July 21, 2016 10:55 AM | Permalink |

Read the Comment Letter in PDF.

Re: File No. S7-06-16, Business and Financial Disclosure Required by Regulation S-K

Dear Mr. Fields,

The Securities and Exchange Commission (SEC) plays a critical role in our economy as the agency charged with ensuring that our markets operate in a fair, orderly and efficient fashion.[i] We applaud the SEC’s decision to seek public comment on the business and financial disclosures required by Regulation S-K. These disclosures provide investors and the public with information that is absolutely critical to making our economy work.

Unfortunately, the disclosures currently required by Regulation S-K have proven inadequate in providing both investors and the public at large with the information they need to make critical economic decisions. It is with this in mind that we make recommendations for how to improve international tax and subsidiary disclosures.

Citizens for Tax Justice’s Work and SEC Disclosures

Citizens for Tax Justice (CTJ) is a research and advocacy organization focusing on federal, state and local tax policies and their impact upon our nation. Our mission is to give voice to the public interest in the development of our nation’s tax laws.

For more than 30 years, disclosures to the SEC have played a central role in our work examining the corporate tax code and the effective tax rates that major U.S. companies pay. CTJ’s reports have helped shape the public debate around tax reform broadly and the corporate tax code in particular. CTJ’s 1984 report showing that many large multinational corporations had accumulated so many tax breaks that they owed nothing in taxes was a critical driver of the last major tax reform legislation in 1986. In fact, President Ronald Reagan noted in his autobiography that hearing the information contained in the report motivated him to move “full steam ahead” with overhauling the U.S. tax code.[ii]

In recent years, lawmakers across the political spectrum have once again begun serious deliberations into how to reform the tax system as a whole and the corporate tax code in particular. One of the foundational problems both in Congress and in the public debate around the corporate tax code is that neither have adequate information on how much and where corporations are paying taxes. While CTJ and others doing research on the corporate tax code have made do with the disclosures currently required by the SEC, such disclosures have proven lacking in the kind of definitive information that is required to have a robust debate over the current corporate tax code. Perhaps the area of disclosure that has proven both the most important in recent years and the most lacking is in the area of international tax, income and related disclosures, which is what makes it such an appropriate area of disclosure for the SEC to be seeking comments in its Concept Release on S-K disclosure.

The Problem of International Tax Avoidance

The Public Interest

One of the central features of our corporate income tax code is that it allows corporations to defer paying taxes on their foreign income until that income is repatriated back to the United States. When combined with the fact that many countries throughout the world have single digit or even zero tax rates, this provision of the tax code creates an enormous incentive for U.S. companies to avoid taxes by claiming that as much income as possible is earned in these tax haven countries.

According to our analysis of companies’ 10-K forms, Fortune 500 companies disclose having more than $2.4 trillion in earnings offshore that have not been subject to U.S. taxes. Based on the subset of companies that disclose how much they would owe if they were to repatriate these earnings, we estimate that these companies have paid an average tax rate of just 6.4 percent to foreign governments, meaning they owe an estimated $695 billion in U.S. taxes on these offshore earnings.[iii] The fact that companies on average are paying such a low foreign tax rate is evidence of the fact that a substantial amount of these foreign profits are being stashed in tax havens, rather than being productively invested.

Confirming the pervasive use of tax havens by large U.S. multinational corporations, recent data from the Internal Revenue Service show that companies claimed in 2012 that as much as 59 percent of their foreign profits were earned in just 10 infamous tax haven countries.[iv] To be clear, such claims are obviously ridiculous. For example, U.S. corporations claimed in 2012 that they earned $104 billion in profits in Bermuda, which is more than 17 times the size of Bermuda’s entire gross domestic product of $6 billion.

Tax and accounting scholar Kimberley Clausing estimates that the U.S. government loses over $100 billion in tax revenue every year due to international tax avoidance.[v] Given the many pressures on the U.S. budget, lawmakers are appropriately looking at this area of revenue loss as one that it should address as a way to increase both revenue and fairness in the tax code.

One of the barriers to a thorough investigation of how lawmakers should pursue international tax reform has been the lack of company level data that would allow lawmakers to better understand the specifics of companies’ international accounting and related tax avoidance behaviors. What would help inform this policy debate is to require companies to disclose in their 10-Ks more information about their operations and tax provision on a country-by-country basis (more on this below).

