September 26, 2016 01:52 PM | Permalink |

Read this report in PDF.

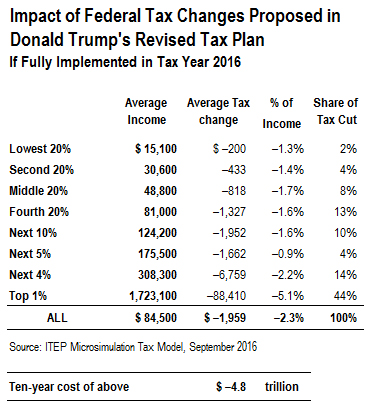

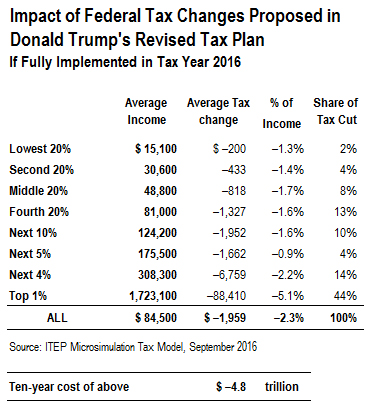

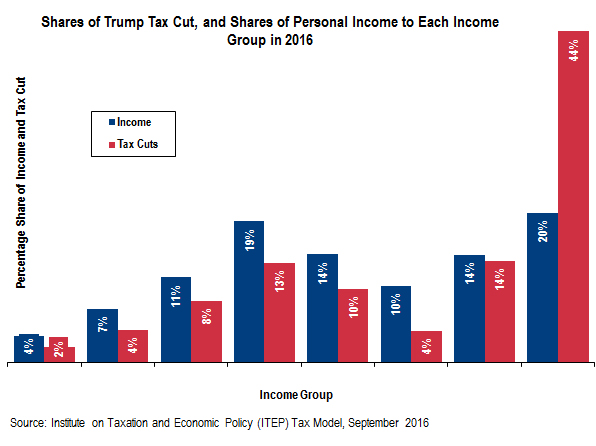

A new Citizens for Tax Justice (CTJ) analysis of the revised tax plan proposed by presidential candidate Donald Trump in September finds that the plan would reduce federal revenues by at least $4.8 trillion over the next decade while cutting taxes for all income groups. The analysis also shows the wealthiest top 1 percent of taxpayers’ share of the tax cut would be 44 percent.

Revenue Impact

Trump’s revised tax proposal would reduce federal revenues by $4.8 trillion over the next decade. Of that, $2.1 trillion would be due to personal income tax and payroll tax cuts; $2.4 trillion would be due to corporate tax cuts, and another $0.3 trillion in revenue loss would be due to repeal of the federal estate tax. It is important to note that this revenue estimate does not factor in the effect of reducing the personal income tax rate on “pass-through” income to 15 percent, a provision that Trump has irregularly indicated would be part of his plan. Adding a 15 percent pass-through rate would add as much as $1.6 trillion to the ten-year cost of the plan, bringing its total cost to $6.4 trillion.

Distributional Impact

The revised Trump plan would cut taxes overall for each income group. The largest tax cuts, as a share of personal income, would go to those in the top 1 percent of the income distribution. This group, with incomes averaging $1.7 million in 2016, would receive tax cuts averaging 5.1 percent of their income or $88,000.

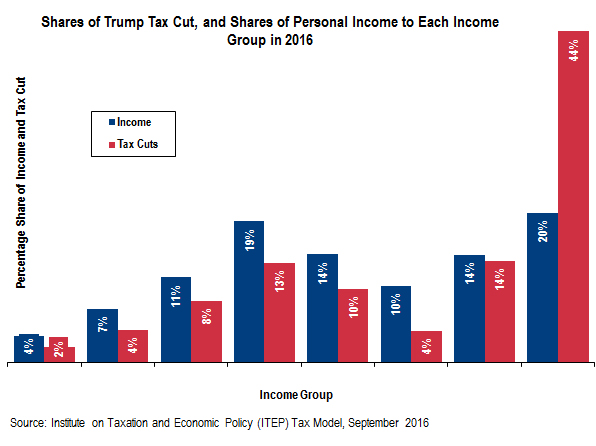

The top 1 percent would also collectively enjoy a bigger share of the tax cuts than any other income group: 44 percent of the tax cuts would accrue to this group in 2016. By contrast, the top 1 percent’s share of nationwide personal income is 21.6 percent and their current share of total income taxes paid is about 23.6 percent. Trump’s proposed tax would reduce the share of total taxes paid by the top 1 percent of taxpayers, thus making the federal tax system less progressive.

Low- and middle-income families would see tax cuts averaging much less, between 1.3 and 1.7 percent of their income. The poorest 20 percent of Americans would see tax cuts averaging $200 if the Trump plan were implemented immediately, while middle-income taxpayers would see an average tax cut of $818.

However, not all families within each income group would receive tax cuts. Some middle- and low-income families’ taxes would go up under Trump’s plan because the bottom income tax rate would increase from 10 to 12 percent under the plan, or because their taxable income might increase.

Those potentially seeing tax hikes include:

Families Currently Paying at the Lowest 10 Percent Tax Rate. Under current law, a married couple pays a 10 percent tax rate on the first $18,550 of taxable income in 2016, with a 15 percent rate applied on income over that threshold. Under Trump’s plan, a higher 12 percent rate would apply to the first dollar of taxable income, and to the first $75,000 of taxable income. This means married couples with low incomes will pay a 2 percent higher tax rate on their first $18,550 of taxable income than they do now. In some cases, new tax benefits provided by the Trump tax cuts would be insufficient to offset this initial tax hike.

