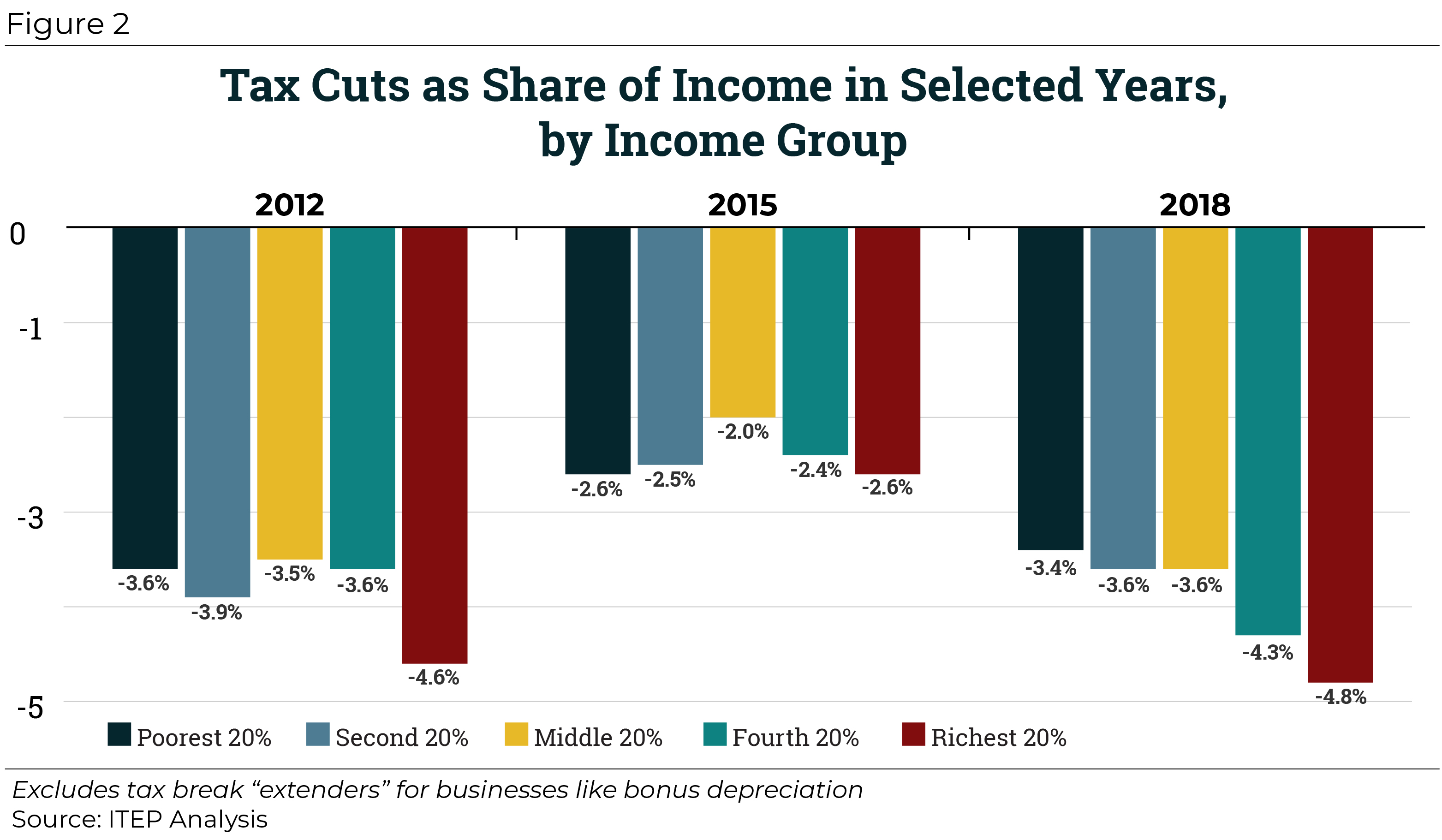

This testimony from Center on Budget and Policy Priorities Chye-Ching Huang before the House Budget Committee highlights flaws in the so-called Tax Cuts and Jobs Act and offers recommendations to undo the damage the law inflicted upon low- and moderate-income people, while rewarding corporations and the wealthy.

Fundamentally Flawed 2017 Tax Law Largely Leaves Low- and Moderate-Income Americans Behind

Center on Budget and Policy Priorities, Feb. 27, 2019