Investor Interests

After the financial crisis, governments across the world, responding to mass public pressure, have started to crack down on the tax avoidance behavior of multinational corporations. This crackdown has taken the form of both unilateral actions by individual nations as well as coordinated efforts by the OECD (Organisation for Economic Co-operation and Development) known as the BEPS (Base Erosion and Profit Shifting) Project.[vi] In the United States, lawmakers from across the political spectrum have also suggested substantial changes to the taxation of international profits, which could result in some amount of taxes owed on offshore profits being paid immediately rather than being indefinitely deferred.

Given this context, investors have a high material interest in knowing how exposed the companies they invest in are to increases in taxes on their international profits. Unfortunately, current disclosure requirements do not provide investors with enough information to reasonably estimate the level of taxation a company may face on its offshore earnings in the future. Currently, the SEC only requires companies to report the broad categories of foreign tax provision and foreign income, which obscures the ability of investors to assess how much of a company’s income is being booked to tax haven jurisdictions and thus is potentially subject to higher taxes in the future.

According to a report by financial services company Credit Suisse, the unspecified tax liability potentially facing many large public U.S. companies is not only material, but rather substantial as a percentage of many companies total market capitalization. The report lists more than 14 companies, including companies like General Electric and Xerox, who could face an off-balance-sheet tax liability of 10 percent or more of their total market cap if they paid a 25 percent tax rate on their offshore earnings.[vii]

The best way to allow for investors to account for tax uncertainty going forward in making their investments would be to require companies to report tax and related information on a country-by-country basis.

What Should Be Disclosed

Country-by-Country Reporting

The public and investors would benefit immensely if companies were required to publically disclose tax and related information in their filings to the SEC. Specifically, companies should be annually required to disclose on a country-by-country basis their: profit or loss before taxes; income tax accrued for the current year; revenues from unrelated parties, related parties, and in total; income tax paid (on a cash basis); effective tax rate; stated capital; accumulated earnings; number of employees; and tangible assets other than cash or cash equivalents. Given that taxes are applied at the country level, country-by-country disclosures are the best way to enable investors and the public to fully evaluate the tax position of a given company.

Requiring the country-by-country disclosure specified above would require little if any additional cost to companies because all of this information is already collected for internal accounting purposes. In addition, many larger U.S. corporations will soon be required to provide the Internal Revenue Service (IRS) with a similar set of information as a result of rules recently issued by the agency.[viii]

In addition to country-by-country disclosure, companies should be required to calculate and disclose the aggregate amount they would owe in U.S. taxes upon repatriation of their offshore earnings in all cases, rather than being allowed to avoid disclosing this information if they deem it “not practicable” to do so. Our study of Fortune 500 companies found that 248 companies out of 303 companies (82 percent) that reported having permanently reinvested earnings used the not practicable loophole in order to avoid disclosing how much they would owe in taxes upon repatriation. In other words, this loophole effectively allows most companies to avoid disclosing information that they have likely already have calculated for business purposes and could easily disclose at little to no additional cost.

Less Comprehensive Disclosure Options

While complete country-by-country disclosure mentioned above would be ideal, there are alternative less comprehensive approaches that would still provide the public with some critically needed information.

During deliberations on their own disclosure review, one approach discussed by the Financial Accounting Standards Board (FASB) would be to require companies to disaggregate foreign income and income tax expense of any country that is significant to total tax expense.[ix] While incomplete, this approach would give investors and the public at least some sense of where the company is reporting the bulk of its profits.

An example of how this sort of disclosure would work is the 2016 10-K of Skechers USA Inc.,[x] which began reporting disaggregated income and tax information in response to a letter to the SEC asking for more information on its foreign income.[xi] Besides providing a template, Skechers also provides a test case as to why publishing this information can be very revealing. In its disaggregated disclosure, the company reveals that it reports over a third of its profits as being earned in Jersey, an infamous tax haven, meaning that the company is likely engaging in precisely the behavior that is concerning to investors and the public alike.

Another important approach discussed by FASB would be to require companies to disaggregate their cash income taxes paid, which is currently disclosed only as a worldwide figure. Following the approach mentioned above, companies should be required to disclose income tax paid information by federal, state and significant foreign countries. Even just requiring companies to disclose cash income taxes paid by federal, state and foreign, as is typically disclosed for a company’s income tax expense, would represent a significant improvement upon current disclosures. The reason cash income taxes paid information is so important to disclose is that it provides investors and the public with an alternative and often more accurate way of calculating a company’s effective tax rate for a given year.

Improving Subsidiary Disclosure

One area of disclosure for which the SEC Concept Release appropriately solicits comments is the disclosure of a company’s subsidiaries. Specifically, the Concept Release asks in question 257, “Should we revise Item 601(b)(21) to eliminate the exclusions and require registrants to disclose all subsidiaries?” The answer to this question is an unambiguous yes. Companies should be required to disclose all of their subsidiaries.

