March 3, 2000 12:55 PM | Permalink |

Click here to see this analysis in PDF format.

Texas Governor George W. Bush’s Record on Taxes

Citizens for Tax Justice, March 3, 2000

George W. Bush began his first term as Governor of Texas in January 1995. Although Bush had campaigned in 1994 on a platform of increasing the state share of public school funding in order to limit the growth of local school property taxes, little happened in Texas tax policy in the 1995 legislative session.

After the legislature adjourned, however, Bush began planting the seeds of a tax plan for the next session by creating a task force to study ways to reduce property taxes. A previous tax task force under Governor Ann Richards in 1991 had recommended that Texas adopt a state personal income tax (Texas is one of nine states without a broad-based personal income tax). That recommendation was not well received and eventually led to a constitutional amendment, passed in 1993, that requires any proposed personal income tax be approved in a statewide referendum.

Bush prohibited his task force from even considering an income tax. Because the state primarily relies on already high consumption taxes–Texas ranks 11th nationally in consumption taxes as a share of personal income–taking the income tax off the table severely handicapped the task force’s ability to design meaningful, property-tax-reducing tax reform. In addition, because consumption taxes hit middle- and low-income families the hardest, and are more regressive than property taxes, any plan to cut property taxes under this restriction was almost certain to shift the relative tax burden off of business and the well-off and onto everyone else.

Many were critical of the decision to exclude a progressive income tax as one reform possibility. “Putting together a task force to come up with an alternative to the property tax–but ruling out consideration of the income tax–is like telling a mechanic to fix your flat tire without using a jack. Pretending that the most logical alternative doesn’t exist won’t get us much closer to tax reform” [Austin American-Statesman 11/6/95]. A 1997 Harte-Hanks Texas Poll showed that 45 percent of the Texans polled said they would support an income tax if property and sales taxes were reduced [Corpus Christi Caller-Times, 5/19/97].

At the beginning of the 1997 legislative session Bush outlined a complicated tax plan based on the task force’s recommendations. It would have repealed the Corporate Franchise Tax (Texas’s tax on business profit and value) and lowered property taxes. These cuts would have reduced government revenue by about $4.8 billion for 1999. To partially offset the revenue loss, he proposed raising the state sales tax from 6.25 percent to 6.75 percent (additional local sales taxes in Texas range up to 2 percent) and adopting a Value Added Tax (“VATs” are common in Europe and are usually considered to operate primarily as hidden sales taxes). This replacement revenue would have amounted to $3.7 billion. Thus, in 1999 the net tax cut would have been a little more than $1 billion. In 1998, as the plan’s provisions were being phased in, the cut would have been $340 million.

Bush was determined to pass his first major legislative tax bill. “I’ve got a lot of capital to spend, and I’m going to spend every dime of it,” Bush said. “I’m going to kick some butts to get this thing passed” [New York Times 5/31/97].

To make his plan add up, of course, the tax cuts of $1.4 billion over the biennium (Texas does its budgets two years at-a-time) had to be paid for in some way. There was a $1 billion state budget surplus projected for the biennium. The legislation embodying his plan, however, did not provide for specific spending cuts. A “Fiscal Impact” analysis of Bush’s plan for the 1998-1999 biennium by the Texas Comptroller of Public Accounts in February 1997 showed that Bush’s plan faced a $400 million shortfall.

Response to Bush’s plan was nearly universally critical. Columnist Dave McNeely said Texans’ responses to Bush’s tax plan “ranged from muted applause to obscene gestures” [Austin American-Statesman 3/2/97]. “This looks like a sinking missile,” political analyst Harvey Kronberg predicted. “What the governor tried to do is ambitious, but mechanically he can’t get there” [Dallas Morning News 2/21/97].

From a Corporate Profits and Value Tax to a Consumption Tax

Bush proposed repealing the Corporate Franchise Tax which is imposed on corporations doing business in Texas. This tax was projected to raise $1.9 billion in 1999. As a tax on profits and corporate value, the benefit of this tax’s repeal would have gone disproportionately to the well-off shareholders of corporations. In addition, since most of this type of state tax is paid by the largest corporations, whose stockholders reside around the country and the world, its repeal would largely have benefitted out-of-state stockholders.

