September 11, 2013 01:51 PM | Permalink | ![]()

In July, a letter[1] signed by thirty national organizations and a report[2] from Citizens for Tax Justice (CTJ) both warned members of Congress about a proposal from Congressman John Delaney of Maryland that would have the effect of rewarding corporations that use offshore tax havens to avoid U.S. taxes. Rep. Delaney’s staff responded with a “rebuttal” that is itself based on misinformation about corporate tax law and about the likely effects of the proposal, which would provide a tax amnesty for offshore profits (often euphemistically called a “repatriation holiday”) for corporations that agree to finance an infrastructure bank.

The proposal, H.R. 2084, would allow American corporations to bring profits of their offshore subsidiaries to the U.S. (to “repatriate” offshore profits) without paying the U.S. corporate income tax that would normally be due. In return, the corporations would have to purchase bonds to provide $50 billion of financing for a bank that would fund infrastructure projects in the U.S. How much a corporation could repatriate tax-free would be determined through a bidding process, with a maximum cap of six dollars in offshore profits repatriated tax-free for every one dollar spent on the bonds.

Profits Not Truly “Locked Offshore”

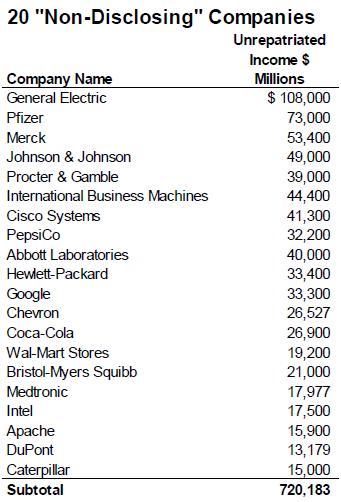

Conversations about this type of proposal begin with a mistaken assumption that Congress should lure to the U.S. the $2 trillion of “permanently reinvested earnings” that American corporations hold in foreign subsidiaries. These are profits that U.S. corporations have generated (or claim to have generated) in foreign countries and on which they have not yet paid U.S. taxes.

As the CTJ report on Delaney’s proposal explains, much, if not most of these “offshore” profits are actually already in the U.S. economy, and nothing prevents our corporations from using them to make investments here. A December 2011 study by the Senate Permanent Subcommittee on Investigations surveyed 27 corporations, including the 15 corporations that repatriated the most offshore cash under the 2004 law, and concluded that in 2010, 46 percent of the “permanently reinvested earnings” held offshore by these corporations were invested in U.S. assets like U.S. bank deposits, U.S. stocks, U.S. Treasury bonds and similar investments.[3]

This fact, which seems to undercut the rationale for a tax amnesty on offshore corporate profits, is not addressed by Congressman Delaney’s rebuttal.