Childless Couples Who Itemize. Trump’s proposal would repeal personal and dependent exemptions and replace them with an expanded standard deduction and generous new deductions for dependents. Since childless couples with large itemized deductions would benefit from neither of these tax breaks, the loss of personal exemptions could result in substantial tax increases that are not offset by reductions in tax rates.

Heads of household. Unmarried taxpayers with dependents, including single parents, can currently claim “head of household” status for tax purposes, which gives them larger exemptions and deductions and broader tax brackets than those available to other single taxpayers. Trump’s plan would eliminate this status. Taken on its own, this change would increase taxes for many heads of household. For example, under current law single parents pay at the 25 percent marginal tax rate on taxable income exceeding $50,400. The Trump plan would apply the 25 percent tax rate to single parents’ taxable income exceeding $37,500.

Families with Children Over the Age of 13. Trump proposes to replace personal exemptions, which are given on a per-family member basis, with a larger standard deduction—which does not increase with family size. While Trump’s proposed new dependent care tax breaks will help offset this tax hike for many families, the new breaks are available only for children under the age of 14. This means families with older children are more likely to see a tax hike under this plan.

Itemizers. One of the revenue raisers in Trump’s plan is a provision capping the total value of itemized deductions at $200,000 for married filers ($100,000 for all others). For some upper-income families, this provision will reduce their deductions and make more of their income subject to tax. For middle- and lower-income families who itemize, the expansion of the standard deduction will offer less, and sometimes no, benefit, increasing the likelihood that these families will see tax increases overall.

Proposed Policy Changes in the Trump Plan

On the personal income tax side, Trump proposes to:

- Reduce personal income tax rates for most taxpayers by creating a three-bracket system with rates of 12 percent, 25 percent and 33 percent on regular income, with top rates applying to taxable income exceeding $225,000 for married couples, $112,500 for all others.

- Capital gains tax rates in the three brackets would be 0, 15 and 20 percent. Carried interest would no longer be taxable at the reduced capital gains rates.

- Repeal the Alternative Minimum Tax.

- Eliminate the Net Investment Income Tax on high-income taxpayers that was enacted as part of President Obama’s health care reforms.

- Increase the standard deduction from $12,600 to $30,000 for married couples, and to $15,000 for all other taxpayers.

- Cap the total value of all itemized deductions at $200,000 for married couples, $100,000 for all other taxpayers.

- Eliminate personal and dependent exemptions, which in 2016 are $4,050 per family member.

- Introduce a new dependent exemption, nominally for child care costs, but apparently available to all families with children under 13 and incomes under $500,000 (married) or $250,000 (all others).

Trump’s proposed corporate tax changes include:

- Reduce corporate tax rate to 15 percent.

- Optional full expensing of capital investments (in exchange for giving up deductibility of interest payments).

- Repeal manufacturing deduction and all other tax credits except R&E credit.

- One-time deemed repatriation tax on offshore profits at 10 percent rate.

Trump would also repeal the federal estate tax, but would disallow stepped up basis for estates valued at more than $10 million. This analysis excludes the impact of the stepped up basis provision due to insufficient data.

Methodological Notes

This analysis excludes some components of the Trump plan, either because these components have not been fully specified or because data limitations prevent analysis. Most notably, the analysis excludes the rate reduction for “pass through” business income that Trump previously announced because the candidate has provided incomplete and conflicting details on how this tax cut would be structured. The analysis also excludes the proposed deduction for elder care due to data limitations, and excludes the plan’s savings incentives because of difficulties in forecasting taxpayers’ response to these incentives.

One of the most important new tax provisions under Trump’s plan is a deduction and credit associated with dependent care. While the deduction is nominally based on a capped amount of actual expenses on dependent care, the campaign’s web site says the tax break “would be provided to families who use stay-at-home parents or grandparents.” Because this means stay-at-home parents could claim the maximum deduction available in each state, we assume all parents of eligible children would claim the maximum deduction, rather than simply deducting their actual dependent care expenses. This assumption increases the projected tax cuts for families with eligible children, and also increases the projected 10-year cost of the plan. The analysis also assumes taxpayers will be allowed to choose whether to claim the proposed deduction or credit or continue to use the dependent care credit that currently exists.

For those concerned with the fate of our corporate tax code, perhaps the most important organization to watch right now is the

For those concerned with the fate of our corporate tax code, perhaps the most important organization to watch right now is the  Tax policy has figured prominently in this presidential election cycle, with both major party candidates releasing tax proposals and, on the campaign trail, frequently discussing how their tax policy changes would affect Americans.

Tax policy has figured prominently in this presidential election cycle, with both major party candidates releasing tax proposals and, on the campaign trail, frequently discussing how their tax policy changes would affect Americans.

This week we are bringing you news of proposed new (or increased) taxes in Missouri, Illinois, Louisiana, California and Oregon and the spread of ‘dark store’ tax avoidance practices across the states. Thanks for reading the Rundown!

This week we are bringing you news of proposed new (or increased) taxes in Missouri, Illinois, Louisiana, California and Oregon and the spread of ‘dark store’ tax avoidance practices across the states. Thanks for reading the Rundown!

On Thursday, Rep.

On Thursday, Rep.