If these two self-appointed Congressional tax reformers, a.k.a. Max and Dave, had just pulled up Intel’s own position paper (PDF) on tax policy, they would have learned that it, like most major U.S. corporations, wants a lower tax rate, and to keep its favorite tax breaks, too.

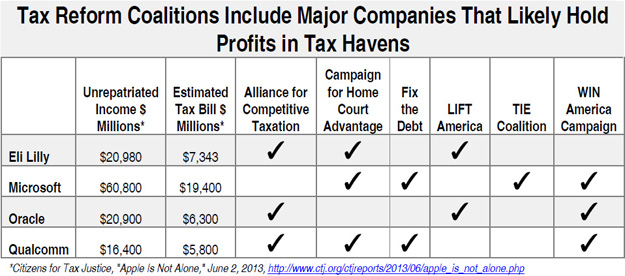

One tax break Intel says it likes is “deferral.” Deferral – a company’s ability to defer paying U.S. taxes on profits generated and kept abroad – is a preferred loophole for companies with intellectual property. It is relatively easy for them (unlike infrastructure-dependent manufacturers) to rent a post office box and call it a “business” anywhere they like, including in tax havens where no business is actually happening. And based on Intel’s public reports, it has six subsidiaries in that most famous of tax havens, the Cayman Islands. Deferral is also one of the most expensive expenditures in the corporate tax code, and will cost U.S. taxpayers around $600 billion in lost revenues over the coming decade.

Intel’s financial reports tell us that it currently has $17.5 billion in profits held offshore (at least for tax and accounting purposes) which are therefore not taxable by the U.S. This doesn’t make Intel an unapologetic offshore cash hoarding champ like Apple, with its $102 billion parked offshore. Intel is more like Google (and HP and Cisco) in that it’s squirreling away billions but won’t report what that money is doing, or where. If the money is working in an economically developed country, Intel is paying taxes on it that would be deducted from its U.S. tax bill if it brought those billions home; if it’s in a tax haven, (say, in a Caymans subsidiary), Intel has paid no taxes on it to any government.

Intel’s financial reports tell us that it currently has $17.5 billion in profits held offshore (at least for tax and accounting purposes) which are therefore not taxable by the U.S. This doesn’t make Intel an unapologetic offshore cash hoarding champ like Apple, with its $102 billion parked offshore. Intel is more like Google (and HP and Cisco) in that it’s squirreling away billions but won’t report what that money is doing, or where. If the money is working in an economically developed country, Intel is paying taxes on it that would be deducted from its U.S. tax bill if it brought those billions home; if it’s in a tax haven, (say, in a Caymans subsidiary), Intel has paid no taxes on it to any government.

As it is, Intel has paid roughly a 27 percent tax rate on its reported domestic corporate profits over the last five years (and a mere 0.3 percent in state taxes). And while Intel says its taxes are too high, what should worry Americans is that the two lawmakers campaigning for tax reform seem sympathetic to this common corporate complaint. Both have said that the current corporate tax rate should be cut, and Camp promotes a form of deferral on steroids, a “territorial” system, and Baucus won’t rule that out.

Baucus and Camp went to Silicon Valley as part of their “Max and Dave Road Show” to drum up support for tax simplification, promoting their bipartisan folksiness but consistently dodging serious questions about what tax reform should accomplish for the American public.

A simpler tax code is a good idea and certainly a popular one, but it is also popular for corporations to pay their fair share. 83 percent of Americans say we should close corporate tax loopholes, and then use that money to invest in the economy and pay down our debt (rather than cut the corporate tax rate), and with good reason. The corporate taxes we collect as a share of the economy has rarely been lower, and is well below average for the developed world. The effective federal income tax rate that big, profitable companies pay is actually only about half of the statutory 35 percent rate they complain about.

Baucus and Camp didn’t need to give another CEO another platform to ask for a tax cut. (And now we learn Treasury Secretary Jack Lew is heading to Silicon Valley to visit Facebook. Don’t get us started!) What they need is to ask the public what we want out of tax reform. We want simple, sure, but we also want fair.

TABOR stands for Taxpayer Bill of Rights, but it’s really a destructive law that restricts tax and spending growth with the goal of starving government. Colorado has the most restrictive version of this kind of law and serves as a cautionary tale. The Colorado TABOR and its implications are described in a

TABOR stands for Taxpayer Bill of Rights, but it’s really a destructive law that restricts tax and spending growth with the goal of starving government. Colorado has the most restrictive version of this kind of law and serves as a cautionary tale. The Colorado TABOR and its implications are described in a

The news that Jeff Bezos, the founder and CEO of Amazon.com, is

The news that Jeff Bezos, the founder and CEO of Amazon.com, is  With projected budget gaps of $1.74 billion in FY 2015 and $2.9 billion in both FY 2016 and FY 2017, START-UP NY has exacerbated the state’s poor fiscal health – making it even more difficult to invest in government services that are proven to grow the economy, like education and infrastructure. Calling START-UP NY an overpriced gimmick, one assemblyman has

With projected budget gaps of $1.74 billion in FY 2015 and $2.9 billion in both FY 2016 and FY 2017, START-UP NY has exacerbated the state’s poor fiscal health – making it even more difficult to invest in government services that are proven to grow the economy, like education and infrastructure. Calling START-UP NY an overpriced gimmick, one assemblyman has  In its latest attack on the

In its latest attack on the  Some of the country’s most influential state tax-writers heard this week from the Institute on Taxation and Economic Policy (

Some of the country’s most influential state tax-writers heard this week from the Institute on Taxation and Economic Policy ( Between 2003 and 2012 the

Between 2003 and 2012 the  Council of Economic Advisers, questioned the whole concept in 2004 when he wrote, “When a fast-food restaurant sells a hamburger, for example, is it providing a ‘service’ or is it combining inputs to ‘manufacture’ a product?”

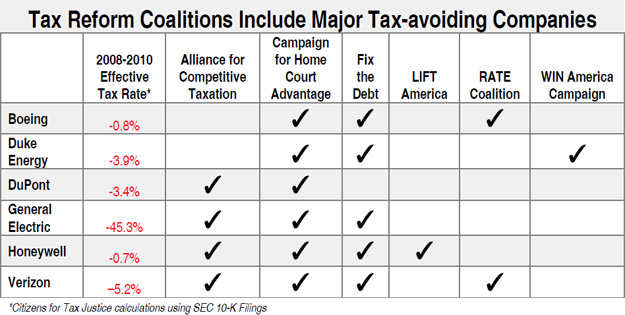

Council of Economic Advisers, questioned the whole concept in 2004 when he wrote, “When a fast-food restaurant sells a hamburger, for example, is it providing a ‘service’ or is it combining inputs to ‘manufacture’ a product?” more U.S. taxes and the revenue “should go towards lowering taxes for companies like Boeing that choose to stay and hire here in the United States of America.” CTJ immediately released figures showing that Boeing’s effective tax rate over the previous decade was

more U.S. taxes and the revenue “should go towards lowering taxes for companies like Boeing that choose to stay and hire here in the United States of America.” CTJ immediately released figures showing that Boeing’s effective tax rate over the previous decade was