Bush’s proposed VAT would have raised $2.8 billion in 1999. The net impact of the $1.9 billion franchise tax elimination and the adoption of the $2.8 billion VAT has been misconstrued by some as proposal to raise taxes on business. But the entity that writes the check to the revenue collection agency is not necessarily the entity that bears the burden of the tax. General sales taxes, for example, are paid to the government by businesses. But most would agree that the burden of the general sales tax falls on the consumers, not on the owners of business.

The important issue with taxes initially paid by business is who ultimately bears the burden. VATs, common in Europe, are generally regarded as consumption taxes that are paid by consumers. Variants of VATs imposed by Michigan (its “Single Business Tax”) and New Hampshire (its “Business Activity Tax”) are usually also regarded as consumption taxes or as taxes that primarily reduce wages for employees. Either way, the burdens of such taxes fall disproportionately on middle- and low-income taxpayers instead of the wealthy stockholders who bear the burden of corporate income taxes such as the Texas franchise tax.

Retailers believed that Bush’s VAT would be passed on to consumers: “These costs will be imbedded in the price of a product, so the consumer will pay it but never see it,” said Richie Jackson, executive director of the Texas Restaurant Association, responding to Bush’s task force recommendation [Austin American-Statesman 9/16/96].

It is not hard to see why the task force, with ample representation from large corporations (Dow Chemical, Tandy Corp., etc.), came out in favor of a proposal that would shift taxes from corporate shareholders to consumers and workers. But not all in the business community were enamored of it. Many types of businesses successfully avoid the Corporate Franchise Tax. For those businesses, the proposed VAT/Franchise Tax trade-off would not have been a good one. Law and medical partnerships feared, for example, that their “employees,” including the doctors and lawyers, would have to, for the first time in Texas, start paying tax on their compensation. And even businesses confident they could pass the tax onto consumers did not want to collect it.

Notwithstanding this opposition of narrow segments of the business community that had nothing to gain from the repeal of the Corporate Franchise Tax, and some of their conservative allies, Bush’s VAT proposal was not, overall, a shift of taxes onto business. The primary impact of the shift from the Corporate Franchise Tax to the VAT would have been to lower taxes for well-off corporate shareholders relative to middle- and low-income taxpayers.

The Property Tax Cuts

Bush proposed to reduce school property taxes, which comprised about 60 percent of Texas property taxes at the time, by about a third. Bush proposed three property tax cuts: amending the state’s constitution to increase the homestead exemption for school property taxes from $5,000 to $25,000 (and from $15,000 to $35,000 for those 65 and older); reducing property tax rates for all school districts by 20 cents per $100 of value; and eliminating the school personal property tax on business inventory. Only 30 percent of the property tax cuts–the increase in the homestead exemption–were exclusive to homeowners. The rest of the cuts either were exclusive to businesses (the business inventory exemption) or shared between businesses and homeowners (the 20-cent reduction). According to a study by the Legislative Budget Board (LBB), almost two-thirds of the 20-cent reduction would have gone to businesses. Thus, of the total property tax cuts, the majority would have gone to businesses, and their shareholders, and the rest to homeowners.

Violating a Pledge?

There was much dispute in Texas during 1997 about whether Governor Bush had violated a pledge by proposing the increase in the state sales tax rate. In 1994 Bush had promised to fight any attempt to raise sales taxes, signing a pledge with Taxpayers for Accountability during his gubernatorial campaign. Bush spokeswoman Karen Hughes said that while she didn’t remember Bush signing the statement, she did not dispute its validity since it was on Bush campaign letterhead [Houston Chronicle 5/1/97; Fort Worth Star-Telegram 6/4/97]. Bush paraphrased his father’s broken tax promise during a 1994 campaign speech when the younger Bush said, “Read my ears . . . there will not be a tax increase when I’m the governor” [Houston Chronicle 10/27/94; New York Times Magazine 9/13/98].

