If Congress decides it cannot spend money to help working families and the unemployed without offsetting the costs by cutting spending, then lawmakers should also refuse to enact tax cuts for businesses unless they can offset the costs by closing business tax loopholes. Sadly, both Democrats and Republicans refuse to acknowledge this commonsense principle as they discuss enacting the so-called “tax extenders” without closing any business tax loopholes — after failing to extend Emergency Unemployment Compensation (EUC) because of a dispute over how to offset the costs.

If there is any federal spending that should not be paid for, surely it is EUC and other temporary spending that is designed to address an economic downturn. As our friends at the Coalition on Human Needs explain:

In January, the national unemployment rate dropped to 6.6 percent from 6.7 percent in December, but jobs grew by a less than expected 113,000. Congress, by failing to renew unemployment benefits, is making things worse. According to the Congressional Budget Office, restoring EUC throughout 2014 will increase employment by 200,000 jobs… EUC has long been considered an emergency program that does not have to be paid for by other spending reductions or revenue increases. Five times under President George W. Bush, when the unemployment rate was above 6 percent, unemployment insurance was extended without paying for it and with the support of the majority of Republicans.

Unfortunately, on February 6, a measure to extend EUC by three months and another to extend it by 11 months both failed to garner the 60 Senate votes needed for passage.

Compare this to Congress’s approach to provisions that are often called the “tax extenders” because they extend a variety of tax breaks that mostly go to business interests. Unlike EUC, these provisions cannot be thought of as temporary, emergency measures. Even though these tax cuts are officially temporary, Congress has routinely extended them every couple of years with little or no review of their impacts, so that they function as permanent tax cuts.

And, sadly, lawmakers of both parties are guilty of enacting these provisions time after time without closing any business tax loopholes to offset the costs. In some years, Democrats have introduced bills that would close tax loopholes to offset the cost of the extenders. For example, in 2009, Citizens for Tax Justice and several other organizations supported legislation that would have offset the costs of the tax extenders by closing the “carried interest” loophole and other tax loopholes.

But in other years, neither party even bothered to discuss paying for the tax extenders. This happened the last time they were enacted as part of the “fiscal cliff” legislation that also extended most of the Bush-era tax cuts. Sadly, 2014 may be another year when neither party even pretends to be “fiscally responsible” when it comes to lavishing businesses with tax breaks. Several news reports indicate that Senators are discussing how to enact the tax extenders with as little debate as possible.

There Is No Provision among the “Tax Extenders” that Is So Beneficial that It Justifies Enacting the Entire Package Without Offsetting the Costs

The feeling among lawmakers that the tax extenders must be enacted under absolutely any circumstances is simply not justified, as demonstrated by examining the most costly provisions among them. This is explained in detail in CTJ’s report on the tax extenders.

The pie chart above, which is taken from the CTJ report, illustrates the costs of the individual tax extenders provisions the last time they were enacted, at the start of 2013 as part of the “fiscal cliff” legislation.

The most costly is the research credit, which is supposed to encourage companies to perform research but appears to subsidize activities that are not what any normal person would consider research, and activities that a business would have performed in the absence of any tax break including activities that the business performed years before claiming the credit. The second most costly is the renewable electricity production credit, which even many supporters agree will be phased out at some point in the near future. The third most costly is the seemingly arcane “active financing exception,” which expands the ability of corporations to avoid taxes on their “offshore” profits and which General Electric publicly acknowledges as one of ways it avoids federal taxes. These three tax provisions make up over half of the cost of the tax extenders.

Next in line is the deduction for state and local sales taxes. Lawmakers from states without an income tax are especially keen to extend this provision so that their constituents will be able to deduct their sales taxes on their federal income tax returns. But, as the CTJ report explains, most of those constituents do not itemize their deductions and therefore receive no help from this provision. Most of the benefits go to relatively well-off people in those states.

Even the provisions that sound well-intentioned are really just wasteful subsidies for businesses. The Work Opportunity Tax Credit ostensibly helps businesses to hire welfare recipients and other disadvantaged individuals, but here’s what a report from the Center for Law and Social Policy concludes about this provision:

WOTC is not designed to promote net job creation, and there is no evidence that it does so. The program is designed to encourage employers to increase hiring of members of certain disadvantaged groups, but studies have found that it has little effect on hiring choices or retention; it may have modest positive effects on the earnings of qualifying workers at participating firms. Most of the benefit of the credit appears to go to large firms in high turnover, low-wage industries, many of whom use intermediaries to identify eligible workers and complete required paperwork. These findings suggest very high levels of windfall costs, in which employers receive the tax credit for hiring workers whom they would have hired in the absence of the credit.

It’s Time for Congress to Change How It Does Business

For Congress to enact unnecessary tax cuts for businesses without closing any business tax loopholes would be very problematic under any circumstances. To do so now, after making clear that help will not be provided to the unemployed unless the costs are offset with spending cuts, is simply outrageous.

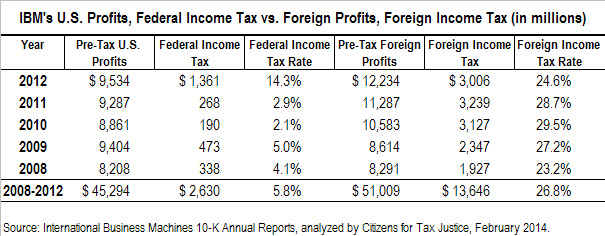

Last week, CTJ published its finding that International Business Machines (IBM) has paid U.S. federal corporate income taxes equal to just

Last week, CTJ published its finding that International Business Machines (IBM) has paid U.S. federal corporate income taxes equal to just

Illinois – Though there has been much legislative activity in Springfield about

Illinois – Though there has been much legislative activity in Springfield about This week the DC Council will be hearing tax reform recommendations from the experts they appointed to study the District’s tax system. While far from perfect, the

This week the DC Council will be hearing tax reform recommendations from the experts they appointed to study the District’s tax system. While far from perfect, the

engage in accounting gimmicks to make most of its U.S. profits appear (to the IRS) to be earned in subsidiaries in Bermuda, the Cayman Islands or other countries that do not tax these profits. Of course, IBM does little or no real business in these countries and its subsidiaries there may be nothing more than post office boxes.

engage in accounting gimmicks to make most of its U.S. profits appear (to the IRS) to be earned in subsidiaries in Bermuda, the Cayman Islands or other countries that do not tax these profits. Of course, IBM does little or no real business in these countries and its subsidiaries there may be nothing more than post office boxes.

Given their lack of funds and the league’s high profits, why do state and local lawmakers feel the need to give extravagant subsidies to NFL teams? One of the main reasons is that NFL teams have frequently threatened to leave a given city if they do not receive the subsidies they want, typically for constructing or maintaining a stadium, and many lawmakers fear that voters will

Given their lack of funds and the league’s high profits, why do state and local lawmakers feel the need to give extravagant subsidies to NFL teams? One of the main reasons is that NFL teams have frequently threatened to leave a given city if they do not receive the subsidies they want, typically for constructing or maintaining a stadium, and many lawmakers fear that voters will

Six states and the District of Columbia enacted

Six states and the District of Columbia enacted