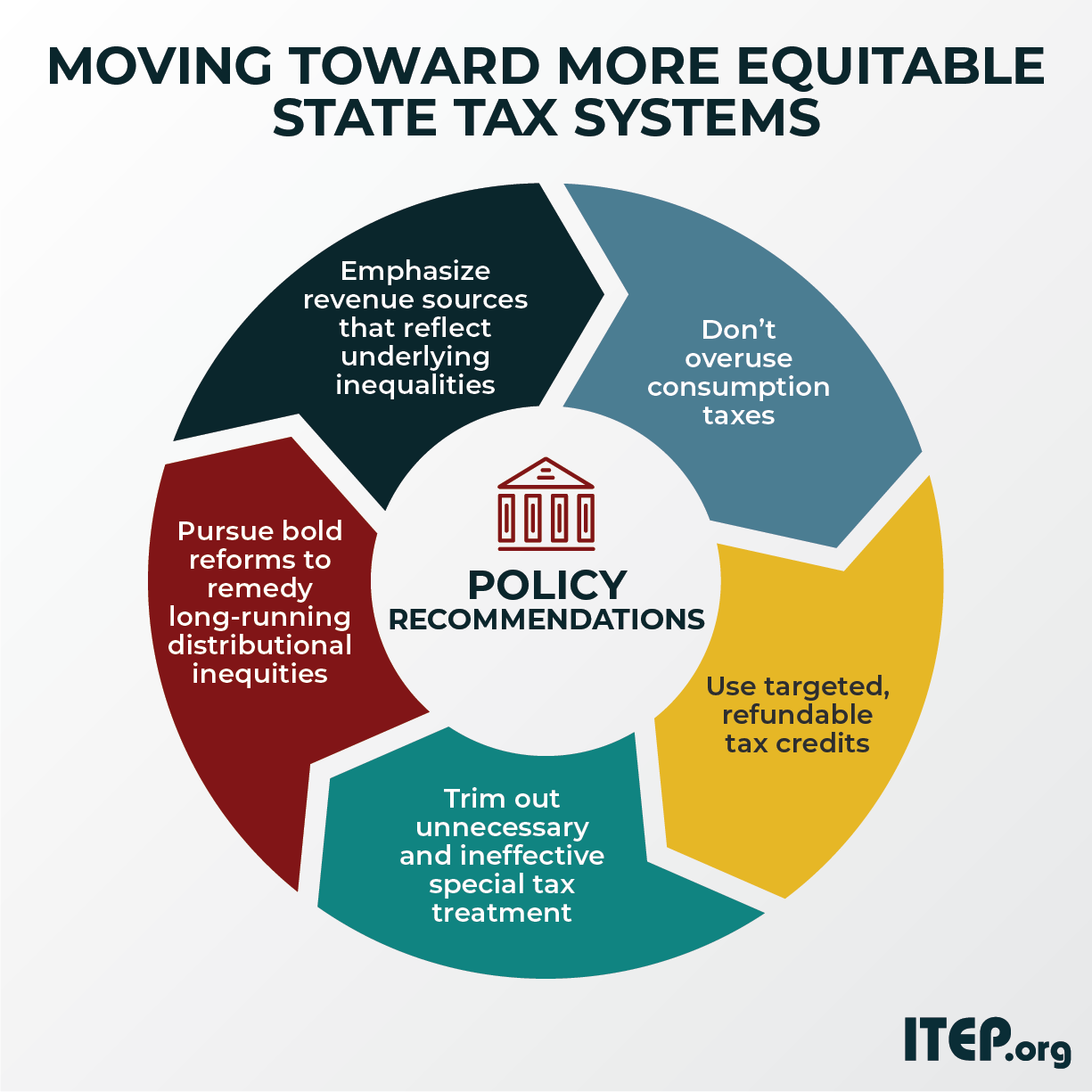

“Efforts to reduce discrimination, equalize access to education, ensure equal treatment by the legal system, and otherwise end racial stratification should continue since they seem to be making real, if slow, progress. But these policies should be paired with broader economic policies to end wage stagnation for Americans of all races and, in so doing, reduce the gaps between racial groups.”

How rising U.S. income inequality exacerbates racial economic disparities

Washington Center for Equitable Growth, Aug. 23, 2018

Related: Income Inequality and the Persistence of Racial Economic Disparities, March 12, 2018