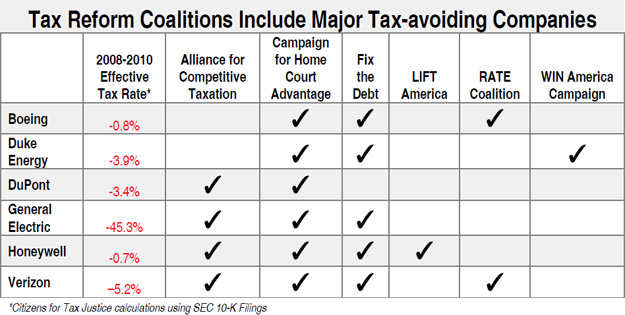

Rewarding the Most Aggressive Corporate Tax Dodgers

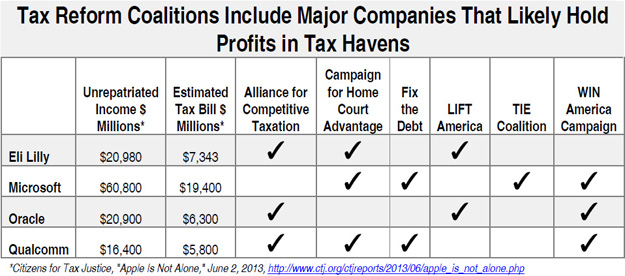

As the letter and the CTJ report explain, one of the troubling aspects of Congressman Delaney’s proposal is that it would reward the most aggressive corporate tax dodgers. Often, an American corporation has offshore profits because its offshore subsidiaries carry out actual business activity. But a great deal of the profits that are characterized as “offshore” are really U.S. profits that have been disguised through accounting gimmicks as “foreign” profits generated by a subsidiary (which may be just a post office box) in a country that does not tax profits (i.e., an offshore tax haven). These tax haven profits are the profits most likely to be “repatriated” under such a proposal for two reasons.

First, offshore profits from actual business activities in foreign countries are often reinvested into factories, stores, equipment or other assets that are not easily liquidated in order to take advantage of a temporary tax break, but profits that are booked as “foreign” profits earned by a post office box subsidiary in a tax haven are easier to “move” to the U.S.

Second, profits in tax havens get a bigger tax break when “repatriated” under such a tax amnesty. The U.S. tax that is normally due on repatriated offshore profits is the U.S. corporate tax rate of 35 percent minus whatever was paid to the government of the foreign country. Profits that American companies claim to generate in tax havens are not taxed at all (or taxed very little) by the foreign government, so they might be subject to the full 35 percent U.S. rate upon repatriation — and thus receive the greatest break when the U.S. tax is called off.

Even more troubling, the Delaney proposal gives those corporations that purchase the most bonds and repatriate the most offshore profits (and therefore those likely to be the most aggressive tax dodgers) the power to appoint a majority of the directors of the infrastructure bank.

How Delaney’s “Rebuttal” Misinforms

In a document titled “Rebuttal to Inaccurate Claims on H.R. 2084,” Congressman Delaney’s staff provides the following descriptions of the criticisms of his proposal and responses. Each is based on misinformation or faulty logic, as explained below.

Delaney staff’s description of opponents’ claim: “H.R. 2084 will not create jobs.”

Delaney staff’s response: “Building infrastructure creates jobs and helps businesses grow. According to conservative estimates used by the Federal Highway Administration every billion in infrastructure investment creates 13,000 jobs, so $750 billion in infrastructure financing would create well over a million jobs. While the past impacts of repatriation on job growth or the effects of broad or theoretical alternatives can be debated – this criticism simply isn’t valid to H.R. 2084. Past repartition efforts were not directly tied to infrastructure investment. This legislation requires that repatriation be chained to infrastructure and job creation.”

The truth about jobs and Rep. Delaney’s proposal:

While infrastructure spending is economically stimulative, this plan is an absurdly wasteful and corrupt way to fund job creation. First, the proposal is designed to give away two dollars in tax breaks for every one dollar spent on infrastructure (and the jobs to build infrastructure) — to give away up to $105 billion in corporate tax breaks in order to raise $50 billion to finance the infrastructure bank. (Up to $300 billion would be repatriated, and we have explained that this is likely to be in the form of offshore profits that have not been taxed at all by any government so under normal rules the full 35 percent U.S. tax rate would apply, and 35 percent of $300 billion is $105 billion.)

Second, given that this proposal would encourage corporations to shift more jobs and profits offshore (as discussed below), its net effect on U.S. job creation could be negative.

Delaney staff’s description of opponents’ claim: “H.R. 2084 creates a repatriation tax holiday.”

Delaney staff’s response: “H.R. 2084 does not create a tax holiday where any company can repatriate any amount of money tax free. Only those companies that purchase infrastructure bonds would be eligible to repatriate any earnings, at rates set competitively to provide taxpayers with the fairest deal.”

The truth about repatriation under Rep. Delaney’s proposal:

Relieving corporations of tax liability on their offshore profits on the condition that they agree make a much smaller payment (whether in taxes or to finance an infrastructure bank) is what reasonable people call a “tax amnesty” or perhaps more euphemistically, a “tax holiday” for offshore corporate profits.