The disclosure of subsidiary information in SEC filings is important for a number of reasons. For one, it provides transparency in allowing the public and investors to know if they are doing business with a company that is ultimately owned in whole or in part by another company. Second, providing subsidiary information allows investors and the public to get a clearer view into the offshore operations of a company.

While the current SEC standard requires a company to disclose their “significant” subsidiaries, this standard has proven woefully inadequate according to a number of studies. In the report “Offshore Shell Games 2015”, a study I co-authored that is cited in the SEC’s Concept Release, we summarized numerous examples of major companies which disclosed sudden drops in their number of subsidiaries from one year to the next.[xii] For example, the report notes that Google reported 25 tax haven subsidiaries in 2009, but since 2010 only discloses two, despite the fact that an academic study found that the 23 excluded after 2010 were still in operation. From the perspective of the public and investors, the shift in the number of disclosed subsidiaries may have misleadingly indicated some shift away from the use of tax havens, but the follow-up study proved this to be just a shift in disclosure.

Given the example of Google, there are a number of companies where investors might rightfully be unsure as to whether those subsidiaries being disclosed year to year by a company are accurately demonstrating any kind of shift in offshore operations. For example, Citigroup reported 427 tax haven subsidiaries in 2008, but only 41 in 2014. Similarly, Bank of America reported operating 264 tax haven subsidiaries in 2013, but disclosed only 22 in 2014. Without an extensive and potentially expensive amount of research, there is no way for the public and investors to know whether either of these changes in disclosure represent a genuine change in operation or simply a decision to not disclose a substantial number of subsidiaries from one year to the next.

Additionally, companies may simply not be disclosing many of their major subsidiaries at all. A study by Americans for Tax Fairness found that Walmart has 78 subsidiaries and branches in 15 tax havens, yet none of them were disclosed in their SEC filings. This omission is especially striking given that the company owns at least $76 billion in assets through their undisclosed shell companies in Luxembourg and the Netherlands.[xiii]

Finally, a recent study performed by CTJ found that the number of subsidiaries that companies are required to disclose represent a relatively small subset of a company’s overall subsidiaries. In the study, we compared the number of subsidiaries that a selection of financial institutions disclosed to the Federal Reserve compared to the number of subsidiaries they disclosed to the SEC. Ultimately, the study found that SEC allowed companies to omit over 85 percent of their subsidiaries compared to those disclosed to the Federal Reserve.[xiv] In other words, this study indicates that the current SEC standard only requires companies to report a fraction of their subsidiaries and thus provides investors and the public with a relatively incomplete picture of their operations.

The straightforward solution to the incomplete picture that current SEC requirements provide is to require that companies disclose all of their subsidiaries. This more complete disclosure would provide complete transparency and prevent any kind of gaming of what is disclosed. Given that a company must internally maintain basic ownership and organizational information, providing a list of complete subsidiaries would likely have a negligible cost to companies.

Besides disclosing all of their subsidiaries, companies should also be required to disclose each subsidiary’s name, location, legal entity identifier number and their relation to the parent entity. This information will allow investors and the public to have a clearer understanding of how the company operates and the specific function of individual subsidiaries within it.

Conclusion

Corporate transparency is critical to an efficient and fair marketplace. In order to keep up with the rapid pace of change in our economy, the SEC is right to constantly reevaluate and improve upon its disclosure requirements. The rapid growth of foreign operations and related tax avoidance now necessitates that the SEC adjust by requiring companies to provide additional information on such operations. The offshore operations of these companies have simply become too crucial to our economy at large to remain in the shadows.

Thank you for your careful consideration of these comments.

Sincerely,

Robert S. McIntyre

Director of Citizens for Tax Justice

[i] Securities and Exchange Commission, “What We Do,” June 10, 2013. https://www.sec.gov/about/whatwedo.shtml

[ii] Robert S. McIntyre, “Remembering the 1986 Tax Reform Act,” Tax Notes, October, 17, 2011. https://ctj.sfo2.digitaloceanspaces.com/pdf/taxnotes_tra25.pdf

[iii] Citizens for Tax Justice, “Fortune 500 Companies Hold a Record $2.4 Trillion Offshore,” March 4, 2016. http://ctj.org/ctjreports/2016/03/fortune_500_companies_hold_a_record_24_trillion_offshore.php

[iv] Citizens for Tax Justice, “American Corporations Tell IRS the Majority of Their Offshore Profits are in 10 Tax Havens,” April 7, 2016. http://ctj.org/ctjreports/2016/04/american_corporations_tell_irs_the_majority_of_their_offshore_profits_are_in_10_tax_havens.php

