Note to Readers: This is the first of a six part series on tax reform in the states. Over the coming weeks, CTJ’s partner organization, The Institute on Taxation and Economic Policy (ITEP) will highlight tax reform proposals and look at the policy trends that are gaining momentum in states across the country.

Following an election that left half the states with veto-proof legislative majorities, 37 states with one-party rule and more than a dozen with governors who put tax reform high on their agendas, 2013 promises to be a big year for changes to state tax laws.

Following an election that left half the states with veto-proof legislative majorities, 37 states with one-party rule and more than a dozen with governors who put tax reform high on their agendas, 2013 promises to be a big year for changes to state tax laws.

The scrutiny lawmakers will be giving to their state and local tax systems presents an extraordinary opportunity to assess and address structural flaws and ensure that states have the necessary revenue to provide vital public services now and in the future. Yet, it is already clear that “tax reform” for some state lawmakers may be little more than a vehicle for ideological goals like shrinking government spending or cutting taxes for profitable corporations and the wealthy.

Lawmakers in more than 30 states will take on taxes in some shape or form this year – at least 15 states are expected to consider a major tax overhaul (CA, IA, KS, KY, LA, MN, MO, NC, NE, NY, OH, OK, OR, VA, WI) and the list seems to grow by the week.

In the past week, Governors’ proposals in Louisiana, Kansas, Nebraska, Ohio and Wisconsin have been taking shape and what we are seeing is not pretty. Tax cutting and wholesale elimination of the progressive personal income tax is high on these governors’ agendas, and North Carolina is likely to be the next state to join this list.

As a historic number of states gear up for major tax changes, we know that Grover Norquist, Arthur Laffer, and other anti-tax advocates will be making their case for less taxes, smaller government and a higher reliance on the sales tax. There needs to be a real policy discussion in the states that helps people understand there’s a smart way to do tax reform, that it can’t just mean cuts or eliminating revenue sources, and that reform has wide ranging, long term consequences.

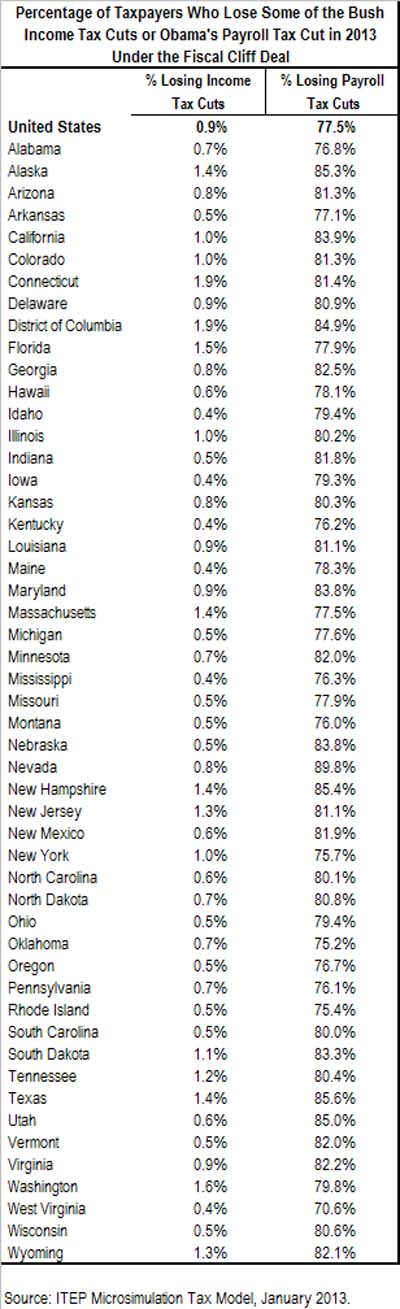

Enter the Institute on Taxation and Economic Policy (ITEP), CTJ’s partner organization. ITEP is closely monitoring tax reform proposals as they develop and will run them through the microsimulation model to see how proposed changes get distributed across different groups of taxpayers – who benefits and who doesn’t and by how much.

ITEP has identified several emerging trends and this series will examine and explain these five major kinds of proposals anticipated this year:

1) Proposals that would sharply reduce or eliminate one or more taxes and replace some or all of the lost revenue by expanding or increasing another tax (“Tax Swaps”)

2) Proposals that would significantly reduce the personal income tax paid by individuals or businesses

3) Proposals to revamp gas taxes

4) Real tax reform- proposals that fix tax codes’ structural flaws rather than dismantling or eliminating taxes

5) Other tax reform ideas including reducing or eliminating property taxes and cutting business taxes

figures.

figures. Following an election that left half the states with veto-proof legislative majorities, 37 states with one-party rule and more than a dozen with governors who put tax reform high on their agendas, 2013 promises to be a big year for changes to state tax laws.

Following an election that left half the states with veto-proof legislative majorities, 37 states with one-party rule and more than a dozen with governors who put tax reform high on their agendas, 2013 promises to be a big year for changes to state tax laws.

Not only does Hawaii have the highest cost of living in the country, it also has some of the highest overall taxes on the poor. A

Not only does Hawaii have the highest cost of living in the country, it also has some of the highest overall taxes on the poor. A  Progress, since fiscal 2011 nearly

Progress, since fiscal 2011 nearly  In the first two days of the new Congress, 21 bills to amend the tax code were introduced in the House of Representatives. The 113th Congress officially convened at noon on January 3rd and by the end of the business day on January 4th, House members had

In the first two days of the new Congress, 21 bills to amend the tax code were introduced in the House of Representatives. The 113th Congress officially convened at noon on January 3rd and by the end of the business day on January 4th, House members had