This week CTJ and ITEP weighed in on the Panama Papers leak, new U.S. Treasury regulations to combat inversions and Pfizer’s subsequent decision to give up its effort to become Irish and avoid billions in U.S. taxes.

Tax Dodging Madness

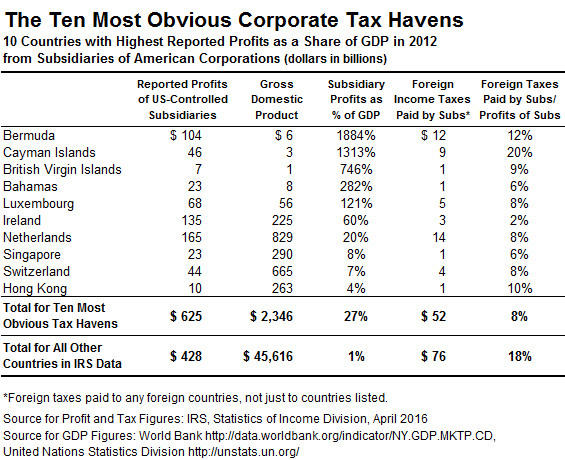

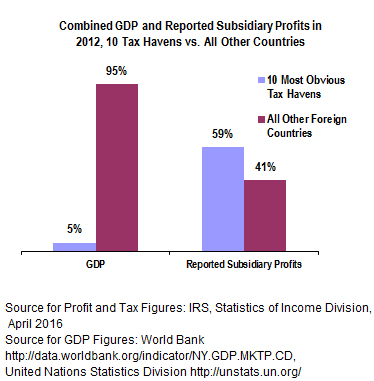

A new CTJ report finds that American corporations are using various tax gimmicks to shift profits earned in the U.S. to subsidiaries located in tax haven countries to avoid paying corporate taxes. In some of these countries the U.S. profits actually exceed the tax haven country’s Gross Domestic Product.

Panama Papers and How the Global Elite Play by a Different Set of Rules

In a CNN commentary, ITEP Director Matt Gardner weighs in on America’s problems with tax avoidance and anonymous shell companies. Read his full piece here. In a separate piece for Quartz, he argues that when heads of state use anonymous shell companies, it’s a “potent symbol of their elite privilege.”

Treasury Regs a Step Forward, But Congress Still Must Act

The Treasury Department’s new regulations strike at the core of one of the main reasons for corporate inversions—avoiding taxes on profit hoards stashed offshore. In a statement and U.S. News and World Report opEd, CTJ director Bob McIntyre lauds Treasury’s action but argues it’s up to Congress to close loopholes that enable rampant corporate tax avoidance. “Unfortunately, the current majority in Congress apparently doesn’t need an excuse to do nothing. It’s up to us voters to rectify that,” he wrote.

Two New CTJ Reports: Comparing U.S. Taxes With Those of Other Developed Countries

