June 4, 2015 02:39 PM | Permalink |

Read the report as a PDF.

What would you think about a corporate income tax regime under which the bigger a company’s profit margin, the lower its tax rate? Or a system that applies a special low tax rate to profits from selling products on which a company enjoys a legal monopoly? Or partial tax exemptions for companies with well-known brand names?

Such odd tax schemes and variants thereof have recently become popular among lawmakers in many European countries. [1] Now big American companies are calling for the same special tax breaks in the United States. And, unfortunately, some politicians are suggesting that they’d be willing to oblige.

Sens. Chuck Schumer (D-NY) and Rob Portman (R-OH) are driving an effort to pass legislation allowing corporate profits gleaned from intellectual property (trademarks, patents, etc.) to be taxed at a lower rate than other profits. Known as a “patent box”, proponents claim this tax break would encourage corporations to locate research jobs to the United States and promote higher economic growth and innovation. But a close examination of the details reveals that, in practice, this would be yet another revenue-losing corporate giveaway that doesn’t live up to its promise. Further, it would forego critical revenue that could otherwise be used to fund the real basic research that businesses aren’t keen to invest in due to financial risks and the lag time before research investments become profitable.

This paper describes some of the reasons a “patent box” is a bad policy idea.

Background

Patent and copyright laws allow innovators and creators to enjoy the fruits of their work for a fixed period, which is not only fair but also makes good economic sense because it provides an incentive for inventors who know they have legal protections over the product they spent time creating. In fact, these laws are so sensible that they were authorized in the original U.S. Constitution.[2]

In 1954, Congress attempted to create additional economic incentive for investments in research and enacted an income tax subsidy for business research that produces innovative products. Section 174 of the tax code provides an exception to the normal tax rules for business investments. It allows businesses to write off research expenses immediately and thus provides them with a generous tax benefit.[3] According to the legislative history of section 174, a primary goal of the tax break, as the Congressional Research Service has explained, is “to encourage firms (especially smaller ones) to invest more in R&D.” Yet, CRS points out, “The main beneficiaries of the section 174 deduction are larger manufacturing corporations primarily engaged in developing, producing, and selling technically advanced products.”[4]

The effect of expensing research alone is excessively generous, yet corporate lobbyists continued to push for more tax breaks. In 1981, corporations persuaded Congress and President Reagan to add a tax credit for business research on top of breaks received under Section 174. The result is that the profits from research are now taxed at a negative effective tax rate.

From its inception, the research credit has been heavily abused. Congress intended the law to apply to basic scientific research that would benefit businesses that performed the research and society as a whole. But businesses quickly began claiming the credit for product development activities that have nothing to do with the credit’s ostensible goals.[5]

Time has passed, and now even a significantly negative tax rate on profits that stem from “research” does not fully satisfy corporate America. So companies are now lobbying for a patent box, a loophole that would make the effective tax rate on research profits even more negative.

A patent box is wholly unnecessary and a bad policy choice.

1. The creation of a patent box in the U.S. would be extremely expensive and open a new loophole in the corporate tax code.

The ostensible goal of revenue-neutral corporate tax reform is to pay for a lower statutory corporate tax rate by eliminating corporate tax breaks and loopholes. Creating a patent box is anathema to this goal as it would simply establish another special interest tax break.

While the Joint Committee on Taxation (JCT) has not scored a patent box regime, a former Ways and Means Committee analyst predicted that a patent box could cost “hundreds of billions” over a decade in lost revenue.[6] A key driver of its large cost is the difficulty in narrowly defining income attributable to intellectual property, especially since the incentive that companies would have to lobby for an expansive patent box definition and to redefine as much of their income as possible as to meet the definition. Lawmakers find it nearly impossible to agree on enough tax base-broadening measures to lower the corporate rate to their intended target of 25 or 28 percent, so it’s difficult to conceive that they would be able to find even more in base broadening measures to pay for another enormous new tax break.

2. The U.S. tax code already has extremely generous incentives for companies that perform research.

While the U.S. does not have a patent box, it already provides many billions in tax incentives to corporations for research activities. The tax code allows companies to immediately deduct the cost of investments in research and it gives companies the research and experimentation credit, which provides a tax credit for research performed over a base level. Taken together these credits can push the effective tax rate on research-generated profits to less than zero. Each year these tax incentives already provide around $13 billion in tax incentives for research activities.

