February 6, 2015 10:17 AM | Permalink |

PDF of this report.

Earlier this week, President Barack Obama released details of his proposed federal budget for the fiscal year ending in 2016. While many observers and some members of Congress derided the budget blueprint as an irrelevant exercise in political theatre, the President’s plan includes a number of ideas that are likely to be incorporated into politically viable tax reform proposals in the weeks and months to come. It also includes some proposals that, while politically dead on arrival in the current Congress, have the potential to reshape the Washington tax reform debate moving forward. Here’s a quick overview of the best—and the worst—tax policy ideas in the president’s budget plan.

The President’s proposed budget includes $1.7 trillion in tax increases over the next ten years, almost all of which would fall primarily on the wealthiest individual taxpayers and on corporations. Obama proposes to use $470 billion of those tax hikes to pay for targeted tax cuts, primarily targeted to middle- and low-income families, and would use the rest to pay for needed public investments and reduce the deficit.

Where the Money Comes From

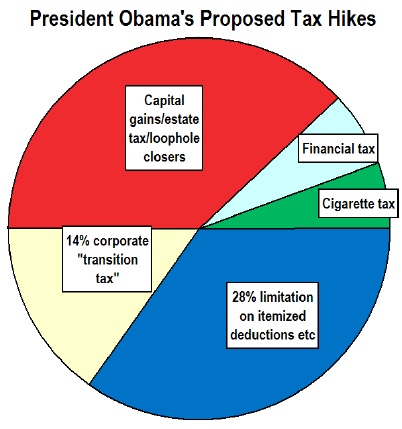

President Obama’s budget would raise about $1.7 trillion in new tax revenues over the next ten years.

President Obama’s budget would raise about $1.7 trillion in new tax revenues over the next ten years.

Roughly a third of these revenues would come from a variety of proposals designed to pare back tax benefits accruing to wealthy investors. Most notably, the President would increase the top tax rate on capital gains to 28 percent, would end the “stepped up basis” break that allows investors to avoid any tax on some capital gains, and would end the “carried interest” loophole that allows hedge fund managers to characterize income as capital gains.

Another one-third of the revenue-raisers would come from a single provision, known as the “28 percent limitation,” that would reduce itemized deductions and other tax breaks for high-income taxpayers currently paying federal tax rates above 28 percent. (In 2014, this means couples earning more than about $225,000.) This reform is broadly similar to proposals the president has included in previous budgets.

The budget includes two new revenue-raising proposals that would affect corporations: a one-time “transition tax” on U.S.-based corporations holding profits offshore, and a low-rate tax on the liabilities of the very largest financial companies.

The president’s budget also includes one tax change that would fall primarily on low- and middle-income families: an increase in the federal cigarette tax. This would represent just 5 percent of the tax hikes included in the Obama budget blueprint.

Where the Money Goes

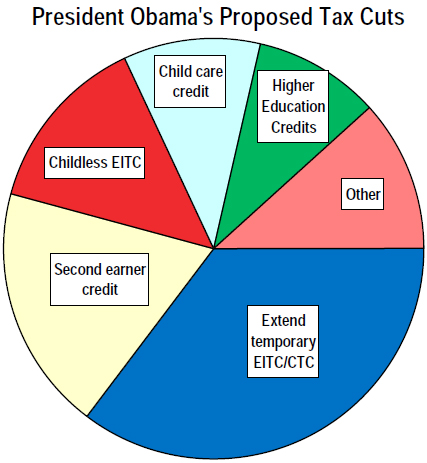

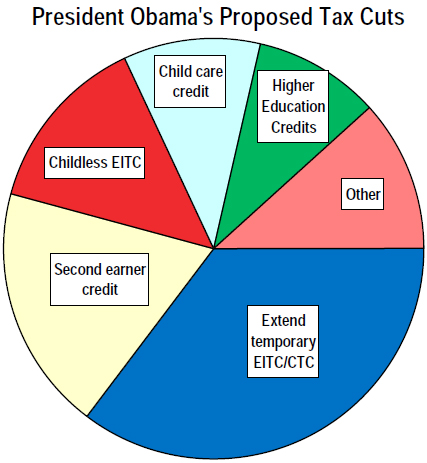

The president’s budget would use about a third of the revenues from his proposed tax increases to cut taxes. Almost all of these tax cuts are designed to benefit middle- and low-income working families.

