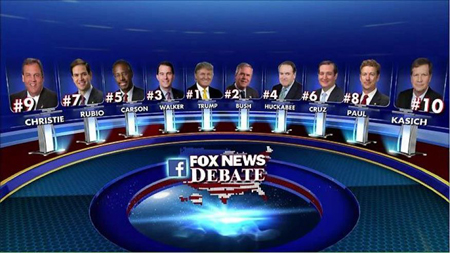

August 6, 2015 10:31 AM | Permalink | ![]()

Whether the candidates’ positions on taxes will be discussed during tonight’s Republican candidate’s debate remains to be seen, but tax policy will be a central issue this election cycle. By now, it’s apparent to most Americans that the notion that politicians can keep cutting individuals and corporate taxes and adequately pay for the programs and services the public broadly wants is simply false. Besides defining their public policy positions, every political candidate should tell the public how they plan to fund the nation’s priorities. Although not every candidate has staked out a clear position on taxes, nearly all have either a legislative record or have made public statements about the tax policies they support. Not surprisingly, most of the Republican candidates are toeing the party line on taxes, some more radically than others.

Whether the candidates’ positions on taxes will be discussed during tonight’s Republican candidate’s debate remains to be seen, but tax policy will be a central issue this election cycle. By now, it’s apparent to most Americans that the notion that politicians can keep cutting individuals and corporate taxes and adequately pay for the programs and services the public broadly wants is simply false. Besides defining their public policy positions, every political candidate should tell the public how they plan to fund the nation’s priorities. Although not every candidate has staked out a clear position on taxes, nearly all have either a legislative record or have made public statements about the tax policies they support. Not surprisingly, most of the Republican candidates are toeing the party line on taxes, some more radically than others.

Over the last six months, CTJ has scoured its own archives as well as public archives to produce a series of blog posts outlining the presidential candidates’ record on taxes.

Donald Trump “[Trumps] more recent proposals, in contrast to ones he proposed back around the 2000 election, would likely sharply increase the national debt and make the U.S. tax system substantially more regressive by both cutting taxes for the rich and creating a massive new tax that would disproportionately hurt lower-income Americans.” Donald Trump’s Regressive and Retrograde Tax Plan – June 22, 2015 |

Jeb Bush “Of all the GOP presidential candidates, former Florida Gov. Jeb Bush has been the most tightlipped on federal tax reform. So far, Bush has kept his vision vague, calling for a “vastly simpler system” and “clearing out special favors for the few, reducing rates for all.” His record as governor of Florida and his recent public pronouncements suggest his tax reform proposals would likely focus on lopsided tax cuts.” Jeb Bush Loves Tax Cuts, Especially for the Rich – July 9, 2015

|

Scott Walker Scott Walker

“After his 2011 election, Wisconsin Gov. Scott Walker aggressively pursued and helped pass a series of tax cuts in 2011, 2013, 2014 and 2015. His policies pushed the state into bad fiscal straits and there is no evidence that tax changes enacted under his leadership have had the positive impact on the state’s economy that he promised. In addition, Gov. Walker has hinted that he favors repealing state and federal income taxes, a move that would make the tax system substantially more regressive.” Scott Walker’s Tax-Cut-Driven Economic Plan – July 28, 2015

|

Ben Carson “Dr. Ben Carson enters the Republican presidential field without any significant legislative experience so he doesn’t have a record on tax policy. But in a 2013 op-ed, the well-respected neurosurgeon explained his avid support for a flat tax system. The case Carson made for the flat tax is based on a number of falsehoods about our current tax system and how a flat tax would work in practice.” Dr. Ben Carson enters the Republican presidential field without any significant legislative experience so he doesn’t have a record on tax policy. But in a 2013 op-ed, the well-respected neurosurgeon explained his avid support for a flat tax system. The case Carson made for the flat tax is based on a number of falsehoods about our current tax system and how a flat tax would work in practice. “ Presidential Candidate Dr. Ben Carson Once Avidly Argued for a Flat Tax — And Got the Facts Wrong – May 5, 2015

|

Mike Huckabee “Despite having a relatively moderate record on tax policy as the governor of Arkansas, Mike Huckabee has wholeheartedly embraced a radically regressive tax plan as a central plank of his presidential candidate platform.” Would the Real Mike Huckabee Please Stand Up? – May 7, 2015

|

Ted Cruz “Texas Senator, and now presidential candidate, Ted Cruz is a supporter of radical tax plans that would dramatically increase taxes on poor and middle class Americans in order to pay for huge tax cuts for the wealthiest Americans.” How Presidential Candidate Ted Cruz Would Radically Increase Taxes on Everyone But the Rich – March 23, 2015

