There’s a multi-million dollar effort underway to convince working people like us that corporations and the wealthy need tax cuts. Their case is a shoddily built house with no foundation. In this video, we break it down.

Month: September 2017

Fact v. Myth

Lawmakers and an army of well-financed special interests have embarked on a campaign to convince the public that supply-side tax cuts will benefit the middle-class. But the American people know better: 24 percent of Americans think the wealthy are paying their fair share of taxes, and just 19 percent of Americans think corporations are paying their fair share of taxes (Source: Gallup). In this series, we challenge myths about the nation’s tax system.

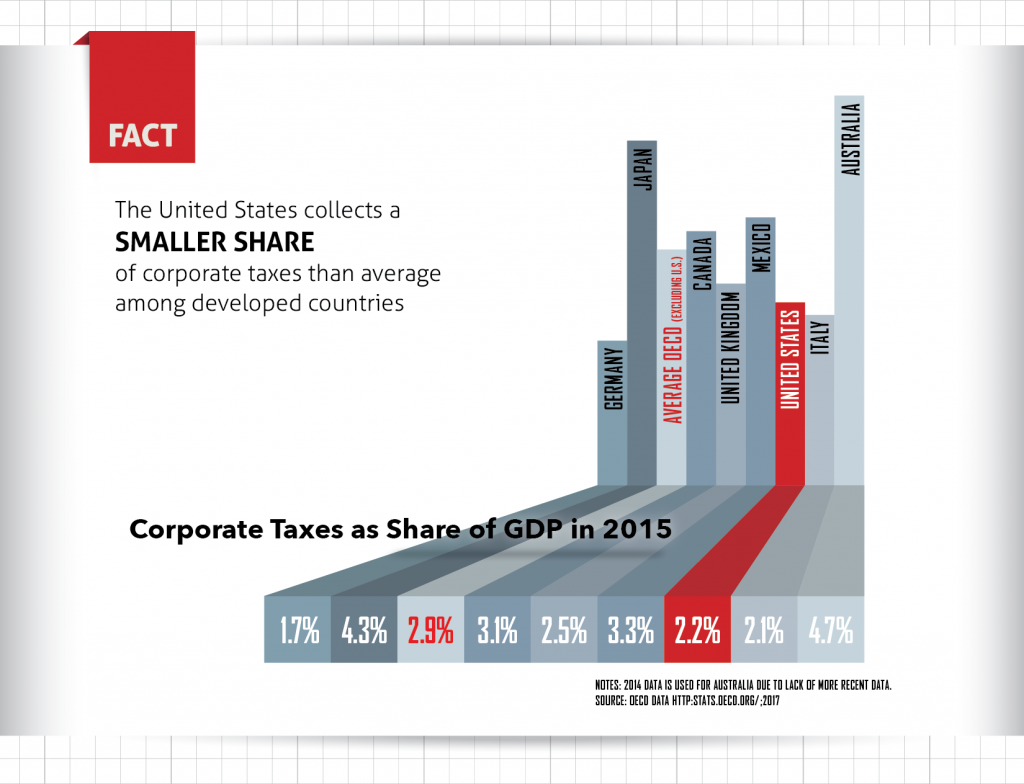

MYTH: The corporate tax rate is too high

Data from the OECD show that U.S. corporate taxes as a percentage of GDP are 2.2 percent, which is substantially less than the 2.9 percent weighted average among the 34 other OECD countries for which data were available. For a full list of countries and their GDP, view this ITEP report.

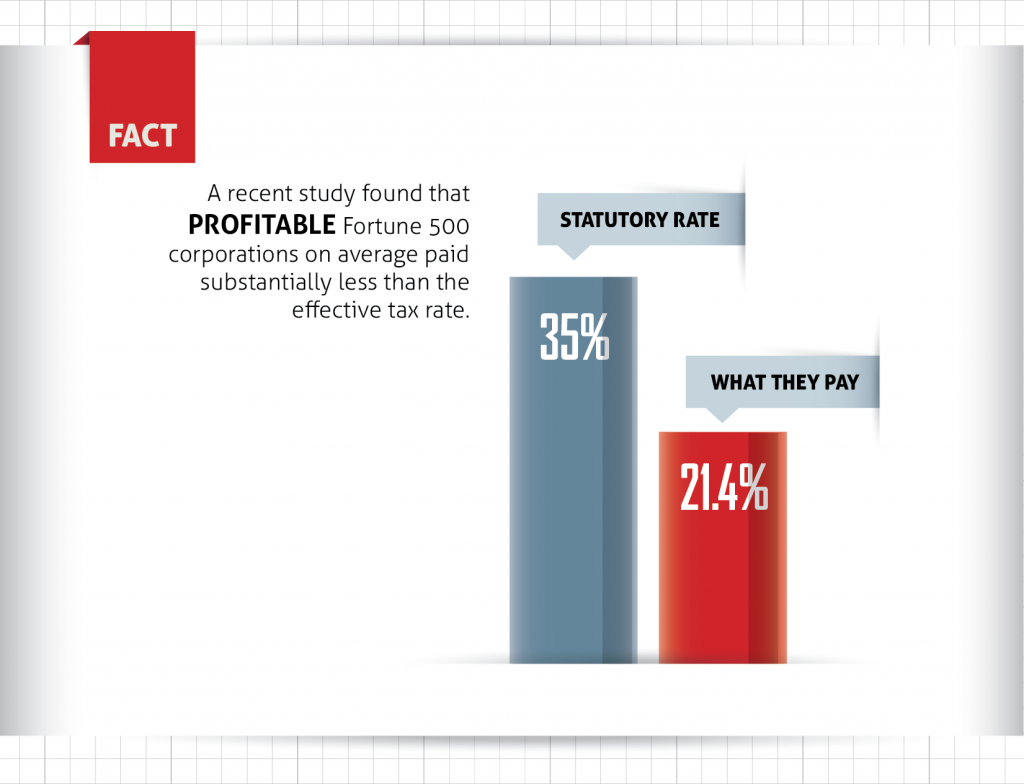

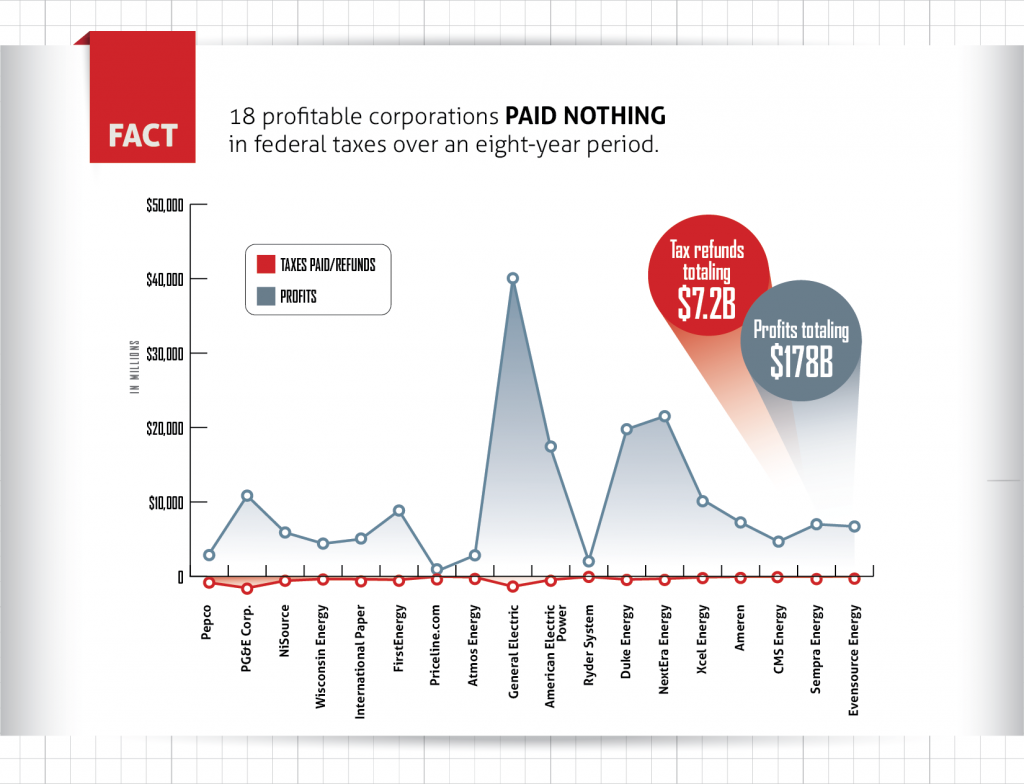

A comprehensive study examined the average effective tax rate paid by profitable Fortune 500 companies over an eight-year period. A substantial number of firms had years in which they were profitable but paid either nothing in federal taxes or single-digit tax rates. The average effective rate paid by profitable U.S. corporations from 2008 to 2015 was 21.4 percent. The 35 Percent Corporate Tax Myth has more detailed information.