The president’s budget would use about a third of the revenues from his proposed tax increases to cut taxes. Almost all of these tax cuts are designed to benefit middle- and low-income working families.

The biggest single item on the tax-cut side is one that would have no effect until tax year 2018. At that time, temporary expansions of the Earned Income Tax Credit (EITC) and the Child Tax Credit are set to expire. The president’s budget would make these expansions permanent, strengthening bipartisan tax provisions designed to reward work and help at-risk families stay above the poverty line.

The president would also fill one of the most glaring gaps in the structure of the EITC: its low benefits for childless workers. The budget would ensure that the wage subsidy for low-income single workers would approach the tax break already available to those with children.

Sound Tax Reform Ideas in the President’s Budget

The president’s budget includes a healthy dose of progressive tax reform proposals. Some, like the sensible proposal to shift education tax breaks away from the best-off Americans and toward the middle class, have already been abandoned. Others, including the president’s plan to eliminate some tax preferences for capital gains, never stood a chance. But a few, like President Obama’s already enacted (but set to expire in 2017) expansion of two low-income tax credits for working families, are likely to be ratified as part of the annual budgetary give-and-take. And politics aside, these proposals signify a clear and sensible policy shift toward giving middle-income working families the tools they need to get ahead.

- Ending “stepped up basis” for capital gains: The federal income tax has long had a loophole wealthy investors could drive a truck through: the complete forgiveness of federal income tax liability on the value of stocks and other capital assets passed on from decedents to their heirs. The president’s plan would end this tax break for heirs inheriting more than $200,000 for a married couple ($100,000 for singles). While the tax policy community has long agreed that the so-called “stepped up basis” is absurd, few elected officials have actively sought to repeal it—until now.

- Taxing wealth more like work: Current law imposes a top tax rate on capital gains that, at 23.8 percent, is well below the 39.6 percent top tax rate on wages. By hiking the top capital gains rate to 28 percent for the very best-off Americans, President Obama’s plan would at least slightly reduce the tax preference for wealth over work. Notably, even if the president’s plan were enacted, the top rate on investment income would remain fully 11.6 percent below the top rate on wages.

- Shifting education tax breaks down the income ladder: The President proposed to simplify and restructure the hodgepodge of education tax breaks currently allowed, repealing tax breaks used primarily by upper-income families (such as the “529” savings incentive) and expanding the middle-income American Opportunity Tax Credit. Simpler and fairer? Sounds good. Sadly, Obama quickly abandoned the 529 reform in the wake of heated opposition.

- Tripling the child care credit: Recognizing that dependent care expenses can be unaffordable for working parents, the president proposes to substantially increase an existing tax credit against child care expenses, tripling the potential tax credit for some working families.

- Boosting wages for low-income working families: the Earned Income Tax Credit provides a needed wage subsidy for workers near or below the poverty line, but generally shortchanges workers without children. The budget blueprint would make permanent an existing, temporary boost to the EITC and make needed new expansions for childless workers.

- Adequately funding the Internal Revenue Service. With no apparent knowledge of the irony, Congress routinely creates dozens of new tax breaks each year, charges the IRS with the responsibility of administering these tax breaks, and then slashes the agency’s annual administrative budget. President Obama’s budget would reverse that trend: the $2 billion boost in IRS funding the president proposes would help offset the billions in funding cuts the agency has suffered in recent years.

…And the Not-So-Good Ideas

While the president’s outline of individual tax reforms would clearly be a win for tax fairness, some provisions would needlessly complicate the tax code. On the corporate side, President Obama’s efforts are far more timid, offering billions of dollars in tax savings to offshore tax dodgers while continuing to embrace a misguided vision for “revenue-neutral” corporate reform.