The proposal would allow a corporation to repatriate up to $6.00 of offshore profits tax-free for every one dollar used to purchase bonds to capitalize the infrastructure bank. Each six dollars of offshore profits repatriated under the normal rules would be subject to up to $2.10 of U.S. taxes. (As we have explained, the profits repatriated are likely to be those that have not been taxed by any government and therefore would be subject to the full 35 percent U.S. tax rate under the normal rules.) The proposal would allow up to $6.00 of offshore profits to be tax-free for every $1 invested in the infrastructure bank. That’s considerable tax savings for the participating corporations, and therefore constitutes a “tax amnesty.”

Delaney staff’s description of opponents’ claim: “H.R. encourages corporations to move jobs and profits offshore.”

Delaney staff’s response: “This legislation strictly focuses on the profits that are already offshore, and that all sides of the political spectrum want to come back. H.R. 2084 only uses a small fraction, 10% of the roughly $2 trillion, of the overseas earnings and requires companies to aggressively bid for the right to purchase Infrastructure Bonds. Because of the one-time auction mechanism, a company would be ill-advised to increase their offshoring of jobs or profits. The winning bids will be those that require the highest effective tax rate, and no company can be assured that they will win the auction and be able to purchase the bonds in the first place.”

The truth about offshoring jobs and profits under Rep. Delaney’s proposal:

When Congress provided a tax amnesty for offshore corporate profits in 2004 (it was euphemistically called a “tax holiday” by its supporters back then) several experts pointed out[4] that corporations would be encouraged to shift even more profits offshore if they believed that Congress was likely to do this more than once. Given how easy it is to make U.S. profits appear to be profits generated in Bermuda, the Cayman Islands, Ireland, or some other tax haven, corporations would reasonably conclude that they should artificially shift profits to such tax havens and then wait for Congress to enact the next tax amnesty for offshore profits. Any attempt by Congress to repeat such a tax amnesty, even a limited one, reinforces the precedent set in 2004 that Congress is willing to provide such breaks more than once and encourages companies, particularly the very large multinational corporations likely to participate, to shift even more profits (and possibly operations and jobs) offshore.

Delaney staff’s description of opponents’ claim: “H.R. 2084 gives control of the Board to corporate tax dodgers.”

Delaney staff’s response: “This legislation has strong conflict of interest provisions that explicitly prohibit Board appointees from having financial ties with the purchasers of the Infrastructure Bonds. This claim is simply false.

Line 3, Pg. 7 (H.R. 2084) CONFLICTS OF INTEREST.—No member of the Board may have a financial interest in, or be employed by, a Qualified Infrastructure Project (‘‘QIP’’) related to assistance provided under this section or any entity that has purchased bonds under subsection (e).”

The truth about who controls the bank under Rep. Delaney’s proposal:

As we explained, the profits most likely to be repatriated under such a deal are those profits artificially shifted into offshore tax havens. These profits are subject to the highest U.S. taxes when repatriated under the normal rules (because they have not been subject to foreign taxes that would reduce their U.S. tax liability). And offshore profits generated in a country with a developed economy are more likely to be reinvested in something like a factory or equipment or buildings in that country and thus difficult to repatriate, while offshore profits that (on paper) are generated by a subsidiary that is just a post office box in, say, Bermuda, or easier to “move” from one country to another. In other words, the corporations most likely to benefit from the proposal are the most aggressive corporate tax dodgers.

And the corporations that benefit from the proposal are given the right to nominate the majority of the board of directors of the infrastructure bank.

Line 16, Pg. 5 (H.R. 2084)

(C) INITIAL MEMBERS- The Board shall initially consist of the following members, who shall be appointed not later than the end of the 60-day period beginning on the date that bonds are issued under subsection (e):

(i) Four members, appointed by the President, by and with the advice and consent of the Senate.

(ii) Seven additional members, appointed one each by the seven entities purchasing the largest amount of bonds (by aggregate face amount of bonds purchased) under subsection (e).

(Emphasis added.)

