April 10, 2013 04:58 PM | Permalink | ![]()

Companies From Various Sectors Use Legal Tax Dodges to Avoid Taxes

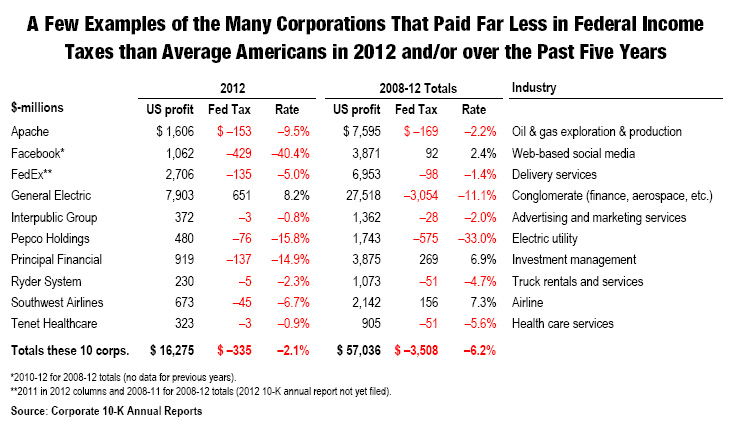

This CTJ report illustrates how profitable Fortune 500 companies in a range of sectors of the U.S. economy have been remarkably successful in manipulating the tax system to avoid paying even a dime of tax on billions of dollars in profits. These ten corporations’ tax situations shed light on the widespread nature of corporate tax avoidance. As a group, the ten companies paid no federal income tax on $16 billion in profits in 2012, and they paid zero federal income tax on $57 billion in profits over the past five years. All but one paid less than zero federal income tax in 2012; all paid exceedingly low rates over five years.

Companies Represent Diverse Economic Sectors

The companies profiled here represent a range of segments of the U.S. economy. While General Electric, Facebook, FedEx and Pepco are fairly well-publicized tax avoiders, this report also includes:

- The oil and gas exploration company Apache, which paid no tax on $7.6 billion in pretax income over five years, enjoying a $169 million tax rebate over that period.

- Health-care giant Tenet Healthcare, which hasn’t paid a dime of federal income tax on $905 million in U.S. income over the past five years, receiving a tax rebate of $51 million.

- In the airline sector, Southwest Airlines paid no federal income taxes on $673 million in U.S. income last year, and actually received an income tax rebate of $45 million.

- The Principal Financial Group, an investment services provider, which avoided all federal income taxes on its $919 million in 2012.

- Ryder System, which provided truck rentals and services, paid a negative 2.3 percent federal income tax rate in 2012 and a negative 4.7 percent rate since 2008.

- The Interpublic Group, a marketing and communications firm, also had negative tax rates both in 2012 and over the five-year period.

All ten companies’ effective federal income tax rates for 2012 and 2008-12 are shown in the following table. (Click on table for high quality version)

Companies’ Low Taxes Stem from a Variety of Legal Tax Breaks

While much recent attention has focused on multinational corporations that have used offshore tax havens to minimize their tax liability, the companies profiled here appear to be using a diverse array of other tax breaks to zero out their federal income taxes:[1]

Southwest Airlines, Ryder and FedEx used accelerated depreciation, a tax break allowing companies to write off the cost of their capital investments much faster than these investments wear out, to dramatically reduce their tax rates. CTJ has estimated that closing the accelerated depreciation loophole could raise over $500 billion over the next five years. Both Congress and President Barack Obama, however, have supported expanding the scope of this tax break in recent years.

Facebook relied on a single tax break — the ability to write off the value of executive stock options for tax purposes — to zero out its tax liability in 2012. Facebook admits that this tax break will offset much of its future taxes as well. U.S. Senator Carl Levin (D-MI) has estimated that this tax break costs between $12 billion and $61 billion a year.

General Electric uses the “active financing” tax break as one of many ways that it eliminates its U.S. income tax bill.[2] This arcane tax break allows some multinational financial institutions to avoid paying income taxes to any government on their international financing activities. The Joint Committee on Taxation estimates the current two-year cost of this provision to be $11.2 billion.

Corporate Tax Reform Should Repeal Tax Loopholes and

Restore Overall Corporate Tax Revenues to a More Reasonable Level

In recent years, the public’s attention has been drawn to the elaborate tax avoidance mechanisms used by a few huge corporations such as General Electric, Apple, Microsoft and others. But as this report indicates, the scope of corporate tax avoidance goes well beyond these few companies, and spans a wide variety of economic sectors. Moreover, the tax breaks that have allowed these companies to be so successful in their tax avoidance are, by and large, perfectly legal, and often have been on the books for decades.

As Congress focuses on strategies for revamping the U.S. corporate income tax, a sensible starting point should be to critically assess the costs of each of these tax breaks, and to take steps to ensure that profitable corporations pay their fair share of the U.S. taxes.

The next step is as, if not more, important. The revenues raised from eliminating corporate tax subsidies should not be given right back to corporations in the form of tax-rate reductions, as corporate lobbyists and their allies inside the Washington Beltway preposterously argue. Instead, as the vast majority of Americans understand, these desperately needed revenues should be used to address our nation’s fiscal problems and to make critically needed public investments in our nation’s future.

[1] Accelerated depreciation and the stock options loophole, and how Congress could raise revenue by repealing them, are described in Citizens for Tax Justice, “Policy Options to Raise Revenue,” March 8, 2012. http://ctj.org/ctjreports/2012/03/policy_options_to_raise_revenue.php The “active financing exception” is described in Citizens for Tax Justice, “Don’t Renew the Offshore Tax Loopholes,” August 2, 2012. http://ctj.org/ctjreports/2012/08/dont_renew_the_offshore_tax_loopholes.php

[2] As the New York Times documented, the director of GE’s tax department literally “dropped to his knee” when begging House Ways and Means Committee staff to extend the active financing tax break when it was set to expire in 2008. http://www.nytimes.com/2011/03/25/business/economy/25tax.html