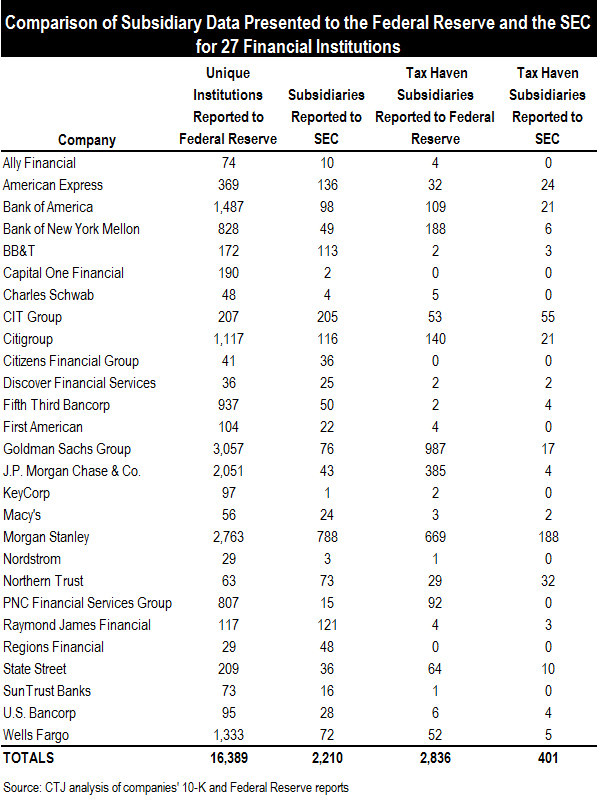

A new review of 27 major American financial firms’ corporate filings finds that some of the nation’s big banks fail to report the vast majority of their tax haven subsidiaries in their annual Securities and Exchange Commission (SEC) corporate filings. This brazen omission gives even more credence to previous studies about how Fortune 500 companies, banks included, are using tax haven subsidiaries to avoid U.S. taxes on a grand scale.

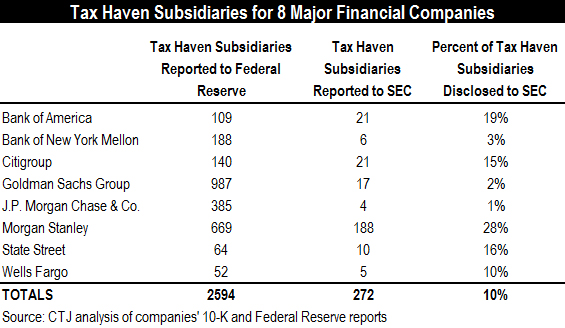

The companies analyzed include banking and financial services giants such as J.P. Morgan Chase, Wells Fargo, Bank of America, Citigroup, Goldman Sachs, and Morgan Stanley. All told, the 27 firms collectively reported 401 tax haven subsidiaries to their shareholders and the SEC in 2015. However, when these same companies reported more complete information to the Federal Reserve, they revealed they own more than 2,800 corporate subsidiaries in notorious tax haven countries such as the Cayman Islands, Bermuda, Luxembourg, and the Netherlands. In other words, these major corporations are reporting to the SEC, their shareholders and financial analysts at least 85 percent fewer subsidiaries companies than what’s on their actual books. It’s hard to believe such an omission on this vast scale is accidental. The more likely answer is that these tax haven subsidiaries are shell corporations that are part of a broader strategy to stash earnings abroad to avoid paying U.S. corporate income taxes.

How Do They Get Away With This?

Corporations can avoid disclosing subsidiaries to shareholders due to the SEC’s requirement that companies only have to disclose their “significant” subsidiaries. Even the Federal Reserve doesn’t require all subsidiaries to be reported, but does apply a stricter set of criteria for disclosure. CTJ analysts discovered the gross discrepancy between what these financial firms report to the SEC and what they report to the Federal Reserve by reviewing disclosures released to both entities.

