This post originally appeared on OKPolicy.org and is reposted here with permission.

The Gist

The Gist

SQ 779 is a constitutional amendment that would raise the state sales and use tax by one percentage point. Of the total revenue generated by the new tax, 60 percent would go to providing a salary increase of at least $5,000 for every public school teacher. The remaining funds would be divided between public schools (9.5 percent), higher education (19.25 percent), career and technology education (3.25 percent), and early childhood education (8 percent). The State Board of Equalization would be required to certify that revenues from the new tax are not being used to supplant existing funds.

Background Information

The ballot initiative is responding to concerns among educators, parents, and others about teacher salaries and education funding.

Average compensation for Oklahoma teachers has fallen to 49th in the nation, and school districts are struggling to recruit and retain enough qualified teachers. Since 2008, Oklahoma has cut state support for the school aid formula by more than $170 million, and funding for higher education and career tech has also been cut.

This year about 1,500 teaching positions and 1,300 support worker positions have been lost to budget cuts in Oklahoma schools, yet schools still report about 1,000 unfilled teaching positions. Hundreds more positions are being filled by emergency certified teachers who do not meet the state’s legal qualifications to be a classroom teacher.

SQ 779 was placed on the 2016 ballot through a successful initiative petition effort that gathered over 300,000 signatures, more than double the required number (123,725). An effort to block the initiative as a violation of the single-subject rule of the state Constitution was rejected by the Oklahoma Supreme Court.

If approved, the new sales tax would take effect July 1, 2017 and is projected to raise $615 million in its first full year.

Supporters Say…

- Since lawmakers have made large cuts to education funding and repeatedly failed to approve a teacher pay raise, there is no other solution to the education funding crisis than passing a ballot initiative that includes a dedicated revenue source.

- Higher teacher salaries are needed to stop the flow of teachers to other states and other professions and to ensure a high-quality education for Oklahoma children. Low-income students are being harmed most by heavy teacher turnover and would benefit most from teachers being paid competitive salaries.

- The ballot measure includes strong constitutional safeguards to make sure the dollars will be spent as intended.

- In addition to the $5,000 pay raise for teachers, the measure would provide funds for such worthwhile purposes as improving reading, increasing high school graduation rates, creating a merit pay system, improving college affordability, and strengthening early childhood education.

Opponents Say…

- While teachers deserve a raise, there are ways to fund a pay raise without raising taxes and without committing to more spending on higher education and career tech.

- The sales tax is regressive, which means that the tax increase will affect low- and moderate-income households more than wealthier households.

- Oklahoma already has one of the highest combined state and local sales tax rates in the nation. A one percentage point increase will give Oklahoma the nation’s highest sales tax rate and push the rate above 10 percent in some areas. Cities, which are heavily reliant on the sales tax, will be hindered in their capacity to raise the sales tax for municipal priorities.

- Even with the measure’s language preventing money from SQ 779 supplanting other funding, there is nothing to prevent the Legislature from enacting further tax cuts that will offset this increase.

Ballot Language

This measure adds a new Article to the Oklahoma Constitution. The new Article creates a limited purpose fund to improve public education. It levies a one cent sales and use tax to provide revenue for the fund. It allocates funds for specific institutions and purposes related to the improvement of public education, such as increasing teacher salaries, addressing teacher shortages, programs to improve reading in early grades, to increase high school graduation rates, college and career readiness, and college affordability, improving higher education and career and technology education, and increasing access to voluntary early learning opportunities for low-income and at-risk children. It requires an annual audit of school districts’ use of monies from the fund. It prohibits school districts’ use of these funds for administrative salaries. It provides for an increase in teacher salaries. It requires that monies from the fund not supplant or replace other education funding. The Article takes effects on the July 1 after its passage.

Links to Other Resources

Text of Measure and Background Information: Ballotpedia

Text of Initiative Petition, Legal Challenges: Secretary of State

Supporters and Opponents

Oklahoma’s Children, Our Future: Yes on SQ 779 Website

Oklahoma State School Boards Association SQ 779 Information

Vote No on SQ 779 Facebook page

Other OK Policy Information

“Our statement on the proposed initiative to fund education with 1 cent sales tax increase”: OK Policy

“The progressive case for State Question 779”: David Blatt, Journal Record

In The Media

“City of Edmond Formally Opposes Sales Tax Increase to Pay for Education”: KOSU

“We have a moral responsibility to our children”: Rev. Ray Owens, Tulsa World

“‘Watch-Out’ Video: The Arguments For, Against the Education Sales Tax”: Oklahoma Watch

“Opponent says education tax proposal aims to return Oklahoma to its ‘Dark Ages’”: Tulsa World

![]()

One of the measures facing Missouri voters this fall is Amendment 4, which would modify the state constitution to prohibit future expansions of state or local sales taxes to “any service or transaction” not already included in the tax base.

One of the measures facing Missouri voters this fall is Amendment 4, which would modify the state constitution to prohibit future expansions of state or local sales taxes to “any service or transaction” not already included in the tax base.

Perhaps one of the most debated ballot measures this fall is Oregon’s Measure 97. Multiple

Perhaps one of the most debated ballot measures this fall is Oregon’s Measure 97. Multiple  The Gist

The Gist

Revenue Impact

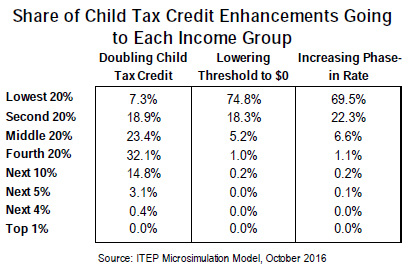

Revenue Impact Understanding the Impact of the Child Tax Credit Changes

Understanding the Impact of the Child Tax Credit Changes