to avoid an estimated $100 billion in federal income taxes each year.

But corporate tax avoidance is not inevitable. Congress could act tomorrow to shut down tax haven abuse by revoking laws that enable and incentivize the practice of shifting money into offshore tax havens. By failing to take action, the default is that our elected officials tacitly approve the fact that when corporations don’t pay what they owe, ordinary Americans inevitably must make up the difference. In other words, every dollar in taxes that corporations avoid must be balanced by higher taxes on individuals, cuts to public investments and services, and increased federal debt.

This study explores how in 2015 Fortune 500 companies used tax haven subsidiaries to avoid paying taxes on much of their income. It reveals that tax haven use is now standard practice among the Fortune 500 and that a handful of the country’s wealthiest corporations benefit the most from this tax avoidance scheme.

The main findings of this report are:

Most of America’s largest corporations maintain subsidiaries in offshore tax havens. At least 367 companies, or 73 percent of the Fortune 500, operate one or more subsidiaries in tax haven countries.

-All told, these 367 companies maintain at least 10,366 tax haven subsidiaries.

-The 30 companies with the most money officially booked offshore for tax purposes collectively operate 2,509 tax haven subsidiaries.

The most popular tax haven among the Fortune 500 is the Netherlands, with more than half of the Fortune 500 reporting at least one subsidiary there.

Approximately 58 percent of companies with tax haven subsidiaries have set up at least one in Bermuda or the Cayman Islands — two particularly notorious tax havens. The profits that all American multinationals — not just Fortune 500 companies — collectively claimed they earned in these two island nations according to the most recent data totaled 1,884 percent and 1,313 percent of each country’s entire yearly economic output, respectively.

In fact, a 2008 Congressional Research Service report found that American multinational companies collectively reported 43 percent of their foreign earnings in five small tax haven countries: Bermuda, Ireland, Luxembourg, the Netherlands, and Switzerland. Yet these countries accounted for only 4 percent of the companies’ foreign workforces and just 7 percent of their foreign investments. By contrast, American multinationals reported earning just 14 percent of their profits in major U.S. trading partners with higher taxes — Australia, Canada, the UK, Germany, and Mexico — which accounted for 40 percent of their foreign workforce and 34 percent of their foreign investment.

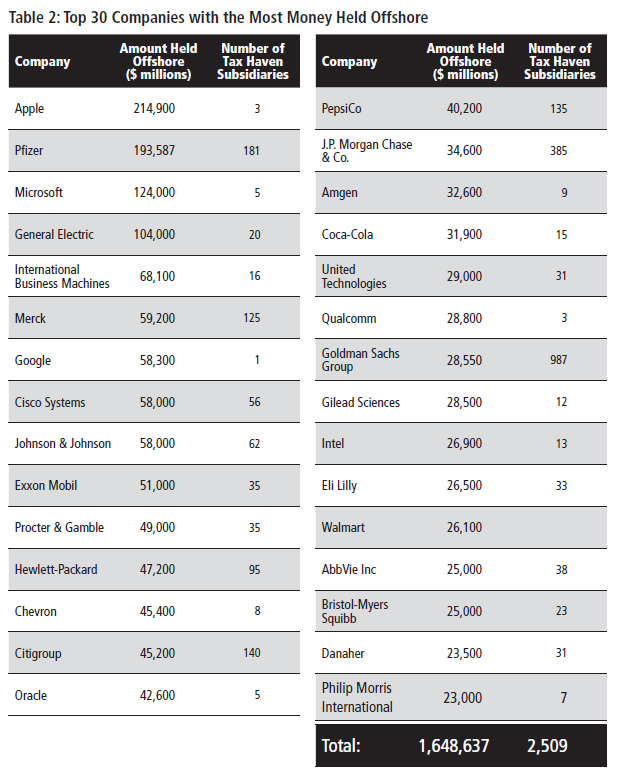

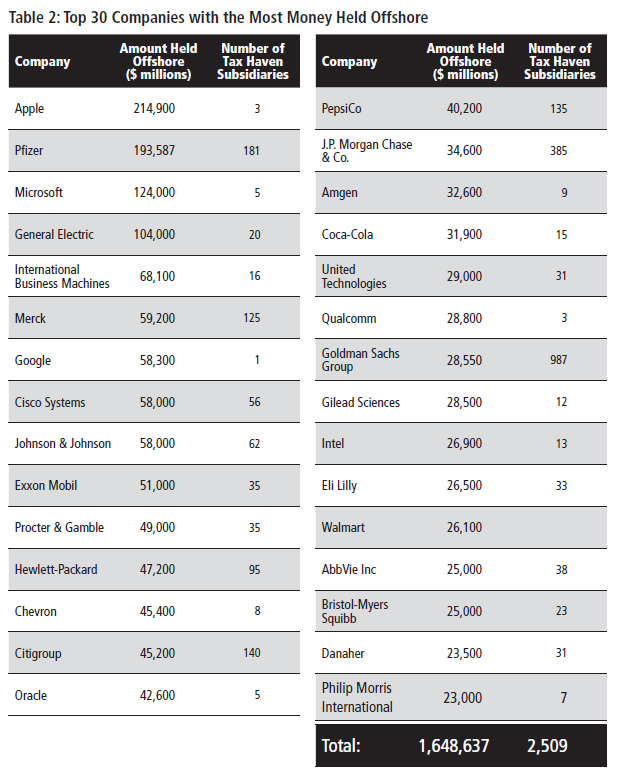

Fortune 500 companies are holding nearly $2.5 trillion in accumulated profits offshore for tax purposes. Just 30 Fortune 500 companies account for 66 percent or $1.65 trillion of these offshore profits.

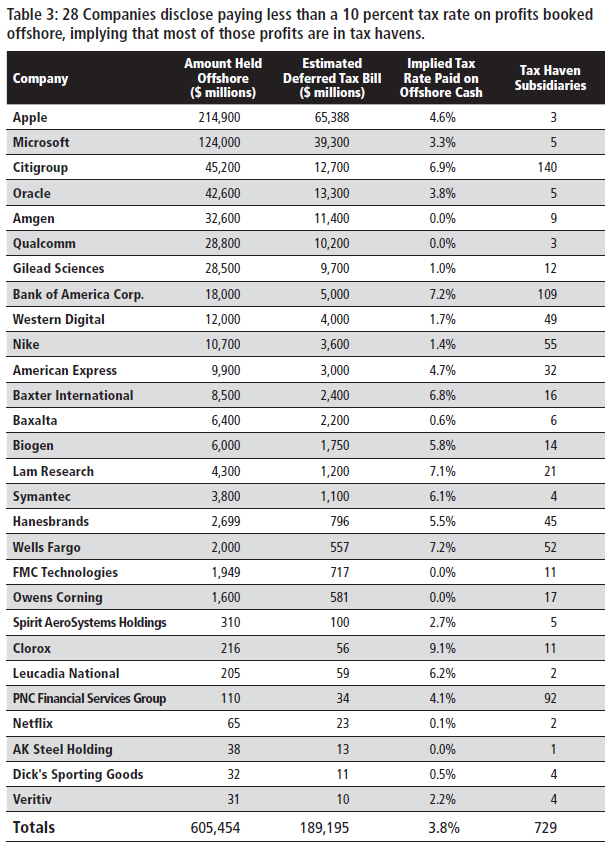

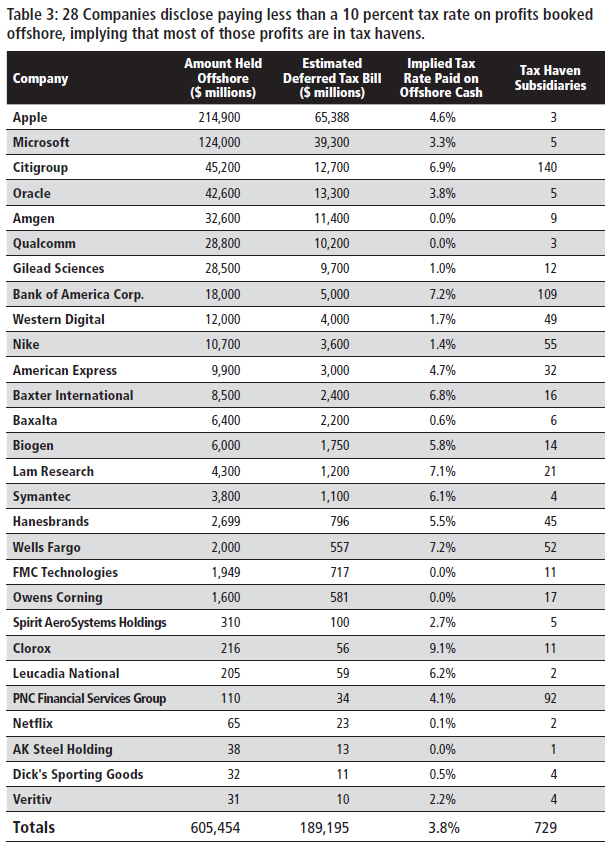

Only 58 Fortune 500 companies disclose what they would expect to pay in U.S. taxes if these profits were not officially booked offshore. In total, these 58 companies would owe $212 billion in additional federal taxes. Based on these 58 corporations’ public disclosures, the average tax rate that they have collectively paid to foreign countries on these profits is a mere 6.2 percent, indicating that a large portion of this offshore money has been booked in tax havens. If we assume that average tax rate of 6.2 percent applies to all 298 Fortune 500 companies with offshore earnings, they would owe a 28.8 percent rate upon repatriation of these earnings, meaning they would collectively owe $717.8 billion in additional federal taxes if the money were repatriated at once. Some of the worst offenders include:

–Apple: Apple has booked $214.9 billion offshore, a sum greater than any other company’s offshore cash pile. It would owe $65.4 billion in U.S. taxes if these profits were not officially held offshore for tax purposes. A 2013 Senate investigation found that Apple has structured two Irish subsidiaries to be tax residents of neither the United States, where they are managed and controlled, nor Ireland, where they are incorporated. A recent ruling by the European Commission found that Apple used this tax haven structure in Ireland to pay a rate of just 0.005 percent on its European profits in 2014, and has required that the company pay $14.5 billion in back taxes to Ireland.

–Citigroup: The financial services company officially reports $45.2 billion offshore for tax purposes on which it would owe $12.7 billion in U.S. taxes. That implies that Citigroup currently has paid only a 7 percent tax rate on its offshore profits to foreign governments, indicating that most of the money is booked in tax havens levying little to no tax. Citigroup maintains 140 subsidiaries in offshore tax havens.

–Nike: The sneaker giant officially holds $10.7 billion offshore for tax purposes on which it would owe $3.6 billion in U.S. taxes. This implies Nike pays a mere 1.4 percent tax rate to foreign governments on those offshore profits, indicating that nearly all of the money is officially held by subsidiaries in tax havens. Nike likely does this by licensing several trademarks for its products to three subsidiaries in Bermuda and then essentially charging itself royalties to use those trademarks. The shoe company, which operates 931 retail stores throughout the world, does not operate one in Bermuda and one of the largest department stores in Bermuda, A.S. Cooper and Sons, does not list Nike as a brand that it offers.

