“Unlike President Obama, I will not raise taxes on the middle class,” Republican presidential candidate Mitt Romney said during his acceptance speech. It was a startling statement because it describes one of the facts about Romney’s own tax plan and attributes it to the policies of his opponent, President Obama.

Romney’s Tax Plan: Breaks for the Rich No Matter How You Look at It, Leaving the Bill for Low- and Middle-Income Americans

A recent CTJ report shows that the basics of Romney’s tax plan would give out huge tax cuts to those who make between half a million and one million dollars and those who make over a million dollars, no matter how the missing details are filled in. Romney cannot possibly meet his goal of offsetting the costs of the tax cuts (besides the enormous Bush tax cuts, which he doesn’t think need to be paid for) without raising taxes on people farther down on the income ladder.

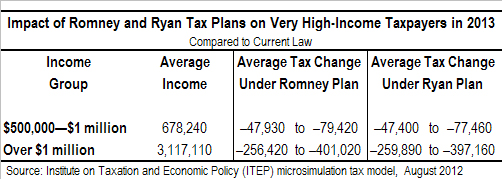

The CTJ report finds that Romney’s  proposed tax cuts would reduce taxes by an average $80,000 for people who make between half a million and one million dollars and by an average $400,000 for people who make over a million dollars.

proposed tax cuts would reduce taxes by an average $80,000 for people who make between half a million and one million dollars and by an average $400,000 for people who make over a million dollars.

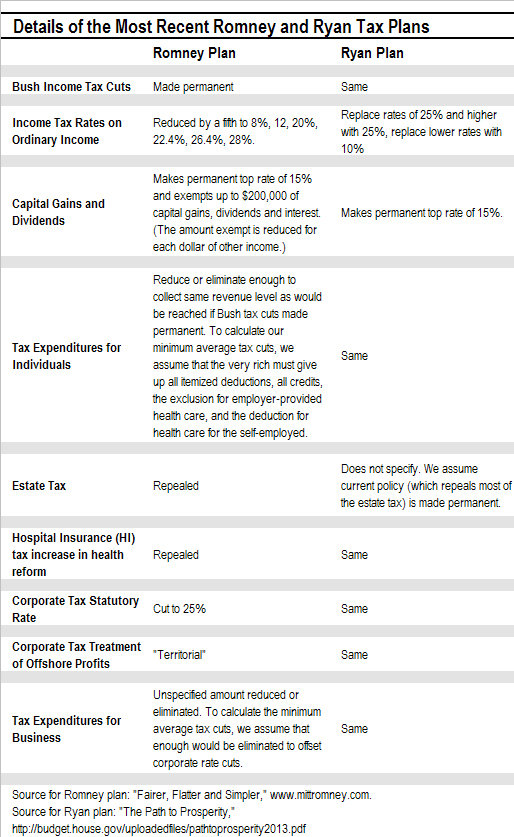

Now, Romney promises to offset the cost of these tax cuts (aside from the enormous Bush tax cuts, which he would make permanent) by reducing or eliminating “tax expenditures,” which are the credits, deductions, exclusions and loopholes that lower people’s tax bills. But even if Romney made the very rich give up all the tax expenditures that he has put on the table, they’d still be getting huge tax cuts — an average $48,000 for people who make between half a million and one million dollars, and an average $250,000 for people who make over a million dollars.[1]

If Romney’s plan is going to be revenue-neutral (not counting the huge cost of the Bush tax cuts) as he claims, then someone is going to have to pay higher taxes than they do now so that the people who make over half a million dollars a year can pay less. The loss of tax expenditures for low- and middle-income people can be larger than the benefits they receive from Romney’s rate reductions and other proposed breaks, meaning they face a net tax increase. In fact, this must happen for Romney to keep his promise about not losing more revenue, as the Tax Policy Center has already pointed out.

Obama’s Problem Is that He’s Cut Taxes Too Much, Not that He Raised Taxes

Romney’s claim that Obama has raised taxes on the middle-class is initially hard to understand, given Obama’s two-year extension of all the Bush tax cuts and his call to again extend the Bush tax cuts entirely for 98 percent of Americans while letting them expire partially for the richest 2 percent of Americans. (In fact, we pointed out that many of the taxpayers within the richest 2 percent, like those with incomes just over $250,000, would only have to give up a tiny fraction of their tax cuts under Obama’s plan.)

Romney’s claim that Obama has raised taxes on the middle-class appears to refer to the new mandate to obtain health insurance, which the Chief Justice of the Supreme Court decided was actually a tax and therefore within the Constitutional powers of Congress.

As we pointed out at the time the Supreme Court ruled on the health care mandate, very few people would ever actually pay the “tax,” which is the fee that will be imposed on people who choose to go without health insurance. As we explained,

It’s a tax that hardly anyone will pay.

That’s because for the vast majority of Americans who don’t have employer health coverage, the government subsidies to buy insurance will be so large that it would be foolish not to buy insurance.

For starters, any family with income less than 133 percent of the poverty line (that means all families of four with incomes of $30,000 or less) will be eligible to sign up for free coverage under Medicaid.

Above that level of income, the government will provide cash subsidies to buy insurance, starting at almost 100 percent of the cost and gradually phasing down. But the subsidies won’t disappear for a family of four until its income exceeds about $90,000.

An Urban Institute study found that fewer than 3 percent of households would be subject to the fee.

Another point that Romney and his allies seem to forget is that the 2009 economic recovery act that they criticize so much actually cut taxes for 98 percent of working families. (See the national and state-by-state estimates from CTJ.)

If President Obama has made any mistakes on taxes, it’s that he has been entirely too willing to extend too many tax cuts for too many Americans at a time when we desperately need revenue.

[1] Notice we say that the $48,000 and $250,000 figures are the tax cuts these groups would get if they had to give up all the tax expenditures that Romney has put on the table. That’s because he has pledged to keep the tax expenditures that benefit the rich the most — breaks for investment, like the low rates for capital gains and stock dividends.

of the policies that you would expect from the party, such as calling for the extension of the Bush tax cuts and reducing corporate tax rates. Here we focus, however, on three planks in the platform that fall far outside the mainstream of tax policy.

of the policies that you would expect from the party, such as calling for the extension of the Bush tax cuts and reducing corporate tax rates. Here we focus, however, on three planks in the platform that fall far outside the mainstream of tax policy.

Governor Brian Sandoval: Of all the GOP governors across the country, Brian Sandoval stands out as the one most likely to put his constituents over politics. Working with Republicans and Democrats, Sandoval

Governor Brian Sandoval: Of all the GOP governors across the country, Brian Sandoval stands out as the one most likely to put his constituents over politics. Working with Republicans and Democrats, Sandoval