February 3, 2015 01:30 PM | Permalink | ![]()

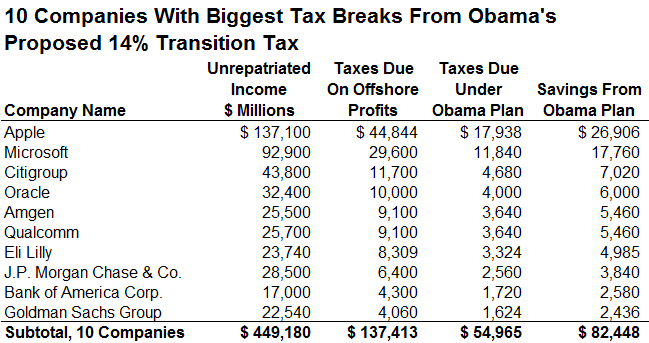

Apple, Microsoft, Citigroup and Amgen Are Among Biggest Winners

Earlier this week, President Barack Obama released details of his proposed federal budget for the fiscal year ending in 2016. The proposal includes a one-time “transition tax” on the offshore profits of all U.S.-based multinational corporations. The President’s plan would tax these profits at a 14 percent rate immediately, rather than at the 35 percent rate that should apply absent the “deferral” loophole. This proposal would provide huge tax cuts to many corporations currently holding profits, often actually earned in the U.S., in low-rate foreign tax havens. Ten of the biggest offshore tax dodgers would receive a collective tax break of $82.4 billion.

Huge Tax Breaks for Notorious Tax Dodgers in Technology and Financial Sectors

The table on this page shows the ten companies that would enjoy the largest tax breaks from President Obama’s proposed “transition tax.”

- Apple currently holds $137 billion of its cash offshore. Under current rules, the company should pay $45 billion when these profits are repatriated. But the Obama plan would allow it to reduce its tax bill to $18 billion — a $26.9 billion tax break.

- Microsoft would see a $17.7 billion tax cut on its $92.9 billion in offshore profits under Obama’s proposal.

- Large financial companies with substantial offshore cash would benefit handsomely from the president’s proposal: Citigroup would enjoy a $7 billion tax cut, while JP Morgan Chase would get a $3.8 billion tax break. Bank of America and Goldman Sachs would receive tax breaks of $2.6 billion and $2.4 billion, respectively.

While these companies operate in different economic sectors, what they have in common is that each has at least $17 billion in profits that they have designated as “permanently reinvested” in other countries and each has admitted, in the detailed notes of their annual financial reports, paying tax rates substantially below the U.S. statutory rate on these offshore profits.

Corporate Tax Reform Should Tax Offshore Profits at Today’s Corporate Tax Rate

Although President Obama has not given a detailed rationale for taxing offshore profits at a 14 percent rate, it’s hard to see why his approach makes sense. The companies currently holding profits in foreign tax havens accumulated these profits over a period when the statutory federal income tax rate stood at its current 35 percent. These companies shifted some of their profits offshore to avoid paying the statutory rate on their U.S. profits, and they should not receive a reward for dodging their tax bills in the form of a substantially lower tax rate.

The ten companies profiled here are among the worst offenders and would reap the biggest rewards for bad corporate behavior. Almost all of them have essentially admitted that their offshore cash is located in tax havens where the tax rate is in the single digits. For example, Microsoft says it would pay a 31.9 percent tax rate if it repatriated its offshore profits. Since the tax it would pay would be equal to the 35 percent statutory tax rate minus any foreign taxes already paid, the clear implication is that the company has paid only a 3.1 percent tax rate on its offshore profits. Rewarding Microsoft with a low 14 percent tax rate on its offshore holdings would amount to huge and unwarranted tax savings for a company that has made a practice of shifting U.S. profits to tax havens to avoid taxes.