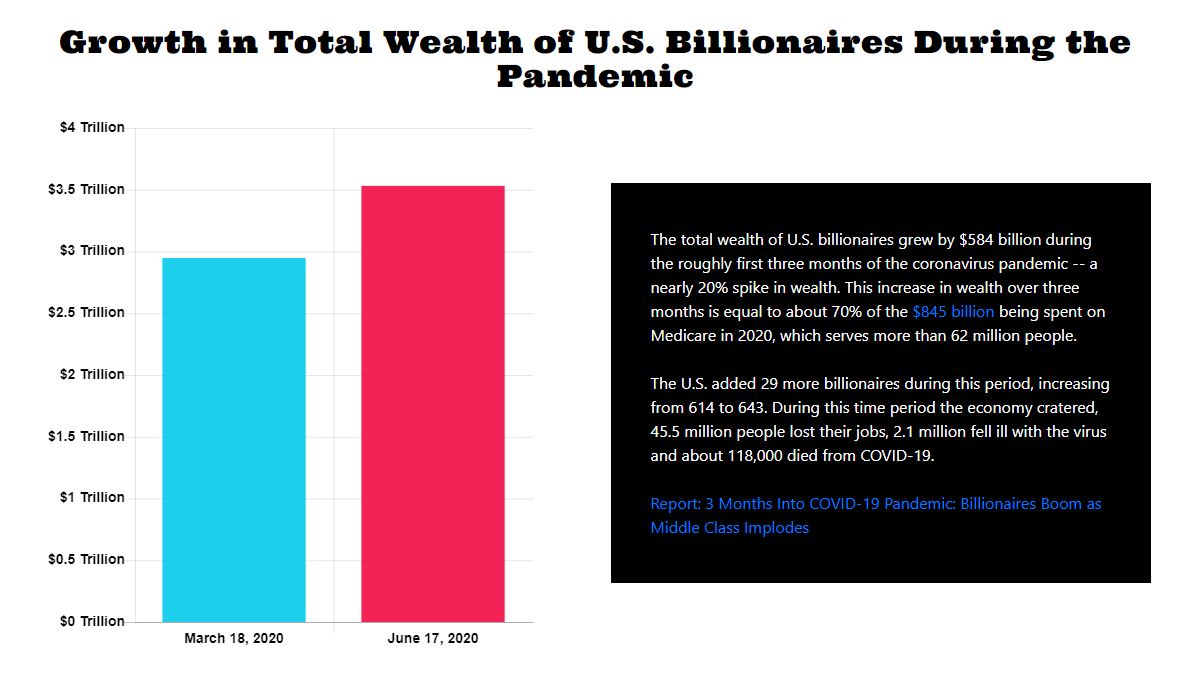

Who pays taxes? What is stepped-up basis? When is a job creator not a job creator? Learn the essentials of tax policy from Patriotic Millionaires, a group of millionaires who believe they are not being asked to pay enough in taxes. They know all the tricks of the trade that have led to their fortunes and with this self-guided tour through tax policy, you will be prepared to speak the language of tax justice.

Patriotic Millionaires University: Tax Basics

Patriotic Millionaires