U.S.-based multinational corporations are allowed to play by a different set of rules than the rest of us when it comes to paying taxes. Thanks to corporate lobbyists, our tax code is riddled with loopholes.

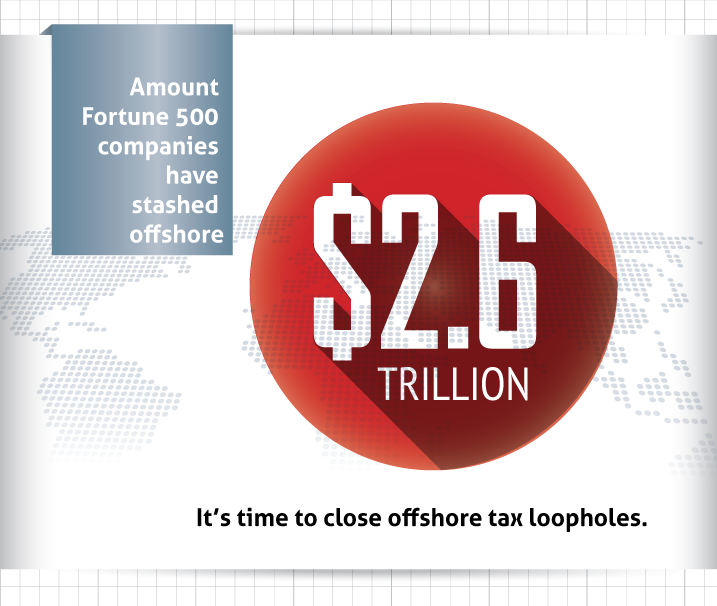

In 2016 alone, nearly three out of every four Fortune 500 companies maintained subsidiaries in offshore tax havens.* This collective offshore cash hoard now totals $2.6 trillion, allowing these companies to avoid $752 billion in U.S. taxes.

But there’s a way to fix this! Congress could act tomorrow to shut down tax haven abuse. If you agree that closing corporate tax loopholes should be the cornerstone of any tax reform effort, please take a minute and let your representatives know.