Some companies that report a significant amount of money offshore maintain hundreds of subsidiaries in tax havens, including the following:

–Pfizer, the world’s largest drug maker, operates 181 subsidiaries in tax havens and holds $193.6 billion in profits offshore for tax purposes, the second highest among the Fortune 500. Pfizer recently attempted the acquisition of a smaller foreign competitor so it could reincorporate on paper as a “foreign company.” Pulling this off would have allowed the company a tax-free way to avoid $40 billion in taxes on its offshore earnings, but fortunately the Treasury Department issued new anti-inversion regulations that stopped the deal from taking place.

–PepsiCo maintains 135 subsidiaries in offshore tax havens. The soft drink maker reports holding $40.2 billion offshore for tax purposes, though it does not disclose what its estimated tax bill would be if it didn’t book those profits offshore.

–Goldman Sachs reports having 987 subsidiaries in offshore tax havens, 537 of which are in the Cayman Islands despite not operating a single legitimate office in that country, according to its own website. The group officially holds $28.6 billion offshore.

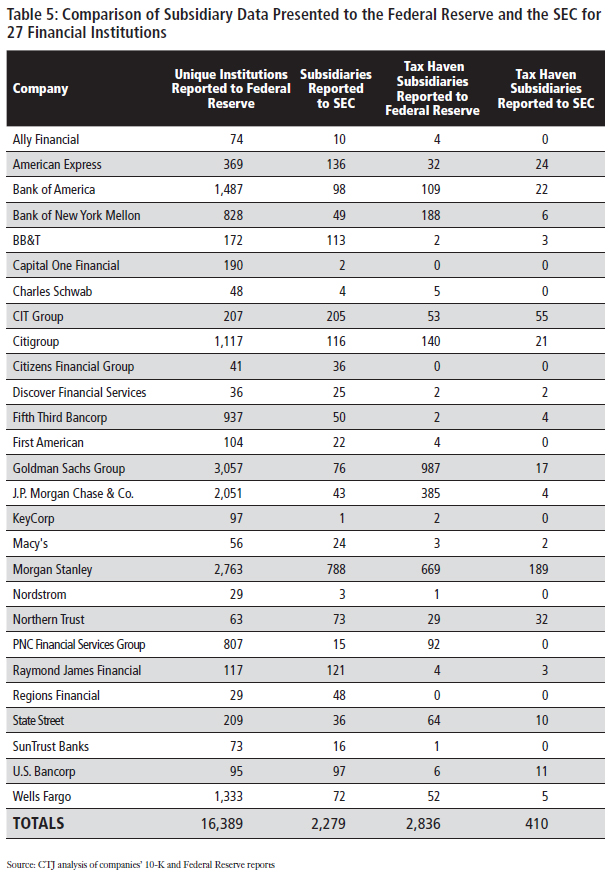

The proliferation of tax haven abuse is exacerbated by lax reporting laws that allow corporations to dictate how, when, and where they disclose foreign subsidiaries, allowing them to continue to take advantage of tax loopholes without attracting governmental or public scrutiny.

Consider:

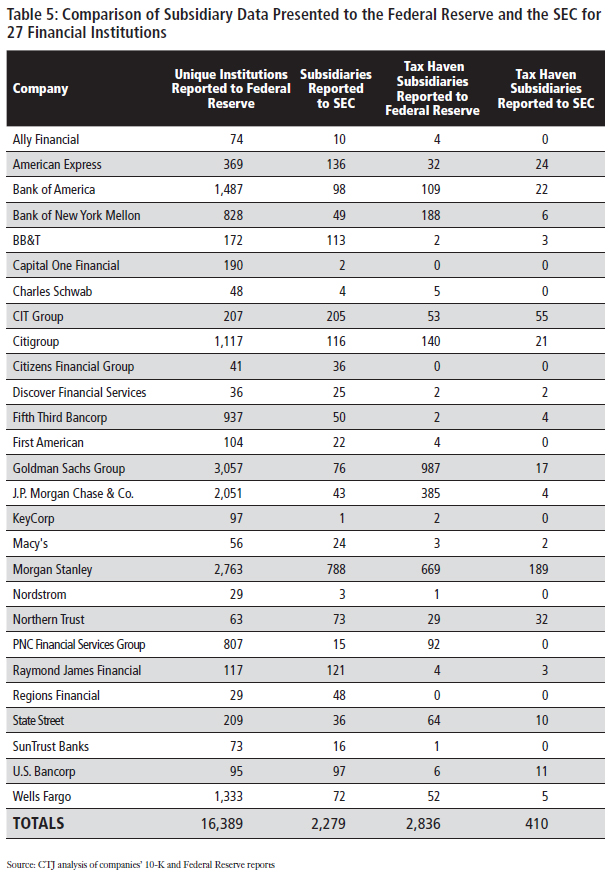

-A Citizens for Tax Justice analysis of 27 companies that disclose subsidiary data to both the Securities and Exchange Commission (SEC) and the Federal Reserve revealed that weak SEC disclosure rules allowed these companies to omit 85 percent of their tax haven subsidiaries on average. If this rate of omission held true for the entire Fortune 500, the number of tax haven subsidiaries in reality could be nearly 55,000, rather than the 10,366 that are being publicly disclosed now.

–Walmart reported operating zero tax haven subsidiaries in 2014 and for the past decade to the SEC. Despite this, a recent report released by Americans for Tax Fairness revealed that the company operates as many as 75 tax haven subsidiaries (using this report’s list of tax haven countries). Over the past decade, Walmart’s offshore profit has grown from $8.7 bi85llion in 2006 to $26.1 billion in 2015.

–Google reported operating 25 subsidiaries in tax havens in 2009, but in 2010 only reported two tax haven subsidies, both in Ireland. In its latest 10-K the company reports one tax haven subsidiary in Ireland. This could lead investors and researchers alike to think that Google either shut down many of its tax haven subsidiaries or consolidated them into one. In reality however, an academic analysis found that as of 2012, despite no longer publicly disclosing them, all of the newly unlisted tax haven subsidiaries were still operating. During this period, Google increased the amount of earnings it reported offshore from $12.3 billion to $58.3 billion. This combination of ceasing disclosures for tax haven subsidiaries and simultaneously increasing reported offshore earnings allows the corporation to create an illusion of legitimate international business while still being able to book profits to low- or no-tax countries.

Congress can and should take action to prevent corporations from using offshore tax havens, which in turn would restore basic fairness to the tax system, fund valuable public programs, possibly reduce annual deficits, and ultimately improve the functioning of markets.

There are clear policy solutions that lawmakers can enact to crack down on tax haven abuse. They should end incentives for companies to shift profits offshore, close the most egregious offshore loopholes and increase transparency.

Introduction

Rather than continuing to prosper under a veil of secrecy, tax havens and multinational corporations are beginning to feel the pressure as governments across the world crack down on international tax avoidance. For years, one report after another has revealed how many of the world’s wealthiest companies manage to use tax havens to pay little to nothing in taxes on a substantial portion of their income. Perhaps the biggest outrage to date is the recent finding by the European Commission that Apple holds as much as $115 billion in earnings in Ireland virtually tax-free, thanks to a scheme that allowed the corporation to keep billions in profits in a subsidiary that didn’t pay taxes to any country.[i] The unfortunate reality, however, is that Apple is far from alone is its offshore tax avoidance.

A symbol of the excesses of the world of corporate tax havens is the Ugland house, a modest five-story office building in the Cayman Islands that serves as the registered address for 18,857 companies.[ii] Simply by registering subsidiaries in the Cayman Islands, U.S. companies can use legal accounting gimmicks to make much of their U.S.-earned profits appear to be earned in the Caymans and thus pay no taxes on those profits.

U.S. law does not even require that subsidiaries have any physical presence in the Caymans beyond a post office box. In fact, about half of the subsidiaries registered at the infamous Ugland house have their billing address in the U.S., even while they are officially registered in the Caymans.[iii] This unabashedly false corporate “presence” is one of the hallmarks of a tax haven subsidiary.

|

What is a Tax Haven?

Tax havens have four identifying features.[iv] First, a tax haven is a jurisdiction with very low or nonexistent taxes. Second is the existence of laws that encourage financial secrecy and inhibit an effective exchange of information about taxpayers to tax and law enforcement authorities. Third is a general lack of transparency in legislative, legal or administrative practices. Fourth is the lack of a requirement that activities be “substantial,” suggesting that a jurisdiction is trying to earn modest fees by enabling tax avoidance.

This study uses a list of 50 tax haven jurisdictions, which each appear on at least one list of tax havens compiled by the Organisation for Economic Cooperation and Development (OECD), the National Bureau of Economic Research, or as part of a U.S. District Court order listing tax havens. These lists are also used in a GAO report investigating tax haven subsidiaries.[v]

|

How Companies Avoid Taxes

Companies can avoid paying taxes by booking profits to a tax haven because U.S. tax laws allow them to defer paying U.S. taxes on profits that they report are earned abroad until they “repatriate” the money to the United States. Many U.S. companies game this system by using loopholes that allow them to disguise profits earned in the U.S. as “foreign” profits earned by subsidiaries in a tax haven.

