An analysis of the tax plan circulating the Senate for an upcoming vote shows that it would raise taxes on at least 29 percent of Americans and cause the populations of 19 states to pay more in federal taxes in 2027 than they do today. The lowest-earning three-fifths of Americans would pay more on average in federal taxes, while the top 40 percent on average would receive a tax cut. The bill would increase the deficit because of the substantial tax breaks it would provide to the wealthy and to foreign investors who own stocks in American corporations and who would therefore benefit from the bill’s corporate tax cuts.

The claims that this plan is designed to support low- and middle-income families are patently false.

Click here to download this graphic

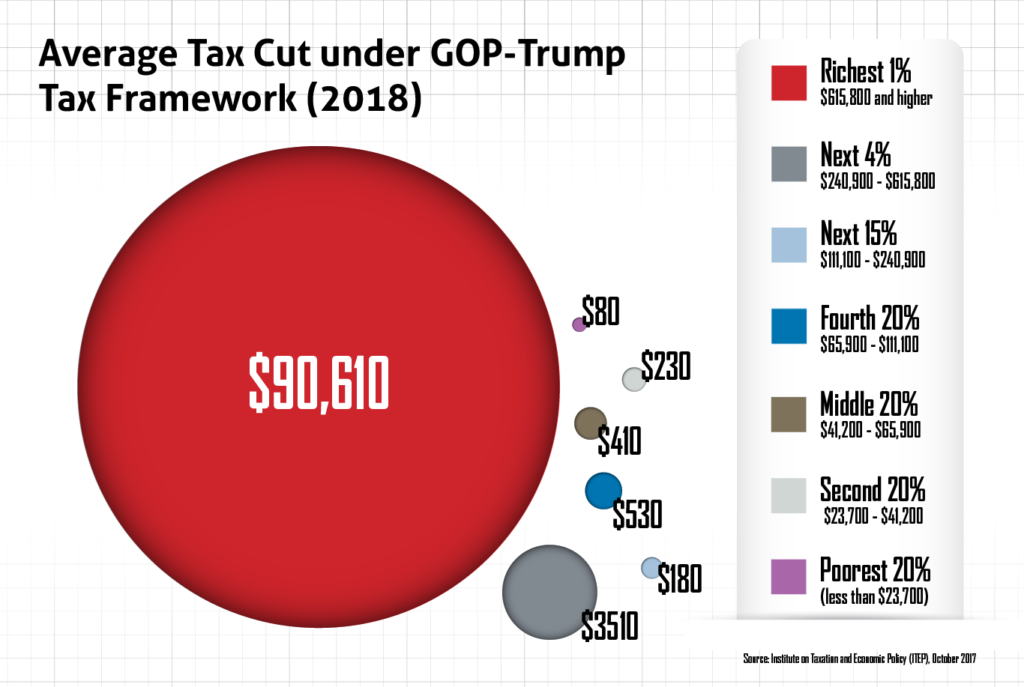

Nationally, the facts are clear.

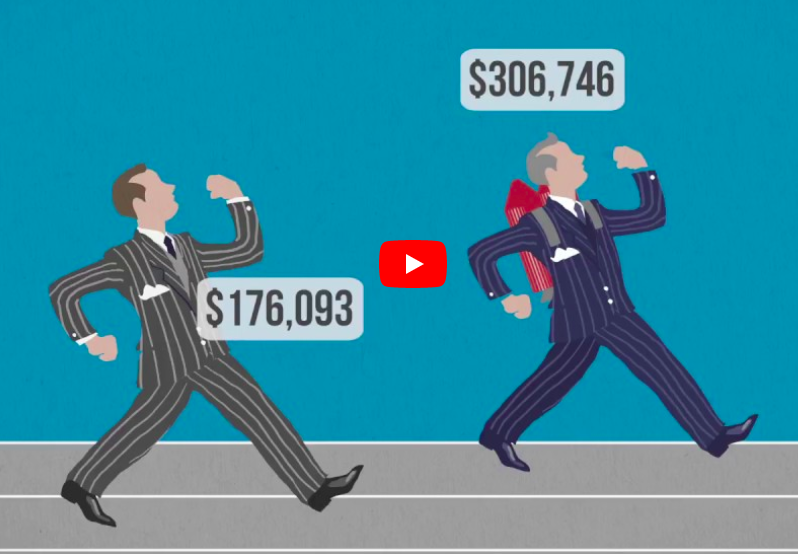

- This is not a Middle Class tax plan. The richest 5 percent of taxpayers collectively get 50% of the tax cuts in 2019; in 2027 the top 1% will get back $9,090 on average in tax cuts; more than six times the average amount everyone else will get combined.

