Senator Rand Paul of Kentucky, an opponent of efforts to crack down on offshore tax havens, is stepping up his efforts by introducing FATCA repeal, and is extending his help to tax-dodging corporations by proposing a repatriation amnesty.

Senator Rand Paul of Kentucky, an opponent of efforts to crack down on offshore tax havens, is stepping up his efforts by introducing FATCA repeal, and is extending his help to tax-dodging corporations by proposing a repatriation amnesty.

Senator Paul’s Campaign for Individual Tax Cheaters: Repeal of FATCA

A year ago we explained that Senator Paul was blocking an amendment to a U.S.-Swiss tax treaty designed to facilitate U.S. tax evasion investigations:

The US and Swiss governments renegotiated their bilateral tax treaty as part of the 2009 settlement of the UBS case. That case charged the Swiss mega-bank UBS with facilitating tax evasion by US customers. Under the settlement agreement, UBS paid $780 million in criminal penalties and agreed to provide the IRS with names of 4,450 US account holders.

Before it could supply those names, however, UBS needed to be shielded from Swiss penalties for violating that country’s legendary bank-secrecy laws. The renegotiation of the US-Swiss tax treaty addressed that problem by providing, as most other recent tax treaties do, that a nation’s bank-secrecy laws cannot be a barrier to exchange of tax information.

Today Senator Paul is still blocking such treaties. Taking his efforts a step further, he has introduced a bill to repeal a major reform that clamps down on offshore tax evasion. That reform is the Foreign Account Tax Compliance Act (FATCA), which was enacted in 2010 as part of the Hiring Incentives to Restore Employment (HIRE) Act. Senator Paul says he opposes it because of “the deleterious effects of FATCA on economic growth and the financial privacy of Americans.”

His arguments are entirely unfounded and the only thing he is accomplishing is to help those illegally hiding their income from the IRS. FATCA basically requires taxpayers to tell the IRS about offshore assets greater than $50,000, and it applies a withholding tax to payments made to any foreign banks that refuse to share information about their American customers with the IRS.

For a country with personal income tax (like the U.S.), that kind of information-sharing is indispensible to tax compliance, as the IRS stated in its most recent report on the “tax gap”:

Overall, compliance is highest where there is third-party information reporting and/or withholding. For example, most wages and salaries are reported by employers to the IRS on Forms W-2 and are subject to withholding. As a result, a net of only 1 percent of wage and salary income was misreported. But amounts subject to little or no information reporting had a 56 percent net misreporting rate in 2006.

So why shouldn’t foreign banks that benefit from the business of U.S. customers report the assets they deposit to U.S. tax enforcement authorities? Without such reporting, people who have the means to shift assets offshore are able to evade U.S. income taxes, while the rest of us are left to make up the difference.

Senator Paul’s Repatriation Amnesty Would Help Corporations That Use Tax Havens

The same week he proposed repeal of FACTA, Senator Paul introduced a bill that would reward corporations for shifting profits overseas. What the corporations are doing is not actually illegal, but in some ways that is exactly the problem, and the Senator’s tax amnesty proposal would make it worse.

The general rule under current law is that U.S. corporations are allowed to “defer” paying U.S. taxes on their offshore profits until those profits are “repatriated” (until they are brought back to the U.S.). A significant tax benefit to corporations, “deferral” actually encourages them to disguise their U.S. profits as foreign profits generated in a country that has no corporate tax or a very low corporate tax — in other words, a tax haven.

Whereas now U.S. corporations do have to pay the U.S. corporate tax on those profits upon repatriation (minus whatever amount they paid to the other country’s government, to avoid double-taxation), a repatriation amnesty would temporarily call off almost all the U.S. tax on those offshore profits. Paul’s proposal would subject the repatriated profits to a tax rate of just five percent.

A similar repatriation amnesty was enacted in 2004 and is widely considered to have been a disaster. A CTJ fact sheet explains (PDF) why proposals for a second repatriation amnesty should be rejected:

■ Another temporary tax amnesty for repatriated offshore corporate profits would increase incentives for job offshoring and offshore profit shifting… One reason why the Joint Committee on Taxation concluded that a repeat of the 2004 “repatriation holiday” would cost $79 billion over ten years is the likelihood that many U.S. corporations would respond by shifting even more investments offshore in the belief that Congress will call off most of the U.S. taxes on those profits again in the future by enacting more “holidays.”

■ The Congressional Research Service concluded that the offshore profits repatriated under the 2004 tax amnesty went to corporate shareholders and not towards job creation. In fact, many of the companies that benefited the most actually reduced their U.S. workforces.

Completely ignoring JCT’s findings, Senator Paul claims that the tax revenue generated from taxing the repatriated profits (even at a low rate of 5 percent) could be used to fund repairs of bridges and highways.

We’d like to assume that Senators know you can’t use a tax proposal that loses revenue to pay for something. We would like to assume that, but, sadly, we can’t.

Photo of Rand Paul via Gage Skidmore Creative Commons Attribution License 2.0

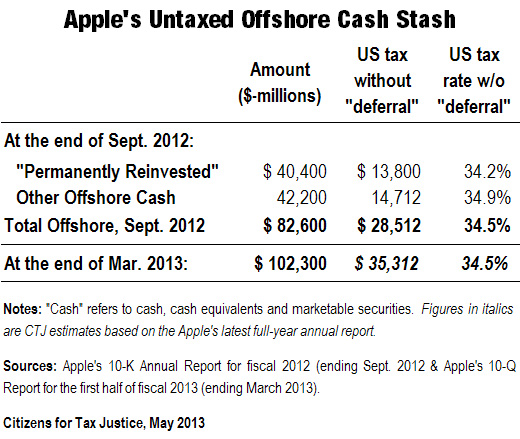

Citizens for Tax Justice has a new analysis of Apple’s financial reports that makes clear that Apple has paid almost no income taxes to any country on this offshore cash.

Citizens for Tax Justice has a new analysis of Apple’s financial reports that makes clear that Apple has paid almost no income taxes to any country on this offshore cash. An analysis of Apple Inc.’s financial reports makes clear that Apple has paid almost no income taxes to any country on its $102 billion in offshore cash holdings. That means that this cash hoard reflects profits that were shifted, on paper, out of countries where the profits were actually earned into foreign tax havens.

An analysis of Apple Inc.’s financial reports makes clear that Apple has paid almost no income taxes to any country on its $102 billion in offshore cash holdings. That means that this cash hoard reflects profits that were shifted, on paper, out of countries where the profits were actually earned into foreign tax havens. annual report show that the company would pay almost the full 35 percent U.S. tax rate on its offshore income if repatriated. That means that virtually no tax has been paid on those profits to any government.

annual report show that the company would pay almost the full 35 percent U.S. tax rate on its offshore income if repatriated. That means that virtually no tax has been paid on those profits to any government.

Senator Rand Paul of Kentucky, an opponent of efforts to crack down on offshore tax havens, is stepping up his efforts by introducing FATCA repeal, and is extending his help to tax-dodging corporations by proposing a repatriation amnesty.

Senator Rand Paul of Kentucky, an opponent of efforts to crack down on offshore tax havens, is stepping up his efforts by introducing FATCA repeal, and is extending his help to tax-dodging corporations by proposing a repatriation amnesty. The Brewers Association, a lobbying group for craft beer brewers, has been

The Brewers Association, a lobbying group for craft beer brewers, has been  While major

While major In an

In an