While the research deduction and credit are in need of substantial reform or repeal, most experts agree that even the seriously flawed research credit is actually a superior approach than a patent box to incentivize research. [7] Tax analyst Martin Sullivan points out that a patent box would be more “costly to administer” than the research credit because it would require identifying income earned from research, which is “an order of magnitude more difficult than identifying research spending itself.” In addition, a patent box is less targeted because it may require subsidizing old as well as new research due to difficulties in separating income from these sources.[8] Similarly, a patent box is less targeted because it may subsidize non-research expenditures, such as marketing, related to the generation of intellectual property income.[9]

Enacting a patent box regime on top of existing tax breaks for research would result in companies paying an even lower negative tax rate and would create a tax shelter ripe for abuse.[10]

3. Patent box regimes are already promoting a damaging global tax race to the bottom. The United States should not follow suit.

The alleged urgency behind the legislative push to adopt a patent box is that the United States will be at a competitive disadvantage compared to countries that have put this policy into place. One problem with this argument is that it assumes that taxes are the only or primary factor in multinational corporations’ decisions about where to locate their research activities. In reality, corporations are much more concerned with an educated workforce, strong infrastructure and a robust legal system to protect their intellectual property, all of which require adequate tax revenue to support.

The best way to encourage companies to keep research jobs in the United States would be to end their ability to defer paying taxes on their foreign income.[11] Ending deferral would make it so that income booked in foreign countries by U.S. corporations, even in countries with a patent box or in zero-tax tax havens, do not receive preferable tax treatment compared to equivalent income booked in the United States.

4. Corporate tax breaks reduce revenue that could be used to directly fund research and innovation.

The 2012 fiscal cliff deal cut federally funded research by $26 billion in 2015 compared to its 2010 level.[12] If lawmakers want to boost research and innovation, the most straightforward way to do so would be to expand direct research funding by the federal government. This approach would avoid the problem of subsidies for “research” has little or nothing to do with real scientific advances. Federally funded research is typically much more beneficial than profit-driven corporate research because it allows companies to focus on broadly beneficial research that may take years or even decades to generate profits.

