On Sunday, House Republicans passed a budget plan that included the repeal of the medical device excise tax, making the end of this tax one of its demands in the ongoing budget negotiations. As the Center on Budget and Policy Priorities (CBPP) notes, the case against the medical device excise tax is being driven by misinformation put out by the medical device industry, which is hoping to avoid paying their fair share in taxes by getting the tax repealed. (The trade association even wrote the letter 75 members of the House sent to Speaker Boehner asking for the repeal.)

On Sunday, House Republicans passed a budget plan that included the repeal of the medical device excise tax, making the end of this tax one of its demands in the ongoing budget negotiations. As the Center on Budget and Policy Priorities (CBPP) notes, the case against the medical device excise tax is being driven by misinformation put out by the medical device industry, which is hoping to avoid paying their fair share in taxes by getting the tax repealed. (The trade association even wrote the letter 75 members of the House sent to Speaker Boehner asking for the repeal.)

One argument made by the industry against the medical device excise tax is that it singles them out for higher taxes. The reality, however, is that the excise tax was passed as one of many levies on various healthcare sectors to help pay for health insurance expansion.

More vaguely, the industry has argued that the medical device excise tax will threaten “medical innovation and Americans jobs.” On its face, this charge is ridiculous considering that healthcare reform will increase demand for devices overall, and that the excise rate on the device is a mere 2.3 percent. That low tax rate should be a drop in the bucket to a medical device company like Medtronic, which had a profit margin of over 20 percent last year. In addition, the excise tax applies to medical devices imported to the US, and does not apply to devices made in the US if they are exported, meaning that the legislation was designed to protect competitiveness and job creation at US medical device companies.

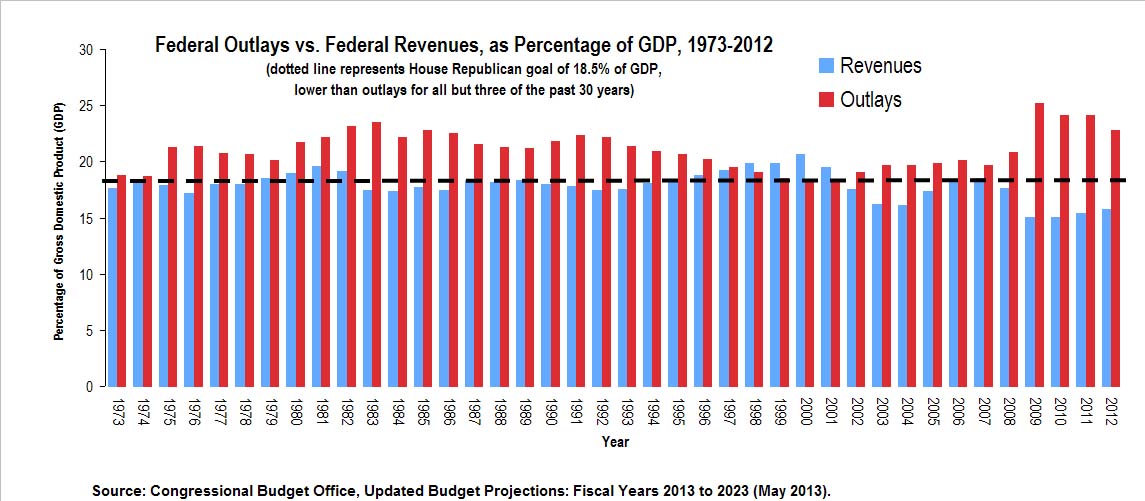

The one critical thing that the medical device tax does accomplish is to raise crucially needed revenue. According to the Joint Committee on Taxation (PDF), the measure will raise about $30 billion over the next ten years. Given that the tax cuts passed earlier this year are already set to double the projected long term national debt, it does not make sense to exacerbate the debt further by passing billions more in tax cuts for an already lucrative industry.

As we noted last year, the push for repeal of the medical device excise tax is yet another example of corporate special interests trying to use their money and influence to increase their profits at the cost of ordinary American taxpayers. Hopefully, lawmakers will resist this relentless lobbying effort not only during immediate budget negotiations but in the long run as well.

Professor

Professor  At the request of Oregon Governor John Kitzhaber, the state’s legislature will convene a

At the request of Oregon Governor John Kitzhaber, the state’s legislature will convene a

It’s become “common-sense” to argue that the federal government should immediately cut spending to reduce the deficit, but this is mistaken. Over the past two years lawmakers have already enacted enough debt reduction (primarily through

It’s become “common-sense” to argue that the federal government should immediately cut spending to reduce the deficit, but this is mistaken. Over the past two years lawmakers have already enacted enough debt reduction (primarily through  Next Tuesday the federal gas tax will celebrate an unfortunate anniversary: 20 years stuck at a rate of exactly 18.4 cents per gallon. A

Next Tuesday the federal gas tax will celebrate an unfortunate anniversary: 20 years stuck at a rate of exactly 18.4 cents per gallon. A  ITEP’s report offers a better path forward, and explains how reform could have prevented our current funding predicament. By allowing the gas tax rate to grow alongside both construction cost inflation and fuel-efficiency, the federal transportation fund could have been brought from frequent deficits to consistent surpluses. ITEP finds that more than $215 billion in additional revenue could have been raised over the 1997-2013 period—money that would have made a real difference in putting people to work and improving the efficiency of our transportation network.

ITEP’s report offers a better path forward, and explains how reform could have prevented our current funding predicament. By allowing the gas tax rate to grow alongside both construction cost inflation and fuel-efficiency, the federal transportation fund could have been brought from frequent deficits to consistent surpluses. ITEP finds that more than $215 billion in additional revenue could have been raised over the 1997-2013 period—money that would have made a real difference in putting people to work and improving the efficiency of our transportation network.

Senator Carl Levin (D-Mich.) today introduced the “

Senator Carl Levin (D-Mich.) today introduced the “ Annual state and local finance

Annual state and local finance