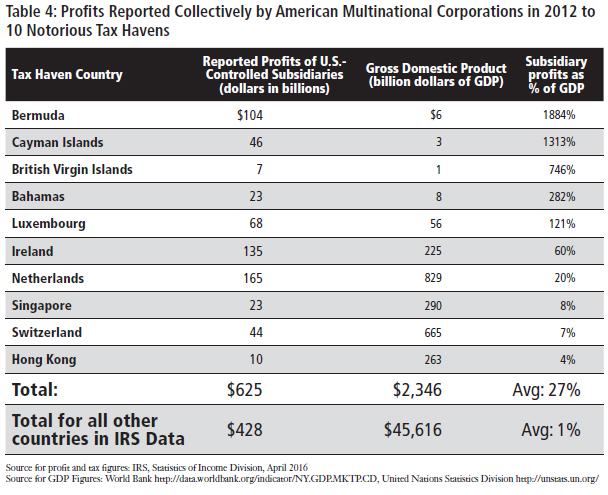

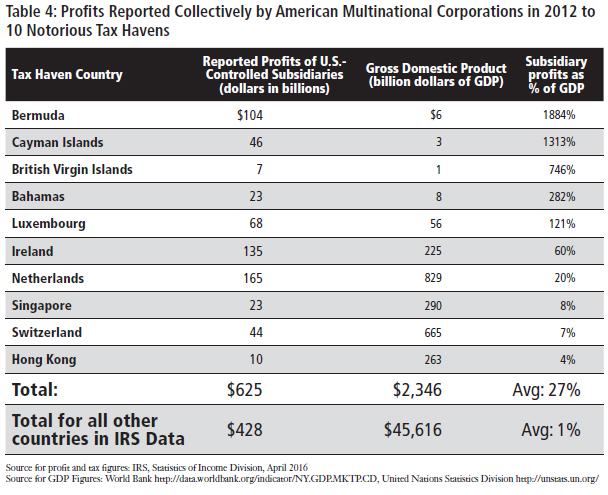

Offshore accounting gimmicks by multinational corporations have created a disconnect between where companies locate their workforce and investments, on one hand, and where they claim to have earned profits, on the other. In its seminal 2008 report, the non-partisan Congressional Research Service found that American multinational companies collectively reported 43 percent of their foreign earnings in five small tax haven countries: Bermuda, Ireland, Luxembourg, the Netherlands, and Switzerland. Yet these countries accounted for only 4 percent of the companies’ foreign workforces and just 7 percent of their foreign investments. By contrast, American multinationals reported earning just 14 percent of their profits in major U.S. trading partners with higher taxes — Australia, Canada, the UK, Germany, and Mexico — which accounted for 40 percent of their foreign workforce and 34 percent of their foreign investment.[vi] Reinforcing these earlier findings, the Internal Revenue Service (IRS) released data earlier this year showing that American multinationals collectively reported in 2012 that an implausible 59 percent of their foreign earnings were “earned” in 10 notorious tax havens (see table 4).[vii]

Showing just how ridiculous these accounting gimmicks can get, much if not most of the profits kept “offshore” are housed in U.S. banks or invested in American assets, but are registered in the name of foreign subsidiaries. In such cases, American corporations benefit from the stability of the U.S. financial system while avoiding paying taxes on their profits that officially remain booked “offshore” for tax purposes.[viii] A Senate investigation of 27 large multinationals with substantial amounts of cash that was supposedly “trapped” offshore found that more than half of the offshore funds were already invested in U.S. banks, bonds, and other assets.[ix] For some companies the percentage is much higher. A Wall Street Journal investigation found that 93 percent of the money Microsoft had officially booked “offshore” was invested in U.S. assets.[x] In theory, companies are barred from investing directly in their U.S. operations, paying dividends to shareholders or repurchasing stock with money they declare to be “offshore.” But even that restriction is easily evaded because companies can use the cash supposedly “trapped” offshore for those purposes by borrowing at negligible rates using their offshore holdings as implied collateral.

|

A NOTE ON MISLEADING TERMINOLOGY

“Offshore profits”: Using the term “offshore profits”

without any qualification inaccurately describes how

U.S. multinationals hold profits in tax havens. The

term implies that these profits were earned purely

through foreign business activity. In reality, much

of these “offshore profits” are actually U.S. profits

that companies have disguised as foreign profits

made in tax havens to avoid taxes. To be more

accurate, this study instead describes these funds

as “profits booked offshore for tax purposes.”

“Repatriation” or “bringing the money back”:

Repatriation is a legal term used to describe when

a U.S. company declares offshore profits as returned

to the U.S. As a general description, “repatriation”

wrongly implies that profits companies have booked

offshore for tax purposes are actually sitting offshore

and missing from the U.S. economy, and that a

company cannot make use of those profits in the U.S.

without “bringing them back” and paying U.S. tax.

|

Average Taxpayers Pick Up the Tab for Offshore Tax Dodging

Corporate tax avoidance is neither fair nor inevitable. Congress created the loopholes in our tax code that allow offshore tax avoidance and force ordinary Americans to make up the difference. The practice of shifting corporate income to tax haven subsidiaries reduces federal revenue by an estimated $100 billion annually.[xi] Every dollar in taxes companies avoid by using tax havens must be balanced by higher taxes paid by other Americans, cuts to government programs, or increased federal debt.

It makes sense for profits earned by U.S. companies to be subject to U.S. taxation. The profits earned by these companies generally depend on access to America’s largest-in-the-world consumer market, a well-educated workforce trained by our school systems, strong private-property rights enforced by our court system, and American roads and rail to bring products to market.[xii] Multinational companies that depend on America’s economic and social infrastructure are shirking their obligation to pay for that infrastructure when they shelter their profits overseas.

Most of America’s Largest Corporations Maintain Subsidiaries in Offshore Tax Havens

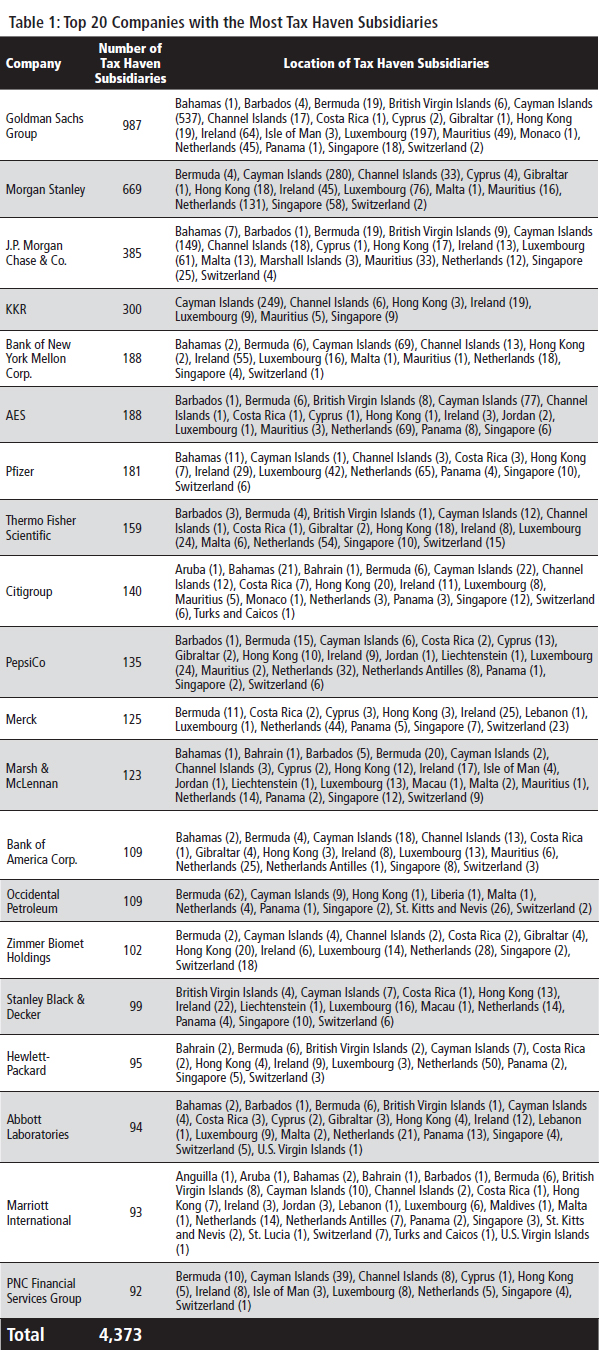

As of 2015, 367 Fortune 500 companies — nearly three-quarters — disclose subsidiaries in offshore tax havens, indicating how pervasive tax haven use is among large companies. All told, these 367 companies maintain at least 10,366 tax haven subsidiaries.[xiii] The 30 companies with the most money held offshore collectively disclose 2,509 tax haven subsidiaries. Bank of America, Citigroup, JPMorgan-Chase, Goldman Sachs, Wells Fargo and Morgan Stanley — all large financial institutions that together received $160 billion in taxpayer bailouts in 2008[xiv] — disclose a combined 2,342 subsidiaries in tax havens.

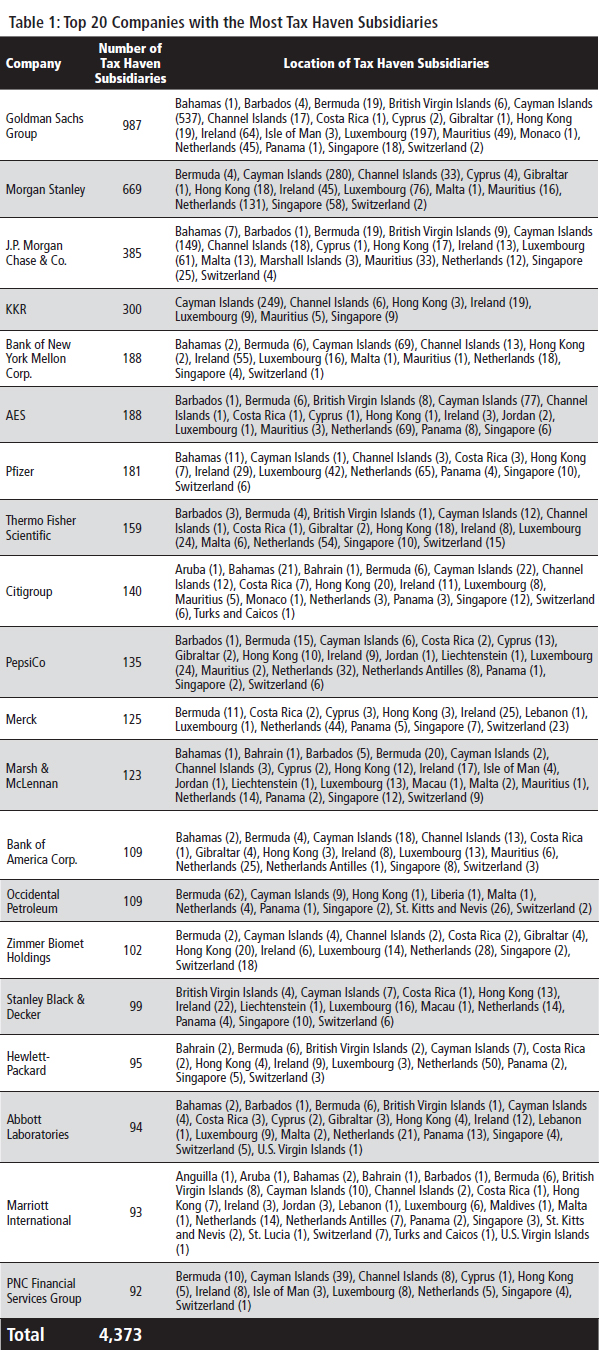

Companies that rank high for both the number of tax haven subsidiaries and how much profit they book offshore for tax purposes include:

–Pfizer, the world’s largest drug maker, operates 181 subsidiaries in tax havens and has $193.6 billion in profits offshore for tax purposes, the second highest among the Fortune 500. More than 41 percent of Pfizer’s sales between 2008 and 2015 were in the United States,[xv] but it managed to report no federal taxable income for eight years in a row. This is because Pfizer uses accounting techniques to shift the location of its taxable profits offshore. For example, the company can transfer patents for its drugs to a subsidiary in a low- or no-tax country. Then when the U.S. branch of Pfizer sells the drug in the U.S., it “pays” its own offshore subsidiary high licensing fees that turn domestic profits into on-the-books losses and shifts profit overseas.