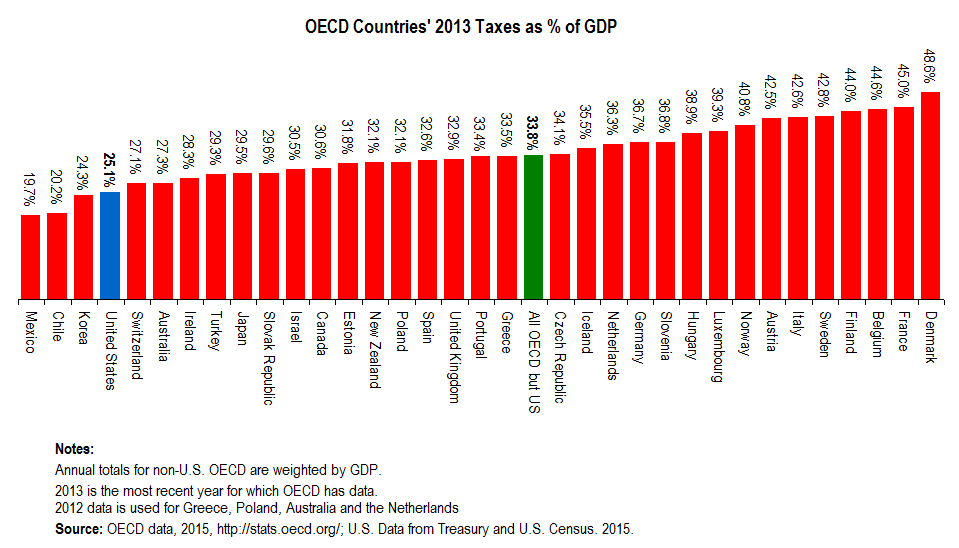

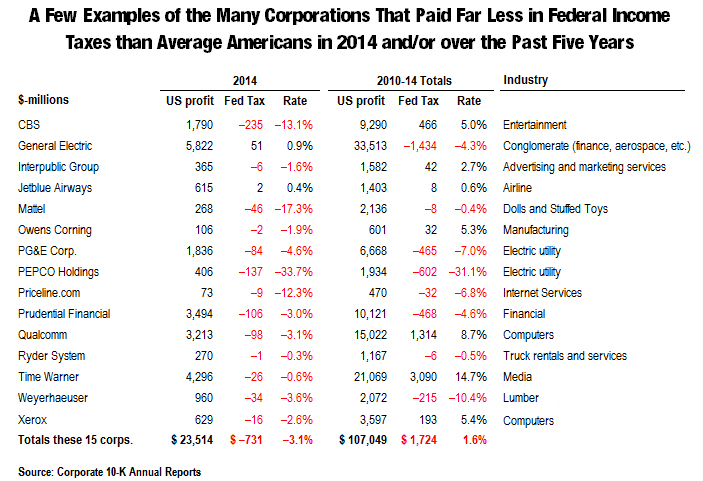

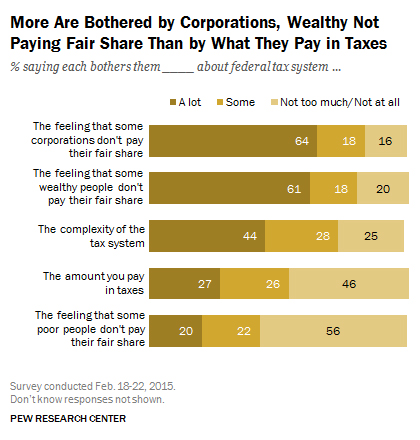

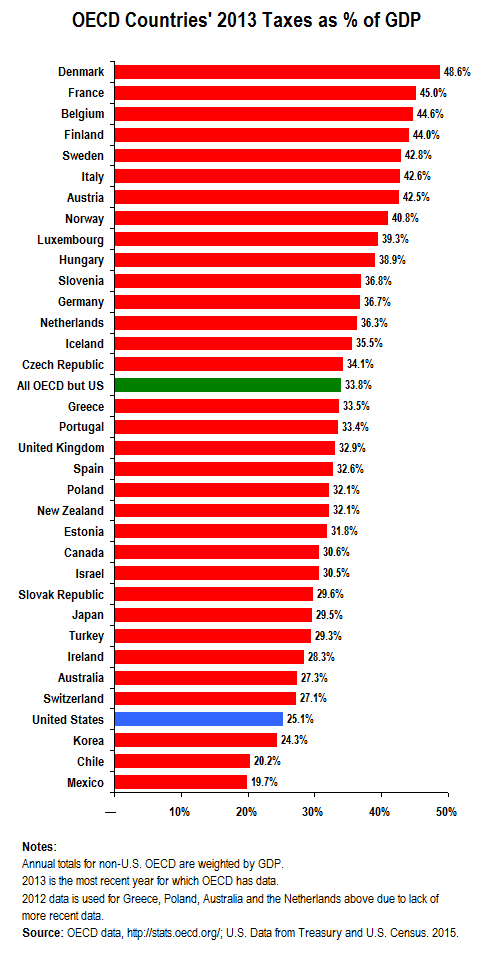

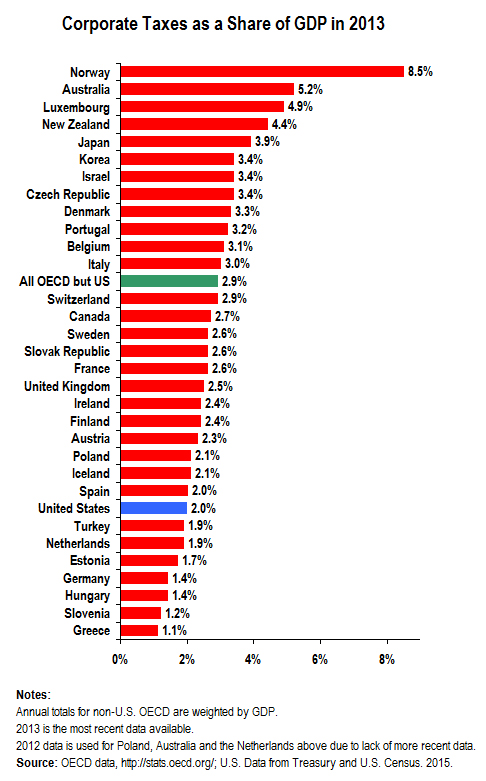

While Congress has cut federal research funding in recent years to lower the deficit, corporations have not been asked to give up generous tax breaks to contribute to deficit reduction. Instead, corporations and their congressional allies continually cite the nation’s 35 percent corporate tax rate as reason for “reform” and more tax breaks. But that is a ruse. U.S. corporate tax collections as a percent of GDP are already close to the lowest in the developed world,[13] and on average large, profitable corporations pay about half the statutory tax rate.[14] Congress should close loopholes and raise more revenue from corporations.[15] If Congress’s priority is research and innovation, it could use the revenue raised from corporations to undo the cuts in federal research spending enacted in recent years.

[1] Joint Committee on Taxation, Present Law and Selected Policy Issues in the U.S. Taxation of Cross-Border Income. https://www.jct.gov/publications.html?func=startdown&id=4742

[2] “The Congress shall have Power … To promote the Progress of Science and useful Arts, by securing for limited Times to Authors and Inventors the exclusive Right to their respective Writings and Discoveries.” “The Constitution of the United States,” Article 1, Section 8 (1787).

[3] Congressional Research Service, “Tax Expenditures: Compendium of Background Material on Individual Provisions,” Committee on the Budget United States Senate, 111th Congress 2d Session, S. PRT. 111–58 (Dec. 2010), p.85. “[E]xpensing has the effect of taxing the returns to an asset at a marginal effective rate of zero, which is to say that it equalizes the after-tax and pre-tax rates of return for an investment.”

