Republican Presidential Candidate Mitt Romney was caught on tape explaining to a group of prospective donors that 47 percent of Americans “pay no income tax” and generally fail to contribute their fair share. In identifying these presumed slackers who would never vote for him, Romney betrayed his own myopia about how the tax system works.

Here’s what Romney doesn’t talk about when he talks about taxes.

1. All Americans Pay Taxes

If you look at the tax system as a whole, the share of taxes paid by Americans in each income group is similar to their share of total income.

While Romney is about right that 47 percent of Americans do not specifically pay the federal income tax (according to Tax Policy Center Data), this statement is extremely misleading because it disappears the more than half of this same group that pays payroll taxes. And, every American pays state and local taxes – income, sales, property, etc.

In fact, the bottom 20 percent of taxpayers pays substantially more in state and local taxes as a percentage of their income than any other income group.

Are there people out there who don’t pay any taxes? When we went looking, we couldn’t find any, so we had to make one up.

2. Our Federal Tax System Rewards Work and Combats Poverty, and that’s Good

While every American  pays some taxes, it is the case that about 18 percent of Americans pay neither payroll nor federal income taxes. Who are these alleged freeloaders? About 60 percent of them are elderly, meaning that they’re unable to work and are largely living on limited retirement income.

pays some taxes, it is the case that about 18 percent of Americans pay neither payroll nor federal income taxes. Who are these alleged freeloaders? About 60 percent of them are elderly, meaning that they’re unable to work and are largely living on limited retirement income.

The rest of the households that don’t pay payroll or federal income taxes are low income households bringing in less than $20,000 each year, and who are benefitting from highly effective tax credits like the earned income tax credit (EITC) and child tax credit (CTC). These credits incentivize work while providing much needed support to low and middle income family budgets, and in 2010 they were responsible for lifting 9.2 million people, including 4.9 million children, above the poverty line.

The effectiveness of these credits is so widely recognized across the political spectrum that every single president since Gerald Ford, from Reagan to Obama, has enacted expansions of the EITC or CTC. Ronald Reagan once called the EITC the “the best anti-poverty, the best pro-family, the best job creation measure to come out of Congress,” and George W. Bush expanded it as part of his 2001 tax cuts.

3. Also Paying No Federal Income Tax Are High Wealth Individuals and Highly Profitable Corporations

Low income families who pay nothing in federal income taxes are using provisions that were written into the tax code by Congress, just like wealthy corporations and individuals (including Romney himself) do to bring down their tax bills.

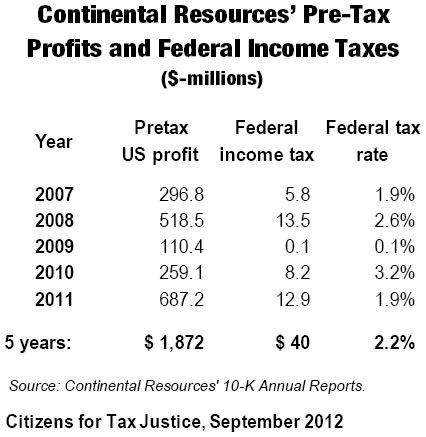

On the corporate side, Citizens for Tax Justice found that from 2008-2011, 30 Fortune 500 companies, including the likes of General Electric and Verizon, made $205 billion in profits, yet their overall tax bill was actually negative. The corporate tax system has become so full of loopholes and tax breaks (yes, written by Congress) that what even the most profitable companies actually pay on average is roughly half the statutory corporate tax rate.

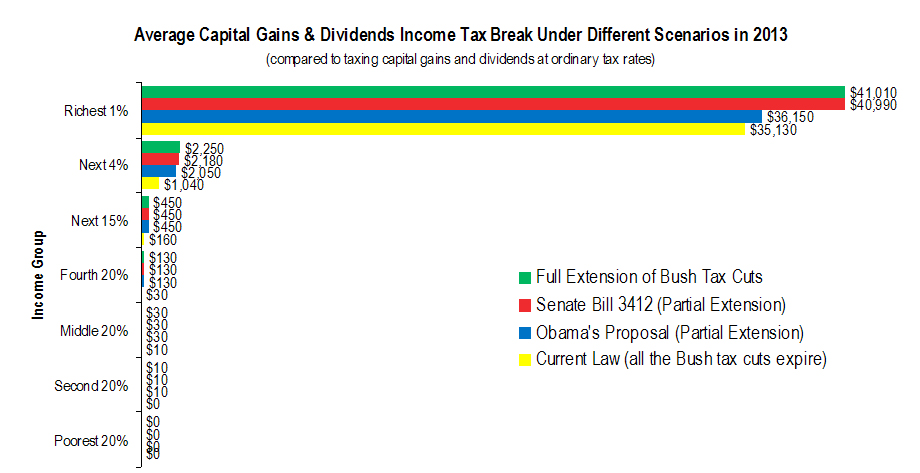

As far as the wealthiest Americans, a recent IRS study found that in 2009 a shocking 35,000 Americans making over $200,000 paid not a dime in federal income tax. Similarly, many of the country’s wealthiest Americans, like billionaire investor Warren Buffet, pay lower tax rates than middle class Americans, largely due to the tax break on capital gains income and a plethora of other tax loopholes.

pays some taxes, it is

pays some taxes, it is

from the company’s public filings with the Securities and Exchange Commission (SEC).

from the company’s public filings with the Securities and Exchange Commission (SEC).