This article originally appeared in The Hill.

For almost four decades, American voters have been fed a tall tale by anti-tax politicians and their allies. They’ve been told that government wastes their money, produces nothing of value, and needlessly robs American workers of their hard-earned pay. And they’ve been told that since their tax dollars aren’t buying anything worthwhile to begin with, even the biggest tax cuts don’t need to be paid for.

These calculated, misleading messages have helped pave the way for a series of irresponsible, unfunded tax cuts that have endangered our nation’s long-term fiscal health. The huge, deficit-financed tax cuts pushed through by President George W. Bush more than a decade ago were one result of this movement. In the current election cycle, the major Republican presidential candidates have presented the American public with tax-cutting plans that would double down on the Bush tax cuts, but they have offered few or no details about how they would pay for these cuts. It’s clear that the latest generation of Republican leaders views fiscal policy through the same rose-colored lenses as their supply-side predecessors.

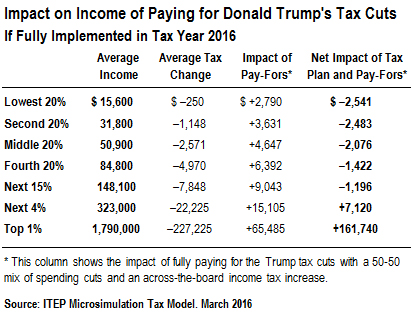

Such breathtaking fiscal irresponsibility creates an analytic challenge for those who care about tax fairness. On its face, a plan to cut taxes by $12 trillion over the next decade, as Donald Trump’s proposal would do, would result in a net income gain for virtually all Americans in the same way that dropping hundred dollar bills from a helicopter would benefit all those beneath it. But any analysis of Trump’s plan that focuses solely on the tax cuts is woefully incomplete: in the long run, tax cuts of this magnitude will have to be paid for, and it won’t be pretty. If history is any guide, a mix of unpopular spending cuts and across-the-board tax increases will be required to offset most or all of the tax cuts.

My organization, Citizens for Tax Justice, has a new report that tells both sides of the story. We not only show the effects of the tax cuts that GOP presidential candidates boast about, but we also count what the candidates don’t want to talk about: the effects of the inevitable spending cuts and/or offsetting tax increases that will be necessary to avoid fiscal catastrophe.

Looking at the GOP tax proposals this way tells a very different story: every income group except the very highest ones would be worse off under the GOP candidates’ tax plans.

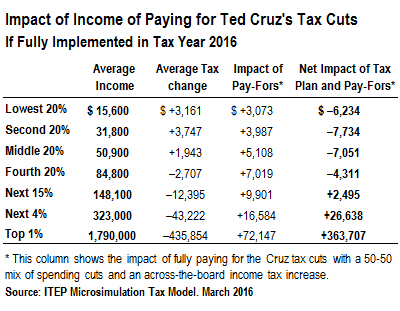

For example, Donald Trump’s tax plan ostensibly offers middle-income Americans a tax cut of about $2,500 a year. But paying for that tax cut will eventually cost them about $4,600, for a net loss of about $2,100 a year. For the same group, Ted Cruz’s plan will have a net annual cost of more than $7,000. And Marco Rubio’s promised tax cut for the middle of $1,400 ends ups as a net cost of almost $2,500 a year.

The same logic applies to plans that would increase taxes. Democratic candidate Bernie Sanders has proposed to increase taxes and provide a government-funded universal health insurance program. As part of that proposal, employer-related health insurance would become unnecessary, and would likely be converted into higher cash wages. Of course, those higher wages would be subject to taxes, but most workers would end up with significantly higher after-tax earnings. Meanwhile, they would get the same or better health insurance coverage than they have now, as would all Americans.

A complete analysis of Sanders’s health proposal would find that the vast majority of Americans, especially those with limited or no health insurance, would be much better off than they are now. Yet according to tables published by some groups and widely covered by the media, all income groups would be worse off because everyone would pay a portion of the taxes imposed to fund the universal insurance program, albeit a very small portion for most of us.

The bottom line is this: Focusing solely on the tax side while ignoring the public services that taxes make possible doesn’t just tell only half of the story. It gets the whole story completely wrong.

Robert McIntyre is the director of Citizens for Tax Justice, a Washington D.C.-based policy organization that does analyses and advocacy for fair tax policies that allow the nation to raise the revenue it needs to fund its priorities.

The Congressional Progressive Caucus (CPC) earlier this week

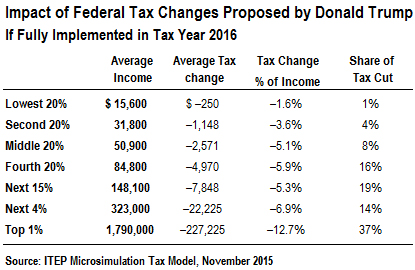

The Congressional Progressive Caucus (CPC) earlier this week  Under Trump’s plan, the top one percent of taxpayers would see an average annual tax cut of $227,225. In contrast, the lowest 20 percent of taxpayers would see an average annual tax cut of just $250 and the middle 20 percent of taxpayers would see $2,571.