Consumers should be concerned about this partial reporting for a few reasons. First, the SEC-mandated annual financial reports are the main source of information readily available to American shareholders who want to understand the financial health—to say nothing of the ethical standards—of the companies in which they invest. Incomplete disclosure means shareholders are routinely receiving a very incomplete view of the structure of the firms they’ve chosen to invest in. Second, if corporations are using shell companies on a mass scale to avoid paying taxes, it ultimately means ordinary working people are going to have to contribute more or the nation will not have enough resources to fund priorities as varies as education, health and transportation.

This finding is doubly troubling because the financial sector is likely not alone in failing to reveal tax haven subsidiary companies. We were only able to discern this information about the financial sector because such companies have both SEC and Federal Reserve reporting requirements. But most U.S. corporations outside the financial sector aren’t regulated by the Federal Reserve, so it is impossible to know the extent to which corporations in other sectors are concealing their tax haven subsidiaries.

Across the Fortune 500, the scope of this non-disclosure is potentially staggering. CTJ’s 2015 “Offshore Shell Games” report found that Fortune 500 companies disclosed over 7,600 tax haven subsidiaries to the SEC in 2014. If the underreporting seen in the financial sector is representative of what is happening with Fortune 500 companies in general, the actual number of tax haven subsidiaries held by this larger group could be closer to 50,000! However, the only way we will be able to discover whether this is the case is if the SEC broadens its requirements so that companies have to report all their subsidiaries and not just the “significant” ones.

Aside from the ethical concerns around corporate inversions, the clearest case for establishing legislation to prevent this practice is the

Aside from the ethical concerns around corporate inversions, the clearest case for establishing legislation to prevent this practice is the

We’ve got a jam-packed Rundown for you with legislative action coming down to the fiscal year wire. Read about tax happenings in New Jersey, North Carolina, Pennsylvania, California, and Wisconsin. Thanks for reading the State Rundown!

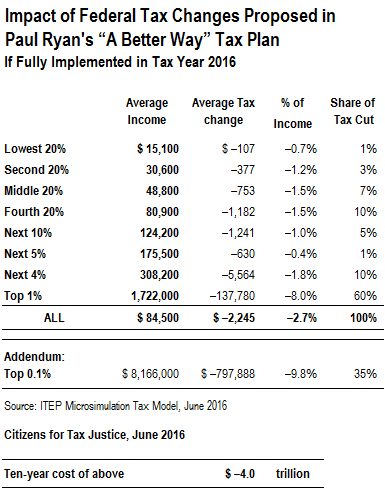

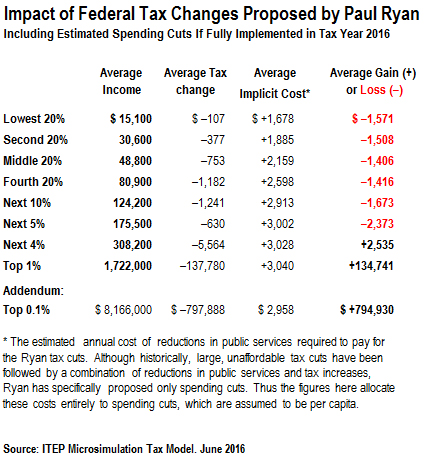

We’ve got a jam-packed Rundown for you with legislative action coming down to the fiscal year wire. Read about tax happenings in New Jersey, North Carolina, Pennsylvania, California, and Wisconsin. Thanks for reading the State Rundown! Since House Speaker Paul Ryan signaled his support of Republican presidential candidate Donald Trump earlier this month, the pundit class has continually speculated whether Trump is “conservative enough” and how Trump’s policy agenda would align with the party’s standard bearers.

Since House Speaker Paul Ryan signaled his support of Republican presidential candidate Donald Trump earlier this month, the pundit class has continually speculated whether Trump is “conservative enough” and how Trump’s policy agenda would align with the party’s standard bearers.

UPDATE: New Jersey did not increase its gas tax on July 1 because of disagreement over tax cuts that many legislators wanted to tie to the gas tax increase. Lawmakers continue to search for a solution to the state’s infrastructure funding shortfall.

UPDATE: New Jersey did not increase its gas tax on July 1 because of disagreement over tax cuts that many legislators wanted to tie to the gas tax increase. Lawmakers continue to search for a solution to the state’s infrastructure funding shortfall.