Since he first began running for President, Barack Obama has consistently proposed to extend almost four-fifths of the tax cuts first enacted under President George W. Bush, proposing to allow the expiration of just the one fifth of the tax cuts that go solely to the richest two percent of Americans. This was President Obama’s proposal to extend the tax cuts for income up to $250,000 for married couples and up to $200,000 for singles (PDF). To extend any more of these tax cuts for the richest two percent of Americans is entirely unwarranted and fiscally irresponsible.

Our latest report estimates the revenue impact of the President’s proposal to extend the Bush tax cuts for income up to $250,000/$200,000 and to reclaim a fraction of the lost revenue by limiting the savings from deductions and exclusions for high-income Americans. Compared to what would happen if Congress extends the Bush income tax cuts and makes no other changes, this would save $1.4 trillion. Compared to what would happen if Congress does nothing and lets the Bush tax cuts expire, this would lose $2.4 trillion.

That report also illustrates the impact of President Obama’s recent proposal which became public on December 17, and which is the same except that the income threshold for higher tax rates on ordinary income would be raised from $250,000/$200,000 to $400,000. If the limit on deductions and exclusions is still included, this would save 85 percent as much revenue as the President’s original, $1.4 trillion proposal. If the limit on deductions and exclusions is not included, the report finds this would save just 49 percent as much as Obama’s original, $1.4 trillion proposal.

Today, several news reports indicate that the deal taking shape in Washington would raise less revenue than the President’s December 17 proposal. There are reports that the threshold for higher income tax rates would be $400,000 for singles and $450,000 for married couples, and that this $450,000/$400,000 threshold would also apply to higher income tax rates on capital gains and dividends. (The President’s December 17 proposal would still have allowed higher rates to go into effect for capital gains and dividends for income in excess of $250,000/$200,000.)

Further, it is unclear whether or not any limit on deductions and exclusions is included in the deal taking shape now. This means that the proposal could save considerably less than half as much revenue as the President’s original, $1.4 trillion proposal.

In addition to this, lawmakers want to address the Bush-era estate tax cuts, which also expire tonight. The President has long proposed to make permanent the estate tax cuts that were in effect for one year, in 2009. CTJ has criticized this proposal because it asks only a tiny fraction of the wealthy to pay any estate tax. (CTJ’s figures show that only 0.3 percent of deaths in 2009 resulted in federal estate tax liability.) There are reports that the deal taking shape would extend an even larger estate tax cut, one much closer to the estate tax cut that was in effect for 2011 and 2012.

CTJ’s most recent reports on other components of the New Year’s Eve tax deal taking shape are online at:

Capital Gains and Dividends

Alternative Minimum Tax (AMT)

EITC and Child Tax Credit

State-by-State figures on Bush tax cuts

Congress should reject any deal that extends more of the Bush income tax cuts or Bush estate tax cuts than President Obama originally proposed to extend. America would be better off if Congress simply does nothing and allows the Bush income and estate tax cuts to expire completely. This would merely allow the tax rules to revert to those in place at the end of the Clinton administration. Given the economic prosperity experienced at the of the Clinton years, it’s difficult to believe that this more fiscally responsible approach will have a significant adverse effect on our economy. Of course, Congress should act to stimulate the economy so that the private sector creates more jobs, but almost any measure would be more effective in accomplishing this goal than extending more of the disastrous Bush tax cuts for the rich.

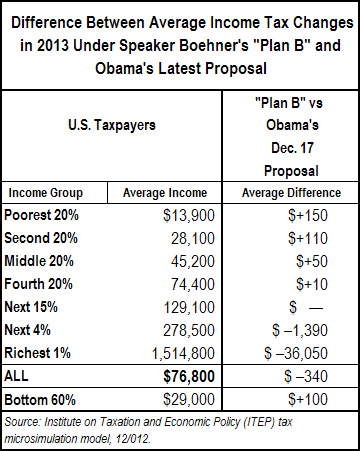

finds that the “Plan B” tax proposal that House Speaker John Boehner plans to put to a vote in the House of Representatives would allow the richest one percent of Americans to pay $36,000 less in federal income taxes, on average, than they would pay under President Obama’s most recent proposal.

finds that the “Plan B” tax proposal that House Speaker John Boehner plans to put to a vote in the House of Representatives would allow the richest one percent of Americans to pay $36,000 less in federal income taxes, on average, than they would pay under President Obama’s most recent proposal.

Following an election that left half the states with veto-proof legislative majorities, 39 states with one-party rule and more than a dozen with governors who put tax reform high on their agendas, 2013 promises to be a big year for changes to state tax laws, and that could end up being a good thing. From the National Governors Association to the

Following an election that left half the states with veto-proof legislative majorities, 39 states with one-party rule and more than a dozen with governors who put tax reform high on their agendas, 2013 promises to be a big year for changes to state tax laws, and that could end up being a good thing. From the National Governors Association to the  Enter the Institute on Taxation and Economic Policy (

Enter the Institute on Taxation and Economic Policy ( ’s Responsible Wealth project

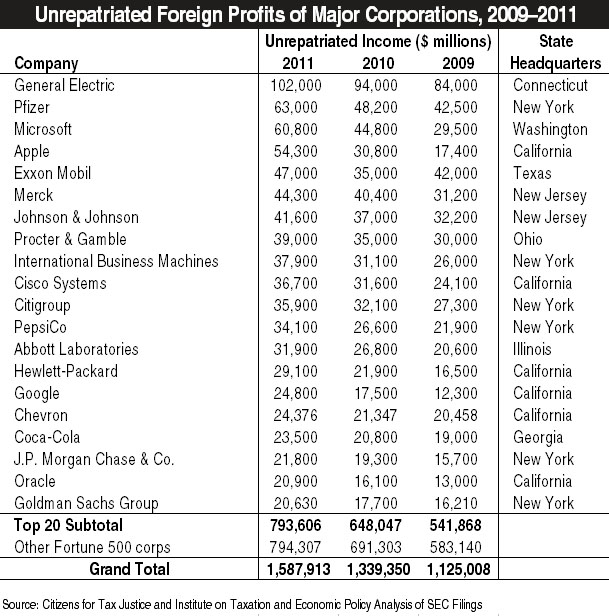

’s Responsible Wealth project  corporations — including household names like GE, Microsoft, Apple, IBM, Coca-Cola and Goldman Sachs — held $794 billion offshore, half of the total. The data are compiled from figures buried deep in the footnotes of the “10-K” financial reports filed by the companies annually with the Securities and Exchange Commission.

corporations — including household names like GE, Microsoft, Apple, IBM, Coca-Cola and Goldman Sachs — held $794 billion offshore, half of the total. The data are compiled from figures buried deep in the footnotes of the “10-K” financial reports filed by the companies annually with the Securities and Exchange Commission.  While we’re not regular listeners to Rush Limbaugh’s radio program, we caught the fact that Limbaugh

While we’re not regular listeners to Rush Limbaugh’s radio program, we caught the fact that Limbaugh