July 14, 2015 02:18 PM | Permalink |

Read the report as a PDF.

The U.S. system of taxing multinational corporations’ earnings encourages companies to direct more investment abroad, either in reality or on paper. The fact that the earnings of the foreign subsidiaries of U.S. corporations are not taxed until they are officially transferred to the domestic parent company leads to an incentive to “permanently reinvest” funds in low-tax jurisdictions and indefinitely defer paying U.S. taxes. This incentive has resulted in multinationals parking huge sums of profits in tax havens (such as Luxembourg, Bermuda, and the Cayman Islands). This report explains and compares several proposals to address this issue, including a repatriation holiday, deemed repatriation, and ending the deferral of taxes on U.S. multinational corporations’ foreign earnings.

Current Deferral System Encourages Use of Tax Havens

U.S. multinational corporations’ offshore cash holdings nearly doubled between 2008 and 2013 to more than $2.1 trillion.[1] Why is such a huge sum held abroad and designated as “permanently reinvested”? The answer has to do with the way the U.S. corporate income tax system treats the earnings of foreign subsidiaries of U.S. multinational corporations. In a residential (or worldwide) tax system, residents are taxed on their worldwide income, regardless of the source. At the other end of the spectrum is a territorial tax system, in which corporate income taxes are only collected on income earned within the country. The U.S. has a hybrid of these two systems — taxes are collected both on income earned domestically and, in theory, the income corporations earn abroad. However, corporations can defer paying taxes on foreign income until they “repatriate” foreign profits (i.e., paid to the U.S. parent company as dividends). Additionally, the U.S. tax system provides a foreign tax credit on repatriated income, which is a dollar-for-dollar reduction in U.S. tax liability to offset any taxes paid to foreign governments (limited to the total U.S. tax that would be due in cases where the foreign tax rate is higher than the U.S. rate).

This deferral system creates a tax incentive for multinational corporations to increase the share of earnings they book abroad (at least on paper). While corporations may legitimately earn some of these profits via foreign subsidiaries, this system also encourages companies to disguise profits earned in the U.S. as foreign profits for the sole purpose of avoiding U.S. taxes. Further, corporations hold a large portion of profits in tax havens, so many pay little to nothing in foreign taxes. IRS data showed that 54 percent of multinationals’ reported foreign earnings in 2010 were in 12 jurisdictions widely considered to be tax havens.[2] CTJ’s 2014 Offshore Shell Games report found that 362 Fortune 500 companies (72 percent) had at least 7,827 subsidiaries in offshore tax havens as of 2013.[3] Multinationals are avoiding an estimated $90 billion or more in U.S. taxes each year by booking profits in tax havens.[4]

International Tax Reform Should Tax Existing Offshore Profits and Discourage Further Offshoring

In the past several years, proposals for a “repatriation holiday” or a “deemed repatriation” have become increasingly popular among lawmakers. Under a repatriation holiday, corporations can voluntarily repatriate foreign earnings for a limited time at a sharply reduced tax rate. Proponents tout proposals for a repatriation holiday as a way to encourage U.S. multinationals to bring home some of the $2.1 trillion that the U.S. government has not taxed. A deemed repatriation would treat all accumulated foreign earnings as repatriated, regardless of whether they are actually brought back to the United States, but would also tax them at a lower rate than the 35 percent statutory corporate rate. While both of these proposals would lead to a short-run increase in revenue by collecting taxes on those offshore profits that are currently deferred, the reduced rates would result in decreased revenue in the longer run, in part by encouraging corporations to move even more of their earnings offshore. Instead of rewarding corporations for dodging U.S. taxes, lawmakers should end the system of deferral that encourages them to do so, while taxing their offshore profits at the full 35 percent rate (while still allowing for a foreign tax credit).

|

A COMPARISON OF THREE TYPES OF REPATRIATION PROPOSALS

|

|

|

Existing Offshore Earnings

|

Future Offshore Earnings

|

|

Repatriation Holiday

|

Earnings that are voluntarily repatriated would be taxed at a reduced rate

|

Tax would continue to be deferred until repatriated. The incentive to increase permanently reinvested earnings would be even larger as corporations anticipate future repatriation holidays.