[4] Ibid.

[5] Citizens for Tax Justice, Reform the Research Tax Credit — Or Let It Die. http://ctj.org/ctjreports/2013/12/reform_the_research_tax_credit_–_or_let_it_die.php

[6] Alex Parker, Patent Box Becoming Main ‘Focus’ of Congressional Tax Debate, GOP Aide Says, Bloomberg BNA. http://news.bna.com/dtln/DTLNWB/split_display.adp?fedfid=68316311&vname=dtrnot&wsn=494381000&searchid=25136808&doctypeid=1&type=date&mode=doc&split=0&scm=DTLNWB&pg=0

[7] Citizens for Tax Justice, Reform the Research Tax Credit — Or Let It Die. http://ctj.org/ctjreports/2013/12/reform_the_research_tax_credit_–_or_let_it_die.php

[8] Martin Sullivan, Time for a U.S. Patent Box?, Tax Notes. December 12, 2011.

[9] Joint Committee on Taxation, Economic Growth and Tax Policy. https://www.jct.gov/publications.html?func=startdown&id=4736

[10] Michael J. Graetz and Rachael Doud, Technological Innovation, International Competition, and the Challenges of International Income Taxation, Columbia Law Review. October 1, 2012.

[11] Citizens for Tax Justice, Congress Should End “Deferral” Rather than Adopt a “Territorial” Tax System. http://ctj.org/ctjreports/2011/03/congress_should_end_deferral_rather_than_adopt_a_territorial_tax_system.php

[12] American Association for the Advancement of Science, Historical Trends in Federal R&D. http://www.aaas.org/page/historical-trends-federal-rd

[13] Citizens for Tax Justice, The U.S. Collects Lower Level of Corporate Taxes Than Most Developed Countries. http://ctj.org/ctjreports/2015/04/the_us_collects_lower_level_of_corporate_taxes_than_most_developed_countries.php

[14] Citizens for Tax Justice, Sorry State of Corporate Taxes. http://www.ctj.org/corporatetaxdodgers/sorrystateofcorptaxes.php

[15] Citizens for Tax Justice, Revenue-Positive Reform of the Corporate Income Tax. https://ctj.sfo2.digitaloceanspaces.com/pdf/corporatetaxreform.pdf

![]()

