The Cleveland Plain Dealer provided a helpful history lesson in its recent editorial on Governor John Kasich’s State of the State speech. In the speech, Kasich predictably called for yet another round of tax cuts to fix all that ails the state, but as the editorial board smartly points out, “if tax cuts were the key to rebirth, Ohio’s troubles should have ended long ago.” The paper goes on to chronicle six substantial state income tax cuts implemented since 1985, none of which generated the economic boom promised by proponents. If state legislators unwisely go along with Kasich’s attempt to repeat history, they shouldn’t expect a different result.

The Idaho Trucking Association has come out in favor of a six-cent increase in the state’s 25-cent gas tax, adding Idaho to a list of states considering long-overdue gas tax hikes this year. If passed, the bill (PDF) would raise the state fuel tax two cents a year for the next three years, and would be the first such increase in 18 years. A gas tax increase is needed to close a $262 million hole in the state’s transportation budget, according to the Governor’s Task Force on Modernizing Transportation Funding. Republican Governor Butch Otter has been a vocal advocate of a gas tax increase, but was rebuked by the legislature on the issue in the past. AAA Idaho has come out against the bill in part because they don’t think it asks enough of the long-haul trucks that produce a disproportionate amount of wear and tear on the state’s roads. We will continue to monitor developments.

The Idaho Trucking Association has come out in favor of a six-cent increase in the state’s 25-cent gas tax, adding Idaho to a list of states considering long-overdue gas tax hikes this year. If passed, the bill (PDF) would raise the state fuel tax two cents a year for the next three years, and would be the first such increase in 18 years. A gas tax increase is needed to close a $262 million hole in the state’s transportation budget, according to the Governor’s Task Force on Modernizing Transportation Funding. Republican Governor Butch Otter has been a vocal advocate of a gas tax increase, but was rebuked by the legislature on the issue in the past. AAA Idaho has come out against the bill in part because they don’t think it asks enough of the long-haul trucks that produce a disproportionate amount of wear and tear on the state’s roads. We will continue to monitor developments.

The Georgia Senate passed a constitutional amendment last week that would cap the state’s individual income tax rate at the current six percent level. As the Georgia Budget and Policy Institute has previously explained, this is an immensely silly idea, tying the hands of future policymakers by arbitrarily locking in current tax rules. The amendment’s key sponsor has described the effort as a “first step toward moving Georgia away from taxing income.” But personal income taxes are the fairest of the main revenue sources relied on by state governments. Senate Resolution 415 must now win a two-thirds vote in the House and then, if successful, approval by the voters in November.

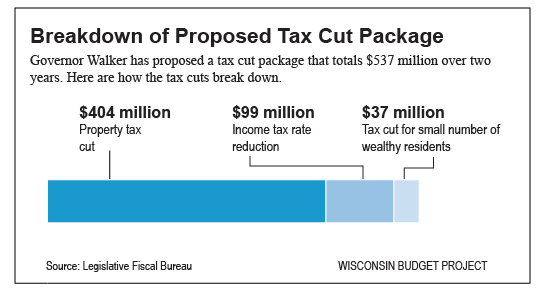

In the 36 states where Governors are up for election, campaign season is well underway. This is especially true in Wisconsin. Governor Scott Walker isn’t likely to fulfill his 2010 campaign pledge of creating 250,000 jobs, but that isn’t stopping him from making a whole new promise. This time he is pledging that property taxes won’t be increased over his next term. Details about how he will keep property taxes at current levels aren’t available yet, but it’s likely he will recommend some kind of ill-advised property tax cap, as well as an increase in state aid to localities.

The

The