April 7, 2014 02:31 PM | Permalink | ![]()

1. The nation’s tax system is barely progressive

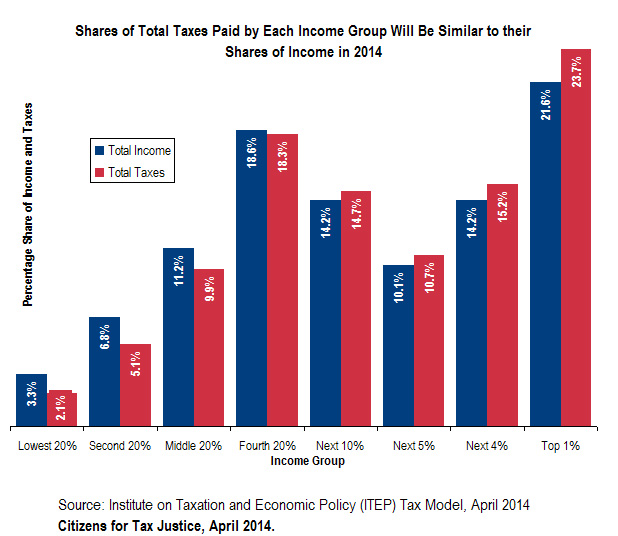

■ A CTJ fact sheet demonstrates that the total share of taxes (federal, state, and local) that will be paid by Americans across the economic spectrum in 2014 is roughly equal to their total share of income.

■ While some taxes, such as the federal income tax, are progressive, other taxes such as state and local sales taxes actually take a larger share of income from low-income families than they take from higher-income families.

■ In 2014, the richest one percent of Americans will pay 23.7 percent of the total taxes in America, but they will also take in 21.6 percent of the total income in America.

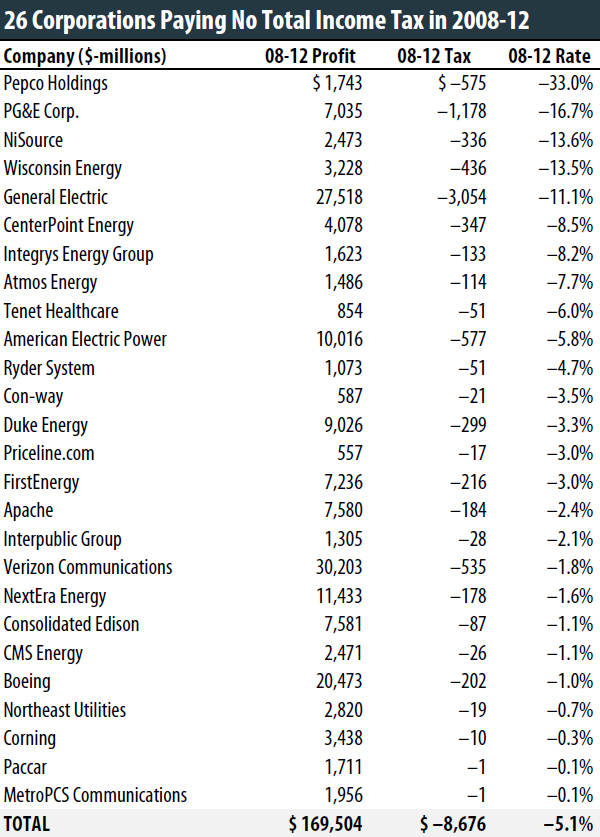

2. The statutory corporate tax rate is 35 percent, but few companies pay that.

■ CTJ’s recent study of consistently profitable Fortune 500 corporations found that over the past five years they paid 19.4 percent of their profits in federal income taxes — far lower than the official 35 percent rate that corporate lobbyists complain about.

■ CTJ’s study also found that 26 of these corporations, including well-known companies General Electric, Boeing, Verizon, Priceline and Corning, paid no federal corporate income tax over the five-year period examined.