Pfizer recently attempted a corporate “inversion” in which it would have acquired a smaller foreign competitor so it could reincorporate on paper in Ireland and no longer be an American company. Pulling this off would have allowed the company a tax-free way to avoid $40 billion in taxes on its offshore earnings, but fortunately the Treasury Department issued new anti-inversion regulations that stopped the deal from taking place.[xvi]

–PepsiCo maintains 135 subsidiaries in offshore tax havens. The soft drink maker reports holding $40.2 billion offshore for tax purposes, though it does not disclose what its estimated tax bill would be if it didn’t keep those profits offshore.

–Goldman Sachs reports having 987 subsidiaries in offshore tax havens, 537 of which are in the Cayman Islands alone, despite not operating a single legitimate office in that country, according to its own website.[xvii] The group officially holds $28.6 billion offshore.

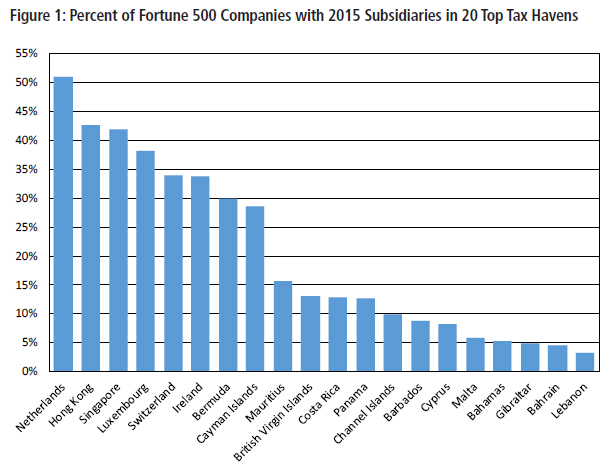

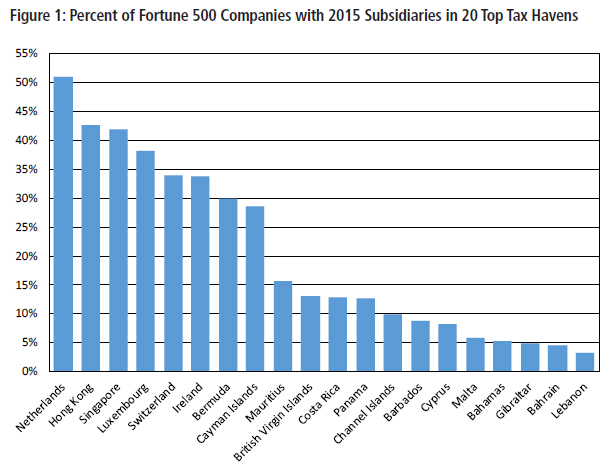

Which Tax Havens do the Fortune 500 Turn To?

While small island nations such as Bermuda and the Cayman Islands have become synonymous with tax havens, many Fortune 500 companies are turning to countries outside the Caribbean for their tax avoidance schemes. In fact, with more than 50 percent of the Fortune 500 companies operating at least one subsidiary there, the Netherlands appears to be the most frequently used tax haven country by major U.S. companies. It is followed by Singapore and Hong Kong, which are critical tax havens in pursuing business ventures in Asia. The next most popular havens are the three other European tax havens, Luxembourg, Switzerland and Ireland.

While they are no longer the dominant tax havens when it comes to corporate tax avoidance, the Cayman Islands or Bermuda are used by 58 percent of Fortune 500 companies for at least one tax haven subsidiary.

Earnings Booked Offshore for Tax Purposes by U.S. Multinationals Doubled between 2009 and 2015

In recent years, U.S. multinational companies have sharply increased the amount of money that they book to foreign subsidiaries. According to our latest estimate, by 2015 companies held $2.49 trillion offshore, more than double the offshore income reported by companies in 2009.[xviii]

For many companies, increasing profits held offshore does not mean building factories abroad, selling more products to foreign customers, or doing any additional real business activity in other countries. Instead, many companies use accounting tricks to disguise their profits as “foreign,” and book them to a subsidiary in a tax haven to avoid taxes.

The 298 Fortune 500 Companies that report offshore profits collectively hold nearly $2.5 trillion offshore, with 30 companies accounting for 66 percent of the total.

The 298 Fortune 500 companies that report holding offshore cash had collectively accumulated more than $2.49 trillion that they declare to be “permanently reinvested” abroad. (This designation allows them to avoid counting the taxes they have “deferred” as a future cost in their financial reports to shareholders.) While 60 percent of Fortune 500 companies report having income offshore, some companies shift profits offshore far more aggressively than others. The 30 companies with the most money offshore account for more than $1.65 trillion of the total. In other words, just 30 Fortune 500 companies account for 66 percent of the offshore cash.

Evidence Indicates Much of Offshore Profits are Booked to Tax Havens

Companies are not required to disclose publicly how much they tell the IRS they’ve earned in specific foreign countries. Still, some companies provide enough information in their annual SEC filings to reveal that for tax purposes, these companies characterize much of their offshore cash as sitting in tax havens.

Only 58 Fortune 500 companies disclose what they would pay in taxes if they did not book their profits offshore.

In theory, companies are required to disclose how much they would owe in taxes on their offshore profits in their annual 10-K filings to the SEC and shareholders. But a major loophole allows them to avoid such disclosure if the company claims that it is “not practicable” to calculate the tax.[xix] Considering that only 58 of the 298 Fortune 500 companies with offshore earnings do disclose how much they would pay in taxes, that means that this loophole allows 80 percent of these companies to get out of disclosing how much they would owe. The 58 companies that publicly disclose the tax calculations report that they would owe $212 billion in additional federal taxes, a tax rate of 28.8 percent.

The U.S. tax code allows a credit for taxes paid to foreign governments when profits held offshore are declared in the U.S. and become taxable here. While the U.S. corporate tax rate is 35 percent, the average tax rate that these 58 companies have paid to foreign governments on the profits they’ve booked offshore appears to be a mere 6.2 percent. [xx] That in turn indicates that the bulk of their offshore cash has been booked in tax havens that levy little or no corporate tax. We can calculate this low rate by subtracting the rate they say they would owe upon repatriation (i.e. the 28.8 percent rate on average) from the 35 percent statutory tax rate.

If the additional 28.8 percent tax rate that the 58 disclosing companies say they would owe is applied to the offshore cash held by the non-disclosing companies, then the Fortune 500 companies as a group would owe an additional $717.8 billion in federal taxes.

Examples of large companies paying very low foreign tax rates on offshore cash include:

–Apple: Apple has booked $214.9 billion offshore — more than any other company. It would owe $65.4 billion in U.S. taxes if these profits were not officially held offshore for tax purposes. This means that Apple has paid a miniscule 4.6 percent tax rate on its offshore profits. That confirms that Apple has been getting away with paying almost nothing in taxes on the huge amount of profits it has booked in Ireland.

–Citigroup: The financial services company officially reports $45.2 billion offshore for tax purposes on which it would owe $12.7 billion in U.S. taxes. That implies that Citigroup currently has paid only a 7 percent tax rate on its offshore profits to foreign governments, indicating that most of the money is booked in tax havens levying little to no tax. [xxi] Citigroup maintains 140 subsidiaries in offshore tax havens.

–Nike: The sneaker giant reports $10.7 billion in accumulated offshore profits, on which it would owe $3.6 billion in U.S. taxes. That implies Nike has paid a mere 1.4 percent tax rate to foreign governments on those offshore profits. Again, this indicates that nearly all of the offshore money is held by subsidiaries in tax havens. Nike is likely able to engage in such tax avoidance in part by transferring the ownership of Nike trademarks for some of its products to three subsidiaries in Bermuda. Humorously, Nike’s tax haven subsidiaries bear the names of Nike shoes such as “Nike Air Ace” and “Nike Huarache.”[xxii] The shoe company, which operates 931 retail stores throughout the world, does not operate one in Bermuda and one of the largest department stores in Bermuda, A.S. Cooper and Sons, does not list Nike as a brand that it offers.[xxiii]

The latest IRS data show that in 2012, more than half of the foreign profits reported by all U.S. multinationals were booked in tax havens for tax purposes.

In the aggregate, IRS data show that in 2012, American multinationals collectively reported to the IRS that they earned $625 billion in 10 well-known tax havens. That’s more than half (59 percent) of the total profits that American companies reported earning abroad that year. For the five tax havens where American companies booked the most profits, those reported earnings were greater than the size of those countries’ entire economies, as measured by Gross Domestic Product (GDP). This illustrates the tenuous relationship between where American multinationals actually do business and where they report that they made their profits for tax purposes.

Approximately 58 percent of companies with tax haven subsidiaries have registered at least one subsidiary in Bermuda or the Cayman Islands — the two tax havens where profits from American multinationals accounted for the largest percentage of the two countries’ GDP.

|

Maximizing the benefit of offshore tax havens by reincorporating as a “foreign” company: a new wave of corporate “inversions.”

To avoid taxes, some American companies have gone so far as to change the address of their corporate headquarters on paper by merging with a foreign company, so they can reincorporate in a foreign country, in a maneuver called an ‘inversion.” [xxiv] Inversions increase the reward for exploiting offshore loopholes. In theory, an American company must pay U.S. tax on profits it claims were made offshore if it wants to officially bring the money back to the U.S. to pay out dividends to shareholders or make certain U.S. investments. However, an inversion scheme stands reality on its head. Once a corporation reconfigures itself as “foreign,” the profits it claims were earned for tax purposes outside the U.S. become exempt from U.S. tax.

Even though a “foreign” corporation still is supposed to pay U.S. tax on profits it earns in the U.S., corporate inversions are often followed by “earnings-stripping.” This is a scheme in which a corporation loads the American part of the company with debt owed to the foreign part of the company. The interest payments on the debt are tax-deductible, thus reducing taxable American profits. The foreign company to which the U.S. profits are shifted will be set up in a tax haven to avoid foreign taxes as well.[xxv]

Fortunately, the U.S. Treasury has taken some action to stop the most egregious earnings stripping and inversion abuses, but many companies are still finding ways to exploit these loopholes to avoid taxes.[xxvi] More action is needed to close the inversion loophole once and for all.

|

Companies are Hiding Tax Haven Subsidiaries from Public View

The subsidiary data in this report relies largely on publicly available data reported by companies in their Securities and Exchange Commission (SEC) filings. The critical problem is that the SEC only requires that companies report all “significant” subsidiaries, based on multiple measures of a subsidiary’s share of the company’s total assets.[xxvii] By only requiring significant rather than all subsidiaries, this allows companies to get away with not disclosing many of their offshore subsidiaries and creates the potential for gaming because avoiding disclosure simply requires splitting a significant subsidiary into several smaller subsidiaries. In addition, a recent academic study found that the penalties for not disclosing subsidiaries are so light that companies might decide that disclosure isn’t worth the bad publicity it could engender. The researchers postulate that increased media attention on offshore tax dodging and/or IRS scrutiny could be a reason why some companies have stopped disclosing all of their offshore subsidiaries.[xxviii]

Examples of large companies that are engaged in substantial tax avoidance while disclosing few or even zero tax haven subsidiaries include:

–Walmart reported operating zero tax haven subsidiaries in 2015 and for the past decade. Despite this, a report released by Americans for Tax Fairness revealed that the company operated as many as 75 tax haven subsidiaries in 2014 (using this report’s list of tax haven countries) that were not included in its SEC filings. [xxix] Over the past decade, Walmart’s offshore profit has grown from $8.7 billion in 2006 to $26.1 billion in 2015.

