March 17, 2016 10:45 AM | Permalink |

Read this report in PDF.

Tax Plan Targets Biggest Tax Cuts for the Best-off Americans

An updated Citizens for Tax Justice analysis of presidential candidate Donald Trump’s tax plan reveals that it would add $12.0 trillion to the national debt over a decade. More than one-third of these tax cuts, $4.4 trillion, would go to the top one percent of taxpayers. Trump’s tax cuts would have to be paired with $12 trillion in spending cuts to avoid massive budget deficits, meaning this plan could require eliminating 94 percent of all discretionary spending to make up for its cost. This analysis also finds that if Congress chooses to pay for the Trump plan’s tax cuts with a mix of spending cuts and tax increases, the net impact of the Trump tax plan would provide an even greater boon to the wealthy and be even more detrimental to low- and middle-income taxpayers.

A Majority of Trump’s Tax Cut Would Go to the Top Five Percent of Taxpayers

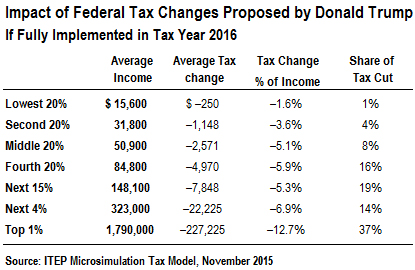

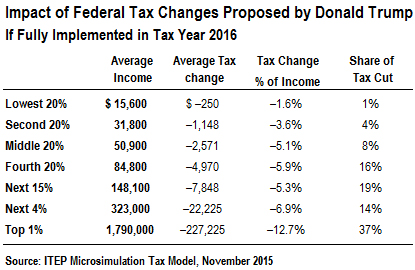

Under Trump’s plan, the top one percent of taxpayers would see an average annual tax cut of $227,225. In contrast, the lowest 20 percent of taxpayers would see an average annual tax cut of just $250 and the middle 20 percent of taxpayers would see $2,571.

Under Trump’s plan, the top one percent of taxpayers would see an average annual tax cut of $227,225. In contrast, the lowest 20 percent of taxpayers would see an average annual tax cut of just $250 and the middle 20 percent of taxpayers would see $2,571.

More than half of Trump’s proposed tax cuts would go to the top five percent of taxpayers, with 37 percent going just to the top one percent. Despite making the first goal of his tax plan “Tax relief for middle class Americans”, it is worth noting that only 13 percent of the overall tax cut would go to the bottom 60 percent of Americans. This regressive pattern reflects the fact that Trump would sharply reduce top personal and corporate income tax rates, while at the same time eliminating the estate tax and alternative minimum tax.

Evaluating the Impact of Paying for the Trump Tax Cuts

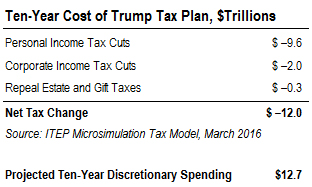

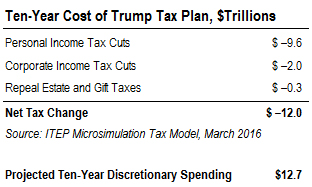

The tax changes proposed by Trump would, if hypothetically fully implemented in this year, reduce federal tax collections by $12 trillion over the next decade. This includes $9.6 in personal income tax cuts, $2 trillion in corporate income tax cuts, and the $300 billion cost of repealing estate and gift taxes. Our analysis shows the impact in 2016 because that is the first year for which Trump would, as President, likely be able to affect income tax laws.

The tax changes proposed by Trump would, if hypothetically fully implemented in this year, reduce federal tax collections by $12 trillion over the next decade. This includes $9.6 in personal income tax cuts, $2 trillion in corporate income tax cuts, and the $300 billion cost of repealing estate and gift taxes. Our analysis shows the impact in 2016 because that is the first year for which Trump would, as President, likely be able to affect income tax laws.