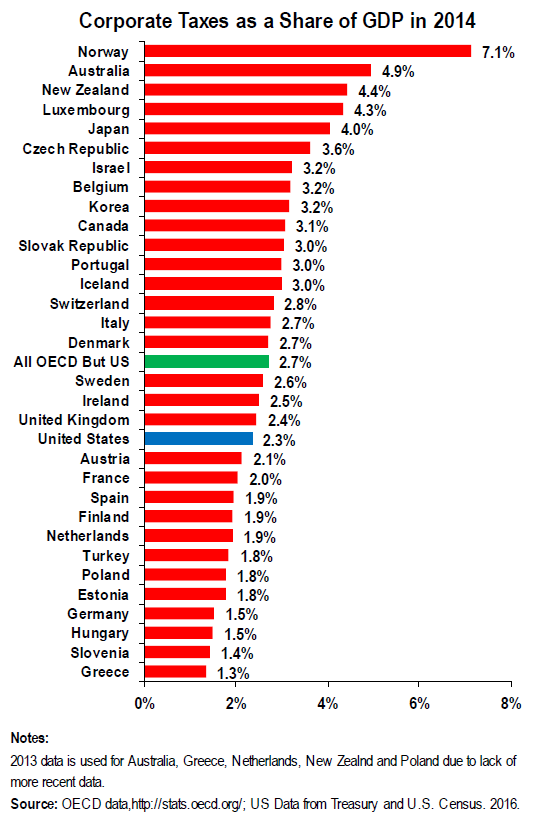

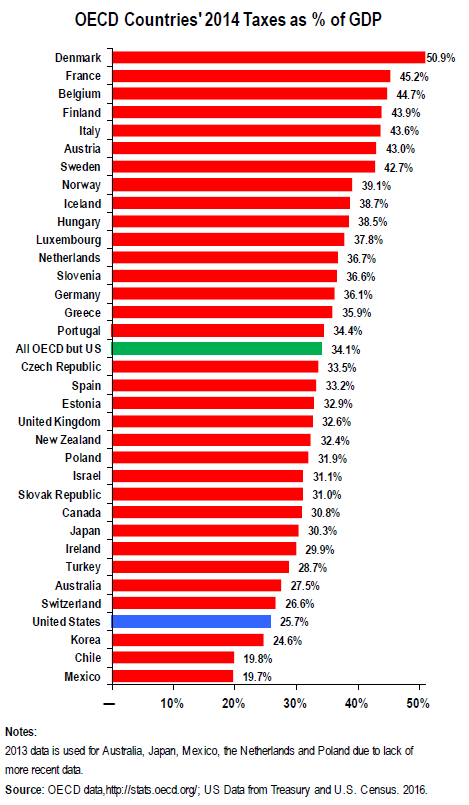

This week CTJ released two new reports that compare how the U.S. ranks in terms of other developed countries when it comes to taxes. Spoiler alert: U.S. corporate taxes as a percentage of the economy are comparatively low, and total U.S. tax receipts as a share of the economy are less than the OECD average.

The U.S. Is One of the Least Taxed Developed Countries

U.S. Corporate Taxes Are Below Developed Country Average

State News:

Tax justice advocates in Georgia are breathing a sigh of relief after dangerous tax cut proposals fell flat this legislative session. Read ITEP Senior Analyst Dylan Grundman’s full blog post.

State sales taxes are often the source of much contention. Policy analysts of all political stripes agree that a broad sales tax base is best. But the reality is often quite different. Here’s ITEP’s take on the shifting landscape of sales tax bases.

ICYMI: Tax Day is right around the corner! CTJ is gearing up to release new Tax Day focused data and reports. Be sure to closely follow Citizens for Tax Justice on social media for the latest. (Facebook and Twitter).

If you have any feedback on the Digest, please email me here: kelly@itep.org

To sign up to receive the Tax Justice Digest in your inbox click here.

For frequent updates find us on Twitter (CTJ/ITEP), Facebook (CTJ/ITEP), and at the Tax Justice blog.

.png?1460132481)

Thanks for reading the State Rundown! Here’s a sneak peek: St. Louis, Missouri residents renew earnings tax by a wide margin. Ferguson, Missouri, voters reject property tax increase to fund police reform but approve sales tax increase. Mississippi House passes scaled-down tax cut package. Ohio Gov. John Kasich promises another tax-cut package next year.

Thanks for reading the State Rundown! Here’s a sneak peek: St. Louis, Missouri residents renew earnings tax by a wide margin. Ferguson, Missouri, voters reject property tax increase to fund police reform but approve sales tax increase. Mississippi House passes scaled-down tax cut package. Ohio Gov. John Kasich promises another tax-cut package next year.

These 10 countries have either zero tax rates or provide loopholes that allow corporate profits to go largely untaxed in many circumstances. The two columns on the right side of the table on page one show the amount of corporate income taxes paid on the subsidiary profits to the country where they were supposedly earned or any other foreign country. This is shown first as a dollar figure and then as a percentage of the profits supposedly earned in that country.

These 10 countries have either zero tax rates or provide loopholes that allow corporate profits to go largely untaxed in many circumstances. The two columns on the right side of the table on page one show the amount of corporate income taxes paid on the subsidiary profits to the country where they were supposedly earned or any other foreign country. This is shown first as a dollar figure and then as a percentage of the profits supposedly earned in that country.

“Political casualties are mounting fast in the wake of the Panama Papers—a historic leak of confidential documents from a Panama-based law firm that revealed connections between a number of world leaders and nearly 215,000 offshore shell companies.

“Political casualties are mounting fast in the wake of the Panama Papers—a historic leak of confidential documents from a Panama-based law firm that revealed connections between a number of world leaders and nearly 215,000 offshore shell companies.

The most recent data from the Organization for Economic Cooperation and Development (OECD) show that the United States is one of the least taxed developed nations.

The most recent data from the Organization for Economic Cooperation and Development (OECD) show that the United States is one of the least taxed developed nations.  “Anonymous shell corporations and secret bank accounts are vital resources for those engaged in tax evasion and money laundering. But this web of secrecy has started to crumble in recent years due in part to revelations from whistle-blowers embedded in this complex web of tax havens and fake corporations.

“Anonymous shell corporations and secret bank accounts are vital resources for those engaged in tax evasion and money laundering. But this web of secrecy has started to crumble in recent years due in part to revelations from whistle-blowers embedded in this complex web of tax havens and fake corporations.