–Google reported operating 25 subsidiaries in tax havens in 2009, but in 2010 only reported two tax haven subsidies, both in Ireland. In its latest 10-K the company only reports one tax haven subsidiary in Ireland. This could lead investors and researchers alike to think that Google either shut down many of its tax haven subsidiaries or consolidated them into one. In reality however, an academic analysis found that as of 2012, despite no longer publicly disclosing them, all of the newly unlisted tax haven subsidiaries were still operating. During this period, Google increased the amount of earnings it reported offshore from $12.3 billion to $58.3 billion.[xxx] Google likely uses accounting techniques like the infamous “double Irish” and the “Dutch sandwich,” according to a Bloomberg investigation. Google likely shifts profits through Ireland and the Netherlands to Bermuda, shrinking its tax bill by approximately $2 billion a year.[xxxi]

One significant indication that there is a substantial gap between companies’ number of subsidiaries and the number they report to the SEC is the substantially larger number of subsidiaries that 27 Fortune 500 companies report to the Federal Reserve versus the SEC. According to a CTJ analysis of SEC and Federal Reserve data, these 27 companies reported 16,389 total subsidiaries and 2,836 tax haven subsidiaries to the Federal Reserve, while only reporting 2,279 total subsidiaries and only 410 tax haven subsidiaries to the SEC.

In other words, these companies are allowed to omit more than 85 percent of the tax haven subsidiaries they reported to the Federal Reserve in their SEC filings. Taking this analysis one step further, if we were to assume this ratio of omission applied to all Fortune 500 companies in this study, then the total number of tax haven subsidiaries that Fortune 500 companies operate could be nearly 55,000.[xxxii]

Measures to Stop Abuse of Offshore Tax Havens

Strong action to prevent corporations from using offshore tax havens will not only restore basic fairness to the tax system, but will also alleviate pressure on America’s budget deficit and improve the functioning of markets. Markets work best when companies thrive based on their innovation or productivity, rather than the aggressiveness of their tax accounting schemes.

Policymakers should reform the corporate tax code to end the incentives that encourage companies to use tax havens, close the most egregious loopholes, and increase transparency so companies can’t use layers of shell companies to shrink their tax bills.

End incentives to shift profits and jobs offshore.

-The most comprehensive solution to ending tax haven abuse would be to stop permitting U.S. multinational corporations to indefinitely defer paying U.S. taxes on profits they attribute to their foreign subsidiaries. In other words, companies should pay taxes on their foreign income at the same rate and time that they pay them on their domestic income. Paying U.S. taxes on this overseas income would not constitute “double taxation” because the companies already subtract any foreign taxes they’ve paid from their U.S. tax bill, and that would not change. Ending “deferral” could raise up to $1.3 trillion over ten years, according to the U.S. Treasury Department.[xxxiii]

-The best way to deal with existing profits being held offshore would be to tax them through a deemed repatriation at the full 35 percent rate (minus foreign taxes paid), which we estimate would raise $717.8 billion. President Obama has proposed a much lower tax rate of 14 percent, which would allow large multinational corporations to avoid around $500 billion in taxes that they owe. Former Republican Ways and Means Chairman Dave Camp proposed a rate of only 8.75 percent, which would allow large multinational corporations to avoid around $550 billion in taxes that they owe. At a time of fiscal austerity, there is no reason that companies should get hundreds of billions in tax benefits to reward them for booking their income offshore.

Increase transparency.

-Require full and honest reporting to expose tax haven abuses. To accomplish this, multinational corporations should be required to publicly disclose critical financial information on a country-by-country basis (information such as profit, income tax paid, number of employees, assets, etc) so that companies cannot manipulate their income and activities to avoid taxation in the countries in which they do business. One way that this could be accomplished without legislation would be for the SEC or the Financial Accounting Standards Board (FASB) to require that this information be disclosed in companies’ annual 10-K filings to the agency.[xxxiv]

Close the most egregious offshore loopholes.

Short of ending deferral, policy makers can take some basic common-sense steps to curtail some of the most obvious and brazen ways that some companies abuse offshore tax havens.

-Cooperate with the OECD and its member countries to implement the recommendations of the group’s Base Erosion and Profit Shifting (BEPS) project, which represents a modest first step toward international coordination to end corporate tax avoidance.[xxxv]

-Close the inversion loophole by treating an entity that results from a U.S.-foreign merger as an American corporation if the majority (as opposed to 80 percent) of voting stock is held by shareholders of the former American corporation. These companies should also be treated as U.S. companies if they are managed and controlled in the U.S. and have significant business activities in the U.S.[xxxvi] Two additional strategies to combat inversions would be to enact an exit tax on any expatriating company or to crack down on the practice of earnings stripping.[xxxvii]

-Reform the so-called “check-the-box” rules to stop multinational companies from manipulating how they define their status to minimize their taxes. Right now, companies can make inconsistent claims to maximize their tax advantages, telling one country that a subsidiary is a corporation while telling another country the same entity is a partnership or some other form.

-Stop companies from shifting intellectual property (e.g. patents, trademarks, licenses) to shell companies in tax haven countries and then paying inflated fees to use them. This common practice allows companies to legally book profits that were earned in the U.S. to the tax haven subsidiary owning the patent. Limited reforms proposed by President Obama could save taxpayers $21.3 billion over ten years, according to the Joint Committee on Taxation (JCT).[xxxviii]

Reject the Creation of New Loopholes

When some lawmakers say they want to fix our broken international tax system, what they really mean is that they want to fix it to be more in favor of the multinational corporations. To prevent the tax avoidance problem from becoming even worse, lawmakers should:

-Reject a “territorial” tax system. Tax haven abuse would be worse under a system in which companies could shift profits to tax haven countries, pay minimal or no tax under those countries’ tax laws, and then freely use the profits in the United States without paying any U.S. taxes. The JCT estimates that switching to a territorial tax system could add almost $300 billion to the deficit over ten years.[xxxix]

-Reject the creation of a so-called “innovation” or “patent box.” Some lawmakers are trying to create a new loophole in the code by giving companies a preferential tax rate on income earned from patents, trademarks, and other “intellectual property” which is easy to assign to offshore subsidiaries. Such a policy would be an unjustified and ineffective giveaway to multinational U.S. corporations.[xl]

-Reject corporate integration proposals, which seek to lower taxes on capital by cutting corporate or capital gains and dividends taxes. [xli] Such proposals would lead to substantial swaths of income going entirely untaxed, ignore the entity-level advantages that corporations receive and would undermine a critical source of progressive revenue.

Methodology

The list of 50 tax havens used is based on lists compiled by three sources using similar characteristics to define tax havens. These sources were the Organisation for Economic Co-operation and Development (OECD), the National Bureau of Economic Research, and a U.S. District Court order. This court order gave the IRS the authority to issue a “John Doe” summons, which included a list of tax havens and financial privacy jurisdictions.

The companies surveyed make up the 2016 Fortune 500, a list of which can be found here: http://money.cnn.com/magazines/fortune/fortune500/.

To figure out how many subsidiaries each company had in the 50 known tax havens, we looked at “Exhibit 21” of each company’s most recent 10-K report, which is filed annually with the Securities and Exchange Commission (SEC). Exhibit 21 lists every reported subsidiary of the company and the country in which it is registered. We used the SEC’s EDGAR database to find the 10-K filings. 367 of the Fortune companies disclose offshore subsidiaries, but it is possible that many of the remaining 132 companies do in fact have offshore tax haven subsidiaries but declined to disclose them publicly. For those companies who also disclosed subsidiary data to the Federal Reserve (which is publicly available in their online National Information Center), we used this more comprehensive subsidiary data in the report.

We also used 10-K reports to find the amount of money each company reported it kept offshore in 2015. This information is typically found in the tax footnote of the 10-K. The companies disclose this information as the amount they keep “permanently reinvested” abroad.

As explained in this report, 58 of the companies surveyed disclosed what their estimated tax bill would be if they repatriated the money they kept offshore. This information is also found in the tax footnote. To calculate the tax rate these companies paid abroad in 2015, we first divided the estimated tax bill by the total amount kept offshore. That number equals the U.S. tax rate the company would pay if they repatriated that foreign cash. Since companies receive dollar-for-dollar credits for taxes paid to foreign governments, the tax rate paid abroad is simply the difference between 35% — the U.S. statutory corporate tax rate — and the tax rate paid upon repatriation.

End Notes

Back to Contents

[i] Matt Gardner, “EU Ruling on Apple’s Egregious Tax Avoidance Is Welcome News, But $14.5 Billion Is Only a Fraction of the Story,” Tax Justice Blog, August 30, 2016.http://www.taxjusticeblog.org/archive/2016/08/eu_ruling_on_apples_egregious.php

[ii] Government Accountability Office, Business and Tax Advantages Attract U.S. Persons and Enforcement Challenges Exist, GAO-08-778, a report to the Chairman and Ranking Member, Committee on Finance, U.S. Senate, July 2008, http://www.gao.gov/highlights/d08778high.pdf.

[iii] Id.

[iv] Organisation for Economic Co-operation and Development, “Harmful Tax Competition: An Emerging Global Issue,” 1998. http://www.oecd.org/tax/transparency/44430243.pdf

[v] Government Accountability Office, International Taxation; Large U.S. Corporations and Federal Contractors with Subsidiaries in Jurisdictions Listed as Tax Havens or Financial Privacy Jurisdictions,December 2008.

[vi] Mark P. Keightley, Congressional Research Service, An Analysis of Where American Companies Report Profits: Indications of Profit Shifting, 18 January, 2013.

[vii] Citizens for Tax Justice, American Corporations Tell IRS the Majority of Their Offshore Profits Are in 10 Tax Havens, 7 April 2016.

[viii] Kitty Richards and John Craig, Offshore Corporate Profits: The Only Thing ‘Trapped’ Is Tax Revenue, Center for American Progress, 9 January, 2014, http://www.americanprogress.org/issues/tax-reform/report/2014/01/09/81681/offshore-corporate-profits-the-only-thing-trapped-is-tax-revenue/.

[ix] Offshore Funds Located On Shore, Majority Staff Report Addendum, Senate Permanent Subcommittee on Investigations, 14 December 2011, http://www.levin.senate.gov/newsroom/press/release/new-data-show-corporate-offshore-funds-not-trapped-abroad-nearly-half-of-so-called-offshore-funds-already-in-the-united-states/.

