The Senate just passed (by two votes) a budget that clears the way for $6 trillion in cuts from critical services and $1.5 trillion in tax cuts. Their arguments for the tax plan they have proposed center around one core argument: That lowering the corporate tax rate will somehow benefit working families. This has been proven by independent analyses and history to be patently FALSE. We call the whole thing magic math. This video breaks it down.

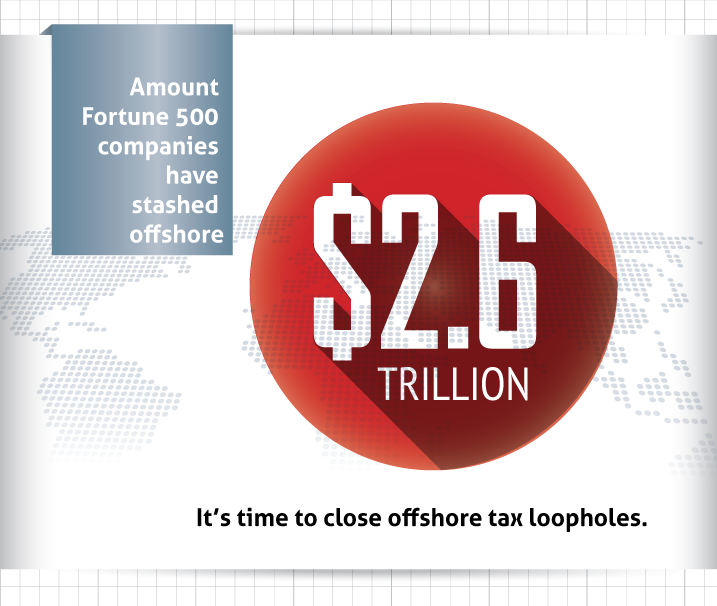

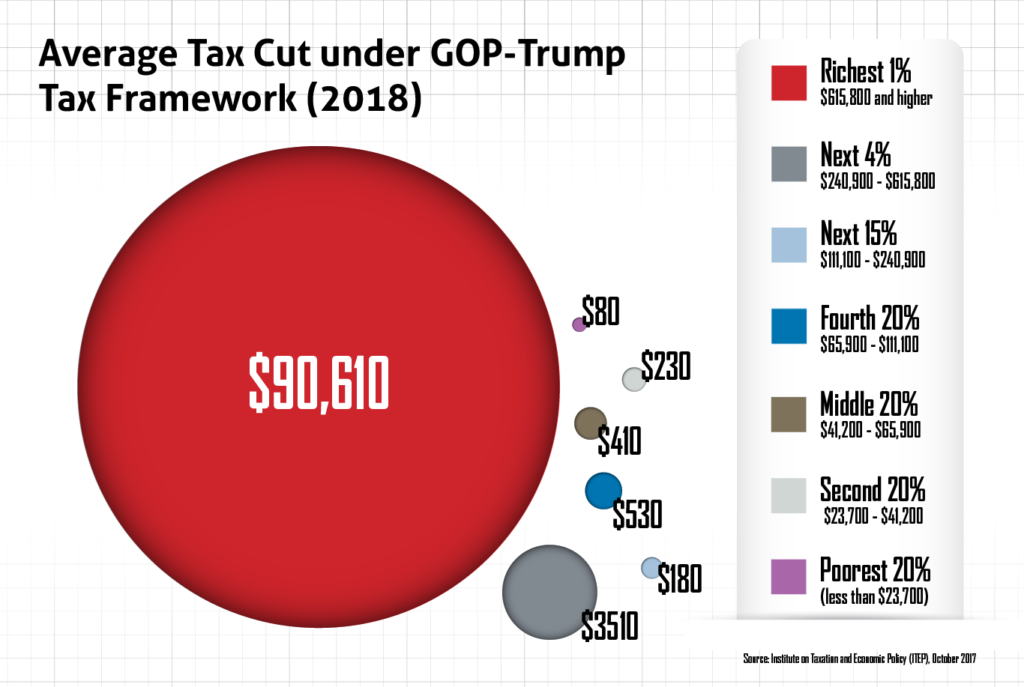

The tax plan they are proposing is a massive giveaway for corporations and the wealthiest 1%, paid for by working and middle class families. But that’s not what you’ll hear Trump and GOP leaders say publicly. Their public spin centers around what we like to call MAGIC MATH. This concept (that somehow cutting the corporate tax rate will give working people better jobs) has been proven by independent analyses (not to mention history) FALSE. And we’re not fooled by their tricks.

This video breaks that “magic math” down. Enjoy!

If this “magic math” makes you you as mad as it does us, won’t you consider spending a few minutes to call Congress and let them know you aren’t fooled by their tricks?

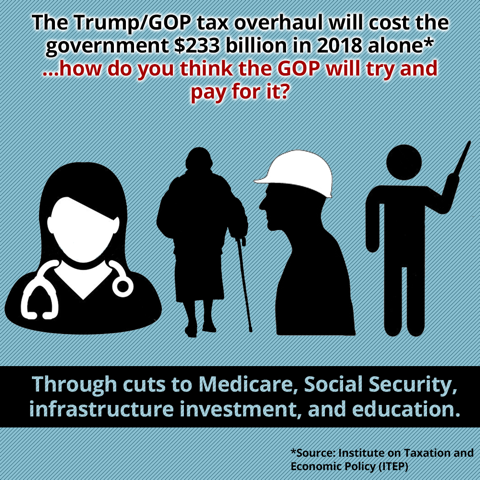

Overall this tax plan will lose $233 billion in revenue in 2018 alone for the government, putting at risk essential social services such as Medicare, Medicaid, Social Security and education (Source: ITEP)

Overall this tax plan will lose $233 billion in revenue in 2018 alone for the government, putting at risk essential social services such as Medicare, Medicaid, Social Security and education (Source: ITEP)