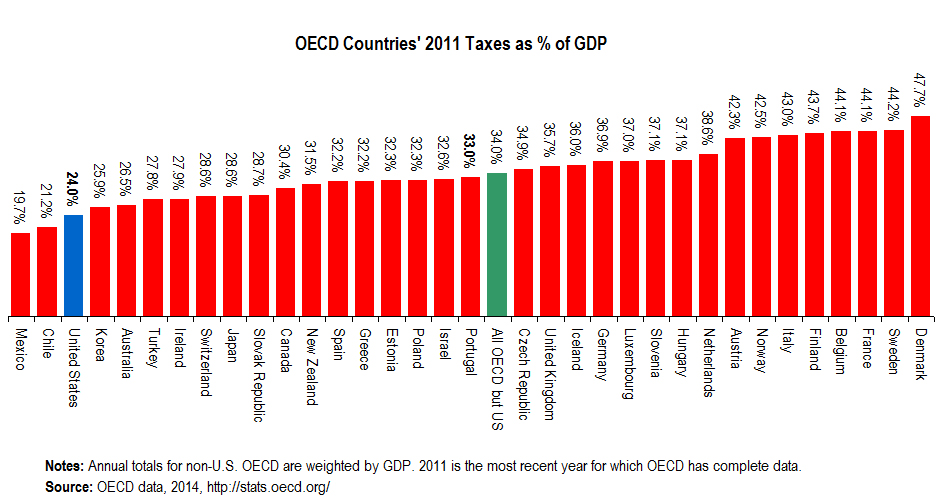

3. Among developed countries, the United States is one of the least taxed.

■ Taxes accounted for 24 percent of the nation’s GDP in 2011. A CTJ fact sheet explains that among 35 developed nations, only two (Chile and Mexico) collected less tax revenue as a share of their economy that year.

■ The countries collecting more in taxes as a share of their economy than the U.S. include our trade partners and competitors, like France, Germany, the United Kingdom, Canada, South Korea and others.

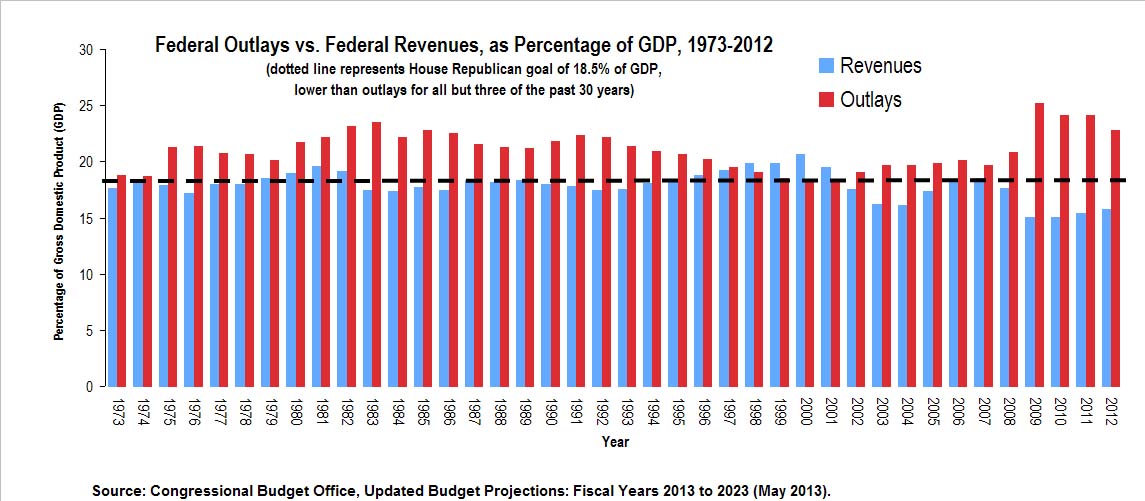

4. The goals of tax reform should be to raise revenue, make the system more progressive, and end offshore tax dodging.

■ The federal government cannot fund public investments at a level that Americans expect if we do not change our tax laws to collect more revenue.

■ A CTJ report explains why the goals of federal tax reform should be to raise revenue, make the system more progressive and end offshore tax avoidance by corporations.

5. Tax reform that accomplishes the above goals is achievable.

■ Citizens for Tax Justice recently published its own tax reform plan that accomplishes these goals.

■ The plan mostly maintains current tax rates and incorporates lawmakers’ proposals to close loopholes.

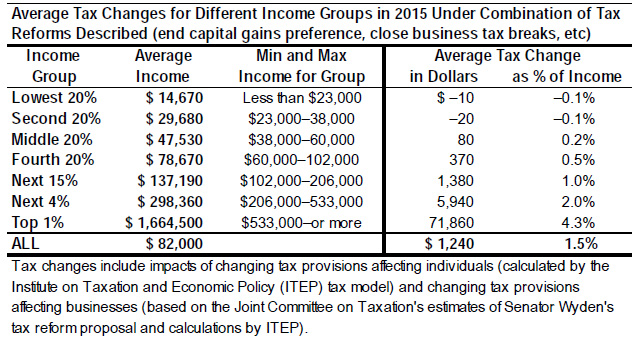

■ The table below illustrates the impacts on Americans at different income levels and how CTJ’s plan would make the tax system more progressive.

■ Another CTJ report explains that the main tax reform proposal before Congress right now unfortunately fails to achieve these goals.