[x] Kate Linebaugh, “Firms Keep Stockpiles of ‘Foreign’ Cash in U.S.,” Wall Street Journal, 22 January 2013, http://online.wsj.com/article/SB10001424127887323284104578255663224471212.html.

[xi] Kimberly A. Clausing, “Profit shifting and U.S. corporate tax policy reform,” Washington Center for Equitable Growth, May 2016. http://equitablegrowth.org/report/profit-shifting-and-u-s-corporate-tax-policy-reform/

[xii] “China to Become World’s Second Largest Consumer Market”, Proactive Investors United Kingdom, 19 January, 2011 (Discussing a report released by Boston Consulting Group),http://www.proactiveinvestors.co.uk/columns/china-weekly-bulletin/4321/china-to-become-worlds-second-largest-consumer-market-4321.html.

[xiii] The number of subsidiaries registered in tax havens is calculated by authors looking at exhibit 21 of the company’s 2015 10-K reports filed annually with the Securities and Exchange Commission. For a selection of 27 companies we used subsidiaries disclosed to the Federal Reserve. The list of tax havens comes from the Government Accountability Office report cited in note 5.

[xiv] ProPublica, “Bailout Recipients,” updated September 14, 2016.https://projects.propublica.org/bailout/list

[xv] Calculated by the authors based on revenue information from Pfizer’s 2014 10-K filing.

[xvi] Robert McIntyre, “Obama Wins One Against Corporate Tax Dodging,” U.S. News and World Report. April 7, 2016. http://www.usnews.com/opinion/economic-intelligence/articles/2016-04-07/pfizer-inversion-stopped-because-obama-is-serious-on-corporate-tax-dodging

[xvii] Goldman Sachs, “Office Locations.” Accessed 9/28/16. http://www.goldmansachs.com/who-we-are/locations/

[xviii] Audit Analytics, “Indefinitely Reinvested Foreign Earnings Still on the Rise,” July 2016.http://www.auditanalytics.com/blog/indefinitely-reinvested-foreign-earnings-still-on-the-rise/.

[xix] Citizens for Tax Justice, “Apple is not Alone” 2 June 2013,http://ctj.org/ctjreports/2013/06/apple_is_not_alone.php#.UeXKWm3FmH8.

[xx] See methodology for an explanation of how this was calculated.

[xxi] Companies get a credit for taxes paid to foreign governments when they repatriate foreign earnings. Therefore, if companies disclose what their hypothetical tax bill would be if they repatriated “permanently reinvested” earnings, it is possible to deduce what they are currently paying to foreign governments. For example, if a company discloses that they would need to pay the full statutory 35% tax rate on its offshore cash, it implies that they are currently paying no taxes to foreign governments, which would entitle them to a tax credit that would reduce the 35% rate. This method of calculating foreign tax rates was originally used by Citizens for Tax Justice (see note 19).

[xxii] Citizens for Tax Justice, “Nike’s Tax Haven Subsidiaries Are Named After Its Shoe Brands,” 25 July 2013,http://www.ctj.org/taxjusticedigest/archive/2013/07/nikes_tax_haven_subsidiaries_a.php#.U3y0Gijze2J.

[xxiii] Nike, “Nike Stores.” Accessed 9/28/2016. http://www.ascooper.bm/,http://www.nike.com/us/en_us/sl/find-a-store/; A.S. Cooper Bermuda, “Home Page,” Accessed 9/28/2016. http://www.ascooper.bm/

[xxiv] Zachary R. Mider, “Tax Break ‘Blarney’: U.S. Companies Beat the System with Irish Addresses,”Bloomberg News, 5 May 2014, http://www.bloomberg.com/news/2014-05-04/u-s-firms-with-irish-addresses-criticized-for-the-moves.html.

[xxv] Citizens for Tax Justice, “The Problem of Corporate Inversions: the Right and Wrong Approaches for Congress,” 14 May 2014,http://ctj.org/ctjreports/2014/05/the_problem_of_corporate_inversions_the_right_and_wrong_approaches_for_congress.php#.U3tavSjze2J.

[xxvi] Richard Phillips, “Why Treasury’s New Anti-Inversion Rules Are Critical,” Tax Justice Blog, July 7, 2016. http://www.taxjusticeblog.org/archive/2016/07/why_treasurys_new_anti-inversi.php

[xxvii] Securities and Exchange Commission, “Business and Financial Disclosure Required by Regulation S-K,” Release No. 33-10064; 34-77599; File No. S7-06-16. https://www.sec.gov/rules/concept/2016/33-10064.pdf

[xxviii] Jeffrey Gramlich and Janie Whiteaker-Poe, “Disappearing subsidiaries: The Cases of Google and Oracle,” March 2013, Working Paper available at SSRN, http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2229576.

[xxix] Americans for Tax Fairness, “The Walmart Web,” 17 June 2015.http://www.americansfortaxfairness.org/files/TheWalmartWeb-June-2015-FINAL.pdf

[xxx] See note 28.

[xxxi] Jesse Drucker, “Google Joins Apple Avoiding Taxes with Stateless Income,” Bloomberg News, 22 May 2013, http://www.bloomberg.com/news/2013-05-22/google-joins-apple-avoiding-taxes-with-stateless-income.html.

[xxxii] Updated numbers based on methodology of this report: Citizens for Tax Justice, “Lax SEC Reporting Requirements Allow Companies to Omit Over 85 Percent of Their Tax Haven Subsidiaries,” June 30, 2016.http://ctj.org/ctjreports/2016/06/lax_sec_reporting_requirements_allow_companies_to_omit_over_85_percent_of_their_tax_haven_subsidiari.php

[xxxiii] Economic Policy Institute, “Corporate Chart Book,” September 19, 2016.http://www.epi.org/publication/corporate-tax-chartbook-how-corporations-rig-the-rules-to-dodge-the-taxes-they-owe/

[xxxiv] FACT Coalition, “A Taxing Problem for Investors,” September 12, 2016.https://thefactcoalition.org/taxing-problem-investors-shareholders-increasingly-risk-lack-disclosure-corporate-tax-practices/

[xxxv] OECD, “BEPS 2015 Final Reports,” October 5, 2015. http://www.oecd.org/tax/beps-2015-final-reports.htm

[xxxvi] Citizens for Tax Justice, “Proposals to Resolve the Crisis of Corporate Inversions,” August 21, 014.https://ctj.sfo2.digitaloceanspaces.com/pdf/inversionsproblemsandsolutions.pdf

[xxxvii] Citizens for Tax Justice, “Proposals to Resolve the Crisis of Corporate Inversions,” August 21, 2014. http://ctj.org/ctjreports/2014/08/proposals_to_resolve_the_crisis_of_corporate_inversions.php

[xxxviii]Joint Committee on Taxation, “Estimated Budget Effects of the Revenue Provisions Contained in the President’s Fiscal Year 2015 Budget Proposal,” April 15, 2014, https://www.jct.gov/publications.html?func=startdown&id=4585.

[xxxix] Listed as “Deduction for dividends received by domestic corporations from certain foreign corporations.” Joint Committee on Taxation, “Estimated Revenue Effects of the “Tax Reform Act of 2014,” February 26, 2014, https://www.jct.gov/publications.html?func=startdown&id=4562. JCT estimated that the cost of a territorial system would be $212 billion over a decade if the U.S. corporate tax rate were reduced to 25%. That translates to a cost of $297 billion under the current 35% tax rate.

[xl] Citizens for Tax Justice, “A Patent Box Would Be a Huge Step Back for Corporate Tax Reform,” June, 4, 2015. https://ctj.sfo2.digitaloceanspaces.com/pdf/patentboxstepback.pdf

[xli] Citizens for Tax Justice, “Corporation Integration: A Solution in Search of a Problem,” May 16, 2016.http://ctj.org/ctjreports/2016/05/corporation_integration_a_solution_in_search_of_a_problem.php

Executive Summary:

U.S.-based multinational corporations are allowed to play by a different set of rules than small and domestic businesses or individuals when it comes to paying taxes. Corporate lobbyists and their congressional allies have riddled the U.S. tax code with loopholes and exceptions that enable tax attorneys and corporate accountants to book U.S. earned profits to subsidiaries located in offshore tax haven countries with minimal or no taxes. The most transparent and galling aspect of this is that often, a company’s operational presence in a tax haven may be nothing more than a mailbox. Overall, multinational corporations use tax havens to avoid an estimated $100 billion in federal income taxes each year.

But corporate tax avoidance is not inevitable. Congress could act tomorrow to shut down tax haven abuse by revoking laws that enable and incentivize the practice of shifting money into offshore tax havens. By failing to take action, the default is that our elected officials tacitly approve the fact that when corporations don’t pay what they owe, ordinary Americans inevitably must make up the difference. In other words, every dollar in taxes that corporations avoid must be balanced by higher taxes on individuals, cuts to public investments and services, and increased federal debt.

This study explores how in 2015 Fortune 500 companies used tax haven subsidiaries to avoid paying taxes on much of their income. It reveals that tax haven use is now standard practice among the Fortune 500 and that a handful of the country’s wealthiest corporations benefit the most from this tax avoidance scheme.

The main findings of this report are:

Most of America’s largest corporations maintain subsidiaries in offshore tax havens. At least 367 companies, or 73 percent of the Fortune 500, operate one or more subsidiaries in tax haven countries.

-All told, these 367 companies maintain at least 10,366 tax haven subsidiaries.

-The 30 companies with the most money officially booked offshore for tax purposes collectively operate 2,509 tax haven subsidiaries.

The most popular tax haven among the Fortune 500 is the Netherlands, with more than half of the Fortune 500 reporting at least one subsidiary there.

Approximately 58 percent of companies with tax haven subsidiaries have set up at least one in Bermuda or the Cayman Islands — two particularly notorious tax havens. The profits that all American multinationals — not just Fortune 500 companies — collectively claimed they earned in these two island nations according to the most recent data totaled 1,884 percent and 1,313 percent of each country’s entire yearly economic output, respectively.

In fact, a 2008 Congressional Research Service report found that American multinational companies collectively reported 43 percent of their foreign earnings in five small tax haven countries: Bermuda, Ireland, Luxembourg, the Netherlands, and Switzerland. Yet these countries accounted for only 4 percent of the companies’ foreign workforces and just 7 percent of their foreign investments. By contrast, American multinationals reported earning just 14 percent of their profits in major U.S. trading partners with higher taxes — Australia, Canada, the UK, Germany, and Mexico — which accounted for 40 percent of their foreign workforce and 34 percent of their foreign investment.

Fortune 500 companies are holding nearly $2.5 trillion in accumulated profits offshore for tax purposes. Just 30 Fortune 500 companies account for 66 percent or $1.65 trillion of these offshore profits.