While candidate Trump has not specified how he proposes to pay for his tax plan, he would have to cut discretionary spending, which the Congressional Budget Office (CBO) estimates will be $12.7 trillion over the next ten years, by 94 percent to offset the $12.0 trillion 10-year cost of his tax cuts. In other words, defense, environmental protection, food safety and the whole host of other discretionary spending programs would have to be almost entirely eliminated to pay for the tax plan.

This means that Trump’s plan would exponentially balloon the national debt or would have to be paid for with a mix of spending cuts and tax increases. This is roughly what happened after the tax cuts pushed through by the Reagan administration in 1981: as it became clear that the tax cuts were unaffordable, Congress significantly cut domestic spending, including Social Security, and increased taxes multiple times.

This means that Trump’s plan would exponentially balloon the national debt or would have to be paid for with a mix of spending cuts and tax increases. This is roughly what happened after the tax cuts pushed through by the Reagan administration in 1981: as it became clear that the tax cuts were unaffordable, Congress significantly cut domestic spending, including Social Security, and increased taxes multiple times.

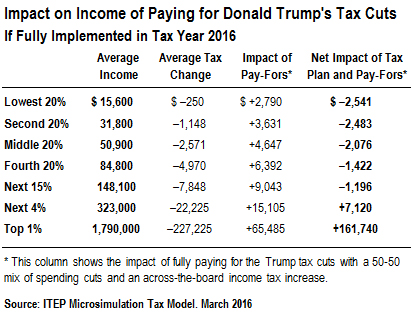

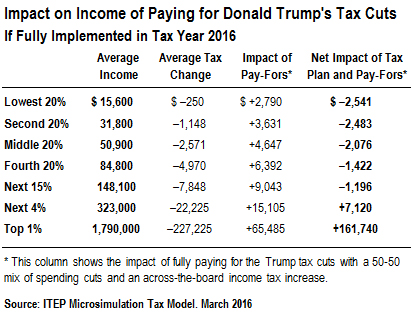

The table at right shows the net impact of Trump’s tax plan for Americans at different income levels, from implementing the tax plan and then fully offsetting its cost by enacting a mix of “pay fors” composed half of spending cuts and half of across-the-board income tax increases.[1] The spending cuts are allocated across income groups on a per-capita basis, with the same dollar impact on every American adult and child from these cuts.

CTJ’s analysis finds that these “pay-fors” would be a substantial cost for taxpayers at all income levels, and that low- and middle-income families would be especially hard hit. In particular:

- The poorest 20 percent of Americans, initially seeing a tax cut averaging $250 from the Trump tax plan, would pay an additional $2,790 in the form of additional tax hikes and spending cuts as a result of the “pay-fors.” For this income group, the “pay-fors” are more than ten times the size of the tax cut they would initially receive.

- Middle-income families, initially seeing a tax cut averaging $2,571 from the Trump tax plan, would pay an additional $4,647 in tax hikes and spending cuts as a result of the “pay fors.” For this income group, the “pay-fors” are just under twice the size of the tax cut they would initially receive.

- The best off 1 percent of Americans, initially seeing a tax cut averaging $227,225, would lose an average of $65,485 of those tax cuts from the “pay-fors,” leaving them with a still-enormous net tax cut averaging $161,740.

To be clear, the “pay-fors” outlined here are hypothetical. Trump has not said he would seek increases in other taxes to pay for the tax changes he has proposed. If, in keeping with this statement, the Trump tax cuts were paid for entirely with spending cuts, the net impact on low- and middle-income families of the Trump plan would likely be an even bigger cost than is shown here.

Appendix: Proposed Tax Changes in the Trump Plan

The plan’s tax cuts include:

- Reduce the top personal income tax rate from 39.6 percent to 25 percent, and reduce the number of tax brackets from 7 to 3.

- Reduce the federal corporate income tax rate from 35 to 15 percent.