Who Would Have Gotten the Biggest Tax Cuts Under Bush’s Plan

Bush claimed that his plan would make the state’s tax system more fair. While touting his plan, Bush emphasized that school property taxes could fall as much as 40 percent for Texas residents. But this figure excluded the substantial offsetting tax hikes. With over half of the property tax cuts going to businesses (and their owners), none going directly to renters, abolishing the progressive Corporate Franchise Tax, adopting a regressive VAT and hiking the regressive sales tax, it is clear that the effect of Bush’s tax plan would have most benefitted the well-off. In fact, a significant portion of middle- and low-income families would have seen their consumption tax increase exceed their property tax cut (if they got any property tax cut–renters, who comprise 40 percent of Texas families, would have received no direct tax break).

This increase in the regressivity of the Texas tax system would have made one of the most regressive tax systems in the country even more regressive. A 1996 study by Citizens for Tax Justice found that low-income Texas families pay 13.8 percent of their income in state and local taxes, middle-income families pay 8.6 percent and the wealthiest pay only 4.4 percent. Not only was Texas found to have the third most regressive tax system in the country, but the burden on the poor was the sixth highest. At best, Governor Bush’s proposal did nothing to address this–and, in fact, it would have made things much worse.

According to an official report prepared for lawmakers by the Texas Legislative Budget Board (LBB) (www.lbb.state.tx.us), which relied on assumptions quite generous to the Governor’s plan with regard to who would benefit from his plan, Texans with higher incomes would have benefitted more from Bush’s proposal than those with lower incomes. The report found that “the current state and local tax system is regressive–lower income groups pay a larger percentage of their income in taxes than the percentage paid by higher income groups.” And Bush’s plan “would make the system slightly more regressive” by providing the largest benefits to Texans with incomes over $75,000. The report found that families earning under $20,000 would receive an average tax cut of $3 per month. Families with income between $20,000 and $75,000 would receive an average tax reduction of $8.93 per month. But families earning over $75,000 would receive an average tax cut of $24.04 per month. This confirmed what Dick Lavine, with the Center for Public Policy Priorities (www.cppp.org), said: “What most people will get in property tax relief will be outweighed by what they lose in higher taxes.” Indeed, even using Bush’s calculations, the Houston Chronicle found that if Bush’s 1997 plan had been enacted, the average family would have paid $71 more per year in consumption taxes [9/6/98].

Higher Federal Income Taxes for Texas Residents

The 20 percent of Texas residents who itemize deductions on their federal return can deduct the amount of Texas property taxes they pay. By cutting this major tax deduction, but raising state taxes which are not deductible (such as sales taxes and the VAT), Bush’s plan would have resulted in these Texans paying higher federal personal income taxes. The LBB estimated that Texans who itemize deductions on their federal income tax returns would have paid close to $250 million more in federal personal income tax as a result of losing part of their property tax deductions.

What Happened to Bush’s 1997 Proposal?

All tax bills in Texas must originate in the Texas House of Representatives. House Speaker Pete Laney formed a special committee to review Bush’s plan. In spite of Bush’s full-court-press lobbying efforts, the committee scrapped his plan and started from scratch. Bush signed on to the House version despite it being radically different than his proposal.

One particularly controversial provision in the House bill would have “guaranteed tax-exempt status” for almost 50 real estate investment trusts (REITs) which own and manage about $7 billion in Texas commercial real estate [Houston Chronicle 4/23/97]. The trusts’ total property taxes would have been cut between $10 million to $15 million. [Houston Chronicle 4/23/97]. One trust, Crescent Real Estate Equities, founded by Bush business partner Richard Rainwater, would have saved at least $2.5 million in property taxes under the bill. Bush’s blind trust owned about $105,000 in Crescent stock in 1997 [Houston Chronicle 4/22/97].

The Texas Senate came up with its own version of a tax bill which was very different from both the original Bush proposal and the House bill. The House and Senate bills were sent to a conference committee to resolve the differences.

In May 1997, the conference committee had a long and acrimonious debate. Just when it seemed as though no tax bill at all would pass, a compromise tax cut was reached a few days before the session ended. On June 2 the Texas legislature approved a plan to raise the homestead exemption for school property taxes from $5,000 to $15,000. The state’s $1 billion surplus was allocated to offset the lost revenues to schools from the exemption increase. Nothing in the legislation required the schools to reduce their property tax rates or revenues. The cut in the homestead exemption was half what Bush had proposed and none of the other major provisions of Bush’s plan were adopted.

