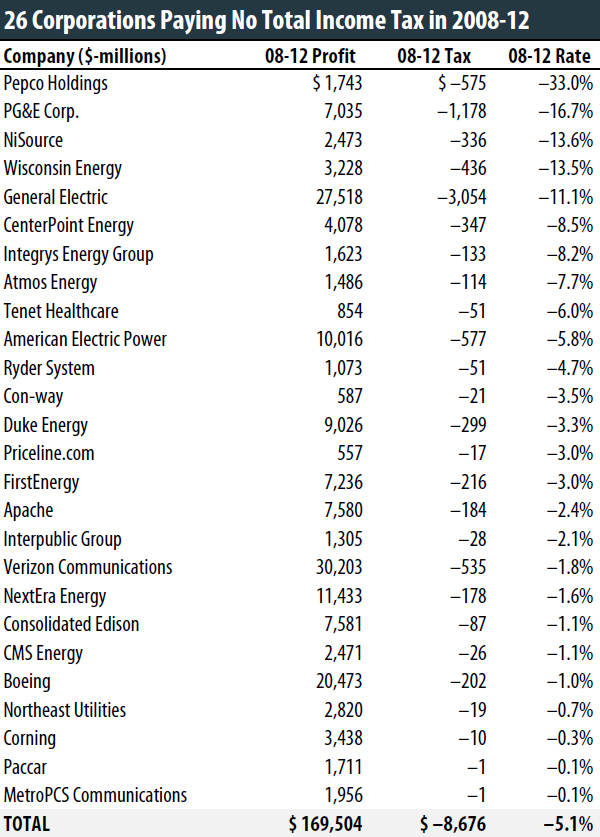

Large tech companies are among the most notorious tax dodgers, but they are hardly the only ones to enlist crafty accountants to avoid paying U.S. taxes.

So it’s refreshing to see lawmakers also taking a look at other companies, as Sen. Carl Levin’s Permanent Subcommittee on Investigations did last week when it documented that Caterpillar is exploiting loopholes to dodge taxes just like companies in Silicon Valley.

Caterpillar is one of the most widely recognized manufacturers of heavy construction equipment in the United States. Its major profit center is spare parts sales.ons did last week when it documented that Caterpillar is exploiting loopholes to dodge taxes just like companies in Silicon Valley.

So just how did Caterpillar dodge taxes?

Until 1999, Caterpillar purchased spare parts from suppliers and subsequently resold them to local dealers. But for the past 15 years, Caterpillar has transferred ownership of most of its parts to a Swiss subsidiary, CSARL. Even though the Swiss subsidiary “owned” the parts, Caterpillar continued to store them in its Illinois warehouse and send them directly to buyers, exactly as it always has.

But when Caterpillar shipped the parts to overseas customers, it attributed the profits to CSARL, even though the Swiss subsidiary never took physical possession. The result? According to the subcommittee report, the company declared at least 85 percent of its profits on sales to non-U.S. customers—profits that appeared on U.S. tax returns before 1999—as Swiss income, subject only to a special single-digit tax rate negotiated directly with the Swiss government.

In depositions before the subcommittee, Caterpillar executives and tax attorneys were sometimes remarkably candid in admitting that this maneuver did not change the way the company does business, and the rationale for the move was simply to avoid taxes. During investigations prior to last week’s hearing, this exchange occurred:

Government: Was there any business advantage to Caterpillar, Inc., to have this arrangement put into place other than the avoidance or deferral of income taxation at higher rates?

Caterpillar: No, there was not.

Caterpillar Counsel: Let’s take a break.

The subcommittee report estimates that since 1999, Caterpillar has shifted $8 billion in profits offshore, avoiding $2.4 billion in U.S. income taxes.

Policy solutions?

Fortunately, Congress has the option to enact straightforward policies to end shenanigans practiced by Caterpillar, as well as the army of tech-company tax dodgers. Ending deferral—the ability of multinationals to postpone paying U.S. taxes on their foreign profits until those profits are brought home to the US—would remove the incentive of companies to shift their income into foreign tax havens because it would require companies like Caterpillar to pay tax at the U.S. rate (minus any taxes already paid to foreign governments) on offshore profits. Until Congress finds the backbone to enact this needed reform, it can put a stop to Caterpillar’s hijinks using the “economic substance” doctrine it codified in 2010, which says that for a corporate transaction to be recognized for tax purposes, the transaction must have a legitimate non-tax business purpose—a purpose Caterpillar executives were generally at a loss to identify.

Congress should also take a hard look at the role played in this mess by their accountant, PricewaterhouseCoopers, which actually dreamed up this tax dodge for Caterpillar in its capacity as the company’s tax advisor, and later approved its own tax-dodging ideas in its capacity as Caterpillar’s tax auditor.

It’s not acceptable for burglars to moonlight as parole officers, nor should accounting firms be free to create clear conflicts of interest by evaluating their own tax schemes.

The Obama administration has, sensibly, attempted to implement regulations that would allow the Internal Revenue Service to regulate tax preparers. But earlier this year, a federal court

The Obama administration has, sensibly, attempted to implement regulations that would allow the Internal Revenue Service to regulate tax preparers. But earlier this year, a federal court

With Obamacare exceeding the Administration’s goal of

With Obamacare exceeding the Administration’s goal of

Earlier this year our partners at the Institute on Taxation and Economic Policy

Earlier this year our partners at the Institute on Taxation and Economic Policy  State gas tax policies have

State gas tax policies have