April 9, 2015 06:26 PM | Permalink | ![]()

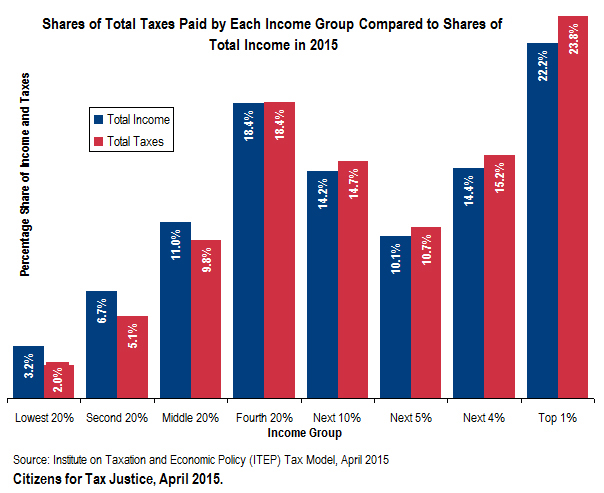

1. The nation’s tax system is just barely progressive.

- A new CTJ analysis based on 2015 tax rates reveals that when federal, state and local taxes are tallied, the share of taxes paid by Americans across the economic spectrum is roughly equivalent to their total share of income.

- Although the federal income tax is progressive, state and local tax systems are highly regressive. A recent report from the Institute on Taxation and Economic Policy (ITEP) found that the poorest 20 percent of Americans on average pay 10.9 percent of their income in state and local taxes, while the top 1 percent pay half as much, only 5.4 percent.

- One of the more regressive features of the nation’s tax code is the preferential tax rate on income derived from capital gains and dividends that allows many wealthy investors to pay a lower rate on their income than many middle class Americans.

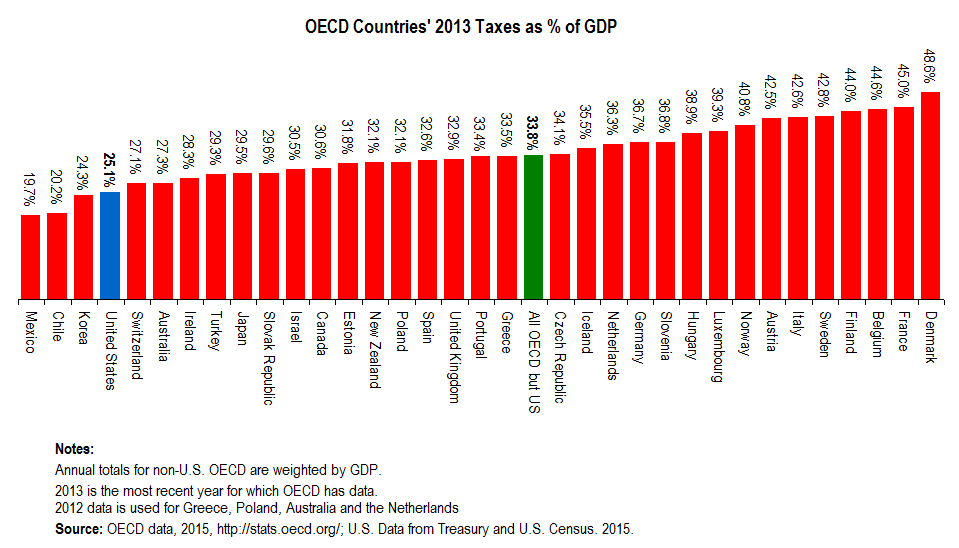

2. The United States has substantially lower overall taxes than the vast majority of developed countries.

- The United States had the fourth lowest level of taxes among the 34 OECD countries in 2013, the latest year for which data are available. Only Mexico, Chile and Korea collected fewer taxes as a percent of GDP.

- The level of taxation in the United States, 25.1 percent of GDP, is well below the 33.8 percent average for developed countries.

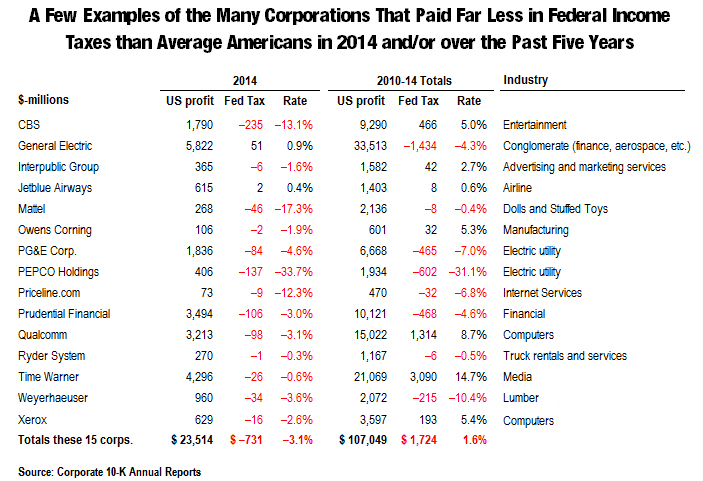

3. The United States has a low effective corporate income tax rate.

- The United States has the eighth lowest level of corporate taxes as a percentage of gross domestic product (GDP) out of the 33 developed countries for which data are available.

- The statutory federal corporate tax rate is 35 percent, but many profitable corporations, including CBS, Xerox and Time Warner, paid nothing in taxes in 2014. Over the five-year period from 2010 to 2014, General Electric paid an effective rate of negative 11.1 percent and received a refund of $1.4 billion on $33.5 billion in profits.

- Dozens of corporations, including Apple, Nike and Microsoft, have publicly disclosed avoiding billions in taxes by holding their profits offshore in tax havens. A new CTJ report estimates that Fortune 500 companies are avoiding up to $600 billion in federal income taxes by holding profits offshore.

4. While federal tax reform is stalled, state governments are making major changes to their tax codes.

- More than 20 states are currently considering harmful tax proposals that would deprive local governments of much needed revenue for public services and make state tax systems even more regressive.

- Many of these proposals would exacerbate the extent to which state tax systems already contribute to increasing income equality.

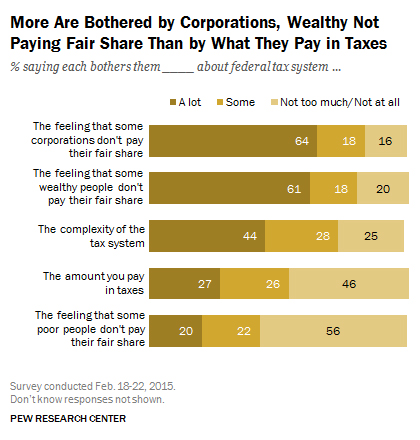

5. The American public is more bothered by corporations and the wealthy not paying their fair share in taxes, than by what they themselves have to pay.

- 64 percent of Americans are bothered a lot by corporations not paying their fair share in taxes and 61 percent are bothered a lot by the wealthy not paying their fair share. In contrast, only 27 percent of Americans are bothered a lot by how much they have to pay in taxes.

- 82 percent of voters believe that loophole-closing tax reform should be used to reduce the deficit or make new investments, rather than lowering tax rates on the wealthy and corporations.