|

|

Deemed Repatriation

|

One-time tax would be levied on all permanently reinvested earnings. Current proposals would tax earnings at a reduced rate

|

Tax would continue to be deferred until repatriated. If deemed repatriation is enacted as a transition tax, the taxation of future earnings would depend on the specifics of the reform.

|

|

Ending Deferral

|

Would probably tax existing earnings over a period of time, possibly at a reduced tax rate.

|

Would tax all offshore earnings, regardless of whether they are repatriated.

|

Repatriation Tax Proposals Background

Under a repatriation holiday, companies are not required to repatriate their foreign profits but may do so to take advantage of the low tax rate. Lawmakers first conceived of repatriation holidays as tools for economic stimulus under the assumption that they would give companies an incentive to use profits that were “trapped” offshore to increase domestic investment, spurring job creation. This was the rationale for a repatriation holiday enacted in 2004 as part of the American Jobs Creation Act (P.L. 108-357), which, for a limited time, allowed corporations to repatriate their offshore earnings at a rate of 5.25 percent (in contrast to the 35 percent statutory corporate rate). Members of Congress put forth proposals for a repeat of a similar repatriation holiday during the Great Recession and subsequent recovery, but they never passed. More recently, lawmakers have proposed repatriation holidays to replenish the Highway Trust Fund.

In contrast to a repatriation holiday, a deemed repatriation would require multinationals to pay a tax on their previously untaxed offshore earnings, regardless of whether they are actually repatriated. While deemed repatriation could tax these earnings at the full corporate rate, the recent proposals all provide for a reduced rate. Most of these proposals have been part of broader corporate tax overhaul proposals, and the tax collected on accumulated offshore earnings would be considered a “transition tax” as the U.S. moves to a new tax regime. The table in the appendix details the various repatriation tax proposals that have been put forth.

Problems with a Repatriation Holiday

Effectiveness

While some proposals for repatriation holidays are defended as economic stimuli (such as those by Rep. Kevin Brady and Sen. John McCain and Rep. Trent Franks), there is no evidence that they have this effect. A report by the Congressional Research Service found that the 2004 repatriation holiday did not lead to job creation or economic growth.[5] Instead, there is evidence that corporations distributed a large portion of repatriated profits to shareholders via higher dividends or stock repurchases or used the money to increase executive pay. Although the law intended to prohibit these uses of repatriated funds, corporations could use these funds for already budgeted expenses, freeing up cash for “prohibited” uses. Some of the newer proposals, including the Sen. Barbara Boxer/Sen. Rand Paul and Sen. Ron Wyden bills, include similar restrictions to the earlier repatriation holiday, but the fungibility of corporations’ funds would make them impossible to enforce. Those companies that benefitted the most from the 2004 repatriation were no more likely than other corporations to use the repatriated funds for growth-generating activities.[6] In fact, many of the companies that took advantage of the repatriation holiday actually reduced their domestic workforces in subsequent years.[7]

Additionally, claims that repatriation holidays will free up funds that would otherwise be “trapped” offshore are contradicted by findings that much or most of these funds are already invested in the U.S. economy. A study by the Senate Permanent Subcommittee on Investigations surveying 27 corporations, including the 15 that repatriated the most funds during the 2004 repatriation holiday, found that at least 46 percent of their offshore “permanently reinvested” earnings were actually invested in U.S. assets like Treasury bonds, U.S. stocks, and U.S. bank deposits by the American corporations’ controlled foreign subsidiaries.[8] Multinationals are theoretically prohibited from using these funds to invest in their own U.S. operations, pay shareholder dividends, or repurchasing stock, but they can get around this by borrowing at low interest rates, using their foreign earnings as implied collateral.