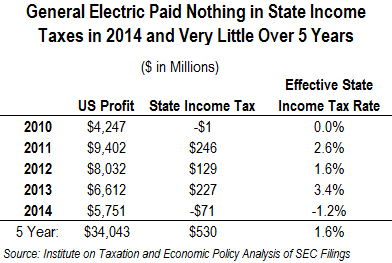

Each year, General Electric publishes basic data on its nationwide state (and federal) income tax liabilities in its annual financial report, as required by the Securities and Exchange Commission. These reports show that the company routinely pays little or no state income tax on billions of dollars in profit nationwide:

Each year, General Electric publishes basic data on its nationwide state (and federal) income tax liabilities in its annual financial report, as required by the Securities and Exchange Commission. These reports show that the company routinely pays little or no state income tax on billions of dollars in profit nationwide:

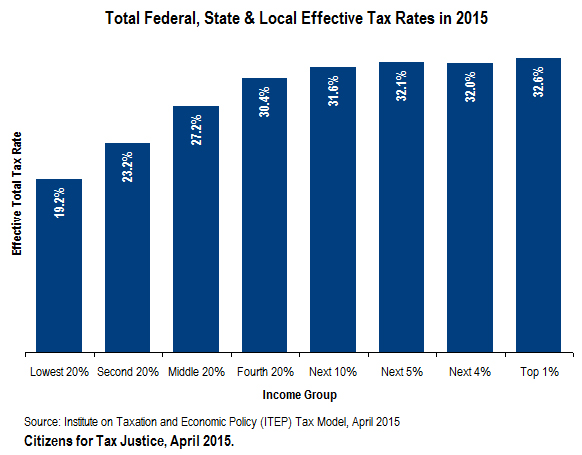

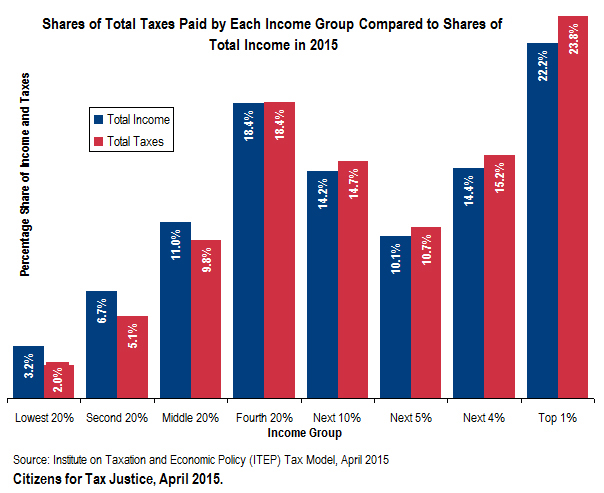

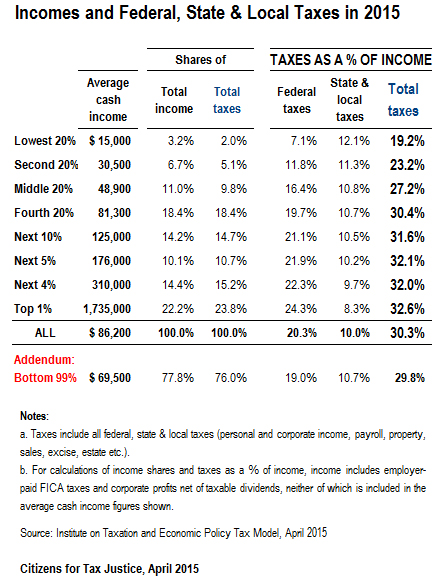

But in sum, the nation’s tax system is barely progressive. Those who advocate for top-heavy tax cuts and erroneously claim the wealthy are overtaxed focus solely on the federal personal income tax, while ignoring other taxes that Americans pay. As the table to the right illustrates, the total share of taxes (federal, state, and local) that will be paid by Americans across the economic spectrum in 2015 is roughly equal to their total share of income.

But in sum, the nation’s tax system is barely progressive. Those who advocate for top-heavy tax cuts and erroneously claim the wealthy are overtaxed focus solely on the federal personal income tax, while ignoring other taxes that Americans pay. As the table to the right illustrates, the total share of taxes (federal, state, and local) that will be paid by Americans across the economic spectrum in 2015 is roughly equal to their total share of income.