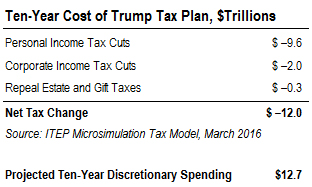

Under Trump’s plan, the top one percent of taxpayers would see an average annual tax cut of $227,225. In contrast, the lowest 20 percent of taxpayers would see an average annual tax cut of just $250 and the middle 20 percent of taxpayers would see $2,571. The tax changes proposed by Trump would, if hypothetically fully implemented in this year, reduce federal tax collections by $12 trillion over the next decade. This includes $9.6 in personal income tax cuts, $2 trillion in corporate income tax cuts, and the $300 billion cost of repealing estate and gift taxes. Our analysis shows the impact in 2016 because that is the first year for which Trump would, as President, likely be able to affect income tax laws.

The tax changes proposed by Trump would, if hypothetically fully implemented in this year, reduce federal tax collections by $12 trillion over the next decade. This includes $9.6 in personal income tax cuts, $2 trillion in corporate income tax cuts, and the $300 billion cost of repealing estate and gift taxes. Our analysis shows the impact in 2016 because that is the first year for which Trump would, as President, likely be able to affect income tax laws. This means that Trump’s plan would exponentially balloon the national debt or would have to be paid for with a mix of spending cuts and tax increases. This is roughly what happened after the tax cuts pushed through by the Reagan administration in 1981: as it became clear that the tax cuts were unaffordable, Congress significantly cut domestic spending, including Social Security, and increased taxes multiple times.

This means that Trump’s plan would exponentially balloon the national debt or would have to be paid for with a mix of spending cuts and tax increases. This is roughly what happened after the tax cuts pushed through by the Reagan administration in 1981: as it became clear that the tax cuts were unaffordable, Congress significantly cut domestic spending, including Social Security, and increased taxes multiple times.

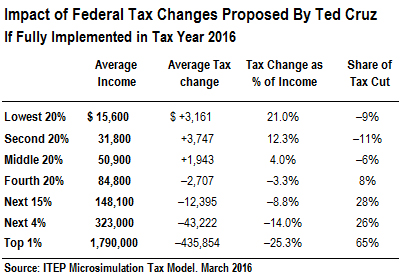

Under Cruz’s plan, the bottom 20 percent of taxpayers would see an average annual tax increase of $3,161, the second 20 percent would see an average annual tax increase of $3,747 and the middle 20 percent would get an average annual tax increase of $1,943. This means that the poorest sixty percent of Americans would, as a group, see substantial tax increases under the tax changes proposed by Cruz.

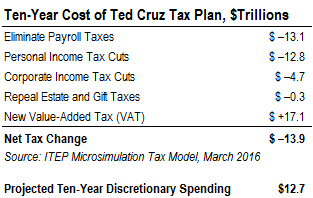

Under Cruz’s plan, the bottom 20 percent of taxpayers would see an average annual tax increase of $3,161, the second 20 percent would see an average annual tax increase of $3,747 and the middle 20 percent would get an average annual tax increase of $1,943. This means that the poorest sixty percent of Americans would, as a group, see substantial tax increases under the tax changes proposed by Cruz. The tax changes proposed by Cruz would, if hypothetically fully implemented in tax year 2016, reduce federal tax collections by $13.9 trillion over the next decade. This includes $30.9 trillion in income, payroll, corporate and estate tax cuts, partially offset by a new value-added tax that would likely raise $17.1 trillion over the next decade. Our analysis shows the impact in 2016 because that is the first year for which Cruz would, as President, likely be able to affect income tax laws.

The tax changes proposed by Cruz would, if hypothetically fully implemented in tax year 2016, reduce federal tax collections by $13.9 trillion over the next decade. This includes $30.9 trillion in income, payroll, corporate and estate tax cuts, partially offset by a new value-added tax that would likely raise $17.1 trillion over the next decade. Our analysis shows the impact in 2016 because that is the first year for which Cruz would, as President, likely be able to affect income tax laws.

Nabisco, the purveyor of Oreos and ‘Nilla wafers, is facing

Nabisco, the purveyor of Oreos and ‘Nilla wafers, is facing  Thanks for reading the Tax Justice Digest. In the Digest we recap the latest reports, posts, and analyses from Citizens for Tax Justice and the Institute on Taxation and Economic Policy.

Thanks for reading the Tax Justice Digest. In the Digest we recap the latest reports, posts, and analyses from Citizens for Tax Justice and the Institute on Taxation and Economic Policy.

One truism of American politics, often touted by governors on the campaign trail, is that state governments have to get stuff done. Thanks to the requirements that they balance their budgets each year, governors and state legislatures are forced to work across the aisle.

One truism of American politics, often touted by governors on the campaign trail, is that state governments have to get stuff done. Thanks to the requirements that they balance their budgets each year, governors and state legislatures are forced to work across the aisle. Wendy’s: Where’s the tax payments?

Wendy’s: Where’s the tax payments?