January 17, 2013 11:34 AM | Permalink | ![]()

More Detailed Tables in Appendix in Full Report

Read the full report in PDF

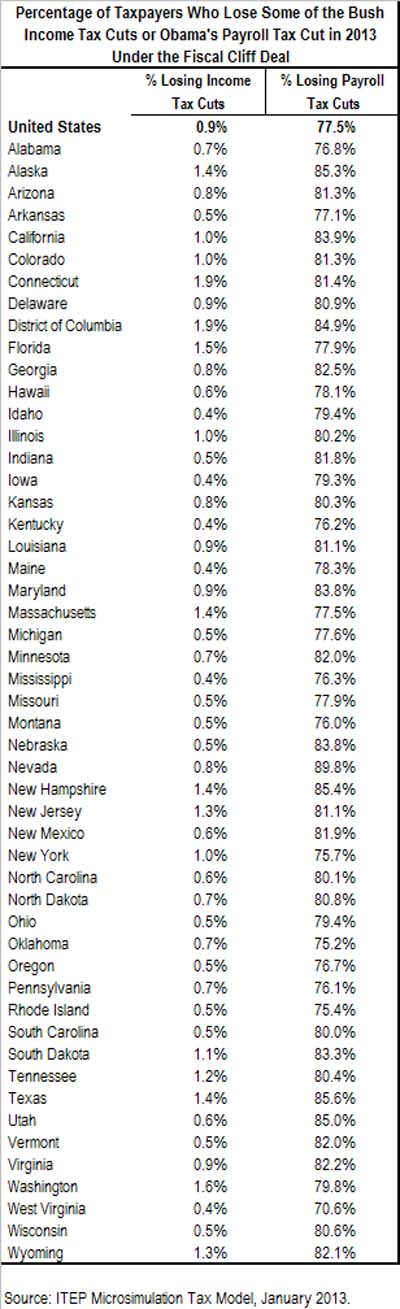

The expiration of parts of the Bush-era income tax cuts under the fiscal cliff deal affects just under one percent of taxpayers this year, while the expiration of the payroll tax cut affects over three-fourths of taxpayers this year.

The fiscal cliff deal (the American Taxpayer Relief Act of 2012), which was approved by the House and Senate on New Year’s Day and signed into law by President Obama, extended most of the Bush-era income tax cuts but allowed all of the payroll tax cut in effect over the previous two years to expire.

The table to the right shows the percentage of taxpayers nationally and in each state who will pay higher income taxes or payroll taxes as a result in 2013.

Under the fiscal cliff deal, even the wealthiest Americans will continue to receive some of the tax cuts first enacted under President George W. Bush in 2001 and 2003. Under the new law, the Bush-era income tax rate reductions no longer apply to taxable income over $450,000 for married couples and over $400,000 for singles. But even multi-millionaires will still enjoy the rate reductions that apply for all taxable income below these levels. Also, many people have gross income exceeding $450,000 or $400,000 but will lose no part of their income tax cuts because their exemptions and deductions reduce their taxable income to a much lower amount.

The Bush-era income tax cuts also included the repeal of the personal exemption phase-out and the limit on itemized deductions (often called PEP and Pease). The fiscal cliff deal allows PEP and Pease to come back into effect (and therefore limits personal exemptions and itemized deductions), but only for married couples with adjusted gross income (AGI) exceeding $300,000 and singles with AGI exceeding $250,000.

The payroll tax cut in effect in 2011 and 2012 had reduced the Social Security payroll tax that employed people pay directly from 6.2 percent of earnings to 4.2 percent of earnings. (The Social Security payroll tax applies to earnings up to a maximum, which is $113,700 in 2013, and not to any earnings above that level.) The payroll tax cut benefited everyone with income in the form of wages or salary.

The appendix in the full report includes more detailed tables showing the percentage of taxpayers in each income group in each state who lose part of the income tax cuts or the payroll tax cut under the deal. Read the full report in PDF.