Since the start of the year, House Democratic leadership and President Barack Obama have proposed bold new tax plans based on the central idea that wealthy investors are not paying their fair share in taxes.

Since the start of the year, House Democratic leadership and President Barack Obama have proposed bold new tax plans based on the central idea that wealthy investors are not paying their fair share in taxes.

For their part, House Democratic leaders have proposed to finance a substantial portion of their $1.2 trillion middle-class tax-cut plan by imposing a financial transactions tax (FTT) at an unspecified rate. Obama has proposed to curb preferential treatment of capital gains and to impose a fee on large banks, to raise about $320 billion over 10 years. While both proposals would primarily hit wealthy investors, Obama’s proposal is better targeted and does not include the flaws of a financial transactions tax.

How does the FTT work? Basically, it is an excise tax applied to sales of securities such as stocks and bonds. Because these securities are often traded, the proposed tax rate applied to each sale would be very low, yet the tax has the potential to raise a substantial amount of revenue. A FTT proposal from Rep. Peter DeFazio (D-OR), for example, would set a rate of only three hundredths of one percent and would raise about $352 billion over 10 years. Thus, a tiny tax imposed over and over again ends up yielding substantial revenue.

A major problem with the FTT is that it is not based on taxpayers’ ability to pay. It taxes transactions regardless of whether investors earned income from the sale. A person could purchase a stock for $100, sell it for $90, and still have to pay the tax even though he or she lost money on the transaction. In contrast, the capital gains tax is applied to profit, if any, from the sale.

An advantage of the FTT that is often touted by proponents is that it could reduce short-term trading, in particular the split-second back-and-forth trading that computer technology has allowed some wily traders to engage in (which can amount to insider trading). But such trading could be outlawed directly.

On the other hand, the fact that securities are frequently traded improves the liquidity of the stock market (making it easy for shareholders to sell their stocks) and reduces the volatility of stock prices somewhat. In fact, many studies have found that the FTT’s increased transaction costs could reduce liquidity and increase volatility by discouraging transactions not only by unprincipled speculators, but also the everyday transactions that are a necessity for pension plans and other normal investors.

Obama’s proposed bank fee would apply a very low variable rate structure (with a higher rate for riskier liabilities) to firms with more than $50 billion in assets. Unlike the FTT, the bank fee’s variable rate structure would discourage excessive risk taking by financial firms, and thus would help avoid a future financial crisis. The fee could raise as much as $110 billion over 10 years.

Obama’s proposals to increase taxes on capital gains and big banks appear to be better targeted at wealthy investors than a FTT, while reducing excessive financial speculation by big banks. In addition, Obama’s proposals could raise roughly the same amount of revenue as a FTT, depending on the details of the latter ($320 billion under Obama vs. $352 billion using the DeFazio FTT proposal mentioned above).

The company’s newest annual financial report, released earlier this week, discloses that Adobe is currently holding more than $3 billion of its profits abroad in the form of “permanently reinvested” foreign earnings, and it has paid very little tax on these profits to any country—a clear indication that much of these profits are likely in foreign tax havens.

The company’s newest annual financial report, released earlier this week, discloses that Adobe is currently holding more than $3 billion of its profits abroad in the form of “permanently reinvested” foreign earnings, and it has paid very little tax on these profits to any country—a clear indication that much of these profits are likely in foreign tax havens. Much of the fireworks surrounding President Barack Obama’s

Much of the fireworks surrounding President Barack Obama’s

Last week, the Institute on Taxation and Economic Policy released

Last week, the Institute on Taxation and Economic Policy released  Who said tax reform was a dead letter in the nation’s capital? With President Barack Obama’s State of the Union address still a day away, it’s already clear that the President will make income tax reform a major talking point. A

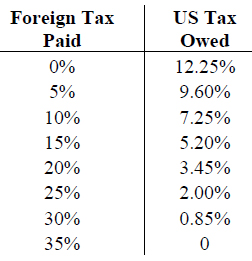

Who said tax reform was a dead letter in the nation’s capital? With President Barack Obama’s State of the Union address still a day away, it’s already clear that the President will make income tax reform a major talking point. A  Delaney’s fallback proposal would end the deferral of U.S. taxes on offshore profits of American companies, but it would exempt a significant percentage of “active income” depending on the taxes, if any, already paid to foreign countries. For example, a companywith all of its offshore money in tax havens (with no tax paid) would pay the U.S. government only a 12.25 percent tax rate on its “active” foreign income. A company that paid a 25 percent rate on offshore income would owe the U.S. only 2 percent in taxes on “active” income. (See the table for a breakdown of the rate paid at different levels of foreign taxes.) For “passive” income, however, Delaney follows Baucus’s Option Z, and would not allow any exemption from the 35 percent U.S. corporate tax rate. “Passive income” includes income such as royalties that are very easy to shift into tax havens.

Delaney’s fallback proposal would end the deferral of U.S. taxes on offshore profits of American companies, but it would exempt a significant percentage of “active income” depending on the taxes, if any, already paid to foreign countries. For example, a companywith all of its offshore money in tax havens (with no tax paid) would pay the U.S. government only a 12.25 percent tax rate on its “active” foreign income. A company that paid a 25 percent rate on offshore income would owe the U.S. only 2 percent in taxes on “active” income. (See the table for a breakdown of the rate paid at different levels of foreign taxes.) For “passive” income, however, Delaney follows Baucus’s Option Z, and would not allow any exemption from the 35 percent U.S. corporate tax rate. “Passive income” includes income such as royalties that are very easy to shift into tax havens.