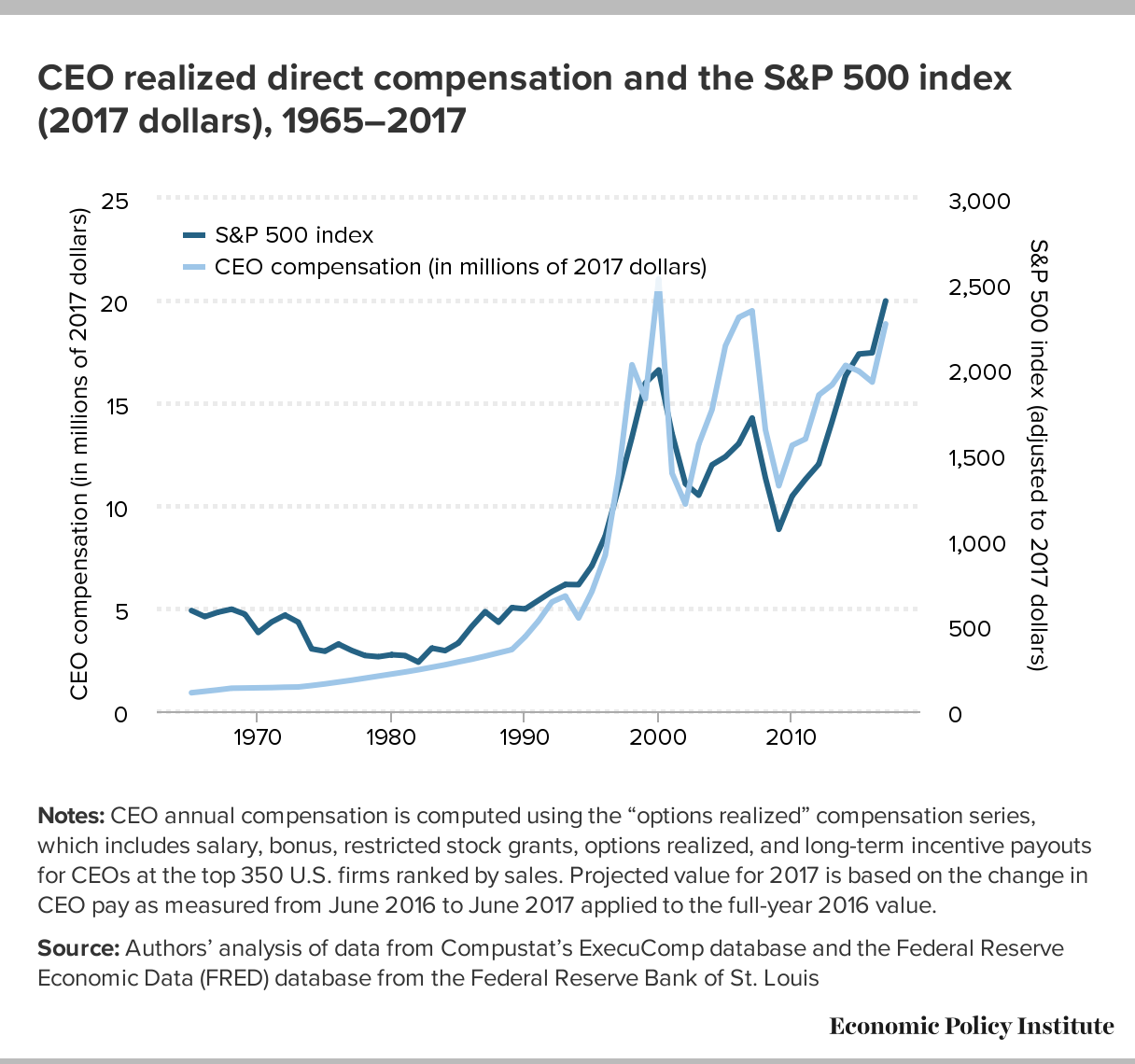

How companies compensate their employees and executives matters. For the last decade, corporate profits have continually hit record levels, but aside from recent wage growth (that still has only modestly exceeded the rate of inflation, and may only be up temporarily due only to the tightened labor market), the benefits of economic growth have flowed mostly to executive suites. In other words, corporations haven’t invested in their rank-and-file workforces in a way that would create family-sustaining jobs and improve family economic security.

Executive Paywatch

American Federation of Labor and Congress of Industrial Organizations (AFL-CIO)