After months and months of speculation and deliberation on numerous versions of “tax reform,” political leaders in the Tar Heel state reached an agreement this week on a tax package that will leave the state short of more than $700 million a year to spend on public education, health care, and other vital investments. And, in the end, the wealthiest North Carolinians and profitable, multi-national corporations are the biggest winners under the agreement. The new plan moved fast, easily passing out of the House and Senate with little opportunity for debate and Governor McCrory will likely sign the legislation this week. (Find its detailed provisions at the end of this post.)

An analysis from the Institute on Taxation and Economic Policy (ITEP) shows:

- The final “tax reform” plan is a big giveaway to the richest taxpayers in North Carolina. Those with average incomes of nearly $1 million will see their share of their income paid in state and local taxes drop by 1.2% for an average cut of more than $10,000.

- Furthermore, the top 5% of taxpayers are the beneficiaries of almost 90% of the net tax cut from the combined changes to the personal and corporate income taxes, sales taxes, and the change in tax treatment of electricity, natural gas, and entertainment.

- Contrary to lawmakers’ claims that everyone in the state wins under this plan, there are many losers, as the state’s own bean counters revealed just today. Losers include some low and middle income families who currently benefit from the $50,000 business income pass-through deduction, families with significant deductible medical expenses and other itemized deductions and some elderly families who lose retirement benefits, among others.

- And, when considering that many low-and moderate-income working families will lose the benefit of a refundable state EITC (set to expire after this year and not extended under this plan), the plan actually hikes taxes on the bottom 80 percent of taxpayers on average.

- North Carolina’s tax system will become even more upside down, with the bottom 20% of taxpayers paying on average 9.2 percent of their income in state and local taxes while the top 1% will be paying only 5.7%. Under the current system (with a state EITC in place), the bottom 20% pay 8.9 percent and the top 1% pay 6.5%.

The final negotiated package is being hailed as “historic” and a “jobs plan” for North Carolina by proponents of the plan. But, as the North Carolina Budget and Tax Center explains, it’s nothing of the sort and instead is going to be a bad deal for North Carolinians into the future:

“[The tax reform agreement] puts at risk the ability to educate our children, care for our elders, keep our communities safe and support businesses, while failing to fix the problems with the state’s tax code. And, it gets rid of policies that work such as the Earned Income Tax Credit.

This is not a historic day for North Carolina; tax reform hasn’t been achieved. Instead, we’ve been handed a plan that will tarnish our state’s reputation as a leader in the South, a place where people want to live and businesses want to grow.

It is very likely that as a result of this failure to pursue real, comprehensive tax reform, state sales taxes and local property taxes will go up in the future. That’s what happened in every other Southern state that has personal and corporate income taxes that can’t keep up with growing public needs.

Our state cannot be competitive nationally or internationally with this reckless approach. It undermines the education of our workforce and support for research and innovation. The prospects of an ongoing race to the bottom for North Carolina now are all too real.”

Key components of the negotiated deal:

Personal Income Tax

- Flat 5.75% rate (fully phased-in)

- Eliminates the personal exemption, retirement benefit, business pass-through income deduction, and all credits other than the Child Tax Credit. Notably, the plan does not restore the state’s Earned Income Tax Credit (EITC) set to expire after 2013.

- Increases the standard deduction to $15,000 (MFJ),$12,000 (HOH), and $7,500 (Single/MFS)

- Limits itemized deductions to mortgage interest plus property taxes capped at $20,000 (MFJ), $16,000 (HOH), and $10,000 (single) plus unlimited charitable contributions. Taxpayers take the higher of the standard deduction or itemized deductions.

- Retains the child tax credit of $100 and increases it to $125 for taxpayers with AGI under $40,000 (MFJ) or $32,000 (HOH)

Corporate Income Tax (CIT)

- Reduces the rate from 6.9 to 6% in 2014, to 5% in 2015 and if revenue expectations are met, could be lowered to as low as 3% by 2017.

Estate Tax

- The state estate tax is eliminated

Sales/Privilege/Franchise Taxes

- Expands the sales tax base by eliminating a number of exemptions including newspapers, baked goods, some farm exemptions and food sold in dining halls and adds service contracts.

- Adjusts the tax rates on modular and manufactured homes.

- Eliminates the gross receipts franchise taxes on electricity and natural gas and in place includes these items in the sales tax base.

- Eliminates state and local privilege taxes on amusement/entertainment and in place includes these items in the sales tax base.

- Eliminates the state’s sales tax holiday and energy star appliance tax holiday.

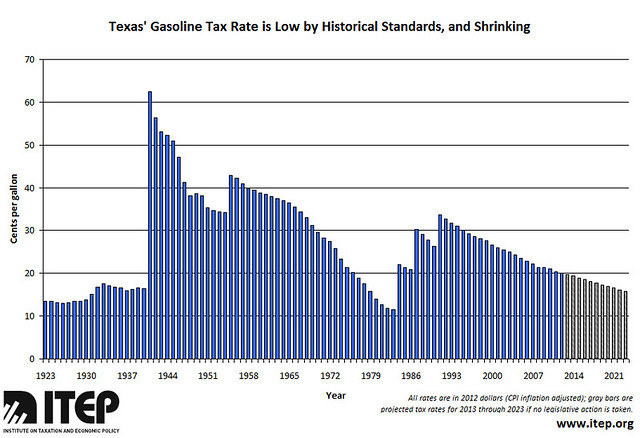

Gas Tax

- Caps the gas tax at 37.5 cents/gallon for 2 years.

Not even a month after

Not even a month after

Rhode Island is about to put seventeen of its “economic development” tax breaks under the microscope, thanks to a

Rhode Island is about to put seventeen of its “economic development” tax breaks under the microscope, thanks to a  Months after the

Months after the

Some House Republicans are hitting the IRS when it’s down, using recent

Some House Republicans are hitting the IRS when it’s down, using recent