February 2, 2005 03:52 PM | Permalink | ![]()

Click here to see the full analysis in PDF format.

Click here to see this press release in PDF format.

Click here for detailed data on 71 zero-tax corporations.

A new analysis of the state corporate income taxes paid by 252 of America’s largest and most profitable corporations finds that by 2003, these companies on average failed to include two-thirds of their actual U.S. pretax profits on their state tax returns.

The report, released by Citizens for Tax Justice and the Institute on Taxation and Economic Policy, is a follow-up to the groups’ September 2004 study of the federal income taxes paid—or not paid—by these same companies. The original report covered 275 Fortune 500 corporations. Of those, 252 fully disclosed their state and local income tax payments.

All of the information on state corporate taxes for the companies came from corporate annual reports to shareholders. Here are some of the key facts that the 252 companies’ annual reports reveal:

■ By 2003, these 252 companies had slashed their state income tax payments to an average of only 2.3 percent of their U.S. profits. Since the average statutory state corporate tax rate is about 6.8 percent (weighted by gross state product), that means that in 2003, two-thirds of their profits escaped state taxes entirely.

■ A shocking 71 of the 252 companies managed to pay no state income tax at all in at least one year from 2001 through 2003—despite telling their shareholders they made $86 billion in pretax U.S. profits in those no-tax years. Twenty-five of these companies enjoyed multiple no-tax years.

■ Some companies, such as Toys “R” Us, AT&T, Boeing, Eli Lilly, Merrill Lynch, and ITT Industries, paid no net state income tax over the full three-year period.

■ In 2003 alone, 35 companies paid no state income tax. Another 138 of the companies paid less than half the statutory state corporate tax rate that year.

■ Perhaps most striking, if these 252 corporations had paid the 6.8 percent average state corporate tax rate on the almost $1 trillion in U.S. profits that they reported to their shareholders, they would have paid $67.1 billion in state corporate income taxes over the 2001-03 period. Instead, they paid only $25.4 billion. Thus, these 252 companies avoided a total of $41.7 billion in state corporate income taxes over the three years.

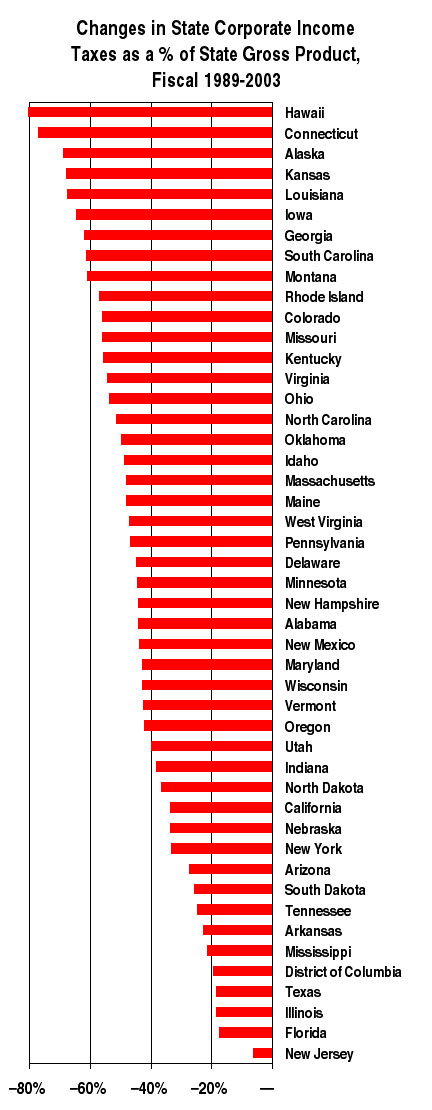

The low state income taxes paid by the 252 corporations in the study reflect the dramatic decline in state corporate income tax collections since the late 1980s. Since fiscal 1989, total state corporate income taxes have fallen by an average of almost 40 percent as a share of the economy. In many states, the declines were much larger than that, ranging as high as an 80 percent drop in Hawaii.

The report outlines some of the key ways that companies avoid their state tax obligations, and offers a menu of suggestions for how states could reform their laws to curb these abuses.

“The data in our report show in stark terms just how successful large, corporations have become at shirking their tax responsibilities to state and local governments,” said Robert S. McIntyre, director of Citizens for Tax Justice and an author of the study. “The companies have been abetted in this effort by America’s major accounting firms, used heavy lobbying and even threats, and often persuaded state elected officials to become their facilitators, too. As a result, individual taxpayers and purely in-state (usually smaller) businesses are paying a heavy price, in the form of higher taxes, reduced public services and unfair competition.”

“State taxpayers can continue to tolerate this situation,” McIntyre said, “or they can call on their elected representatives to take steps to address it.”

The full report includes detailed tables for all 252 companies sorted alphabetically, by tax rates, and by location of corporate headquarters. It is available at www.ctj.org

–000–