Because the homestead exemption is in the Texas Constitution, a vote of the people was required for it to become law. The increase in the exemption passed. A 1997 Fort Worth Star-Telegram editorial gave Bush and the Texas Legislature an ‘F’ on taxes. “Gov. George W. Bush and lawmakers devoted their attention to one aspect of the state’s flawed tax system, property taxes, and missed the larger point of revising the system,” the editorial said [6/8].

Legacy of the 1997 Tax Bill

Whether the legislature’s 1997 tax bill was a tax cut or not is debatable. Essentially, the plan did two things: (1) required schools to exempt the first $15,000 of home value, up from $5,000, from school property taxes, and (2) allocated the $1 billion biennial state budget surplus to school districts. With $1 billion more from the state, presumably, the school districts did not have to raise as much in property taxes. But how much schools chose to devote to property tax reduction and how much went into increased school spending is unclear.

Overall, school property taxes did not decline. In fact, they continued to rise. In the fall of 1997, 44 percent of school districts raised their property tax rates, 36 percent lowered them and 20 percent left them the same. In addition, 26 school districts lowered additional optional homestead exemptions they’d adopted–offsetting the effect of the state legislation. From 1997 to 1998, school district property taxes in Texas rose by 10.4 percent on single family homes and by 8.7 percent or $900 million overall, according to the Texas Comptroller’s 1998 Annual Property Tax Report. Thus, it is clear that, while the 1997 tax bill may have slowed the increase in school property taxes in Texas, it did not reduce property taxes from what they had been.

Republican Lt. Governor Rick Perry was speaking of the 1997 tax cut when he told the Dallas Morning News: “That tax cut didn’t stand the test of time as well as many of us would have liked it to” and referred to it as “rather illusory” [Dallas Morning News 6/22/99].

The fact that school districts raised their taxes reflected the needs perceived by local communities for greater school spending. This was, of course, not necessarily a bad thing. To the extent, however, that Governor Bush counts the legislature’s 1997 tax bill as a tax cut for Texas, two things should be kept in mind: (1) the final legislation barely resembled what the Governor proposed (although he clearly got the ball rolling for some action on taxes) and, (2) the average tax bill for the average property owner in fact increased in 1998, despite the legislative action.

Fellow Oil Men Get a Break

As the 1999 legislative session started, the oil industry, bemoaning low oil prices, was hunting for a tax break. Specifically, they wanted an exemption from Texas’s oil production tax for wells that produce less than 15 barrels a day ( “stripper wells”). In order for the Texas Legislature to consider legislation in the first 60 days of the session, the governor must declare the subject to be an emergency. Governor Bush declared the emergency and the oil industry got its tax break.

The 1999 Tax Cut

The big tax bill of the 1999 session, however, began with Bush seeking $2.6 billion in sales, corporate and property tax cuts over the biennium. The legislature ended up passing about $2 billion.

Mindful of the criticisms that his 1997 cuts did not adequately benefit middle- and lower-income Texans, Bush proposed three progressive sales tax cuts. These changes had been introduced into the debate by public interest lobbyists in 1997 to demonstrate a progressive alternative to the governor’s regressive proposal. Bush endorsed exempting medicine and diapers from the sales tax, and creating a two-week “sales tax holiday” on clothing and shoes timed to begin right before school started in the fall. Bush also proposed eliminating the sales tax on Internet access.

Some argued that Bush’s new-found concern for poor Texans, who pay the highest burdens in sales taxes, was hypocritical, considering his support in 1997 in raising the state’s sales tax rate from 6.25 percent to 6.75 percent [Houston Chronicle 9/6/98]. Bush defended his flip-flop, however, arguing that his proposed 1997 sales tax increase would have been offset by property tax cuts. But, as was discussed above, this claim certainly didn’t address the genuine problems with the equity of his 1997 plan.

One problem with the governor’s 1999 sales tax proposals was that since local governments levy their sales tax on the state’s sales tax base, they too would lose revenue–over $40 million over the biennium from the non-prescription drug exemption alone. Bush provided no provisions to compensate local governments for the revenue lost because of this and the other sales tax base changes.