- Reduce the top tax rate on “pass-through” business income from 39.6 to 15 percent.

- Eliminate the 3.8 percent high-income surtax on unearned income that was enacted as part of President Barack Obama’s health care reforms.

- Eliminate the Alternative Minimum Tax, which was designed to ensure that the wealthiest Americans pay at least a minimal amount of tax.

- Increase the standard deduction to $25,000 for single filers and $50,000 for married couples.

- Eliminate the estate tax.

The plan also includes a few revenue-raising provisions:

- Reduce some itemized deductions and exemptions for high-income taxpayers by a larger percentage than under current law. Deductions for mortgage interest and charitable contributions would not be reduced.

- End the deferral of income taxes on corporate income booked in other countries, and cap the deductibility of business interest expenses.

- Ostensibly repeal the “carried interest” loophole for investment fund managers, but this change would be gutted by Trump’s lower income tax rates.

- Trump also says his plan “reduces or eliminates other loopholes for the very rich and special interests … [and] some corporate loopholes that cater to special interests,” but gives no further details on these potential revenue raisers.

[1] Citizens for Tax Justice, “The Net Effect: Paying for GOP Tax Plans Would Wipe Out Income Gains for Most Americans,” March 9, 2016. https://ctj.sfo2.digitaloceanspaces.com/pdf/neteffectreport0316.pdf

*The revenue and distributional estimate have been updated to include the impact of reducing the top tax rate on pass-through income to 15 percent. The impact of this provision increased the total revenue impact from $10.8 to $12 trillion and increased the tax break for those in the top quintiles substantially.

![]()

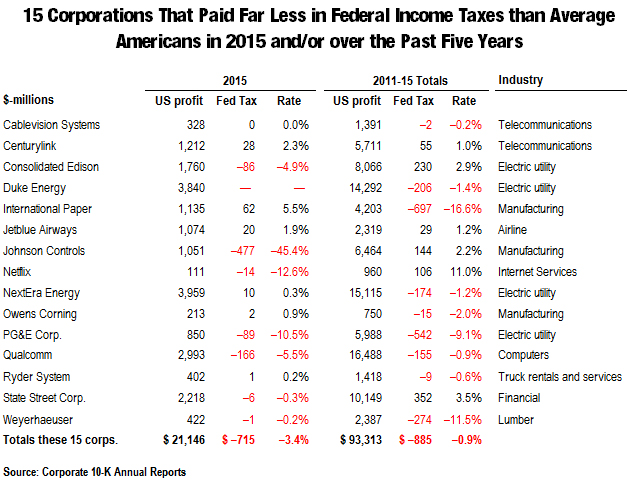

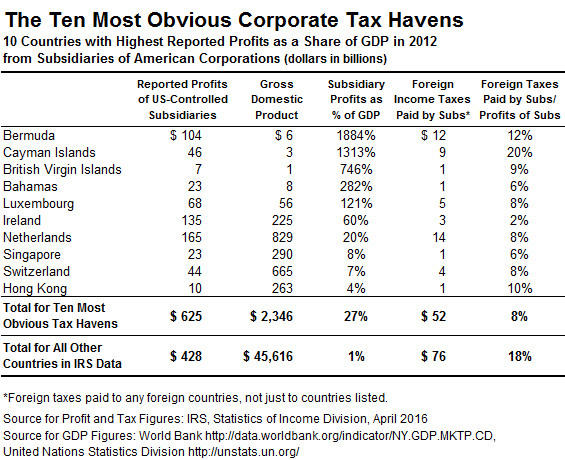

These 10 countries have either zero tax rates or provide loopholes that allow corporate profits to go largely untaxed in many circumstances. The two columns on the right side of the table on page one show the amount of corporate income taxes paid on the subsidiary profits to the country where they were supposedly earned or any other foreign country. This is shown first as a dollar figure and then as a percentage of the profits supposedly earned in that country.

