April 11, 2013 03:55 PM | Permalink | ![]()

President Obama has proposed some very modest changes in federal taxes in his Fiscal 2014 budget plan. Over the upcoming decade, the President’s proposal would boost total federal revenues by only $851 billion. That’s less than a 3 percent increase.

Here are the percentage changes in federal taxes that Obama proposes over the upcoming decade by type of tax:

■ Personal income taxes, mostly on the wealthy, would go up by 4 percent.

■ Corporate taxes would increase by 1 percent.

■ Excise taxes would increase by 10 percent.

■ Estate and gift taxes would go up by 40 percent.

In total, federal revenues would increase by 2.8 percent over 10 years.

Except for the excise tax increases (mainly almost a $1 per pack tax hike on cigarettes), most of the President’s proposed net tax increases would fall on the very well off.

Because his tax proposals are so modest, the President found it necessary to propose major reductions in domestic programs in order to reduce future budget deficits. Overall, his budget predicts that domestic appropriations will fall by almost a third as a share of the GDP by fiscal 2023. That sharply reduced level would also be a third less as a share of the GDP than under President Ronald Reagan.

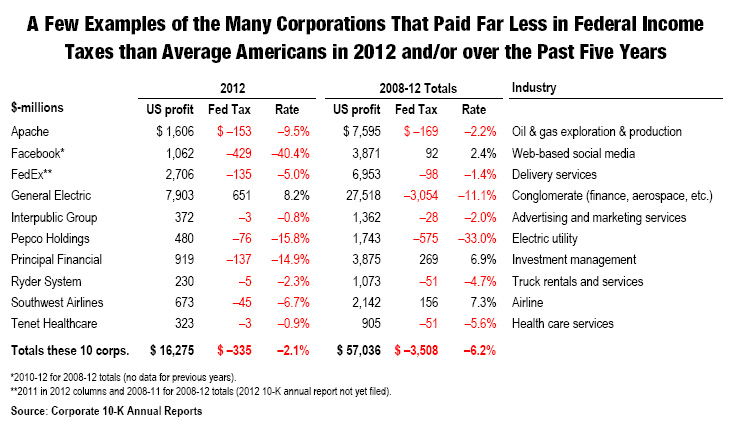

In the text of his budget, the President also says he favors “revenue-neutral” “corporate tax reform that will close loopholes [and] lower the corporate tax rate.” Toward that end, he lists 57 specific changes that he would make to limit or expand corporate loopholes in the context of reform (these items are not included in his budget plan). Enacting all of these proposals would raise an average of less than $10 billion a year. That would allow about a half a percentage point reduction in the corporate tax rate from the current 35 percent to about 34.5 percent.

A summary list of the tax changes proposed by the President and their estimated revenue effects can be found below:

|

Tax Changes Proposed in President Obama’s Fiscal 2014 Budget |

|

|

10-Year Totals, Fiscal 2014-23; $-billions |

|

|

Individual income tax increases: |

|

|

Limit the benefits of itemized deductions and certain other deductions and exclusions to 28% of the amount deducted or excluded |

$ +529 |

|

Reduce the inflation adjustment for tax brackets and other tax items (“chained CPI”) |

+100 |

|

Implement the “Buffett Rule” (30% minimum tax on the wealthy) |

+53 |

|

Tax investment managers at regular tax rates on their management fees (“carried interest” |

+16 |

|

Limit the total amount that can be accumulated in IRAs and other retirement funds to $3 million |

+9 |

|

Other individual income tax increases |

+7 |

|

Subtotal, individual income tax increases |

$ 715 |

|

Individual income tax reductions: |

|

|

Make the recently extended expansion of the EITC and child credit permanent |

$ –161 |

|

Expansion of retirement savings tax breaks for low- and moderate-income taxpayers |

–18 |

|

Tax “simplification” |

–9 |

|

Expand the dependent care tax credit |

–9 |

|

Other individual income tax reductions |

–3 |

|

Subtotal, individual income tax reductions |

$ –199 |

|

Net individual income tax changes ……………………………………………………………… |

$ +516 |

|

Other tax increases: |

|

|

Restore the 2009 estate & gift tax rules, plus other small estate tax reforms |

$ +79 |

|

Increase the cigarette tax by 94 cents per pack |

+78 |

|

Reduce the tax gap (reduce cheating by individuals and businesses) |

+78 |

|

Increase the unemployment tax |

+67 |

|

Impose a fee on large banks |

+59 |

|

Restore Superfund environmental clean-up tax on polluters |

+20 |

|

Miscellaneous |

+4 |

|

Subtotal, other tax increases |

$ +385 |

|

Other tax cuts: |

|

|

Tax breaks for public infrastructure investments |

$ –17 |

|

Various business tax cuts |

–33 |

|

Subtotal, other tax cuts |

$ –50 |

|

Net other tax increases and tax cuts …………………………………………………………….. |

$ +334 |

|

Total Net Proposed Tax Changes …………………………………………………………….. |

$ +851 |

|

Note: Tax changes include proposed changes in refundable tax credits. |

Idaho Senate leadership took a

Idaho Senate leadership took a