May 20, 2013 11:53 AM | Permalink | ![]()

Virtually None of Its $102 Billion Offshore Stash Has Been Taxed By Any Government

An analysis of Apple Inc.’s financial reports makes clear that Apple has paid almost no income taxes to any country on its $102 billion in offshore cash holdings. That means that this cash hoard reflects profits that were shifted, on paper, out of countries where the profits were actually earned into foreign tax havens.

An analysis of Apple Inc.’s financial reports makes clear that Apple has paid almost no income taxes to any country on its $102 billion in offshore cash holdings. That means that this cash hoard reflects profits that were shifted, on paper, out of countries where the profits were actually earned into foreign tax havens.

How We Know Apple’s Offshore Cash is Largely in Tax Havens

Under current law, corporations can indefinitely defer paying U.S. income taxes on their offshoreprofits. Multinational corporations with offshore profits sometimes disclose in their financial reports the amount of tax they would pay if there were no “deferral” and their offshore profits were taxable in the United States. But this potential tax rarely amounts to the full 35 percent U.S. corporate tax rate, since these companies typically have already paid some foreign income taxes on these foreign profits when they were earned. Companies are allowed a “foreign tax credit” against their U.S. tax when and if the profits are subject to U.S. tax. So a company that has already paid (for example) a 25 percent tax rate on its unrepatriated offshore income would only pay the difference between that amount and the U.S. corporate tax rate of 35 percent (in this example, 10 percent) when that income is repatriated to the U.S.

The data in Apple’s latest  annual report show that the company would pay almost the full 35 percent U.S. tax rate on its offshore income if repatriated. That means that virtually no tax has been paid on those profits to any government.

annual report show that the company would pay almost the full 35 percent U.S. tax rate on its offshore income if repatriated. That means that virtually no tax has been paid on those profits to any government.

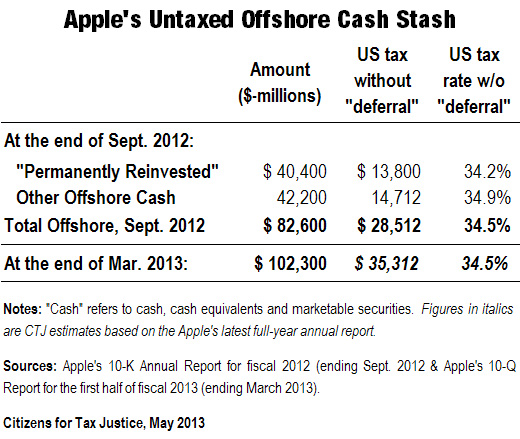

At the end of March 2013, Apple’s foreign subsidiaries had accumulated $102.3 billion in cash, cash equivalents and marketable securities. Based on more complete information provided in Apple’s latest full annual report, without “deferral” Apple would owe $35 billion in U.S. income taxes on this cash hoard.

Here is what we know from Apple’s 2012 annual report:

-

At the end of fiscal year 2012, Apple had $82.6 billion in cash and cash equivalents parked offshore.

-

Of this $82.6 billion, $40.4 billion was “permanently reinvested” foreign income that the company declared it had no plans to ever allow the United States to tax. Without “deferral,” however, Apple said that it would owe a U.S. tax bill of $13.8 billion on this $40.4 billion stash. That works out to a 34.2 percent U.S. tax rate

-

The remainder of Apple’s offshore cash at the end of its last fiscal year was $42.2 billion. Apple did not treat this amount as “permanently reinvested” offshore. Therefore, it reported a potential future U.S. tax liability of $14.7 billion, which means a 34.9 percent U.S. tax rate.

-

So all together, without deferral, Apple would have paid $28.5 billion in U.S. taxes on its $82.6 billion in offshore cash. This means the company’s U.S. tax rate would have been 34.5 percent, barely under the maximum U.S. corporate tax rate.

Applying this same U.S. tax rate to Apple’s $102.3 billion offshore cash hoard as of March 2013 would generate $35.3 billion in U.S. income taxes, without deferral.

Much of Apple’s Offshore Cash Hoard Likely Reflects Profits Shifted from the U.S.

In recent interviews, Apple CEO Tim Cook has denied that any of its cash in tax-haven subsidiaries has been shifted from the U.S., stating that “Apple does not funnel its domestic profits overseas. We don’t do that.”

While it’s virtually impossible to know precisely the source of Apple’s offshore cash, it seems very likely that much, if not most, of it stems from profits that were actually earned in the United States but shifted into tax havens. After all, the primary source of Apple’s profits is the research and design work that it does in the U.S.

But if a larger than expected amount of Apple’s offshore cash was generated by profits shifted into tax havens from foreign countries where Apple does real business, then that provides further proof that the “territorial” tax system used by countries such as the United Kingdom, Germany and so forth make offshore profit-shifting even easier to do than the United States’ “deferral” system.

A “Territorial” Tax System or “Repatriation Holiday” Would Increase Incentives for Apple to Shift Profits to Offshore Tax Havens

If Congress simply repealed the rule allowing U.S. corporations to defer U.S. taxes on their offshore profits, there would be no incentive for a company like Apple to claim that its profits are earned in offshore tax havens. The profits would be subject to the U.S. corporate tax no matter where they are generated.

But many multinational corporations are pushing Congress to move in the opposite direction and exempt offshore corporate profits from U.S. taxes. Some companies are lobbying for a permanent exemption, which is essentially what a “territorial” tax system provides. Others are lobbying for a temporary exemption, which proponents call a “repatriation holiday.”

A “repatriation holiday” is a tax amnesty for offshore corporate profits. Most variations of this type of proposal would allow U.S. corporations to bring their offshore profits back to the U.S. and pay no U.S. corporate taxes on those profits, or pay U.S. corporate taxes at an extremely low rate.

A similar repatriation amnesty was enacted in 2004 and is widely considered to have been a failure. A CTJ fact sheet explains why proposals for a second repatriation amnesty should be rejected:[i]

-

Another temporary tax amnesty for repatriated offshore corporate profits would increase incentives for job offshoring and offshore profit shifting… One reason why the Joint Committee on Taxation concluded that a repeat of the 2004 “repatriation holiday” would cost $79 billion over ten years is the likelihood that many U.S. corporations would respond by shifting even more investments offshore in the belief that Congress will call off most of the U.S. taxes on those profits again in the future by enacting more “holidays.”

-

The Congressional Research Service concluded that the offshore profits repatriated under the 2004 tax amnesty went to corporate shareholders and not towards job creation. In fact, many of the companies that benefited the most actually reduced their U.S. workforces.

[i] Citizens for Tax Justice, “Why Congress Should Reject A “Territorial” System and a “Repatriation” Amnesty: Both Proposals Would Remove Taxes on Corporations’ Offshore Profits,” October 19, 2011. https://ctj.sfo2.digitaloceanspaces.com/pdf/corporateinternationalfactsheet.pdf