[1] Americans for Tax Fairness press release, “Corporate Tax Amnesty Bill to Fund an Infrastructure Bank Slammed in Letter to U.S. House of Representatives,” July 16, 2013. http://www.americansfortaxfairness.org/press/2013/07/16/corporate-tax-amnesty-bill-to-fund-an-infrastructure-bank-slammed-in-letter-to-u-s-house-of-representatives/

[2] Citizens for Tax Justice, “Delaney’s Delusion: Latest Proposed Tax Amnesty for Repatriated Offshore Profits Would Create Infrastructure Bank Run by Corporate Tax Dodgers,” June 25, 2013. http://ctj.org/ctjreports/2013/06/delaneys_delusion.php

[3] United States Senate, Permanent Subcommittee on Investigations, Committee on Homeland Security and Governmental Affairs, “Offshore Funds Located Onshore: Majority Staff Report Addendum,” December 14, 2011. http://www.hsgac.senate.gov/download/report-addendum_-psi-majority-staff-report-offshore-funds-located-onshore

[4] Citizens for Tax Justice, “Will Congress Make Itself a Doormat for Corporations that Avoid U.S. Taxes?,” January 30, 2009 https://ctj.sfo2.digitaloceanspaces.com/pdf/repatriation.pdf

bstantially faster than they actually wear out, is the main reason for the company’s low taxes. Accelerated depreciation is a long-standing tax break that Congress has acted to expand substantially in the past decade.

bstantially faster than they actually wear out, is the main reason for the company’s low taxes. Accelerated depreciation is a long-standing tax break that Congress has acted to expand substantially in the past decade.

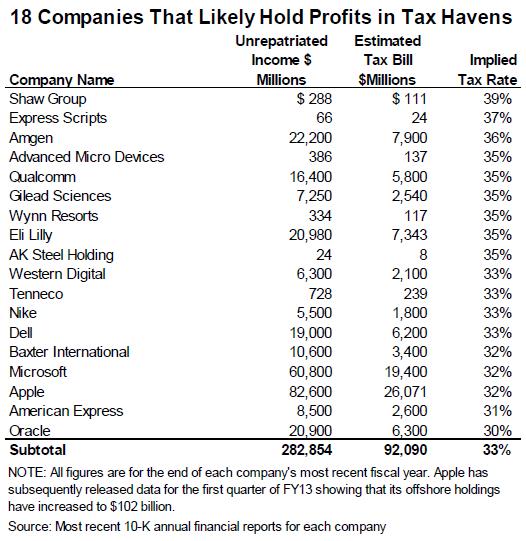

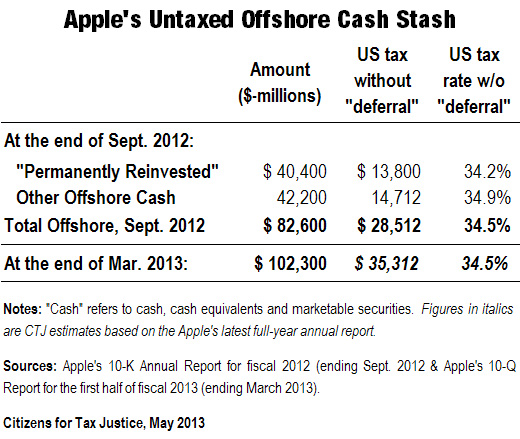

An analysis of Apple Inc.’s financial reports makes clear that Apple has paid almost no income taxes to any country on its $102 billion in offshore cash holdings. That means that this cash hoard reflects profits that were shifted, on paper, out of countries where the profits were actually earned into foreign tax havens.

An analysis of Apple Inc.’s financial reports makes clear that Apple has paid almost no income taxes to any country on its $102 billion in offshore cash holdings. That means that this cash hoard reflects profits that were shifted, on paper, out of countries where the profits were actually earned into foreign tax havens. annual report show that the company would pay almost the full 35 percent U.S. tax rate on its offshore income if repatriated. That means that virtually no tax has been paid on those profits to any government.

annual report show that the company would pay almost the full 35 percent U.S. tax rate on its offshore income if repatriated. That means that virtually no tax has been paid on those profits to any government.