April 9, 2015 10:32 AM | Permalink | ![]()

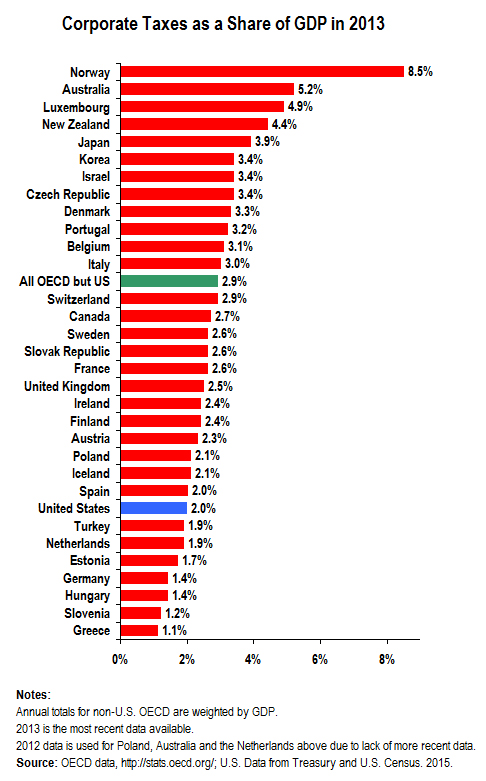

The United States has one of the lowest corporate tax levels in the developed world, according to an analysis of the most recent data from the Organization for Economic Cooperation and Development (OECD). In 2013, the United States had the eighth lowest level of corporate taxes as a share of GDP

(2.0 percent) among the 33 developed countries for which data are available. On average, corporate taxes account for 2.9 percent of GDP – almost 50 percent higher than the level in the United States – among our competitors.

U.S. corporate income taxes have continually declined as a percentage of GDP since 1945. Yet there is a growing and vocal movement among well-financed lobbying groups to push federal lawmakers to lower the corporate tax rate. These business-backed groups claim the U.S. corporate tax rate is too high, citing the 35 percent federal statutory tax rate. But that narrow argument ignores critical facts such as the many egregious tax breaks and loopholes that pervade our corporate tax code. A 2014 study by Citizens for Tax Justice examined five years’ worth of data and found that Fortune 500 companies paid an average federal effective corporate income tax rate of 19.4 percent, which is substantially less than the U.S. statutory rate of 35 percent. In fact, the same study found that many profitable, large U.S. corporations such as Boeing, General Electric and Verizon paid no federal corporate income taxes at all.[1]

[1] Citizens for Tax Justice, “The Sorry State of Corporate Taxes”, February 2014. http://www.ctj.org/corporatetaxdodgers/