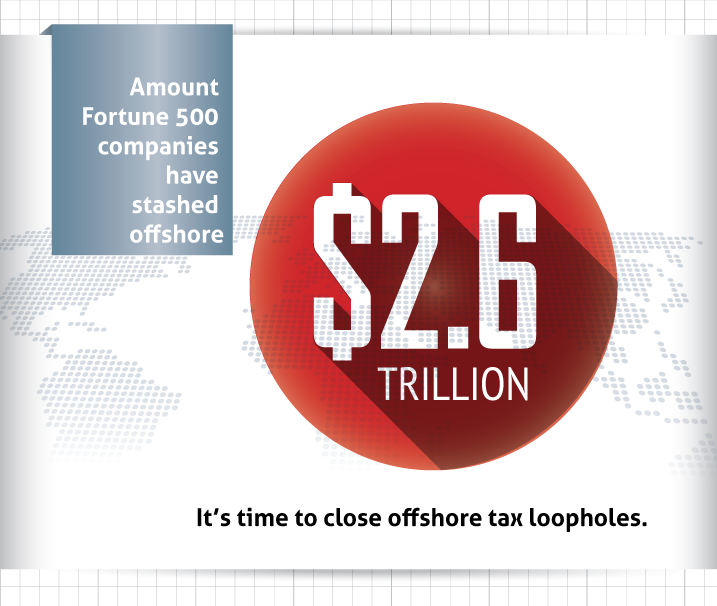

It is a common occurrence for big-box retailers and major logistics, warehouse, manufacturing, and other companies, to parachute into a community promising to bring jobs and economic growth. In exchange, these companies often demand preferential tax treatment for the gift of their presence. Good Jobs First has created a first-of-its-kind tool to track the fiscal cost of these economic development tax incentive programs to make clear how much revenue communities in need are losing out on.

Tax Break Tracker: A Database on Governmental Tax Abatement Disclosures

Good Jobs First