|

|

“Sen. Rubio’s newest tax deform plan is a much larger version of his gimmicky tax proposals of years past. In each case, he attempts to get credit for touting tax cuts, while at the same time hiding the real cost of his proposals. The crucial difference this time around is the sheer scale of the damage his tax reform plan would do to tax fairness, public programs and the U.S. economy if it were ever enacted.” Marco Rubio: The Great Tax Deformer – April 14, 2015

|

Rand Paul “No member of Congress has been more active in the cause of protecting tax cheaters and tax avoidance by our nation’s wealthiest individuals and corporations than Sen.(now presidential candidate) Rand Paul.” Rand Paul’s Record Shows He’s a Champion for Tax Cheats and the Wealthy – April 7, 2015

|

|

“During his five years in office, New Jersey Gov. and now presidential candidate Chris Christie has consistently blocked progressive tax increases and sought to pass regressive and fiscally irresponsible tax cuts. The starkest example of how Gov. Christie has sought to make New Jersey’s tax code more unfair is that he consistently vetoed a small tax rate increase on millionaires but (conveniently until this week) refused to reverse his cuts to the state’s earned income tax credit (EITC). On the federal level, Gov. Christie has similarly laid out a broad tax cut plan that would heavily favor the wealthiest taxpayers while simultaneously slashing federal revenue.” Chris Christie’s Long History of Opposition to Progressive Tax Policy – June 30, 2015

|

John Kasich “Nine-term congressman and current Ohio Gov. John Kasich has received accolades for his perceived position as the “moderate” or “compassionate” candidate in the 2016 GOP presidential race. It’s true that he embraced a few policies benefiting low-income families, notably the expansion of Medicaid, but a handful of progressive policies do not a moderate make. The bulk of Kasich’s economic agenda as a governor and former congressman has been pursuing tax cuts for the wealthy and increasing taxes on low- and middle-income families. “ John’s Kasich’s Uncompassionate Conservatism – August 5, 2015

|

Second-Tier Debate

|

“If his 2012 presidential campaign is any indication, former Texas Gov. Rick Perry will continue making a pitch in his 2016 presidential campaign for regressive tax policies and cuts in essential public services to fund tax breaks for the wealthy and corporations.” Rick Perry Supports a Federal Tax System Akin to Texas’s Regressive Tax System – June 4, 2015 |

“While Louisiana Governor Bobby Jindal has yet to lay out a specific tax plan in the run up to his presidential campaign announcement, he has fought to reduce taxes for the wealthy and corporations at the expense of everyone else. He outlined his vision in his 2013 plan that sought to eliminate the state’s income tax and replace it with revenue from an expanded sales tax, a reform that would dramatically cut taxes for the wealthy while increasing them for at the expense of low- and middle-income people.” Bobby Jindal’s Louisiana is a Cautionary Tale for the Nation – June 24, 2015

|

Carly Fiorina “Based on what we know from her time as a corporate CEO and a candidate for the U.S. Senate, Fiorina’s call for the public to stand up to the political class may be all talk. Instead, she may ally with corporate influencers.” Carly Fiorina Has Toed the Party Line on Taxes – May 11, 2015 |

“While Sen. Graham’s support of regressive tax proposals and the flat tax specifically place him well within the rightwing tax camp, his support for a variety of revenue-raising measures sets him somewhat apart from his rabidly anti-tax colleagues.” Lindsey Graham’s Moments of Moderation and Extremism on Tax Issues – June 18, 2015

|

|

“Former Pennsylvania senator and now Republican presidential candidate Rick Santorum has long touted himself as a champion of the “blue-collar” crowd, yet his record on tax policy indicates he’s more interested in championing hedge-fund moguls.” There’s Nothing Blue-Collar About Rick Santorum’s Tax Proposals – May 27, 2015

|

Jim Gilmore Jim Gilmore

Another Day, Another Republican Presidential Candidate with a Tax-Cutting Agenda – August 4, 2015 |

George Pataki “Former New York Gov. and now presidential candidate George Pataki has made cutting taxes one of the central themes of his political career. In fact, Pataki has repeatedly said over the years that “I’ve never met a tax cut I didn’t like.” His tax cuts largely went to New York’s wealthiest taxpayers and deprived the state of critical revenue over his tenure as governor.” George Pataki’s History of Irresponsible and Regressive Tax Cuts – August 7, 2015 |

|