In addition to his consumer-oriented sales tax cuts, Bush proposed a business-oriented 20 percent sales tax exemption for data processing and information services. This provision too, would cost local governments as well as the state.

In addition to these sales tax cuts and property tax proposals, Bush proposed sizable corporate franchise tax cuts. He supported an exemption for firms with less than $100,000 in gross receipts. He also proposed allowing a Research and Development (R&D) credit in the franchise tax. Under the R&D credit, corporations could subtract a credit equal to five percent of their R&D costs from their franchise tax liability, reducing their liability by up to 50 percent.

The 1999 Compromise

The legislature adopted much of the Governor’s sales and franchise proposals. The diaper exemption was not adopted, local governments were given an opt-out option for the sales tax holiday, conditions were attached to the R & D credit, other provisions were altered and some new provisions added.

On the property tax, the legislature did substantially less than the governor proposed. The final legislation took steps to provide funds to schools to encourage them to reduce their taxes. With respect to school property taxes to pay for existing debt service, school rate cuts were required. In the final analysis, however, school property taxes for other purposes went up by about the same amount as they were cut for debt service. Thus, the tax bill has not resulted in lower school property taxes. Again, it is impossible to know if school property taxes would have gone up significantly, but for the additional state funding. It is apparent, however, that the communities of Texas, overall, chose to forego property tax cuts even though the state provided them with the funds appropriated to make such cuts possible. Instead, they chose to increase spending on schools.

The 1999 tax bill did, however, cap the amount by which schools can increase their tax rates. These provisions, however, do not appear to have prevented a substantial number of school tax increases. And, there were complaints that this was an intrusion into local authority.

Who Gets the 1999 Tax Cuts?

The franchise tax cuts in the 1999 legislation exceed the sales tax cuts substantially: $1.1 billion versus $820 million over 5 years. Thus, better-off corporate investors receive more of the tax cut than do middle- and low-income taxpayers who pay a higher share of their income in sales taxes than do the well-off.

Whether property taxes were actually reduced significantly by the 1999 tax bill is somewhat unclear at this point. In addition, because the property tax change’s impact is so dependent on local circumstances–including the level of pre-existing debt for each school district–the allocation between homeowners and businesses is not readily calculable.

Reformer with a Record?

Reformer with a Record?

Presidential candidate Bush has claimed that he has cut taxes substantially in Texas. He has claimed that he is reform-minded. He has claimed that if he came to Washington, things would be different.

Taxes have indeed been cut under Governor Bush in Texas. But most of the claimed reduction has been in school property taxes. And, in fact, school property taxes have not gone down.

As for reform: In 1995, Bush came to the governorship of a state with one of the most regressive tax systems in the country. His 1997 proposal would have made the tax system even more regressive. In 1999 Governor Bush again pushed tax legislation that, while having progressive elements, appears to have mainly helped businesses and their well-off owners. Texas still has one of the most regressive tax systems in the country. When it comes to tax policy, Governor Bush does have a record, but it’s hardly one of accomplishing reform.

Would things be different in Washington if the Governor became the President? Tax breaks for business, little relief for middle- and low-income families, an executive branch leader who has difficulty getting his legislation through the legislative branch? These would not be new to our nation’s capital.

![]()

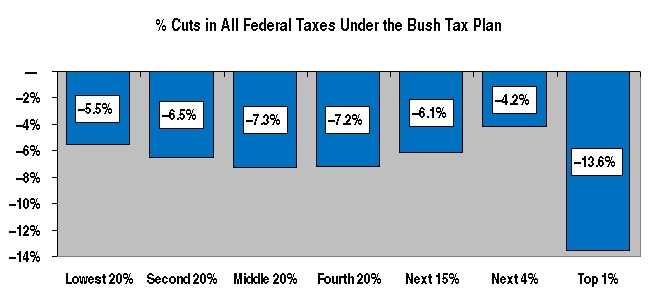

taxpayers would get nothing at all from the Bush plan. Moreover, as a share of current federal taxes, the Bush plan (as revised in May 2000) amounts to:

taxpayers would get nothing at all from the Bush plan. Moreover, as a share of current federal taxes, the Bush plan (as revised in May 2000) amounts to: