Having already cut taxes for the state’s wealthiest residents, Governor Mike Pence and Indiana’s legislative leadership have shifted their focus toward cutting taxes for businesses. Specifically, they’ve declared eliminating or reducing the business personal property tax to be a top priority for the upcoming legislative session. The business personal property tax, levied mainly on equipment and machinery, currently raises over $1 billion each year for localities, school districts, and library districts. State lawmakers would not see their revenues directly affected by repeal of the tax.

Having already cut taxes for the state’s wealthiest residents, Governor Mike Pence and Indiana’s legislative leadership have shifted their focus toward cutting taxes for businesses. Specifically, they’ve declared eliminating or reducing the business personal property tax to be a top priority for the upcoming legislative session. The business personal property tax, levied mainly on equipment and machinery, currently raises over $1 billion each year for localities, school districts, and library districts. State lawmakers would not see their revenues directly affected by repeal of the tax.

Governor Pence says that he wants to take this revenue source away from local governments in a way that would not “unduly harm” them, though he did not specify how he would accomplish this goal, or what an acceptable level of “harm” would be. While some localities collect just 3 percent of their total property tax revenues from business property, others depend on the tax for as much as 40 percent of their property tax collections.

If the tax is repealed, state aid would be hugely important in avoiding deep cuts in local services, but other states’ track records in providing such aid is less than encouraging. Lawmakers face a constant temptation to renege on promises they’ve made to localities as they begin to look for ways to pay for their own tax or spending priorities, or when the state budget eventually falls on hard times.

Unsurprisingly, then, the head of the Indiana Association of Cities and Towns says that “every mayor that I have spoken with is deeply concerned about what the elimination of the personal property tax might mean to local government.” The Associated Press also provides some important context for their concern, noting that “many communities are still struggling with their budgets five years after the enactment of statewide property tax caps.”

If the business personal property tax is repealed and local governments are left to fend for themselves, Dr. Larry DeBoer of Purdue University estimates that other property owners would be asked to make up about half of the lost revenue. Specifically, he expects that they would see their property taxes raised by a combined total of about $453 million per year. In part because of the 2008 property tax caps, however, localities would also have to cut their budgets to make up much of the difference. Unless state lawmakers devise a plan to truly make localities whole (and actually to stick to that plan), Indiana residents could expect their local services to be cut by up to $510 million each year, on top of the cuts that have already gone into effect.

remain firmly shut. Nixon has called a special legislative session to urge the Missouri legislature to approve tax cuts totaling $1.7 billion , also geared toward Boeing and other aerospace companies.

remain firmly shut. Nixon has called a special legislative session to urge the Missouri legislature to approve tax cuts totaling $1.7 billion , also geared toward Boeing and other aerospace companies. harmless pledge often works out to be what Mary Poppins called a “pie crust promise”—easily made and easily broken. Just nine years after Governor Richardson burnished his tax-cutting credentials by exempting groceries from local (and state) gross receipts taxes—while simultaneously implementing a “hold harmless” provision so that locals wouldn’t feel the pain of losing such a large chunk of their tax base—a law is now in place that will completely phase out the hold-harmless aid to locals between 2015 and 2030. A recent Santa Fe New Mexican

harmless pledge often works out to be what Mary Poppins called a “pie crust promise”—easily made and easily broken. Just nine years after Governor Richardson burnished his tax-cutting credentials by exempting groceries from local (and state) gross receipts taxes—while simultaneously implementing a “hold harmless” provision so that locals wouldn’t feel the pain of losing such a large chunk of their tax base—a law is now in place that will completely phase out the hold-harmless aid to locals between 2015 and 2030. A recent Santa Fe New Mexican

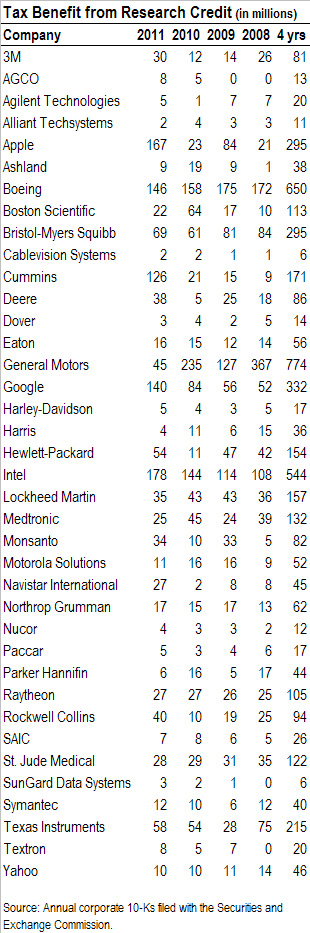

In what has been a cherished annual tradition for tax accountants everywhere, the day is approaching—January 1, to be precise—when dozens of temporary federal income tax provisions are set to expire. The so-called “extenders”—tax breaks enacted by Congress on a temporary basis and extended at the last minute, usually because lawmakers can’t find a way to pay for making them permanent—include a rogue’s gallery of ineffective giveaways ranging from the

In what has been a cherished annual tradition for tax accountants everywhere, the day is approaching—January 1, to be precise—when dozens of temporary federal income tax provisions are set to expire. The so-called “extenders”—tax breaks enacted by Congress on a temporary basis and extended at the last minute, usually because lawmakers can’t find a way to pay for making them permanent—include a rogue’s gallery of ineffective giveaways ranging from the  tax loopholes that most small businesses can’t use and want to close.

tax loopholes that most small businesses can’t use and want to close.

Congress should let the research credit expire, and redirect the billions of dollars that it costs into true, basic, truly scientific research, which businesses rarely engage in because the payoffs often take years to arrive.

Congress should let the research credit expire, and redirect the billions of dollars that it costs into true, basic, truly scientific research, which businesses rarely engage in because the payoffs often take years to arrive.

Congress should let the research credit expire, and redirect the billions of dollars that it costs into true, basic, truly scientific research, which businesses rarely engage in because the payoffs often take years to arrive.

Congress should let the research credit expire, and redirect the billions of dollars that it costs into true, basic, truly scientific research, which businesses rarely engage in because the payoffs often take years to arrive.