[v] Kimberly A. Clausing, “Profit shifting and U.S. corporate tax policy reform,” Washington Center for Equitable Growth, May 2016. http://equitablegrowth.org/report/profit-shifting-and-u-s-corporate-tax-policy-reform/

[vi] Organisation for Economic Co-operation and Development, “About BEPS and the inclusive framework,” http://www.oecd.org/ctp/beps-about.htm

[vii] Credit Suisse, “Parking A-Lot Overseas: At Least $690 Billion in Cash and Over $2 Trillion in Earnings,” March 17, 2015. https://doc.research-andanalytics.csfb.com/docView?language=ENG&format=PDF&source_id=em&document_id=1045617491&serialid=jHde13PmaivwZHRANjglDIKxoEiA4WVARdLQREk1A7g%3D

[viii] Kelsey Kober, “To Maximize Corporate Transparency, the IRS Must Strengthen its Rules on Country-by-Country Reporting,” Tax Justice Blog, June 14, 2016. http://www.taxjusticeblog.org/archive/2016/06/to_maximize_corporate_transpar.php

[ix] Financial Accounting Standards Board, “Board Meeting Handout: Disclosure Framework—Disclosure Review, Income Taxes,” March 23, 2016. https://ctj.sfo2.digitaloceanspaces.com/pdf/fasbmeeting3232016.pdf

[x] Skechers U.S.A. Inc., “10-K Annual Report,” Securities and Exchange Commission, February 26, 2016. https://www.sec.gov/Archives/edgar/data/1065837/000156459016013515/skx-10k_20151231.htm

[xi] Matt Gardner, “Skechers’ Sketchy Corporate Tax Disclosure Illustrates Need for Country-by-Country Reporting” Tax Justice Blog, May 1, 2015. http://www.taxjusticeblog.org/archive/2015/05/skechers_sketchy_corporate_tax.php

[xii] Citizens for Tax Justice and US PIRG, “Offshore Shell Games 2015,” October 5, 2015. http://ctj.org/ctjreports/2015/10/offshore_shell_games_2015.php

[xiii] Americans for Tax Fairness, “The Walmart Web,” June 17, 2015. http://www.americansfortaxfairness.org/files/TheWalmartWeb-June-2015-FINAL.pdf

[xiv]Citizens for Tax Justice, “Lax SEC Reporting Requirements Allow Companies to Omit Over 85 Percent of Their Tax Haven Subsidiaries,” June 30, 2016. http://ctj.org/ctjreports/2016/06/lax_sec_reporting_requirements_allow_companies_to_omit_over_85_percent_of_their_tax_haven_subsidiari.php

This week’s Rundown features an ongoing stalemate in New Jersey, talk of new tax cuts in Arkansas, “tampon taxes,” and the taxation of fantasy sports. Be sure to check out the What We’re Reading section for new research on public attitudes toward tax and budget issues. Thanks for reading the Rundown!

This week’s Rundown features an ongoing stalemate in New Jersey, talk of new tax cuts in Arkansas, “tampon taxes,” and the taxation of fantasy sports. Be sure to check out the What We’re Reading section for new research on public attitudes toward tax and budget issues. Thanks for reading the Rundown! The tax-related proposals in the

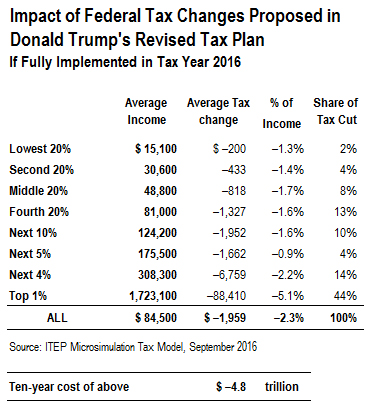

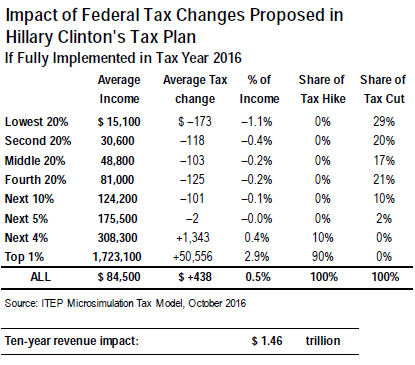

The tax-related proposals in the  As the eyes of the U.S. turn to the Democratic National Convention this week, many people will be getting their first look at Hillary Clinton’s

As the eyes of the U.S. turn to the Democratic National Convention this week, many people will be getting their first look at Hillary Clinton’s

A

A