Fiscal Issues

Another failure of repatriation holidays is that while they may increase revenue in the first few years, they result in a significant revenue loss in the long run, as profits are repatriated early, leaving less to be repatriated later, and as firms are encouraged to move even more profits abroad in anticipation of another tax holiday. A previous CTJ report found that the 20 corporations that repatriated the most offshore profits under the 2004 holiday nearly tripled the amount of their cash “permanently reinvested” offshore between 2005 and 2010, indicating that they are indeed hoping for another repatriation holiday to take advantage of the lower rates.[9] The Joint Committee on Taxation (JCT) estimated that the Boxer/Paul proposal, which is similar to the 2004 repatriation holiday but with a rate of 6.5 percent, would cost $118 billion in revenue over ten years.[10] Thus, proposals that would use revenues from repatriation to fund infrastructure improvements or save the Highway Trust Fund (see, for instance, the bills proposed by Rep. John Delaney and by Sens. Boxer and Paul) are simply gimmicks that raise money in the very short run but lose much more revenue thereafter.

Fairness Issues

Another big problem with repatriation holidays is that they reward corporations for aggressive tax avoidance. Corporations that have shifted profits into offshore tax havens have more to gain from repatriation holidays since they have paid little or no foreign taxes to offset their U.S. tax liability. These companies can also more easily move funds into tax havens compared to companies whose foreign investments are in things like buildings and equipment. One study found that the companies that repatriated under the 2004 holiday were on average larger and had lower effective foreign tax rates than those that did not repatriate, suggesting that the repatriating companies use foreign operations as tax-avoidance strategies.[11] IRS data show that three quarters of funds repatriated during the 2004 holiday had previously been held in tax haven jurisdictions.[12] Additionally, around half of the repatriations were by pharmaceutical and technological companies, who can more easily shift U.S. earnings offshore by transferring intellectual property such as patents and copyrights to their foreign subsidiaries.[13]

Problems with Deemed Repatriation

A deemed repatriation of accumulated offshore earnings can be viewed as either a tax increase or a tax cut in the context of the current international tax system, depending on whether those earnings would have ever been repatriated. Earnings that are actually permanently invested in operations abroad may never be repatriated, and since those earnings aren’t taxed under the deferral system, a deemed repatriation would result in a tax increase. However, because a significant portion of permanently reinvested earnings are not invested in actual operations and may eventually be repatriated at the full 35 percent rate, a deemed repatriation at a lower rate would represent a tax break on these earnings. Just as with a repatriation holiday, a low preferential rate may encourage corporations to shift more of their future earnings abroad in anticipation of another future deemed repatriation and would provide the greatest rewards to the most egregious tax dodgers. A CTJ analysis of President Obama’s proposal for a 14 percent transition tax identified 10 major corporations, each with at least $17 billion in “permanently reinvested” offshore profits, that would collectively owe $82 billion less in taxes than if the full 35 percent rate was applied.[14]

Another problem common to both deemed repatriation and repatriation holiday proposals is that they are short-sighted. A large portion of the revenues raised is likely to simply reflect the shifting forward of revenues that would have been received from foreign income repatriated in later years. The actual revenue implications of a deemed repatriation will depend on what portion of permanently reinvested earnings would have later been repatriated. JCT estimated that President Obama’s transition tax, which is payable over five years, would raise revenue in the first five years, but lose revenue in the next five years.[15] Therefore, proposals to fund the Highway Trust Fund with revenues from deemed repatriation (including the Obama, Delaney, and Camp plans) are only short-term solutions in contrast to a more sustainable solution, such as increasing the gasoline tax.[16]

One concern that has been raised about a deemed repatriation is that companies with investments in non-cash assets abroad (e.g. factories) may not have the liquidity to cover their U.S. tax liability. The tax reform proposal by the former Ways and Means Chairman Dave Camp proposal attempted to address this issue by setting a lower rate on non-cash assets than on cash and other more liquid assets. However, it is likely that corporations with non-cash foreign investments (as opposed to those with liquid assets held in tax havens) are already paying significant foreign taxes and would have little or no U.S. tax liability under a deemed repatriation once foreign tax credits are taken into account. In the event that corporations do face liquidity challenges, most proposals mitigate this problem by allowing the tax to be paid over several years.