- One in 3 taxpayers face a tax increase in 2027. In 2019 28.8 million taxpayers will pay more in taxes or see no difference; that number grows exponentially by 2027, when 29% of taxpayers will face a tax hike. By 2027, 61 million people will pay more or the same in taxes (50 million will pay more). The bottom three income brackets receive a net INCREASE in taxes by 2027, while the top 1% continues to receive an average tax cut of $9,090.

- People in 19 states will see their federal taxes rise by 2027. The states with the biggest net increase are Florida, North Carolina, Louisiana, Idaho and Maine.

- Foreign investors get a bigger share in this tax plan than U.S. taxpayers. In 2027, $22 billion of the tax cuts go to foreign investors; compared to the $8 billion in net benefit to all U.S. taxpayers.

- The tax provision (AMT) that cost Donald Trump $31 million in 2005 is gone through 2025. This means the super-wealthy will be more likely to be able to use loopholes to avoid paying taxes altogether.

- The plan reduces revenue by almost 1.5 trillion which will either grow the deficit or force significant spending cuts to vital investments like education, health care, science research, job training and infrastructure.

- Tax cuts for individuals expire after 2025, corporate tax cuts are permanent. This change explains why wealthy investors and the top 1 percent would still reap immense benefit from the tax cuts after 2025.

Interested in state-specific graphics? Click below to download the animation above with state-specific numbers in:

Millionaires win big. 97% of Alaskans with average incomes of $1.15 million win will get back $4,070 on average in 2027. Working families get INCREASES. On average, people in the bottom 60%, with household incomes of $31,300 on average, will just see their annual taxes RISE by $240 on average. In total, 147,200 Alaskans will see their taxes rise in 2027. Meanwhile, foreign investors will continue to get huge breaks from this plan — $22 billion in U.S. taxpayer money in 2027.

1.2 million Arizonians will see their taxes rise in 2027. Meanwhile, foreign investors will continue to get huge breaks from this plan — $22 billion in U.S. taxpayer money in 2027. Working families will pay more. On average, the bottom 60% of income earners will see their tax bills rise by 2027 on average $150. Millionaires get huge tax cuts, at the cost of working families. 92% of the top 1%, with average incomes of $1.9 million/year receive tax cuts of $5,000 on average in 2027.

Taxes will rise for nearly one-in-four — or half a million — households in 2027 (24%). More than half a million taxpayers (544,900) will pay on average $110 MORE in taxes under the Senate GOP plan in 2027. Meanwhile, 98% of the richest 1% will see their taxes drop by an average of $4,790. Collectively, Kentuckians will pay $105,100,000 MORE in federal taxes under this plan.

Mainers will pay more in taxes. On average, the bottom 60% of income earners will see their tax bills rise $120 in 2027. More than 1 in 4 (28%) taxpayers in Maine will pay more in 2027 under the Senate GOP tax plan. That’s nearly a quarter of a million people — 205,000. Millionaires win big. Meanwhile, 97% of the people in the top 1%, with average household incomes of $1.75 million will get on average $4,740.

Working families in Tennessee will pay more overall in taxes — on average the bottom 60% of income earners will see their taxes rise on average $110 in 2027. Overall, 1.1 million Tennesseans will see their taxes rise on average $110 in 2027. Meanwhile, 91% of the richest 1% will get tax cuts of $6,030 in 2027.

Overall this tax plan will lose $233 billion in revenue in 2018 alone for the government, putting at risk essential social services such as Medicare, Medicaid, Social Security and education (Source: ITEP)

Overall this tax plan will lose $233 billion in revenue in 2018 alone for the government, putting at risk essential social services such as Medicare, Medicaid, Social Security and education (Source: ITEP)