Only 58 Fortune 500 companies disclose what they would expect to pay in U.S. taxes if these profits were not officially booked offshore. In total, these 58 companies would owe $212 billion in additional federal taxes. Based on these 58 corporations’ public disclosures, the average tax rate that they have collectively paid to foreign countries on these profits is a mere 6.2 percent, indicating that a large portion of this offshore money has been booked in tax havens. If we assume that average tax rate of 6.2 percent to all 298 Fortune 500 companies with offshore earnings, this implies they would owe a 28.8 percent rate upon repatriation of these earning, meaning they would collectively owe $717.8 billion in additional federal taxes. Some of the worst offenders include:

-Apple: Apple has booked $214.9 billion offshore, a sum greater than any other company’s offshore cash pile. It would owe $65.4 billion in U.S. taxes if these profits were not officially held offshore for tax purposes. A 2013 Senate investigation found that Apple has structured two Irish subsidiaries to be tax residents of neither the United States, where they are managed and controlled, nor Ireland, where they are incorporated. A recent ruling by the European Commission found that Apple used this tax haven structure in Ireland to pay a rate of just 0.005 percent on its European profits in 2014, and has required that the company pay $14.5 billion in back taxes to Ireland.

-Citigroup: The financial services company officially reports $45.2 billion offshore for tax purposes on which it would owe $12.7 billion in U.S. taxes. That implies that Citigroup currently has paid only a 7 percent tax rate on its offshore profits to foreign governments, indicating that most of the money is booked in tax havens levying little to no tax. Citigroup maintains 140 subsidiaries in offshore tax havens.

-Nike: The sneaker giant officially holds $10.7 billion offshore for tax purposes on which it would owe $3.6 billion in U.S. taxes. This implies Nike pays a mere 1.4 percent tax rate to foreign governments on those offshore profits, indicating that nearly all of the money is officially held by subsidiaries in tax havens. Nike likely does this by licensing several trademarks for its products to three subsidiaries in Bermuda and then essentially charging itself royalties to use those trademarks. The shoe company, which operates 931 retail stores throughout the world, does not operate one in Bermuda and one of the largest department stores in Bermuda, A.S. Cooper and Sons, does not list Nike as a brand that it offers.

Some companies that report a significant amount of money offshore maintain hundreds of subsidiaries in tax havens, including the following:

-Pfizer, the world’s largest drug maker, operates 181 subsidiaries in tax havens and holds $193.6 billion in profits offshore for tax purposes, the second highest among the Fortune 500. Pfizer recently attempted the acquisition of a smaller foreign competitor so it could reincorporate on paper as a “foreign company.” Pulling this off would have allowed the company a tax-free way to avoid $40 billion in taxes on its offshore earnings, but fortunately the Treasury Department issued new anti-inversion regulations that stopped the deal from taking place.

-PepsiCo maintains 135 subsidiaries in offshore tax havens. The soft drink maker reports holding $40.2 billion offshore for tax purposes, though it does not disclose what its estimated tax bill would be if it didn’t book those profits offshore.

-Goldman Sachs reports having 987 subsidiaries in offshore tax havens, 537 of which are in the Cayman Islands despite not operating a single legitimate office in that country, according to its own website. The group officially holds $28.6 billion offshore.

The proliferation of tax haven abuse is exacerbated by lax reporting laws that allow corporations to dictate how, when, and where they disclose foreign subsidiaries, allowing them to continue to take advantage of tax loopholes without attracting governmental or public scrutiny.

Consider:

-A Citizens for Tax Justice analysis of 27 companies that disclose subsidiary data to both the Securities and Exchange Commission (SEC) and the Federal Reserve revealed that weak SEC disclosure rules allowed these companies to omit 85 percent of their subsidiaries on average. If this rate of omission held true for the entire Fortune 500, the number of tax haven subsidiaries in reality could be nearly 55,000, rather than the 10,366 that are being publicly disclosed now.

-Walmart reported operating zero tax haven subsidiaries in 2014 and for the past decade to the SEC. Despite this, a recent report released by Americans for Tax Fairness revealed that the company operates as many as 75 tax haven subsidiaries (using this report’s list of tax haven countries). Over the past decade, Walmart’s offshore income has grown from $8.7 billion in 2006 to $26.1 billion in 2015.

-Google (who recently changed its corporate name to Alphabet) reported operating 25 subsidiaries in tax havens in 2009, but in 2010 only reported two tax haven subsidies, both in Ireland. In its latest 10-K the company reports one tax haven subsidiary in Ireland. This could lead investors and researchers alike to think that Google either shut down many of its tax haven subsidiaries or consolidated them into one. In reality however, an academic analysis found that as of 2012, despite no longer publicly disclosing them, all of the newly unlisted tax haven subsidiaries were still operating. During this period, Google increased the amount of earnings it reported offshore from $7.7 billion to $58.3 billion. This combination of ceasing disclosures for tax haven subsidiaries and simultaneously increasing reported offshore earnings allows the corporation to create an illusion of legitimate international business while still being able to book profits to low- or no-tax countries.

Congress can and should take action to prevent corporations from using offshore tax havens, which in turn would restore basic fairness to the tax system, fund valuable public programs, possibly reduce annual deficits, and ultimately improve the functioning of markets.

There are clear policy solutions that lawmakers can enact to crack down on tax haven abuse. They should end incentives for companies to shift profits offshore, close the most egregious offshore loopholes and increase transparency.

Introduction

Rather than continuing to prosper under a veil of secrecy, tax havens and multinational corporations are beginning to feel the pressure as governments across the world crack down on international tax avoidance. For years, one report after another has revealed how many of the world’s wealthiest companies manage to use tax havens to pay little to nothing in taxes on a substantial portion of their income. Perhaps the biggest outrage to date is the recent finding by the European Commission that Apple holds as much as $115 billion in earnings in Ireland virtually tax-free, thanks to a scheme that allowed the corporation to keep billions in profits in a subsidiary that didn’t pay taxes to any country. The unfortunate reality, however, is that Apple is far from alone is its offshore tax avoidance.

A symbol of the excesses of the world of corporate tax havens is the Ugland house, a modest five-story office building in the Cayman Islands that serves as the registered address for 18,857 companies. Simply by registering subsidiaries in the Cayman Islands, U.S. companies can use legal accounting gimmicks to make much of their U.S.-earned profits appear to be earned in the Caymans and thus pay no taxes on those profits.

U.S. law does not even require that subsidiaries have any physical presence in the Caymans beyond a post office box. In fact, about half of the subsidiaries registered at the infamous Ugland house have their billing address in the U.S., even while they are officially registered in the Caymans. This unabashedly false corporate “presence” is one of the hallmarks of a tax haven subsidiary.

[ADD PHOTO OF ROOM OF P.O. BOXES, IDEALLY AT UGLAND HOUSE IF PHOTO EXISTS]

TEXT BOX: What is a Tax Haven?

Tax havens have four identifying features. First, a tax haven is a jurisdiction with very low or nonexistent taxes. Second is the existence of laws that encourage financial secrecy and inhibit an effective exchange of information about taxpayers to tax and law enforcement authorities. Third is a general lack of transparency in legislative, legal or administrative practices. Fourth is the lack of a requirement that activities be “substantial,” suggesting that a jurisdiction is trying to earn modest fees by enabling tax avoidance.

This study uses a list of 50 tax haven jurisdictions, which each appear on at least one list of tax havens compiled by the Organisation for Economic Cooperation and Development (OECD), the National Bureau of Economic Research, or as part of a U.S. District Court order listing tax havens. These lists are also used in a GAO report investigating tax haven subsidiaries.

[END TEXT BOX]

How Companies Avoid Taxes

Companies can avoid paying taxes by booking profits to a tax haven because U.S. tax laws allow them to defer paying U.S. taxes on profits that they report are earned abroad until they “repatriate” the money to the United States. Many U.S. companies game this system by using loopholes that allow them to disguise profits earned in the U.S. as “foreign” profits earned by subsidiaries in a tax haven.

Offshore accounting gimmicks by multinational corporations have created a disconnect between where companies locate their workforce and investments, on one hand, and where they claim to have earned profits, on the other. In its seminal 2008 report, the non-partisan Congressional Research Service found that American multinational companies collectively reported 43 percent of their foreign earnings in five small tax haven countries: Bermuda, Ireland, Luxembourg, the Netherlands, and Switzerland. Yet these countries accounted for only 4 percent of the companies’ foreign workforces and just 7 percent of their foreign investments. By contrast, American multinationals reported earning just 14 percent of their profits in major U.S. trading partners with higher taxes — Australia, Canada, the UK, Germany, and Mexico — which accounted for 40 percent of their foreign workforce and 34 percent of their foreign investment. Reinforcing these earlier findings, the Internal Revenue Service (IRS) released data earlier this year showing that American multinationals collectively reported in 2012 that an implausible 59 percent of their foreign earnings were “earned” in 10 notorious tax havens (see table 4).

Showing just how ridiculous these accounting gimmicks can get, much if not most of the profits kept “offshore” are housed in U.S. banks or invested in American assets, but are registered in the name of foreign subsidiaries. In such cases, American corporations benefit from the stability of the U.S. financial system while avoiding paying taxes on their profits that officially remain booked “offshore” for tax purposes. A Senate investigation of 27 large multinationals with substantial amounts of cash that was supposedly “trapped” offshore found that more than half of the offshore funds were already invested in U.S. banks, bonds, and other assets. For some companies the percentage is much higher. A Wall Street Journal investigation found that 93 percent of the money Microsoft had officially booked “offshore” was invested in U.S. assets. In theory, companies are barred from investing directly in their U.S. operations, paying dividends to shareholders or repurchasing stock with money they declare to be “offshore.” But even that restriction is easily evaded because companies can use the cash supposedly “trapped” offshore for those purposes by borrowing at negligible rates using their offshore holdings as implied collateral.

[TEXT BOX: A NOTE ON MISLEADING TERMINOLOGY

“Offshore profits”: Using the term “offshore profits” without any qualification inaccurately describes how U.S. multinationals hold profits in tax havens. The term implies that these profits were earned purely through foreign business activity. In reality, much of these “offshore profits” are often U.S. profits that companies have disguised as foreign profits to avoid taxes. To be more accurate, this study instead describes these funds as “profits booked offshore for tax purposes.”

“Repatriation” or “bringing the money back”: Repatriation is a legal term used to describe when a U.S. company declares offshore profits as returned to the U.S. As a general description, “repatriation” wrongly implies that profits companies have booked offshore for tax purposes are sitting offshore and missing from the U.S. economy, and that a company cannot make use of those profits in the U.S. without “bringing them back” and paying U.S. tax.

[END TEXT BOX]

Average Taxpayers Pick Up the Tab for Offshore Tax Dodging

Corporate tax avoidance is neither fair nor inevitable. Congress created the loopholes in our tax code that allow offshore tax avoidance and force ordinary Americans to make up the difference. The practice of shifting corporate income to tax haven subsidiaries reduces federal revenue by an estimated $100 billion annually. Every dollar in taxes companies avoid by using tax havens must be balanced by higher taxes paid by other Americans, cuts to government programs, or increased federal debt.