Ending Deferral of Tax on Foreign Earnings is a Better Long-Term Solution

If Congress wants to increase revenues and encourage domestic investment, it needs to minimize the incentive for U.S. multinationals to shift profits to tax havens in the first place. It could accomplish this by ending the policy of deferring taxes on foreign income. This would mean that corporations would pay the same rate on all income, whether it is earned at home or abroad (or earned in the U.S., but disguised as foreign earnings). Plus, the tax would be due as the income is earned, eliminating the potential for perpetual deferral. In the transition to a new system without deferral, the $2.1 trillion currently designated as permanently reinvested should also be taxed at the full corporate rate (adjusted for foreign tax credits) over a period of time. As momentum gathers around international tax reform, ending deferral is an option that needs to be on the table. It would succeed where repatriation holidays and deemed repatriations fail.

|

APPENDIX: RECENT REPATRIATION TAX PROPOSALS

|

|

Proposed Repatriation Measure

|

Voluntary or Mandatory

|

Part of Comprehensive Reform Proposal?

|

Proposed Maximum Rate

|

Notes

|

|

Obama 2016 Budget Proposal – Transition Tax

|

Mandatory

|

Yes

|

14%

|

- JCT estimated tax would raise $217 billion over 10 years

- Payable over 5 years

- Revenues would go to transportation infrastructure

|

|

Senators Barbara Boxer and Rand Paul – Repatriation Holiday (Invest in Transportation Act, 2015)

|

Voluntary

|

No

|

6.5%

|

- JCT estimated bill would cost $118 billion over 10 years in lost revenue

- Revenues would be transferred to Highway Trust Fund

|

|

Rep. John Delaney – Deemed Repatriation (Infrastructure 2.0 Act, 2015)

|

Mandatory

|

Yes

|

8.75%

|

- Estimated to raise $170 billion over 10 years

- Revenues would go to replenish Highway Trust Fund and capitalize an American Infrastructure Fund

|

|

Rep. John Delaney – Repatriation Holiday (Partnership to Build America Act, 2015)

|

Voluntary

|

No

|

0%*

|

- *While repatriated funds would technically be tax-free, corporations would only be allowed to repatriate a certain amount for each dollar of “qualified infrastructure bonds” they purchase, so the effective tax rate would vary

|

|

Rep. Dave Camp -Transition Tax (Tax Reform Act of 2014)

|

Mandatory

|

Yes

|

8.75%

|

- JCT estimated that proposal would raise $170 billion over 10 years

- 8.75% rate would apply to cash and other liquid assets, while a 3.5% rate would apply to non-liquid assets

- Payable over 8 years

|

|

Sen. Max Baucus -Transition Tax (International Business Tax Reform Discussion Draft, 2013)

|

Mandatory

|

Yes

|

20%

|

|

|

Sen. Ron Wyden -Transition Tax (Bipartisan Tax Fairness and Simplification Act of 2011)

|

Voluntary

|

Yes

|

5.25%

|

- Tax would serve as a transition to a system that would end deferral of tax on foreign earnings

|

|

2004 Repatriation Holiday (American Jobs Creation Act of 2004)

|

Voluntary

|

No

|

5.25%

|

|

[1] Citizens for Tax Justice, Dozens of Companies Admit Using Tax Havens, April 1, 2015.

[2] Citizens for Tax Justice, American Corporations Report Over Half of Their Offshore Profits as Earned in 12 Tax Havens, May 28, 2014.

[3] Citizens for Tax Justice, Offshore Shell Games 2014, June 4, 2014.

[4] Kimberly A. Clausing, “The Revenue Effects of Multinational Firm Income Shifting,” Tax Notes, March 28, 2011, 1560-1566.

[5] Donald J. Marples and Jane G. Gravelle, Congressional Research Service, “Tax Cuts on Repatriation Earnings as Economic Stimulus: An Economic Analysis,” May 27, 2011. https://ctj.sfo2.digitaloceanspaces.com/pdf/crs_repatriationholiday.pdf

[6] Roy Clemons and Michael R. Kinney, “An Analysis of the Tax Holiday for Repatriation Under the Jobs Act,” Tax Analysts Special Report, October 20, 2008.

[7] See note 5.