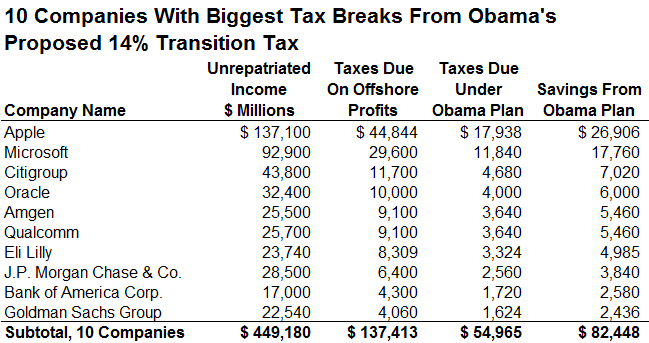

- Low-rate “transition tax” on multinational corporations’ offshore cash. Faced with the prospect of large multinationals such as Apple and Microsoft avoiding U.S. tax by stashing their profits in offshore tax havens, Obama proposes a one-time, 14 percent “transition tax” on these profits, after which they will never be subject to additional U.S. tax. Apparently driven by the philosophy that something is better than nothing, Obama’s plan would, in fact, give $82 billion in tax cuts to just ten of the biggest tax avoiders. A better plan would require these companies to pay the 35 percent tax they have adeptly avoided to date.

- Reinventing the wheel: We already have a federal income tax credit designed to offset expenses for two-earner couples, and, as previously noted, the President sensibly wants to expand it. So his proposal to to create a new “second earner” credit that doesn’t even require such couples to incur child care expenses is unnecessary and wasteful.

- Doubling down on “revenue-neutral” corporate tax reform: Our corporate taxes are among the lowest in the developed world as a share of the economy. So the president’s proposal to eliminate wasteful loopholes and give the money right back to corporations in the form of a lower 28 percent tax rate is unwise at a time when the nation’s is struggling to raise adequate revenue.

- More tax breaks for General Electric and Apple: If you were going to make a list of corporations that need additional tax breaks, GE and Apple would not be high on the list, especially considering their notoriously low and sometimes non-existent corporate tax rates. But by permanently extending the “active financing” loophole and “CFC look-thru rules”, President Obama will be enshrining the pair of temporary tax breaks that allow GE and Apple to escape paying their fair share in taxes.

- Looking for infrastructure funding in all the wrong places: It’s well documented that the nation is underfunding its transportation infrastructure, and it’s equally obvious that Congress’s failure to increase the gas tax since 1993 is the main culprit. But rather than calling for a long-overdue gas tax hike, the president would use the revenues from his one-time corporate “transition tax” to fund infrastructure improvements. While this plan would certainly put a dent in the nation’s transportation funding deficit, this one-shot solution would do nothing to shore up transportation funding in the long-term.

In a testament to the power of health industry lobbying, lawmakers on both sides of the aisle have expressed support for repealing the medical device tax, a levy created as part of the Affordable Care Act that is expected to raise $29 billion over the next 10 years to help fund broader access to health care.

In a testament to the power of health industry lobbying, lawmakers on both sides of the aisle have expressed support for repealing the medical device tax, a levy created as part of the Affordable Care Act that is expected to raise $29 billion over the next 10 years to help fund broader access to health care.

President Obama’s budget would raise about $1.7 trillion in new tax revenues over the next ten years.

President Obama’s budget would raise about $1.7 trillion in new tax revenues over the next ten years. The president’s budget would use about a third of the revenues from his proposed tax increases to cut taxes. Almost all of these tax cuts are designed to benefit middle- and low-income working families.

The president’s budget would use about a third of the revenues from his proposed tax increases to cut taxes. Almost all of these tax cuts are designed to benefit middle- and low-income working families.

In the run-up to the State of the Union, President Barack Obama proposed a slew of new tax reform ideas designed to benefit low- and middle-income families. One of his

In the run-up to the State of the Union, President Barack Obama proposed a slew of new tax reform ideas designed to benefit low- and middle-income families. One of his