Earlier this month, the Securities and Exchange Commission finalized a new rule that will require most public corporations to disclose the ratio between CEO pay and median wages for rank-and-file employees. This rule will give shareholders and the public a clearer window on how corporate salary structures are affecting income inequality.

But while this rule represents an important step toward understanding how specific corporations are compensating ordinary workers compared to corporate executives, it also highlights the inadequacy of an even more fundamental way in which many corporations are likely undermining all middle-income working families: corporate tax avoidance.

Congress and federal regulators have it in their power to bring corporate tax dodging into the light just as they’ve done with executive pay, and should move quickly to do so.

Many of the biggest corporations avoid hundreds of billions of dollars in U.S. taxes in a way that is virtually impossible to glean from their public filings. Big corporations keep shareholders in the dark about whether they are using foreign subsidiaries to avoid paying their fair share of U.S. taxes. Corporate tax filings, for example, often omit disclosure of tax-haven subsidiaries and fail to acknowledge whether the company’s offshore cash is subject to any income tax by any country. Less corporate tax revenue has a direct and corrosive impact on economic inequality just as the executive pay levels do. This should matter to all taxpayers because every billion that a corporation dodges in taxes ultimately must be made up by either taxing individuals at higher rates or drastically cutting funding for vital government services and programs.

And the billions add up fast: a CTJ report earlier this year found that Fortune 500 firms are likely avoiding as much as $600 billion in federal income taxes through the use of offshore tax havens. As CTJ has noted before, there are straightforward steps Congress and the SEC can take that would allow shareholders to know when their investments are supporting tax-dodging corporate leadership.

Lavish CEO pay directly disadvantages a corporation’s middle-income workers, and the new SEC disclosure will hopefully help shame some big companies into treating all workers more equitably. But until the largest corporations are required to be transparent in their use of offshore tax havens, these companies will continue to erode the take-home pay of all working families in a way that is far less visible than the pay ratios public corporations must now disclose.

The good news is that the organization responsible for B corporation certification,

The good news is that the organization responsible for B corporation certification,  Donald Trump’s recently released

Donald Trump’s recently released

Former New York Gov. and

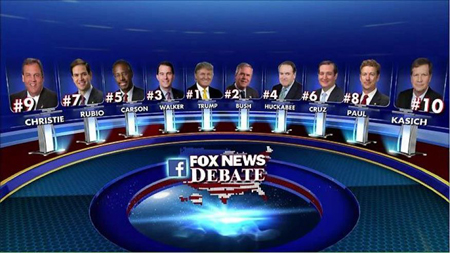

Former New York Gov. and  Whether the candidates’ positions on taxes will be discussed during tonight’s Republican candidate’s debate remains to be seen, but tax policy will be a central issue this election cycle. By now, it’s apparent to most Americans that the notion that politicians can keep cutting individuals and corporate taxes and adequately pay for the programs and services the public broadly wants is simply false. Besides defining their public policy positions, every political candidate should tell the public how they plan to fund the nation’s priorities. Although not every candidate has staked out a clear position on taxes, nearly all have either a legislative record or have made public statements about the tax policies they support. Not surprisingly, most of the Republican candidates are toeing the party line on taxes, some more radically than others.

Whether the candidates’ positions on taxes will be discussed during tonight’s Republican candidate’s debate remains to be seen, but tax policy will be a central issue this election cycle. By now, it’s apparent to most Americans that the notion that politicians can keep cutting individuals and corporate taxes and adequately pay for the programs and services the public broadly wants is simply false. Besides defining their public policy positions, every political candidate should tell the public how they plan to fund the nation’s priorities. Although not every candidate has staked out a clear position on taxes, nearly all have either a legislative record or have made public statements about the tax policies they support. Not surprisingly, most of the Republican candidates are toeing the party line on taxes, some more radically than others.