It makes sense for profits earned by U.S. companies to be subject to U.S. taxation. The profits earned by these companies generally depend on access to America’s largest-in-the-world consumer market, a well-educated workforce trained by our school systems, strong private-property rights enforced by our court system, and American roads and rail to bring products to market. Multinational companies that depend on America’s economic and social infrastructure are shirking their obligation to pay for that infrastructure when they shelter their profits overseas.

Most of America’s Largest Corporations Maintain Subsidiaries in Offshore Tax Havens

As of 2015, 367 Fortune 500 companies — nearly three-quarters — disclose subsidiaries in offshore tax havens, indicating how pervasive tax haven use is among large companies. All told, these 367 companies maintain at least 10,366 tax haven subsidiaries. The 30 companies with the most money held offshore collectively disclose 2,509 tax haven subsidiaries. Bank of America, Citigroup, JPMorgan-Chase, Goldman Sachs, Wells Fargo and Morgan Stanley — all large financial institutions that together received $160 billion in taxpayer bailouts in 2008 — disclose a combined 2,342 subsidiaries in tax havens.

Companies that rank high for both the number of tax haven subsidiaries and how much profit they book offshore for tax purposes include:

-Pfizer, the world’s largest drug maker, operates 181 subsidiaries in tax havens and has $193.6 billion in profits offshore for tax purposes, the second highest among the Fortune 500. More than 41 percent of Pfizer’s sales between 2008 and 2015 were in the United States, but it managed to report no federal taxable income for eight years in a row. This is because Pfizer uses accounting techniques to shift the location of its taxable profits offshore. For example, the company can transfer patents for its drugs to a subsidiary in a low- or no-tax country. Then when the U.S. branch of Pfizer sells the drug in the U.S., it “pays” its own offshore subsidiary high licensing fees that turn domestic profits into on-the-books losses and shifts profit overseas.

Pfizer recently attempted a corporate “inversion” in which it would have acquired a smaller foreign competitor so it could reincorporate on paper in Ireland and no longer be an American company. Pulling this off would have allowed the company a tax-free way to avoid $40 billion in taxes on its offshore earnings, but fortunately the Treasury Department issued new anti-inversion regulations that stopped the deal from taking place.

-PepsiCo maintains 135 subsidiaries in offshore tax havens. The soft drink maker reports holding $40.2 billion offshore for tax purposes, though it does not disclose what its estimated tax bill would be if it didn’t keep those profits offshore.

-Goldman Sachs reports having 987 subsidiaries in offshore tax havens, 537 of which are in the Cayman Islands alone, despite not operating a single legitimate office in that country, according to its own website. The group officially holds $28.6 billion offshore.

Table 1: Top 20 Companies with the Most Tax Haven Subsidiaries

|

Company

|

Number of Tax Haven Subsidiaries

|

Location of Tax Haven Subsidiaries

|

|

Goldman Sachs Group

|

987

|

Bahamas (1), Barbados (4), Bermuda (19), British Virgin Islands (6), Cayman Islands (537), Channel Islands (17), Costa Rica (1), Cyprus (2), Gibraltar (1), Hong Kong (19), Ireland (64), Isle of Man (3), Luxembourg (197), Mauritius (49), Monaco (1), Netherlands (45), Panama (1), Singapore (18), Switzerland (2)

|

|

Morgan Stanley

|

669

|

Bermuda (4), Cayman Islands (280), Channel Islands (33), Cyprus (4), Gibraltar (1), Hong Kong (18), Ireland (45), Luxembourg (76), Malta (1), Mauritius (16), Netherlands (131), Singapore (58), Switzerland (2)

|

|

J.P. Morgan Chase & Co.

|

385

|

Bahamas (7), Barbados (1), Bermuda (19), British Virgin Islands (9), Cayman Islands (149), Channel Islands (18), Cyprus (1), Hong Kong (17), Ireland (13), Luxembourg (61), Malta (13), Marshall Islands (3), Mauritius (33), Netherlands (12), Singapore (25), Switzerland (4)

|

|

KKR

|

300

|

Cayman Islands (249), Channel Islands (6), Hong Kong (3), Ireland (19), Luxembourg (9), Mauritius (5), Singapore (9)

|

|

Bank of New York Mellon Corp.

|

188

|

Bahamas (2), Bermuda (6), Cayman Islands (69), Channel Islands (13), Hong Kong (2), Ireland (55), Luxembourg (16), Malta (1), Mauritius (1), Netherlands (18), Singapore (4), Switzerland (1)

|

|

AES

|

188

|

Barbados (1), Bermuda (6), British Virgin Islands (8), Cayman Islands (77), Channel Islands (1), Costa Rica (1), Cyprus (1), Hong Kong (1), Ireland (3), Jordan (2), Luxembourg (1), Mauritius (3), Netherlands (69), Panama (8), Singapore (6)

|

|

Pfizer

|

181

|

Bahamas (11), Cayman Islands (1), Channel Islands (3), Costa Rica (3), Hong Kong (7), Ireland (29), Luxembourg (42), Netherlands (65), Panama (4), Singapore (10), Switzerland (6)

|

|

Thermo Fisher Scientific

|

159

|

Barbados (3), Bermuda (4), British Virgin Islands (1), Cayman Islands (12), Channel Islands (1), Costa Rica (1), Gibraltar (2), Hong Kong (18), Ireland (8), Luxembourg (24), Malta (6), Netherlands (54), Singapore (10), Switzerland (15)

|

|

Citigroup

|

140

|

Aruba (1), Bahamas (21), Bahrain (1), Bermuda (6), Cayman Islands (22), Channel Islands (12), Costa Rica (7), Hong Kong (20), Ireland (11), Luxembourg (8), Mauritius (5), Monaco (1), Netherlands (3), Panama (3), Singapore (12), Switzerland (6), Turks and Caicos (1)

|

|

PepsiCo

|

135

|

Barbados (1), Bermuda (15), Cayman Islands (6), Costa Rica (2), Cyprus (13), Gibraltar (2), Hong Kong (10), Ireland (9), Jordan (1), Liechtenstein (1), Luxembourg (24), Mauritius (2), Netherlands (32), Netherlands Antilles (8), Panama (1), Singapore (2), Switzerland (6)

|

|

Merck

|

125

|

Bermuda (11), Costa Rica (2), Cyprus (3), Hong Kong (3), Ireland (25), Lebanon (1), Luxembourg (1), Netherlands (44), Panama (5), Singapore (7), Switzerland (23)

|

|

Marsh & McLennan

|

123

|

Bahamas (1), Bahrain (1), Barbados (5), Bermuda (20), Cayman Islands (2), Channel Islands (3), Cyprus (2), Hong Kong (12), Ireland (17), Isle of Man (4), Jordan (1), Liechtenstein (1), Luxembourg (13), Macau (1), Malta (2), Mauritius (1), Netherlands (14), Panama (2), Singapore (12), Switzerland (9)

|

|

Bank of America Corp.

|

109

|

Bahamas (2), Bermuda (4), Cayman Islands (18), Channel Islands (13), Costa Rica (1), Gibraltar (4), Hong Kong (3), Ireland (8), Luxembourg (13), Mauritius (6), Netherlands (25), Netherlands Antilles (1), Singapore (8), Switzerland (3)

|

|

Occidental Petroleum

|

109

|

Bermuda (62), Cayman Islands (9), Hong Kong (1), Liberia (1), Malta (1), Netherlands (4), Panama (1), Singapore (2), St. Kitts and Nevis (26), Switzerland (2)

|

|

Zimmer Biomet Holdings

|

102

|

Bermuda (2), Cayman Islands (4), Channel Islands (2), Costa Rica (2), Gibraltar (4), Hong Kong (20), Ireland (6), Luxembourg (14), Netherlands (28), Singapore (2), Switzerland (18)

|

|

Stanley Black & Decker

|

99

|

British Virgin Islands (4), Cayman Islands (7), Costa Rica (1), Hong Kong (13), Ireland (22), Liechtenstein (1), Luxembourg (16), Macau (1), Netherlands (14), Panama (4), Singapore (10), Switzerland (6)

|

|

Hewlett-Packard

|

95

|

Bahrain (2), Bermuda (6), British Virgin Islands (2), Cayman Islands (7), Costa Rica (2), Hong Kong (4), Ireland (9), Luxembourg (3), Netherlands (50), Panama (2), Singapore (5), Switzerland (3)

|

|

Abbott Laboratories

|

94

|

Bahamas (2), Barbados (1), Bermuda (6), British Virgin Islands (1), Cayman Islands (4), Costa Rica (3), Cyprus (2), Gibraltar (3), Hong Kong (4), Ireland (12), Lebanon (1), Luxembourg (9), Malta (2), Netherlands (21), Panama (13), Singapore (4), Switzerland (5), U.S. Virgin Islands (1)

|

|

Marriott International

|

93

|

Anguilla (1), Aruba (1), Bahamas (2), Bahrain (1), Barbados (1), Bermuda (6), British Virgin Islands (8), Cayman Islands (10), Channel Islands (2), Costa Rica (1), Hong Kong (7), Ireland (3), Jordan (3), Lebanon (1), Luxembourg (6), Maldives (1), Malta (1), Netherlands (14), Netherlands Antilles (7), Panama (2), Singapore (3), St. Kitts and Nevis (2), St. Lucia (1), Switzerland (7), Turks and Caicos (1), U.S. Virgin Islands (1)

|

|

PNC Financial Services Group

|

92

|

Bermuda (10), Cayman Islands (39), Channel Islands (8), Cyprus (1), Hong Kong (5), Ireland (8), Isle of Man (3), Luxembourg (8), Netherlands (5), Singapore (4), Switzerland (1)

|

|

Total

|

4,373

|

|

Which Tax Havens do the Fortune 500 Turn To?

While small island nations such as Bermuda and the Cayman Islands have become synonymous with tax havens, many Fortune 500 companies are turning to countries outside the Caribbean for their tax avoidance schemes. In fact, with more than 50 percent of the Fortune 500 companies operating at least one subsidiary there, the Netherlands appears to be the most frequently used tax haven country by major U.S. companies. It is followed by Singapore and Hong Kong, which are critical tax havens in pursuing business ventures in Asia. The next most popular havens are the three other European tax havens, Luxembourg, Switzerland and Ireland.

While they are no longer the dominant tax havens when it comes to corporate tax avoidance, the Cayman Islands or Bermuda are used by 58 percent of Fortune 500 companies for at least one tax haven subsidiary.

Figure 1: Percent of Fortune 500 Companies with 2015 Subsidiaries in 20 Top Tax Havens

Earnings Booked Offshore for Tax Purposes by U.S. Multinationals Doubled between 2009 and 2015