These 10 countries have either zero tax rates or provide loopholes that allow corporate profits to go largely untaxed in many circumstances. The two columns on the right side of the table on page one show the amount of corporate income taxes paid on the subsidiary profits to the country where they were supposedly earned or any other foreign country. This is shown first as a dollar figure and then as a percentage of the profits supposedly earned in that country.

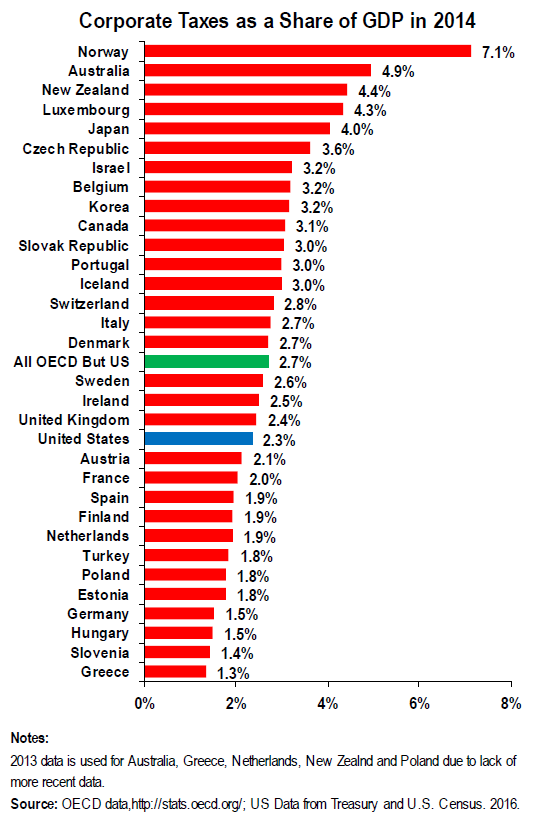

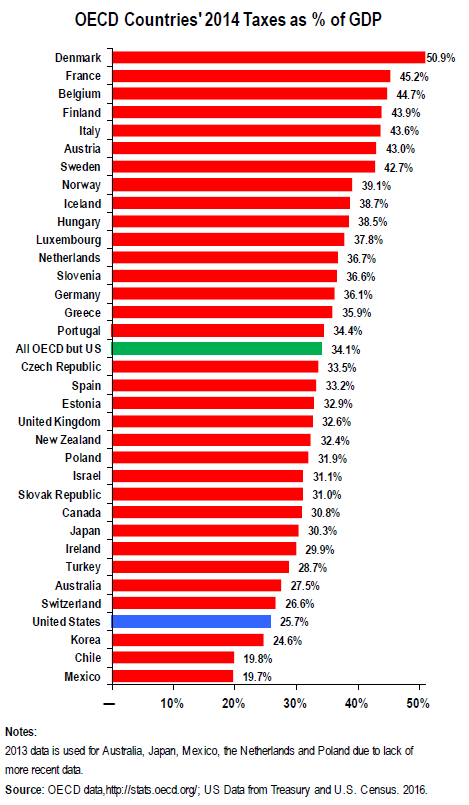

The most recent data from the Organization for Economic Cooperation and Development (OECD) show that the United States is one of the least taxed developed nations.

The most recent data from the Organization for Economic Cooperation and Development (OECD) show that the United States is one of the least taxed developed nations.  Under Trump’s plan, the top one percent of taxpayers would see an average annual tax cut of $227,225. In contrast, the lowest 20 percent of taxpayers would see an average annual tax cut of just $250 and the middle 20 percent of taxpayers would see $2,571.

Under Trump’s plan, the top one percent of taxpayers would see an average annual tax cut of $227,225. In contrast, the lowest 20 percent of taxpayers would see an average annual tax cut of just $250 and the middle 20 percent of taxpayers would see $2,571. The tax changes proposed by Trump would, if hypothetically fully implemented in this year, reduce federal tax collections by $12 trillion over the next decade. This includes $9.6 in personal income tax cuts, $2 trillion in corporate income tax cuts, and the $300 billion cost of repealing estate and gift taxes. Our analysis shows the impact in 2016 because that is the first year for which Trump would, as President, likely be able to affect income tax laws.