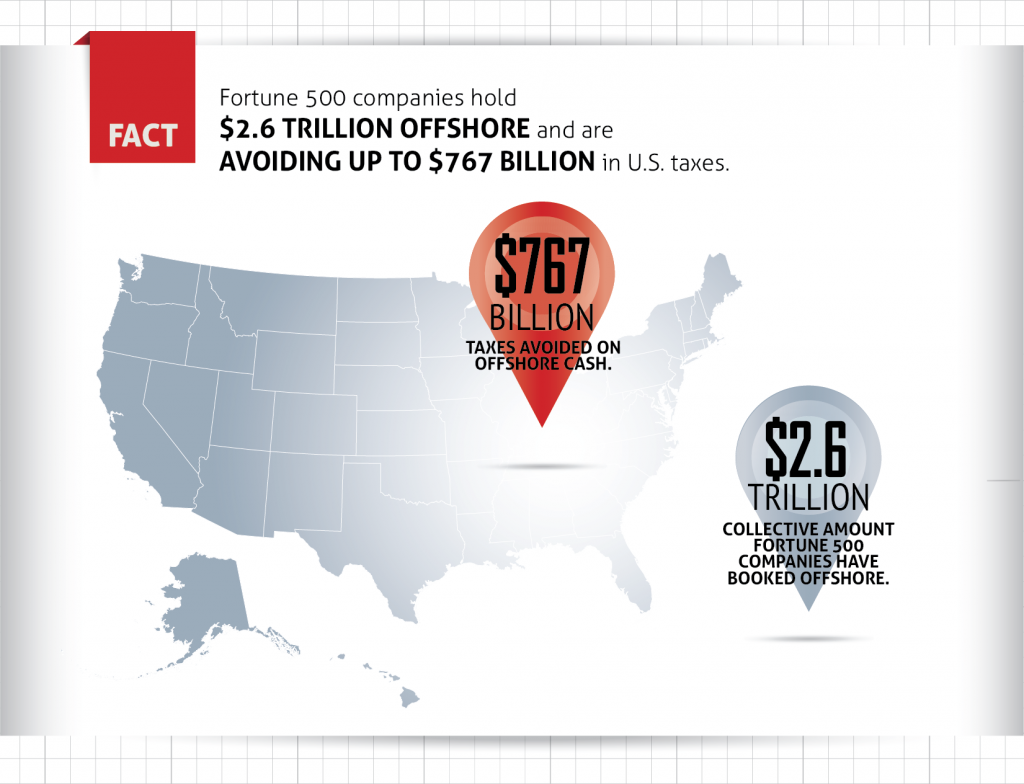

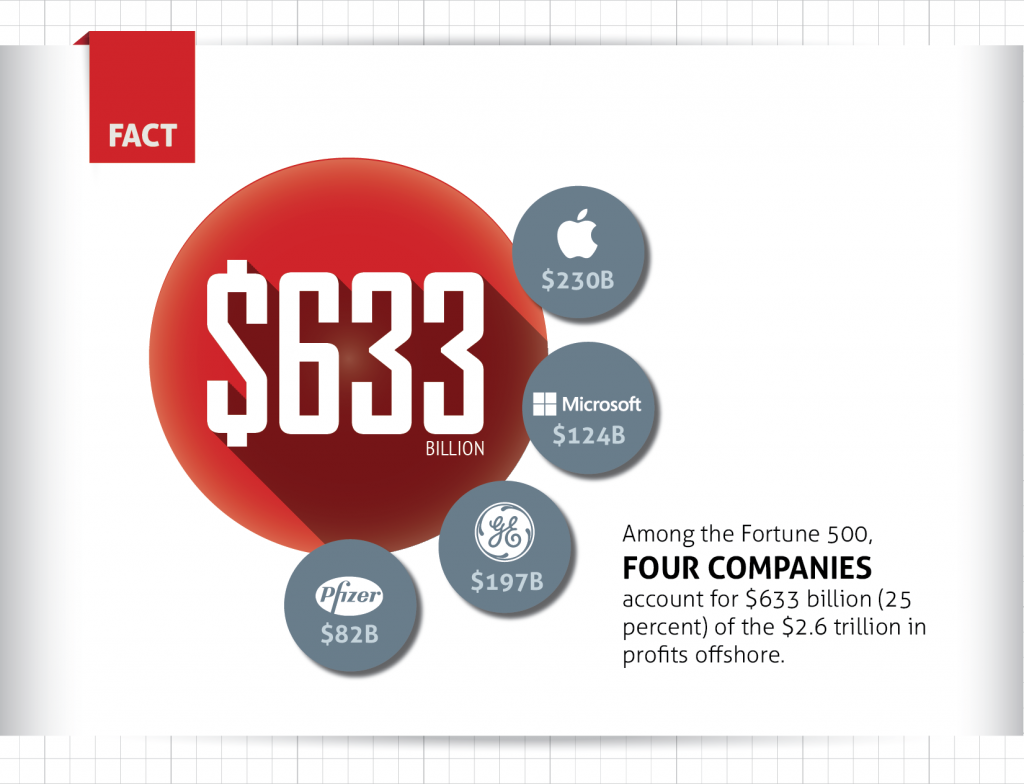

Fortune 500 companies are collectively holding $2.6 trillion offshore and avoiding up to $767 billion in U.S. taxes. Many of these companies acknowledge paying tax rates of 10 percent or less on their offshore profits, indicating they likely are using accounting tricks to shift profits into tax haven countries to avoid U.S. taxes. Read more about corporations’ offshore profits.

Congressional hearings over the past few years have raised awareness of the offshore tax avoidance strategies of major technology corporations, but tech firms are not alone: hundreds of companies shift profits offshore to avoid U.S. taxes. Companies with the biggest offshore cash hoards include major household names such as Apple, Microsoft, GE and Pfizer. Read more

Corporate tax loopholes have allowed 18 profitable corporations to altogether avoid tax over multiple years. In fact, not only have these corporations not paid tax form 2008 to 2015, some of them received federal tax refunds. Read more