[8] United States Senate, Permanent Subcommittee on Investigations, Committee on Homeland Security and Governmental Affairs, “Offshore Funds Located Onshore: Majority Staff Report Addendum,” December 14, 2011. http://www.hsgac.senate.gov/download/report-addendum_-psi-majority-staff-report-offshore-funds-located-onshore

[9] Citizens for Tax Justice, Data on Top 20 Corporations Using Repatriation Amnesty Calls into Question Claims of New Democrat Network, August 26, 2011.

[10] Richard Rubin, “Repatriation Tax Break from Boxer, Paul Cost $118 Billion,” Bloomberg Business, April 30, 2015. http://www.bloomberg.com/news/articles/2015-04-30/repatriation-tax-break-from-paul-boxer-would-cost-118-billion

[11] See note 6.

[12] Americans for Tax Fairness, ”Repatriated Dividends from 12 Tax Havens Due to the 2004 Tax Holiday Legislation, 2004 — 2006.” http://www.americansfortaxfairness.org/files/Repatriated-Funds-from-Tax-Havens-2004-2006.pdf

[13] Chuck Marr and Chye-Ching Huang, Repatriation Tax Holiday Would Lose Revenue And Is a Proven Policy Failure, Center on Budget and Policy Priorities, June 20, 2014. http://www.cbpp.org/research/repatriation-tax-holiday-would-lose-revenue-and-is-a-proven-policy-failure?fa=view&id=4154#_ftn14

[14] Citizens for Tax Justice, Ten Corporations Would Save $82 Billion in Taxes Under Obama’s Proposed 14% Transition Tax, February 3, 2015.

[15] Joint Committee on Taxation, “Estimated Budget Effects of the Revenue Provisions Contained in the President’s Fiscal Year 2016 Budget Proposal,” March 6, 2015. https://www.jct.gov/publications.html?func=startdown&id=4739

[16] Davis, Carl, Adding Sustainability to the Highway Trust Fund, Testimony for the House Committee on Ways and Means Hearing on Long-Term Financing of the Highway Trust Fund. Institute on Taxation and Economic Policy, June 17, 2015.

![]()

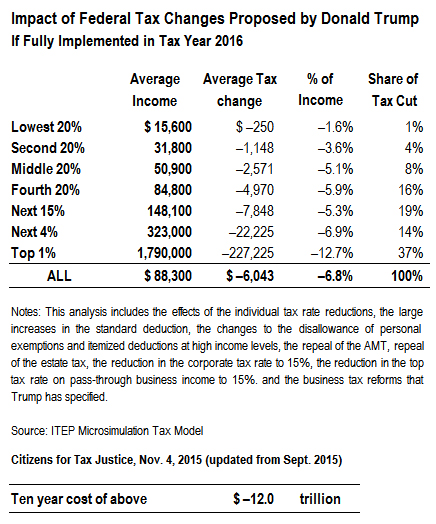

Whether the candidates’ positions on taxes will be discussed during tonight’s Republican candidate’s debate remains to be seen, but tax policy will be a central issue this election cycle. By now, it’s apparent to most Americans that the notion that politicians can keep cutting individuals and corporate taxes and adequately pay for the programs and services the public broadly wants is simply false. Besides defining their public policy positions, every political candidate should tell the public how they plan to fund the nation’s priorities. Although not every candidate has staked out a clear position on taxes, nearly all have either a legislative record or have made public statements about the tax policies they support. Not surprisingly, most of the Republican candidates are toeing the party line on taxes, some more radically than others.

Whether the candidates’ positions on taxes will be discussed during tonight’s Republican candidate’s debate remains to be seen, but tax policy will be a central issue this election cycle. By now, it’s apparent to most Americans that the notion that politicians can keep cutting individuals and corporate taxes and adequately pay for the programs and services the public broadly wants is simply false. Besides defining their public policy positions, every political candidate should tell the public how they plan to fund the nation’s priorities. Although not every candidate has staked out a clear position on taxes, nearly all have either a legislative record or have made public statements about the tax policies they support. Not surprisingly, most of the Republican candidates are toeing the party line on taxes, some more radically than others.