The tax changes proposed by Trump would, if hypothetically fully implemented in this year, reduce federal tax collections by $12 trillion over the next decade. This includes $9.6 in personal income tax cuts, $2 trillion in corporate income tax cuts, and the $300 billion cost of repealing estate and gift taxes. Our analysis shows the impact in 2016 because that is the first year for which Trump would, as President, likely be able to affect income tax laws. This means that Trump’s plan would exponentially balloon the national debt or would have to be paid for with a mix of spending cuts and tax increases. This is roughly what happened after the tax cuts pushed through by the Reagan administration in 1981: as it became clear that the tax cuts were unaffordable, Congress significantly cut domestic spending, including Social Security, and increased taxes multiple times.

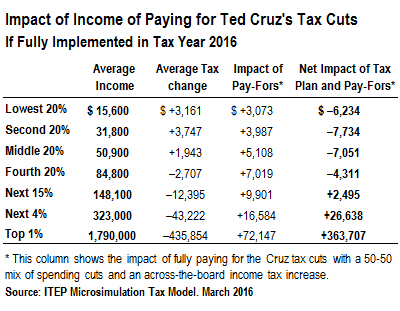

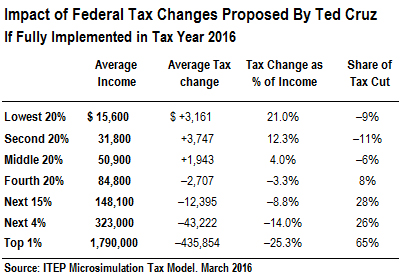

This means that Trump’s plan would exponentially balloon the national debt or would have to be paid for with a mix of spending cuts and tax increases. This is roughly what happened after the tax cuts pushed through by the Reagan administration in 1981: as it became clear that the tax cuts were unaffordable, Congress significantly cut domestic spending, including Social Security, and increased taxes multiple times. Under Cruz’s plan, the bottom 20 percent of taxpayers would see an average annual tax increase of $3,161, the second 20 percent would see an average annual tax increase of $3,747 and the middle 20 percent would get an average annual tax increase of $1,943. This means that the poorest sixty percent of Americans would, as a group, see substantial tax increases under the tax changes proposed by Cruz.

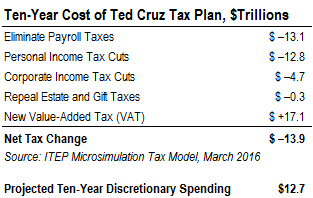

Under Cruz’s plan, the bottom 20 percent of taxpayers would see an average annual tax increase of $3,161, the second 20 percent would see an average annual tax increase of $3,747 and the middle 20 percent would get an average annual tax increase of $1,943. This means that the poorest sixty percent of Americans would, as a group, see substantial tax increases under the tax changes proposed by Cruz. The tax changes proposed by Cruz would, if hypothetically fully implemented in tax year 2016, reduce federal tax collections by $13.9 trillion over the next decade. This includes $30.9 trillion in income, payroll, corporate and estate tax cuts, partially offset by a new value-added tax that would likely raise $17.1 trillion over the next decade. Our analysis shows the impact in 2016 because that is the first year for which Cruz would, as President, likely be able to affect income tax laws.

The tax changes proposed by Cruz would, if hypothetically fully implemented in tax year 2016, reduce federal tax collections by $13.9 trillion over the next decade. This includes $30.9 trillion in income, payroll, corporate and estate tax cuts, partially offset by a new value-added tax that would likely raise $17.1 trillion over the next decade. Our analysis shows the impact in 2016 because that is the first year for which Cruz would, as President, likely be able to affect income tax laws.