Government functions in Minnesota shut down July 1 and  that shutdown continues, nearly two weeks later, as a result of a stand off between Governor Mark Dayton and conservatives in the state’s legislature.

that shutdown continues, nearly two weeks later, as a result of a stand off between Governor Mark Dayton and conservatives in the state’s legislature.

The Governor is using this week to talk directly with Minnesotans and share his message of taking a balanced approach to the crisis. He says, “I’m asking the wealthiest Minnesotans to pay a little more in taxes so that children with special needs don’t have to be denied services … and that’s a Minnesota value.”

The Governor has recently offered an olive branch to conservative lawmakers saying he’d be willing to compromise. He’s even offered to make his proposed tax on millionaires temporary, increase cigarette taxes, increase surcharges on hospitals and health plans and even delay payments to schools. Yet legislators rejected these ideas and have yet to offer any alternative budget proposal of their own.

Dayton is clearly willing to negotiate (though we question the wisdom of a cigarette tax), but the uncompromising negotiation technique of the legislature leaves Minnesotans to deal with the consequences of this avoidable standoff.

Make no mistake, each day that the shutdown is allowed to continue Minnesotans and their state’s economy are harmed. Paul Anton in a recent MinnPost piece notes that “Layoffs of state workers drain about $23 million a week in purchasing power from the state’s economy. Estimates are that the state loses $1 million a week in revenue while the state parks are closed and another $1.25 million a week while the state lottery is not operating.” Of course there are tremendous incalculable impacts too. Background checks and license renewals for health care professionals simply aren’t happening. Let’s not forgot the impact to local governments, schools districts may actually end up having to pay higher interest costs because they may need to borrow more money to balance their own budgets because of delays in state payments.

The St. Cloud Times recently opined, “We don’t support Gov. Mark Dayton traveling the state to talk about his efforts to solve the state’s budget problem. History shows these efforts tend to preach to the choir, no matter the political faith. Then again, we can’t really blame Dayton because the people he needs to talk with — Republican legislative leaders — are clearly not willing to do anything remotely constructive to end this shutdown.”

Dayton has shown he’s willing to negotiate and he’s got the right idea to raise taxes in a progressive way to ensure vital services aren’t cut. Let’s hope for the sake of Minnesota that it doesn’t take the Legislature too much longer to come to a similar conclusion.

Photo via Governor Dayton Creative Commons Attribution License 2.0

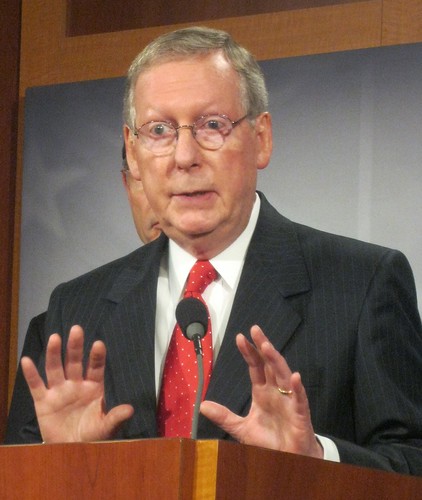

Senator McConnell’s convoluted proposal for lawmakers to raise the debt ceiling while avoiding the blame (

Senator McConnell’s convoluted proposal for lawmakers to raise the debt ceiling while avoiding the blame ( making profits of $26 billion from 2006 through 2010 and receiving tax benefits from the IRS of $4.1 billion over that period, has

making profits of $26 billion from 2006 through 2010 and receiving tax benefits from the IRS of $4.1 billion over that period, has  was ultimately unsuccessful in his

was ultimately unsuccessful in his  Republican leaders in the House and Senate have threatened to allow the U.S. to default on its debt obligations unless the President agrees to cut trillions from public services to reduce the budget deficit.

Republican leaders in the House and Senate have threatened to allow the U.S. to default on its debt obligations unless the President agrees to cut trillions from public services to reduce the budget deficit. Last week, the Times ran an

Last week, the Times ran an  by an

by an  The House Judiciary Committee approved the so-called “Business Activity Tax Simplification Act” (BATSA), H.R. 1439 today.

The House Judiciary Committee approved the so-called “Business Activity Tax Simplification Act” (BATSA), H.R. 1439 today.

lawmakers agreed on a two year, nearly $6 billion, budget plan. The new budget was heavily debated during the state’s third longest legislative session. The state’s budget is now balanced for the next two fiscal years, and compromise on some key issues was reached.

lawmakers agreed on a two year, nearly $6 billion, budget plan. The new budget was heavily debated during the state’s third longest legislative session. The state’s budget is now balanced for the next two fiscal years, and compromise on some key issues was reached.