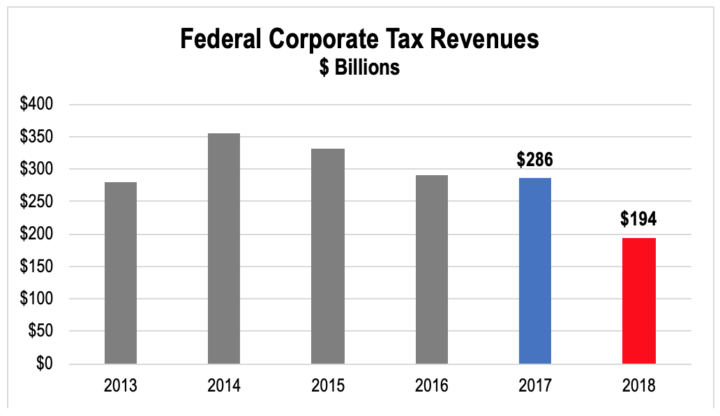

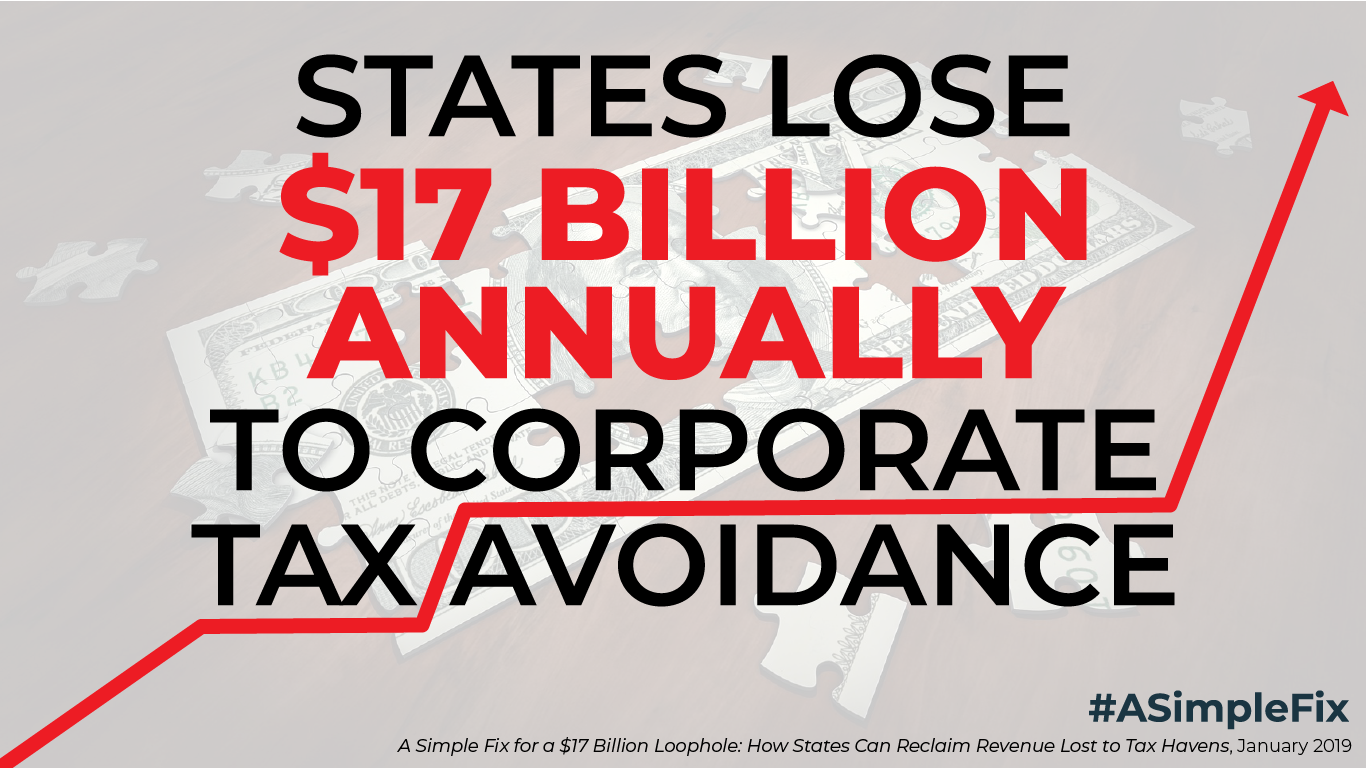

When the White House and GOP leaders passed the unpopular Tax Cuts and Jobs Act, they promised the 40 percent reduction in the corporate tax rate would benefit workers via higher wages and more corporate investment. Instead, the tax law has fueled stock buybacks and incentivized offshore tax havens.

Costly Corporate Tax Cuts Benefit Few Workers

Americans for Tax Fairness, March 13, 2019