As President Obama and Governor Romney discuss foreign policy in their final debate, there’s a major issue that they will, unfortunately, probably ignore: the tangle of international tax rules that allow offshore tax dodging.

The U.S. tax system is already in a mess when it comes to the rules we use to determine how profits of multinational companies are taxed. President Obama has proposed some steps to rein in the worst abuses, but most of these are relatively timid or vague. Meanwhile, Romney proposes that the U.S. follow the example of other countries that have a “territorial” system, which has facilitated high-profile tax avoidance schemes by major multinational corporations. On this issue, the U.S. needs to show leadership that has been lacking so far.

Here are the basics: The U.S. could either have a “worldwide” tax system, in which we tax the offshore profits of our corporations (but provide a credit for foreign taxes paid, to prevent double-taxation) or the U.S. could have a “territorial” tax system, which exempts the offshore profits of our corporations from U.S. taxes. What we have now is a hybrid of the two systems. The U.S. does tax the offshore profits of U.S. corporations and provides a credit for foreign taxes paid, but also allows the corporations to “defer” (delay indefinitely) those U.S. taxes, until the profits are brought to the U.S.

Under the current rules, U.S. corporations have a reason to prefer offshore profits over U.S. profits, because they benefit from the rule allowing them to “defer” U.S. taxes on offshore profits indefinitely. So they may shift operations (and jobs) to a country with lower taxes, or engage in convoluted transactions that make their U.S. profits appear to be earned by subsidiaries in countries with no (or almost no) corporate tax (i.e., offshore tax havens).

The offshore subsidiary may be nothing more than a post office box in the Cayman Islands. CTJ recently explained that Nike, Microsoft, Apple and several other companies essentially admit in their public documents that they engage in these tricks.

The offshore subsidiary may be nothing more than a post office box in the Cayman Islands. CTJ recently explained that Nike, Microsoft, Apple and several other companies essentially admit in their public documents that they engage in these tricks.

If allowing corporations to “defer” U.S. taxes on offshore profits causes them to prefer offshore profits over U.S. profits, then eliminating U.S. taxes on offshore profits would logically increase that preference, and increase these abuses. And that’s exactly what a territorial system, which Romney supports, would do.

CTJ has explained in a fact sheet and a more detailed report that we should move in the opposite direction by simply repealing “deferral” so that we have a true “worldwide” tax system. A CTJ report on options to raise revenue explains that repealing deferral would raise $583 billion over a decade.

President Obama has proposed far more limited steps. His most recent budget blueprint proposes to raise $148 billion over ten years with a package of provisions to crack down on the worst abuses of deferral. (The official revenue estimators for Congress projected that the provisions would raise a little more, $168 billion over a decade.)

These proposals would do some good. For example, one would end the practice of companies taking immediate deductions against their U.S. taxes for interest expenses associated with their offshore operations while they defer (not pay) the U.S. taxes on the resulting offshore profits indefinitely. Another would help ensure that the foreign tax credit, which is supposed to prevent double-taxation of foreign profits, does not exceed the amount necessary to achieve that goal. Still another would reduce abuses involving intangible property like patents and trademarks, which are particularly easy to shift to tax haven-based subsidiaries that are really no more than a post office box.

But none of these reforms proposed as part the President’s budget really addresses the underlying problem with a deferral system or a territorial system: The IRS cannot figure out which portion of a multinational corporation’s profits are truly generated in the U.S. and which portion is truly generated overseas. If a U.S. corporation tells the IRS that a transaction with an offshore subsidiary wiped out its profits, the IRS cannot challenge the company unless it can prove that the transaction was unreasonable. And that’s difficult to do, especially when the transaction involves some product or service that is not comparable to anything else in the market (like a new invention, pharmaceutical, or software program).

But none of these reforms proposed as part the President’s budget really addresses the underlying problem with a deferral system or a territorial system: The IRS cannot figure out which portion of a multinational corporation’s profits are truly generated in the U.S. and which portion is truly generated overseas. If a U.S. corporation tells the IRS that a transaction with an offshore subsidiary wiped out its profits, the IRS cannot challenge the company unless it can prove that the transaction was unreasonable. And that’s difficult to do, especially when the transaction involves some product or service that is not comparable to anything else in the market (like a new invention, pharmaceutical, or software program).

President Obama has also proposed, as part of his “framework” for corporate tax reform, a minimum tax on offshore corporate profits. Because he has not yet specified any rate for this minimum tax, it’s impossible to say whether it would be effective. If the rate is set extremely low, then it would change very little. In theory, if the rate was set high enough, it would almost have the same effect as ending deferral — but no one in the administration is talking about anything that dramatic. (Read CTJ’s response to the President’s “framework” for corporate tax reform.)

There are some members of Congress looking very seriously at offshore tax dodging by corporations (like Senator Carl Levin). But serious leadership is unlikely to come from the presidential candidates anytime soon.

Photo of Barack Obama, Mitt Romney, and Cayman Islands Flag via Austen Hufford, Justin Sloan, and J. Stephen Con Creative Commons Attribution License 2.0

Happy Halloween to our readers!

Happy Halloween to our readers!  This one will send a shudder up the spines of supply-siders who want to cut taxes on businesses and the wealthy under the guise of economic development. The Wisconsin Budget Project is reporting on a national poll which found that a “majority of small-business owners believe that raising taxes on the top 2% of taxpayers is the right thing to do.” On this issue, anyway, it looks as though the good goblins are giving Grover a run for his money!

This one will send a shudder up the spines of supply-siders who want to cut taxes on businesses and the wealthy under the guise of economic development. The Wisconsin Budget Project is reporting on a national poll which found that a “majority of small-business owners believe that raising taxes on the top 2% of taxpayers is the right thing to do.” On this issue, anyway, it looks as though the good goblins are giving Grover a run for his money!

There’s been

There’s been

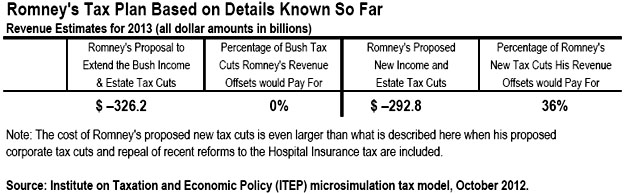

Romney came out swinging saying that President Barack Obama had put the U.S. on a path “heading towards Greece” and that by the end of his second term Obama will have pushed the debt to $20 trillion. He added that a former Chairman of the Joint Chiefs of Staff

Romney came out swinging saying that President Barack Obama had put the U.S. on a path “heading towards Greece” and that by the end of his second term Obama will have pushed the debt to $20 trillion. He added that a former Chairman of the Joint Chiefs of Staff  The Pennsylvania legislature

The Pennsylvania legislature

The offshore subsidiary may be nothing more than a post office box in the Cayman Islands. CTJ recently

The offshore subsidiary may be nothing more than a post office box in the Cayman Islands. CTJ recently  But none of these reforms proposed as part the President’s budget really addresses the underlying problem with a deferral system or a territorial system: The IRS cannot figure out which portion of a multinational corporation’s profits are truly generated in the U.S. and which portion is truly generated overseas. If a U.S. corporation tells the IRS that a transaction with an offshore subsidiary wiped out its profits, the IRS cannot challenge the company unless it can prove that the transaction was unreasonable. And that’s difficult to do, especially when the transaction involves some product or service that is not comparable to anything else in the market (like a new invention, pharmaceutical, or software program).

But none of these reforms proposed as part the President’s budget really addresses the underlying problem with a deferral system or a territorial system: The IRS cannot figure out which portion of a multinational corporation’s profits are truly generated in the U.S. and which portion is truly generated overseas. If a U.S. corporation tells the IRS that a transaction with an offshore subsidiary wiped out its profits, the IRS cannot challenge the company unless it can prove that the transaction was unreasonable. And that’s difficult to do, especially when the transaction involves some product or service that is not comparable to anything else in the market (like a new invention, pharmaceutical, or software program). over tax policy during Tuesday night’s

over tax policy during Tuesday night’s  The Iowa Policy Project’s Research Director Peter Fisher is quoted in a

The Iowa Policy Project’s Research Director Peter Fisher is quoted in a